India’s External Storage Market: Third Consecutive Y/Y Decline in 2020

-15% at $80 million in 3Q20, Dell, NetApp and Lenovo leaders

This is a Press Release edited by StorageNewsletter.com on December 30, 2020 at 2:48 pmAs per IDC Corp.‘s Worldwide Quarterly Enterprise Storage Systems Tracker 3Q20 release, India’s external storage market witnessed a decline of 14.8% Y/Y by vendor revenue and stood at $79.9 million in 3Q20.

The majority of the Y/Y decline in storage spending was due to decreased spending from professional services, government, and manufacturing organizations in 3Q20.

“Emergence of new-age applications, multi-cloud, edge deployments, etc. are forcing organizations to revisit their enterprise IT architecture. To adapt to this changing IT landscape, enterprises need intelligent, hyper agile, scalable, resilient, and cloud-ready data platforms which are flexible and easy to use,” says Dileep Nadimpalli, research manager, enterprise infrastructure, IDC India.

AFAs contributed 39.2% to the overall external storage systems market in 3Q20. Banking, telecommunications, and professional services verticals were the major contributors for AFA demand in 3Q20. Organizations are very keen on adopting AFA for primary workloads, but we expect AFA adoption even in secondary storage in the near future due to the availability of QLC media which offers better performance and cost advantages as compared to HDDs.

Entry storage systems grew by 3.4% Y/Y backed by increased spending from the insurance vertical in 3Q20. High-end and mid-range storage segments witnessed a steep double-digit Y/Y decline in 3Q20.

Covid-19 has brought forth multiple challenges for enterprises by forcing them to change their business and IT priorities to align to customers’ demands. Organizations are considering Opex based deployments like never before for BC requirements and new projects, which is cannibalizing traditional storage demand.

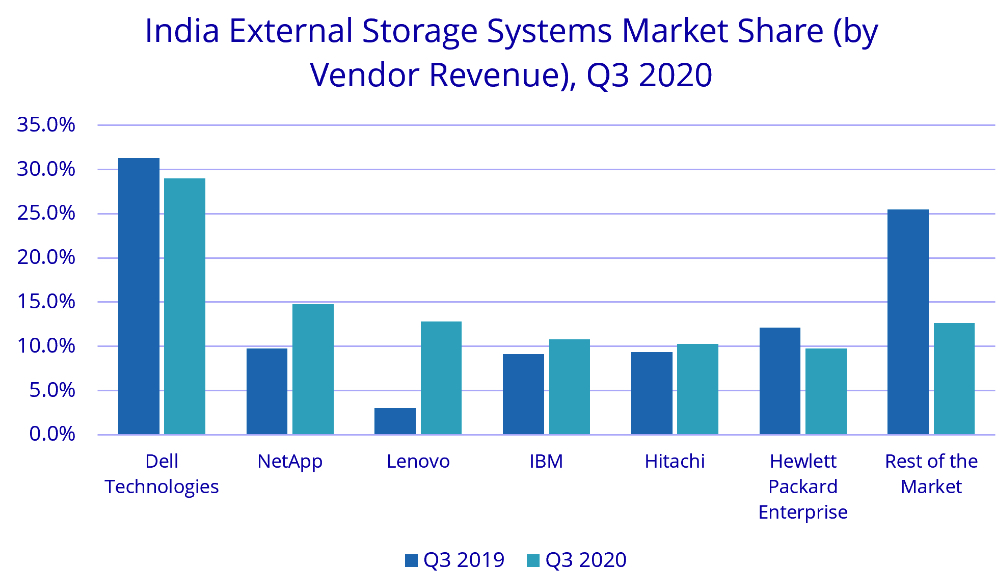

Dell Technologies continued to be the market leader in the external storage systems market with a 29.0% market share by vendor revenue, followed by NetApp with a 14.8% market share in 3Q20.

IDC India Forecast

The external storage systems market is expected to grow at a single-digit CAGR for the 2019-2024 period. External storage systems spending is expected to drop Y/Y in 2020 due to delayed demand across organizations attributing to Covid-19 impact but expect the market to recover in 2021.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter