Indian External Storage Market Witnessed as Much as 22% Y/Y Decline in 2020

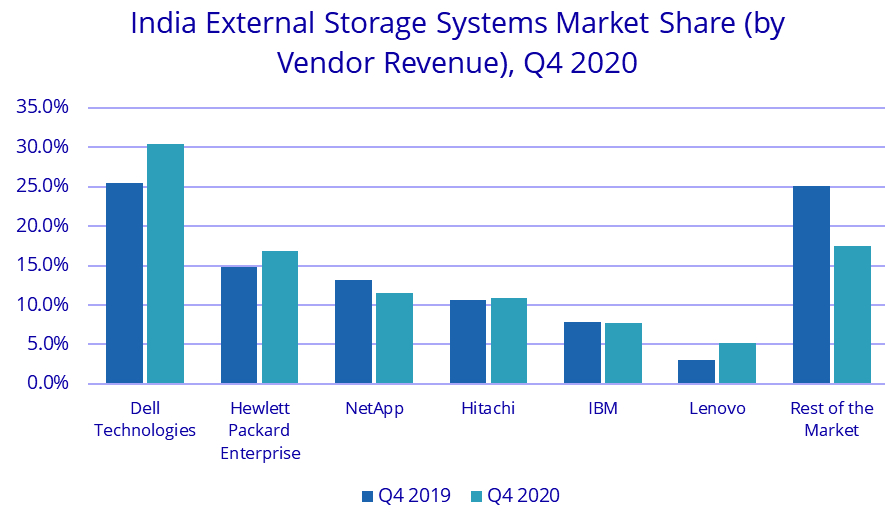

Dell (30%) and then HPE (17%) market leaders in 4Q20

This is a Press Release edited by StorageNewsletter.com on April 12, 2021 at 2:32 pmAs per IDC’s Worldwide Quarterly Enterprise Storage Systems Tracker 4Q20 release, India’s external storage market witnessed a decline of 15.6% Y/Y by vendor revenue and stood at $77.1 million in 4Q20.

The majority of the Y/Y decline in storage spending was due to decreased spending from banking organizations, while manufacturing, central government and security, and investment services saw a growth in 4Q20. The full year decline for the external storage market in India during year 2020 was 21.8%.

“Digital transformation is no longer a choice, forcing organizations to revisit their architectures to accommodate data proliferation from edge to core to cloud. It is essential for enterprises to drive business value, but this is not possible without the right platforms, so organizations are considering new-age intelligent infrastructure platforms,” says Dileep Nadimpalli, research manager, enterprise infrastructure, IDC India.

The growth of AFAs is evident across verticals with a contribution of 39.6% to the overall external storage systems market in 4Q20. BFSI, professional services, manufacturing, and government verticals were the major contributors to AFA demand in 4Q20. Stronger uptake of NVMe-based flash arrays is witnessed due to significant performance benefits with negligible cost differences. In the coming years, enterprises would prefer NVMe-based flash arrays as de facto storage media for all the production workloads.

All the storage class segments saw a sharp Y/Y decline in 4Q20. Entry storage and high-end storage segments witnessed a strong Y/Y decline compared to mid-range systems in this quarter. The impact of entry storage is due to decreased storage demand from SMB and enterprises for their non-core applications.

Enterprises are investing in the modernization of applications/infrastructure, seamless movement of data across multiple clouds, AIO/s for managing infrastructure platforms, and security to be digitally resilient. Organizations are looking for trusted advisors and not standalone technology deployment partners to enable them to be future-ready.

Major vendors

Dell Technologies continued to be the market leader in the external storage systems market with a 30.4% market share by vendor revenue, followed by HPE with a 16.9% market share in 4Q 2020.

The India external storage systems market is expected to grow at a single-digit CAGR for the 2020-2025 period. Analysts forecast that spending is expected to recover and grow Y/Y in year 2021.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter