Very Optimistic Results of Consumer Internal SSD, Storage and Portable HDD Markets in India

Y/Y up 49%, 59% in 1H20 and 17% in 4Q20, respectively

This is a Press Release edited by StorageNewsletter.com on April 19, 2021 at 2:33 pmCyberMedia Research and Services Limited published 3 market reports on storage hardware in India.

Consumer internal SSD Maker reaches record amidst pandemic

• 2H20 records highest shipments in 3 years, grows 49% Y/Y.

• SATA (2.5″ and M.2) SSD shipments increased by 36% Y/Y in 2H20.

• PCIe SSD shipments registered 316% Y/Y growth on a small base in 2H20

The India consumer internal SSD market (SATA and PCIe) shipments recorded remarkable 136% growth when compared to 1H20. The overall market also registered 33% Y/Y growth in comparison to 2019.

“While all the other storage devices struggled to make a comeback during the pandemic hit year, internal SSD expanded its base. 1H20 did slow down but 2H20 shipments increased 2x. The effortless upgrade option over traditional PC HDD at an affordable cost boosted the internal SSD sales throughout. Extended Work from Home (WFH) and e-learning required hassle free installation and enhanced PC experience, giving SSD market enough growth opportunity. Exciting deals and discounts during the festive season and beyond also increased the adoption,” observed Shipra Sinha, lead analyst.

2H20 Highlights

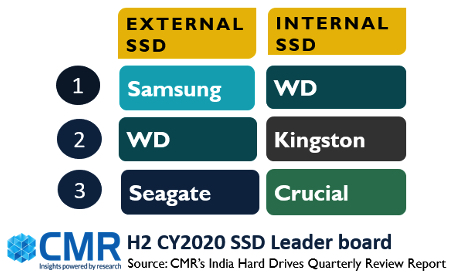

In the overall India consumer internal SSD market in 2H20, WDC was the top contributor with 29% market share followed by Kingston capturing 18% and Crucial at third position with 15% share. Kingston and Crucial shipments recorded substantial Y/Y growth of 67% and 189% respectively. While WDC has always been the consumers favorite, Kingston and Crucial are rapidly climbing the leaderboard. Apart from the renowned brands, a significant contribution was made by the lesser-known brands.

In the external SSD market, Samsung stood at the top spot with 53% market share followed by WDC at 38%. Seagate captured the third position with 7% market share.

Future trends

CMR anticipates the internal SSD market to grow >20% Y/Y by the end of 2021 on back of the increasing awareness about SSDs and its exceptional benefits over conventional HDDs.

According to Sinah, “Need of higher performance and productivity, memory expansion of low internal storage PCs, multitasking, reliability, less power consumption, low latency and fast OS at a reasonable price will be the key growth drivers for internal SSDs. Rise in the online game play will give significant push to the exclusive gaming SSD sales. While SATA SSDs will dominate the market, NVMe SSDs offering 4X speed will also contribute to the overall growth. Similarly, portable SSDs future growth will be driven by its competitive pricing along with supreme features over portable HDDs.”

India consumer storage market grows 59% in 2H20

• The overall market added 924PB in 2020.

• Flash drive was the highest contributor with 58% share in 2020.

• 32GB capacity was most favored with 34% market share in 2020.

The India consumer storage market (micro SD, pen drive and SD card) shipments grew 59% in 2H20 when compared to 1H20. However, the overall market shipments dropped down by 12% Y/Y during the same period.

“1H20 faced the major burnt of the pandemic. The significant decline in 1H20 encouraged brands to bounce back strongly and fulfill the pent-up demand in 2H20. By offering jaw dropping deals and discounts during the festive sale along with the aggressive marketing, brands turned the table around in 2H20. Furthermore, increasing OTG pen drive popularity also aided the flash drive market growth in 2H20,” said Sinha.

Overall market highlights 2H20

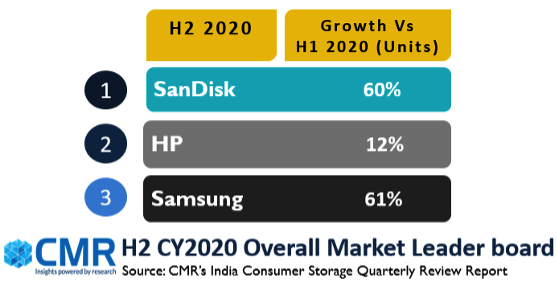

SanDisk remained the market leader with 75% market share. However, its shipments declined 7% Y/Y. HP stood at the second spot with 3% market share followed by Samsung at third position.

32GB capacity segment was the top contributor with 33% market share. 64GB capacity captured 16% market share and its shipments recorded 10% Y/Y increase.

Future trends

CMR anticipates 10-12% Y/Y growth in the overall micro SD, SD cards and pen drives market by the end of 2021.

According to Sinha, “With the significant rise in the smartphone market, flash cards market will be strained. However, more connected devices in the current housebound period due to IoT technology will require proper management of the data generated. All of this encourages the need for smooth, super fast, large capacity and secure storage devices. Brands focus on providing additional features such as memory expansion, waterproof, password protection, multi-language, and most importantly antivirus protection will gain consumer trust. Going forward, the flash drive market will be the growth driver on back of the increased penetration of OTG pen drives.”

Consumer portable HDD market grows 17% Y/Y in 4Q20

• 5″ portable HDD registered 19% Y/Y growth.

• 1TB and 2TB capacities collectively contributed 80% share.

• 4-bay diskless NAS shipments grew 52% Y/Y.

The India external HDD (2.5″ and 3.5″) market recorded 17% Y/Y growth in 4Q20. However, the market dropped down by 24% Q/Q.

“Portable HDD’s compact, robust and extensive storage feature at a reasonable price supported its Y/Y growth amidst the pandemic. Brands succeeded in overcoming the supply shortage and fulfilled the pent-up demand in the second half during the festive season and beyond. Increased PC usage and large data generated during the Extended Work from Home (WFH) and Learning from Home (LFH) catalyzed the portable HDD sales,” observed Sinha.

4Q20 highlights

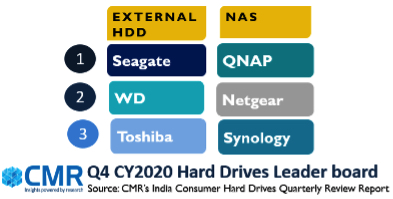

Seagate topped the leaderboard with 50% market share followed by WDC at 37% in the overall external HDD category.

While,1TB remained the most favoured capacity at 46% market share in the overall market, 2TB was the next preferred option capturing 34% market share. Both 1TB and 2TB capacities shipment recorded 29% and 17% Y/Y growth respectively.

The overall diskless NAS market witnessed 7% Y/Y decline. 4-bay NAS continued to be the consumers favourite.

Future trends

External HDD (2.5″ and 3.5″) shipments will grow by 5-6% Y/Y by the end of 2021 and recover from the pandemic impact observed last year.

According to Sinha, “Among all the portable storage options available, portable HDDs have a strong hold and loyal consumer base. Whether it is creating enough space in the PC or backing up the precious data, portable HDDs are the preferred go to option. Furthermore, the less price gap between capacities will assist its future growth. With portable SSD market still at its nascent stage, HDDs have ample growth opportunity. When it comes to personal cloud storage, NAS devices will gain traction as they act as the centralized storage for security systems and IoT connected devices in a smart home.“

Note:

CMR uses the term “shipments” to describe the number of consumer storage flash memory devices leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term ‘shipment’ is sometimes replaced by ‘sales’, but this reflects the market size in terms of units of consumer storage flash memory devices and not their absolute value. In the case of flash memory devices imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter