Marvell: Fiscal 4Q20 Financial Results

Guidance for 1FQ21 reflects reduction of 5% of revenue to account for coronavirus.

This is a Press Release edited by StorageNewsletter.com on March 6, 2020 at 1:56 pm| (in $ million) | 4Q19 | 4Q20 | FY19 | FY20 |

| Revenue | 744.8 | 717.7 | 2,866 | 2,699 |

| Growth | -4% | -6% | ||

| Net income (loss) | (261.0) | 1,773 | (174.1) | 1,584 |

- 4FQ20 revenue: $718 million

- 4FQ20 gross margin: 42.5% GAAP gross margin; 62.3% non-GAAP gross margin

- 4FQ20 diluted income per share: $2.62 GAAP diluted income per share; $0.17 non-GAAP diluted income per share

- Cash and cash equivalents: $648 million, an increase of $209 million from the prior quarter

Marvell Technology Group Ltd. reported financial results for the fourth fiscal quarter and the full fiscal year, ended February 1, 2020.

Revenue for 4FQ20 was $718 million.

The company completed the acquisition of Avera Semiconductor, the ASIC business of GlobalFoundries on November 5, 2019. Its results for the fourth quarter of fiscal 2020 and fiscal year 2020 include the results of Avera from the acquisition date, while prior periods presented do not.

On December 6, 2019, the company completed the divestiture of the Wi-Fi connectivity business to NXP. The company received $1.7 billion in cash proceeds. The divestiture resulted in a pre-tax gain on sale of $1.1 billion. Firm’s results for 3FQ20 and FY020 include the results of the this business through the divestiture date, while prior periods presented include the results of this business for the entire period.

On December 31, 2019, the company completed an intra-entity asset transfer of certain of the company’s IP to a subsidiary in Singapore. The internal restructuring aligns the global economic ownership of the company’s IP rights with the company’s current and future business operations. The internal restructuring resulted in an income tax benefit of approximately $763 million for 4FQ20 and for FY20, which primarily captures the tax effect of future deductions.

GAAP net income for the fourth quarter of fiscal 2020 was $1.8 billion, or $2.62 per diluted share. Non-GAAP net income for the fourth quarter of fiscal 2020 was $117 million, or $0.17 per diluted share.

Revenue for FY20 was $2.7 billion. GAAP net income for fiscal 2020 was $1.6 billion, or $2.34 per diluted share. Non-GAAP net income for fiscal 2020 was $444 million, or $0.66 per diluted share.

“Marvell delivered 4FQ20 revenue above the mid-point of guidance with solid results from both our networking and storage businesses. Our guidance for the first quarter of fiscal 2021 reflects the reduction of approximately 5% of revenue to account for coronavirus impacts we are aware of so far,” said Matt Murphy, president and CEO. “Our customer and design win traction in the wireless infrastructure market continues to grow and Nokia announced an expanded relationship with Marvell to develop multiple gens of leading 5G silicon solutions. We also announced the extension of our long-term collaboration with Samsung on the radio access network.”

Marvell’s first quarter guidance takes into account the US Government’s export restriction on certain Chinese customers. Given the ongoing uncertainty associated with the coronavirus, we also have temporarily widened the guidance range on revenue.

1FQ21 Outlook

• Revenue is expected to be $680 million +/- 5%.

• GAAP gross margin is expected to be approximately 47.5%.

• Non-GAAP gross margin is expected to be approximately 63%.

• GAAP operating expenses are expected to be $410 million +/- $3 million.

• Non-GAAP operating expenses are expected to be $310 million +/- $2.5 million.

• GAAP diluted loss per share is expected to be $(0.20) to $(0.12) per share.

• Non-GAAP diluted income per share is expected to be $0.11 to $0.17 per share.

Comments

With currently 5,500 employees, FY21 will mark the 25th year anniversary of Marvell.

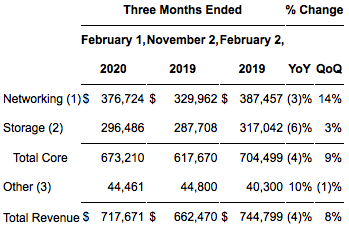

(1) Networking products are comprised primarily of Ethernet solutions, embedded processors and custom ASICs.

(2) Storage products are comprised primarily of storage controllers and FC adapters.

(3) Other products are comprised primarily of printer Solutions, application processors and others.

Storage, at $296.5 million, represents 41% of global revenue (it was 52% in 1FQ19), down from 4% for one year ago and up 3% Q/Q, finally stronger than expectations.

Sequential growth was driven by an increase in demand for storage controller product lines. Specifically HDD business continue to benefit from growing position in the nearline market and enterprise and data center SSD business continue to recover in the most recent quarter. FC business remains strong and stable from 3FQ20.

Total client revenue exposure collectively across both HDD and SSD controllers starting FY21 is only 5% of the entire company's revenue.

Sequential storage revenue growth in 3FQ20 and 4FQ20 was driven by enterprise and data center products. The next phase of firm's storage growth strategy the company had outlined with the emergence of the DIY market for custom SSD controllers and it has now a couple of quarters away from mass production of its first major design win.

In aggregate, Marvell believes the growing footprint of its enterprise and data center storage controllers and preamps upcoming ramp of SSD DIY controllers and progress of its Ethernet-based storage initiatives collectively positions its storage business for long-term success.

Looking to 1FQ21 for storage business, which is generally a seasonally down quarter for this end market coupled with virus related impact of this business, the company expect revenue decline sequentially in the mid-single digits on a percentage basis.

It also expects to continue to ramp its preamplifier's for HDDs over the next couple of years.

It started to ship and ramp preamps and controllers in the 16TB nearline drives and secured the follow-on controller for the next generation platform targeting high-capacity points well into the 20TB+ range.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter