Public Cloud IT Infrastructure Revenue Up 9% Y/Y in 3Q20

Top actors in order: Dell, HPE, Inspur, Cisco, Huawei and Lenovo

This is a Press Release edited by StorageNewsletter.com on January 15, 2021 at 2:12 pmAccording to IDC Corp.‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of IT infrastructure products (server, enterprise storage, and Ethernet switch) for cloud environments, including public and private cloud, increased 9.4% Y/Y in 3Q20. Investments in traditional, non-cloud, IT infrastructure declined -8.3% year over year in 3Q20.

These growth rates show the market response to major adjustments in business, educational, and societal activities caused by the Covid-19 pandemic and the role IT infrastructure plays in these adjustments. Across the world, there were massive shifts to online tools in all aspects of human life, including collaboration, virtual business events, entertainment, shopping, tele-medicine, and education. Cloud environments, and particularly public cloud, were a key enabler of this shift.

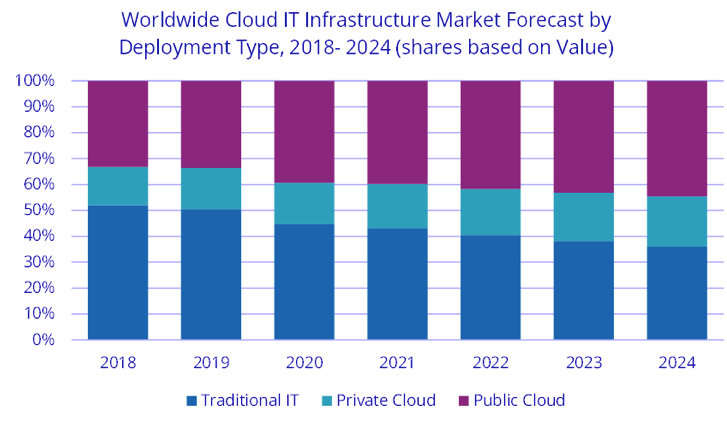

Spending on public cloud IT infrastructure increased 13.1% Y/Y in 3Q20, reaching $13.3 billion. During the previous quarter spending on public cloud IT infrastructure exceeded non-cloud IT infrastructure spending for the first time ever, but non-cloud IT infrastructure spending was back on top in 3Q20 at $13.7 billion. It is expected public cloud IT infrastructure spending to surpass non-cloud IT infrastructure spending again in the near future and expand its lead going forward. Spending on private cloud infrastructure increased 0.6% Y/Y in 3Q20 to $5.0 billion with on-premises private clouds accounting for 63.2% of this amount.

IDC believes the hardware infrastructure market has reached a tipping point and cloud environments will continue to account for an increasingly greater share of overall spending. With only one quarter remaining and the market stabilizing after the initial Covid-19 market shock, analyst firm has increased its forecast slightly for cloud IT infrastructure spending for the full year 2020, expecting 11.1% growth to $74.1 billion. It reduced its forecast for non-cloud infrastructure, expecting a decline of -11.4% to $60.2 billion. Public cloud IT infrastructure is expected to grow by 16.7% Y/Y to $52.7 billion for the full year. Spending on private cloud infrastructure is expected to decline -0.5% to $21.3 billion for the full year.

As of 2019, the dominance of cloud IT environments over non-cloud already existed for compute platforms and Ethernet switches while the majority of newly shipped storage platforms were still residing in non-cloud environments. Starting in 2020, with increased investments from public cloud providers on storage platforms, this shift will remain persistent across all 3 technology domains. Within cloud deployment environments in 2020, compute platforms will remain the largest segment (49.1%) of spending, growing at 2.3% to $36.4 billion while storage platforms will be the fastest growing segment with spending increasing 27.4% to $29.2 billion, and the Ethernet switch segment will grow 4.0% year over year to $8.5 billion.

Spending on cloud IT infrastructure increased across most regions in 3Q20, with the highest annual growth rates in Canada (32.8%), China (29.4%), and Latin America (23.4%). Growth in USA was 4.7%. Japan and Western Europe declined by -6.7% and -3.4%, respectively. In all regions except Canada and Japan, growth in public cloud infrastructure exceeded growth in private cloud IT.

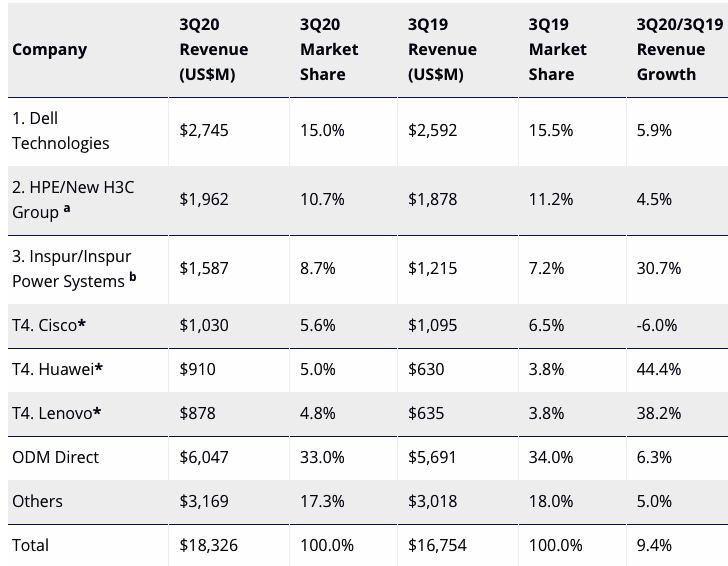

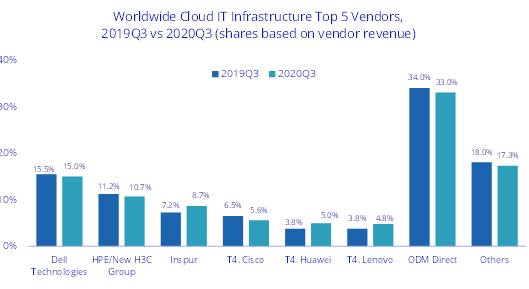

At the vendor level, the results were mixed. Inspur, Huawei, and Lenovo had double-digit Y/Y growth while most other major vendors, including the ODM Direct group of vendors, had single-digit growth. Cisco was the only major vendor with a Y/Y decline.

Top Companies, WW Cloud IT Infrastructure Vendor Revenue, Market Share, and Y/Y Growth, 3Q20

(in $million)

Notes:

* IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is a difference of one percent or less in the vendor revenue shares among two or more vendors.

a Due to the existing joint venture between HPE and the New H3C Group, IDC reports external market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

b Due to the existing joint venture between IBM and Inspur, IDC reports external market share on a global level for Inspur and Inspur Power Systems as Inspur/Inspur Power Systems starting from 3Q18.

Long-term, IDC expects spending on cloud IT infrastructure to grow at a 5-year CAGR) of 10.6%, reaching $110.5 billion in 2024 and accounting for 64.0% of total IT infrastructure spend. Public cloud datacenters will account for 69.9% of this amount, growing at a 11.3% CAGR. Spending on private cloud infrastructure will grow at a CAGR of 9.2%. Spending on non-cloud IT infrastructure will rebound after 2020 but will decline overall at a CAGR of -1.7%.

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

IDC defines Compute Platforms as compute intensive servers. Storage Platforms includes storage intensive servers as well as external storage and storage expansion (JBOD) systems. Storage intensive servers are defined based on high storage media density. Servers with low storage density are defined as compute intensive systems. Storage platforms does not include internal storage media from compute intensive servers. There is no overlap in revenue between Compute Platforms and Storage Platforms, in contrast with IDC’s Server Tracker and Enterprise Storage Systems Tracker, which include overlaps in portions of revenue associated with server-based storage.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter