Marvell: Fiscal 2Q20 Financial Results

Impact from restrictions on shipments to Huawei

This is a Press Release edited by StorageNewsletter.com on September 2, 2019 at 2:43 pm| (in $ million) | 2Q19 | 2Q20 | 6 mo. 19 | 6 mo. 20 |

| Revenue | 665.3 | 656.6 | 1,270 | 1,319 |

| Growth | -1% | 4% | ||

| Net income (loss) | 6,759 | (57.3) | 135.4 | (105.8) |

Marvell Technology Group Ltd. reported financial results for 2FQ20.

Revenue for this period was $657 million, which exceeded the midpoint of the company’s guidance provided on May 30, 2019.

GAAP net loss was $(57) million, or $(0.09) per diluted share. Non-GAAP net income was $110 million, or $0.16 per diluted share. Cash flow from operations was $73 million.

“Marvell delivered solid second quarter results with revenue above the mid-point of our guidance and we fully achieved the operating expense reductions we had outlined last year, two quarters ahead of schedule,” said Matt Murphy, president and CEO. “In our third quarter, we face a worsening macro environment along with the ongoing impact from the current restrictions on shipments to Huawei, offset by a stabilizing storage business and the earlier than expected first production shipments of our 5G solutions.”

3FQ20 Financial Outlook

• Revenue: $660 million +/- 3%.

• GAAP gross margin: 53.5% to 54.5%.

• Non-GAAP gross margin: 63% to 64%.

• GAAP operating expenses: $380 million to $390 million.

• Non-GAAP operating expenses: $280 million +/- $2.5 million.

• GAAP diluted loss per share: $(0.09) to $(0.05) per share.

• Non-GAAP diluted income per share: $0.15 to $0.19 per share.

Comments

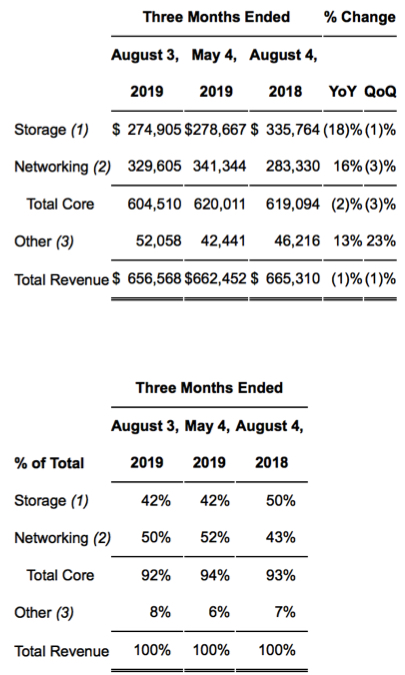

Global sales for the quarter, at $657 million, are down 1% Y/Y and Q/Q.

Networking represented 50% of revenue in this quarter, with storage contributing 42%.

(1) Storage products are comprised primarily of HDD and SSD controllers, FC adapters and data center storage solutions.

(2) Networking products are comprised primarily of Ethernet switches, Ethernet transceivers, Ethernet NICs, embedded communication processors, automotive Ethernet, security adapters and processors as well as WiFi connectivity products. In addition, this grouping includes a few legacy product lines in which we no longer invest, but will generate revenue for several years.

(3) Other products are comprised primarily of printer solutions, application processors and others.

CEO Murphy commented: "Storage revenue for the second quarter came in above our expectations at $275 million declining 1% sequentially better than our guidance for mid single-digit sequential decline. As expected, our storage business was impacted by the export restriction on Huawei. But we benefited from stronger-than-expected demand from a broad set of storage controller customers in the HDD, SSD and FC end markets. It appears that previously elevated inventory levels have slowly started to subside at some our storage controller customers."

Outlook for next quarter: total revenue of $660 +/-3%

For Murphy, "Moving on to our outlook for our storage business in 3FQ20, we expect an increase in demand for our storage controllers from the data center and enterprise markets, especially from high-capacity nearline drives and some additional catching up in the SSD market from the under shipment in prior quarters. Demand for FC adapter should also trend up in the third quarter.

"In contrast, demand for HDDs for PCs in gaming is expected to remain soft with some seasonal growth for this part of the fiscal year. As a result, we expect an approximate high single-digit sequential growth in our third quarter storage revenue."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter