Pure Storage: Fiscal 3Q21 Financial Results

Revenue historically down Y/Y for first time, which huge losses never stopping

This is a Press Release edited by StorageNewsletter.com on November 26, 2020 at 2:08 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 428.4 | 410.6 | 1,151 | 1,181 |

| Growth | -4% | 3% | ||

| Net income (loss) | (30.0) | (74.2) | (196.3) | (229.8) |

Pure Storage, Inc. announced financial results for its third quarter ended November 1, 2020.

“Our strategy and vision to deliver hybrid and multi-cloud data services is exciting the industry, our customers and developers alike,” said Charles Giancarlo, chairman and CEO. “Pure made bold moves in the quarter to deliver on our strategy with the acquisition of Portworx and the addition of Dominick Delfino to lead our sales organization.“

3FQ21 highlights

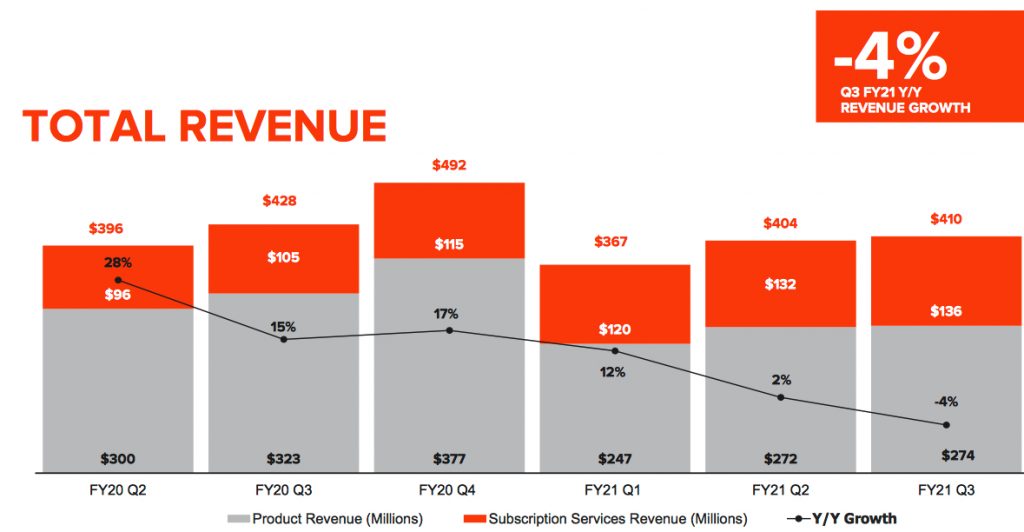

- Revenue $410.6 million, down 4% Y/Y

- Subscription services revenue $136.1 million, up 29% Y/Y

- GAAP gross margin 67.3%; non-GAAP gross margin 69.1%

- GAAP operating loss $(65.2) million; non-GAAP operating income $3.4 million

- Operating cash flow was $32.8 million

- Free cash flow was $7.9 millionotal cash and investments of $1.2 billion

- Deferred revenue $762.8 million, up 19% Y/Y

- Remaining performance obligations (RPO) exceeding $1.0 billion, up 25% Y/Y

“We are pleased with our financial performance and execution during the quarter which slightly exceeded our expectations at the beginning of the quarter,” said Kevan Krysler, CFO. “Key highlights include consecutive quarters of strong sales of our subscription services, and record sales during a quarter for our FlashBlade and FlashArray//C solutions.”

3FQ21 company highlights

The technology momentum across the portfolio includes:

- Subscription services momentum – Subscription services, including Evergreen and unified Pure as-a-Service offerings, grew 29% Y/Y. Selecting Pure as-a-Service in 3FQ21, organizations, including ME Bank in Australia and The University of Texas Health Science Center, recognize the flexibility and choice that these offerings provide. Pure-as-a-Service, which includes Cloud Block Store, enables customers to subscribe to storage in their data center and the cloud, paying for only what they consume, making migration to the public cloud possible at any time without worrying about stranded assets.

- Advancing Pure as-a-Service offerings – Announcement of the Pure Service Catalog, which includes a number of new service tiers. The service tiers deliver increased transparency and flexibility for customers, allowing them to choose the right storage service level for each workload. The firm is also making Pure as-a-Service more accessible by offering lower cost service tiers.

- Acquisition of Portworx, in Kubernetes storage – In 3FQ21, the company acquired Portworx, a Kubernetes data services platform that enterprises trust to run mission-critical applications in containers in production. By combining Portworx with Pure’s data platforms and Pure Service Orchestrator software, Pure provides a suite of data services that can be deployed in-cloud, on bare metal, or on enterprise arrays, all natively orchestrated in Kubernetes.

- FlashArray//C Momentum – FlashArray//C, well into its second gen, continues to grow at an accelerated pace and this month, received the Best of Show Award at the Flash Memory Summit for Most Innovative flash Memory Technology. The performance and financial efficiencies delivered by the product enable customers to reduce the cost of running capacity-oriented workloads so it eliminates the need for hybrid disk arrays.

- Strong FlashBlade momentum and AWS Outposts Designation – FlashBlade’s unified fast file and object capabilities to consolidate and modernize unstructured data across a number of use cases including technical computing, analytics, backup and rapid restore is validated by customer momentum this quarter. Customers such as The First National Bankers Bank, Louisiana Office of Technology Services and Sinai Health System demonstrate that it continues to be the choice to enable rapid recovery and defend vs. ransomware. Also in 3FQ21, FlashBlade achieved the AWS Outposts Ready designation, delivering a hybrid cloud solution with all-flash performance, cloud scalability, and operational simplicity to accelerate modern applications and break down IT silos.

Guidance

The public company will not provide formal guidance due to the resurgence and continued uncertainty of Covid-19. Its current internal view of 4FQ21 outcomes, which should not be viewed as guidance, is that total revenue for next quarter will be $480 million, a decline of 2% Y/Y. With the current view of revenue, Pure believes non-GAAP operating profit will be approximately $26 million 4FQ21.

Comments

Imagine you are in charge of company with revenue down Y/Y historically for the first time and without one quarter of profitability since inception. Will your comment your financial quarter like Pure's CFO Kevan Krysler:"We are pleased with our Q3 financial performance and execution (...)."

Remember also that, for the former quarter, sales, at $403.7 million, increased only 2% Y/Y (historically lowest Y/Y growth in revenue always formerly in double figures percentage).

For the most recent quarter, revenue reaches $410.6 million, up 2% Q/Q and down 4.2% Y/Y. It was expected to be flat sequentially.

Product sales was $274.5 million, down 15.1% Y/Y and totaled $136.1 million, growing yearly 29.5% for subscription services representing 33% of total revenue, up from 25% of total revenue during 3FQ20.

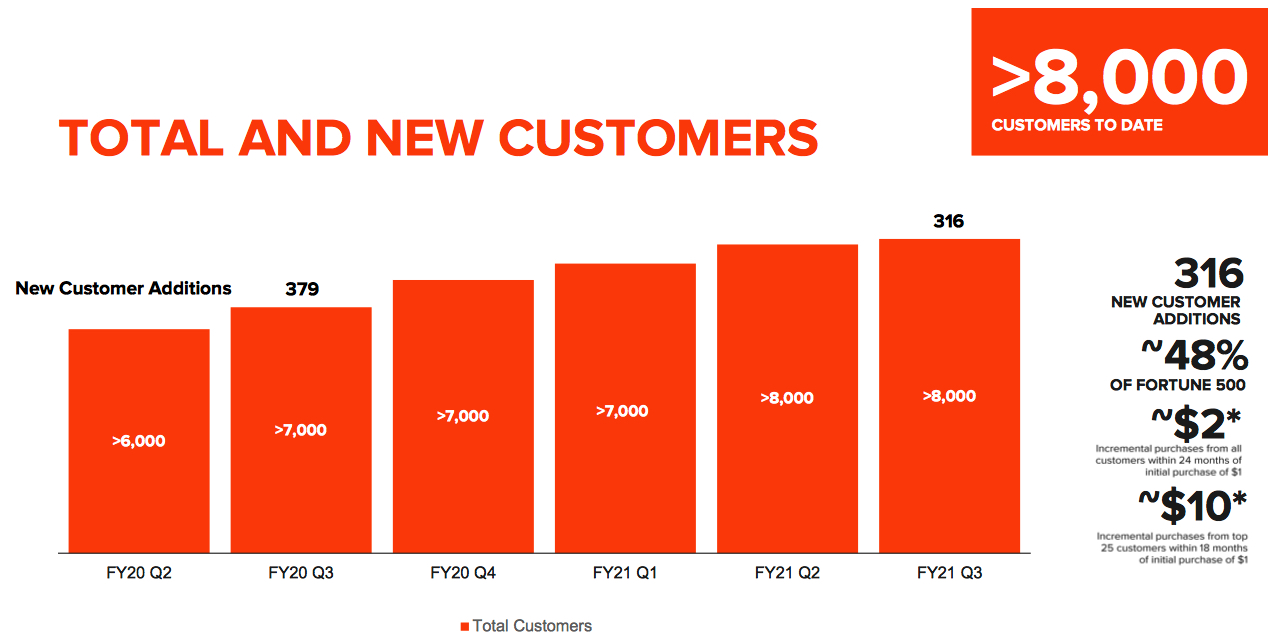

Revenue in USA during 3FQ21 was $302.1 million, declining 4% Y/Y and international revenue was $108.5 million, down yearly 3%. Across its full solution portfolio, the company continues to acquire new customers despite the challenging environment created by Covid-19. It acquired 316 new customers this quarter compared to 379 customers during 3FQ20.

Click to enlarge

Pure expects that global revenue for FY21 will be $1.66 billion representing 1% of growth and will be approximately $480 million for 4FQ21, a 2% decline Y/Y.

Revenue in $ million

(FY ended in February)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter