EMEA External Enterprise Storage Market Down Y/Y 3% in 4FQ20

AFA and hybrid flash array segments also declined.

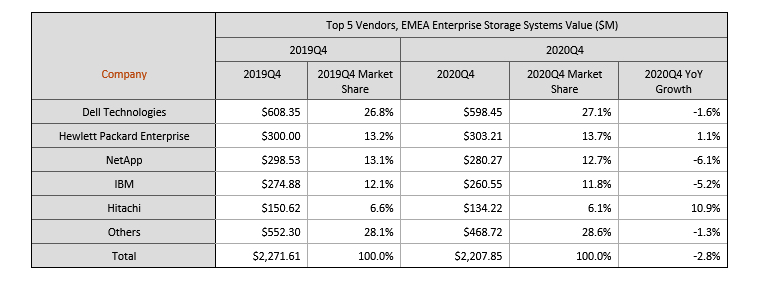

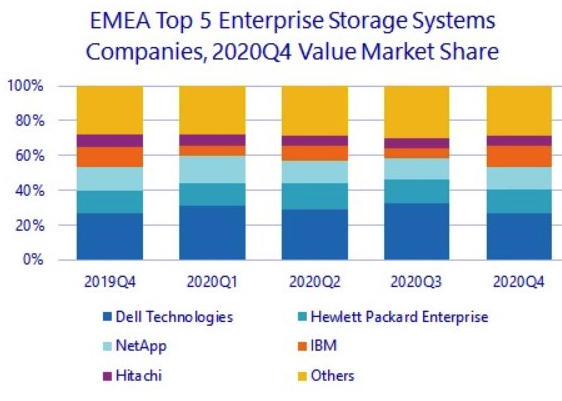

This is a Press Release edited by StorageNewsletter.com on March 24, 2021 at 2:32 pmThe EMEA external storage systems market value was down 2.8% Y/Y in dollars and 9.8% in euros in 4Q20, according to IDC‘s EMEA Quarterly Disk Storage Systems Tracker.

The exchange rate played a central role in making the Y/Y comparison more favorable when looking at it in dollars rather than euros.

Unlike previous quarters, performance was similar across subregions, with Western European value down 2.8% Y/Y and CEMA down 2.9% (both in dollars). The AFA segment also declined, recording a Y/Y fall of 3.9%. The hybrid flash array (HFA) segment was more resilient, with a decline of 0.6%.

The year 2020 saw a drop of 6.5% in dollars (8.4% in euros), but the AFA segment remained afloat (+3.7% in dollars and +1.6% in euros); it was also the largest segment by value (44%, vs. 37% for HFA and 19% for HDD-only).

“While the 2020 economic downturn hit EMEA countries with differing levels of intensity, recent events in the region are changing the way IT infrastructure is purchased and consumed. The requirements for cloud-like consumption models, coupled with distributed IT deployment and wider adoption of digital transformation, will fuel innovation and competitiveness during the recovery,” said Silvia Cosso, associate research director, storage systems, Western Europe.

Western Europe

Western European external storage market value was down 2.8% in dollars (-9.7% in euros) for the quarter and down 9.8% for the full year (-11.6% in euros).

“However, the AFA segment accounted for more than 45% of total shipments for 2020, up from 41% in 2019, while HCI contributed to almost 16% of external storage value – both pointing to a speeding up in datacenter renovation plans from European enterprises,” said Cosso.

Although there are signs of recovery in the subregion, the outlook remains cautious and is heavily dependent on the vaccination rollout – a key factor in the recovery.

Central and Eastern Europe, the Middle East, and Africa

The slowdown in the external storage market in CEMA was expected following the second wave of Covid-19, which led to stricter measures in some countries in the region and more economic setbacks. The decline was 2.9% Y/Y, with market value at $655.7 million.

The MEA region remained flat, as pending high-end storage projects were finally implemented; along with spending on entry-level solutions, this managed to offset the drop in the mid-range.

The CEE market, however, was down. This was mainly due to a decline in the AFA business for the first time since the analyst firm started tracking it in the region. The investments in HCI and PBBA continued to accelerate in double digits (44.3% and 26.3% respectively), but the remaining storage projects, typical for the last quarter of the year, were postponed and this led to a decline of nearly 20% in the mid-range segment.

“Clearly, the fluctuations in the market reflect the impact of the pandemic on the economy, and 2021 will continue in this vein,” said Marina Kostova, research manager, storage systems, CEMA. “However, the transformation of the storage consumption and data management segment will continue and, together with the growth in workloads related to AI, 5G, and edge, will lead to even greater storage demand, larger storage capacities, and further flash developments, but with less hardware and in a progressively hybrid environment.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter