Pure Storage: Fiscal 2Q21 Financial Results

Historically lowest Y/Y growth in revenue: 2%, with net loss never ending

This is a Press Release edited by StorageNewsletter.com on August 27, 2020 at 2:17 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 396.3 | 403.7 | 723.0 | 770.8 |

| Growth | 2% | 7% | ||

| Net income (loss) | (66.0) | (65.0) | (166.6) | (155.6) |

Pure Storage, Inc. announced financial results for its second quarter ended August 2, 2020.

“We had a solid quarter, reflecting Pure’s unmatched technology leadership, simplicity, performance and extraordinary reliability that makes us the right decision during this time,” said Charles Giancarlo, chairman and CEO. “Pure delivers the Modern Data Experience by providing dynamic storage, a cloud-like experience via APIs, shared services and flexible on-demand consumption. Looking forward, I am confident in our opportunity, long-term strategy and ability to reaccelerate growth upon exiting the global crisis.”

2FQ21 Highlights

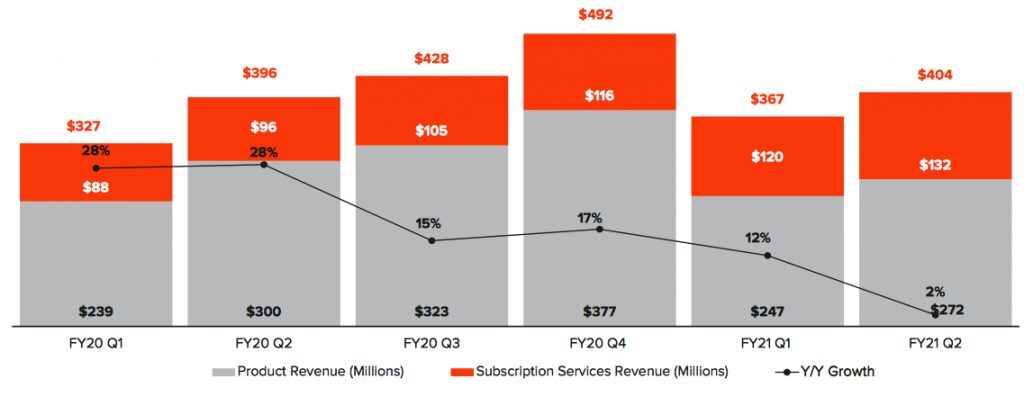

• Revenue $403.7 million, up 2% Y/Y

• Subscription services revenue $131.4 million, up 37% Y/Y

• GAAP gross margin 68.0%; non-GAAP gross margin 69.8%

• GAAP operating loss $(64.1) million; non-GAAP operating income $11.2 million

• Operating cash flow was $50.7 million, up $1.9 million Y/Y

• Free cash flow was $25.7 million, up $5.8 million Y/Y

• Total cash and investments of $1.3 billion

• Deferred revenue of $724.8 million, up 2.6% Q/Q and 19.3% Y/Y

• Remaining performance obligations (RPO) of $956.4 million, up 4.9% quarter-over-quarter and 24.2% Y/Y

“Pure, with its channel partners, continues to deliver solid results during the global economic recession caused by Covid-19,” said Kevan Krysler, CFO. “We are particularly pleased with the sustained strong growth and momentum of our subscription services that offer customers a cloud-like experience with more flexibility and compelling total cost of ownership.“

2FQ21 Highlights

It delivered technology enhancements that support modern applications, multi-dimensional performance, differentiated consumption models and simplicity that make the Modern Data Experience a reality for customers.

• Just introducing the second gen FlashArray//C even lower effective cost/GB, making it now less expensive than competing legacy hybrid disk arrays. The QLC storage array features 24TB and 49TB QLC DirectFlash Modules and leverages the suite of efficiency and reliability features in FlashArray’s Purity software. With FlashArray//C for capacity-oriented workloads, FlashArray//X for performance-centric workloads, and Cloud Block Store in the cloud, customers are able to consolidate tier-1, tier-2 and cloud workloads onto a single platform.

• Delivering rapid recovery at scale – Announced a partnership with Cohesity to deliver an integrated data recovery solution, Pure FlashRecover, Powered by Cohesity. The solution provides all-flash data backup and recovery capabilities that enterprises require for restoring data rapidly in the face of a disaster or ransomware attack. The companies joined forces to develop this solution based on demand from their customers to ensure they will always have fast access to their data.

• Strong subscription services momentum – They saw continued strength and execution with 37% Y/Y growth from existing and new customers. Arrow Energy, BidFX, Dizzion Managed Desktop as-a-Service, Lafayette General Hospital and Telstra joined the list of existing Pure as-a-Service customers such as CDK Global and Options IT.

Additionally, the Pure Good Foundation, which has had a substantial impact on communities around the globe, celebrates its fifth anniversary this month. Through its philanthropic efforts and hands-on volunteerism, Pure employees engaged in more than 8,000 volunteer activities over the last five years.

Guidance

Through 1FH20 Pure has delivered solid results through execution, focus, and operating discipline. The core fundamentals of its business are strong, however, the significant global economic contraction caused by Covid-19 continues to create variability. Therefore, as with the prior quarter, the company is not providing formal guidance.

Current view of 3FQ21 outcomes, which should not be viewed as guidance, is that total revenue will be approximately flat sequentially. The firm expects recurring revenue and sales of its Evergreen and unified subscription services will continue to show strong growth. The company continues to exercise operating discipline throughout the organization and estimates that operating margin during 3FQ21 will be slightly below break even, near negative 2%.

Comments

Pure's shares shared fall more than 8% after the company reported 2FQ21 sales above expectations and GAAP loss meeting forecasts.

At $404 million, sales increased only 2% Y/Y (historically lowest Y/Y growth in revenue always formerly in double figures percentage) and 10% Q/Q with losses never stop since company's inception and increasing from 4.7 million to $9.6 million Q/Q, reaching a global sum of more than $1.5 billion.

Total Revenue

Furthermore, next quarter revenue is expected to be flat, with operating margin slightly below breakeven, near negative 2%.

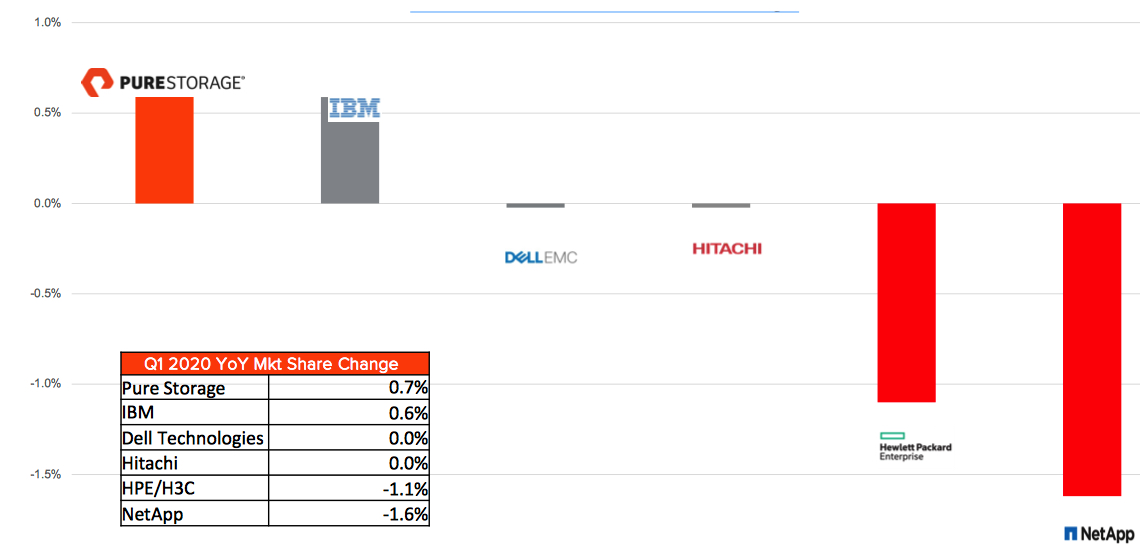

1Q20 WW External OEM Storage Market Share

(Source: IDC)

Product revenue declined 9% Y/Y, while subscription services grew yearly 37% and represented 33% of total sales, up from 24% Y/Y of. Subscription services revenue includes revenues from Evergreen subscriptions and Unified subscription, which includes Pure as-a-Service and Cloud Block Store.

Total revenue in USA during the quarter was $282 million declining 4% Y/Y, and international sales grew yearly 20% to $122 million.

Bookings or sales during 1FH21 grew 8.3% Y/Y, and, during 2FQ21, declined 3.3% Y/Y due to the headwinds faced in USA.

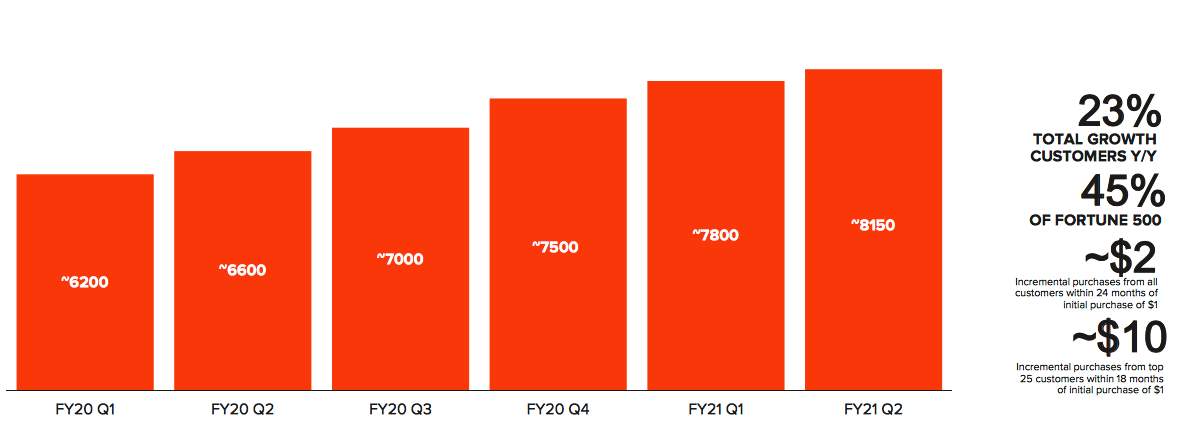

Sales to new customers 2FQ21 represent over 20% of total sales. The company acquired 350 new customers compared to 450 customers 2FQ20, now for total of 8,150.

Total Customers

Click to enlarge

COB and CEO Charles Giancarlo commented: "In 2FQ21, Pure's FlashArray product surpassed the full 7-nines of total availability across our installed base of tens of thousands of arrays including doing all upgrade cycles, which is unprecedented in our industry. To put this in perspective, 7-nines is the equivalent of only 3 seconds of downtime per year."

Revenue in $ million

(FY ended in February)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter