WW Quarterly Cloud IT Infrastructure Up 34% Y/Y in 2Q20 (+136% for Inspur, -12% for Cisco)

Storage platforms fastest growing segment with spending increasing 21% to $27.8 billion

This is a Press Release edited by StorageNewsletter.com on October 2, 2020 at 2:24 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of IT infrastructure products (server, enterprise storage, and Ethernet switch) for cloud environments, including public and private cloud, increased 34.4% Y/Y in 2Q20.

Investments in traditional, non-cloud, IT infrastructure declined 8.7% Y/Y in 2Q20.

These growth rates show the market response to major adjustments in business, educational, and societal activities caused by the Covid-19 and the role IT infrastructure plays in these adjustments.

Across the world, there were massive shifts to online tools in all aspects of human life, including collaboration, virtual business events, entertainment, shopping, telemedicine, and education.

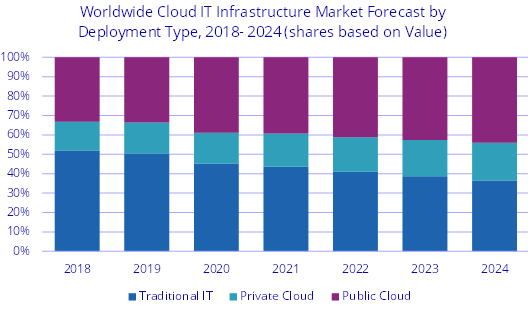

Cloud environments, and particularly public cloud, were a key enabler of this shift. Spending on public cloud IT infrastructure increased 47.8% Y/Y in 2Q20, reaching $14.1 billion and exceeding the level of spend on non-cloud IT infrastructure for the first time. Spending on private cloud infrastructure increased 7% Y/Y in 2Q20 to $5 billion with on-premises private clouds accounting for 64.1% of this amount.

The hardware infrastructure market has reached the tipping point and cloud environments will continue to account for an increasingly higher share of overall spending. While IDC increased its forecast for both cloud and non-cloud IT spending for 2020, investments in cloud IT infrastructure are still expected to exceed spending on non-cloud infrastructure, 54.8% to 45.2%. Most of the increase in spending will be driven by public cloud IT infrastructure, which is expected to slow in 2H20 but increase by 16% Y/Y to $52.4 billion for 2020. Spending on private cloud infrastructure will also experience softness in 2H20 and will reach $21.5 billion for the full year2020, an increase of just 0.3% Y/Y.

As of 2019, the dominance of cloud IT environments over non-cloud already existed for compute platforms and Ethernet switches while the majority of newly shipped storage platforms were still residing in non-cloud environments. Starting in 2020, with increased investments from public cloud providers on storage platforms, this shift will remain persistent across all three technology domains. Within cloud deployment environments in 2020, compute platforms will remain the largest segment (50.9%) of spending at $37.7 billion while storage platforms will be the fastest growing segment with spending increasing 21.2% to $27.8 billion, and the Ethernet switch segment will grow 3.9% year over year to $8.5 billion.

Spending on cloud IT infrastructure increased across all regions in 2Q20 with the two largest regions, China and the U.S., delivering the highest annual growth rates at 60.5% and 36.9% respectively. In all regions except Central & Eastern Europe and the Middle East & Africa, growth in public cloud infrastructure exceeded growth in private cloud IT.

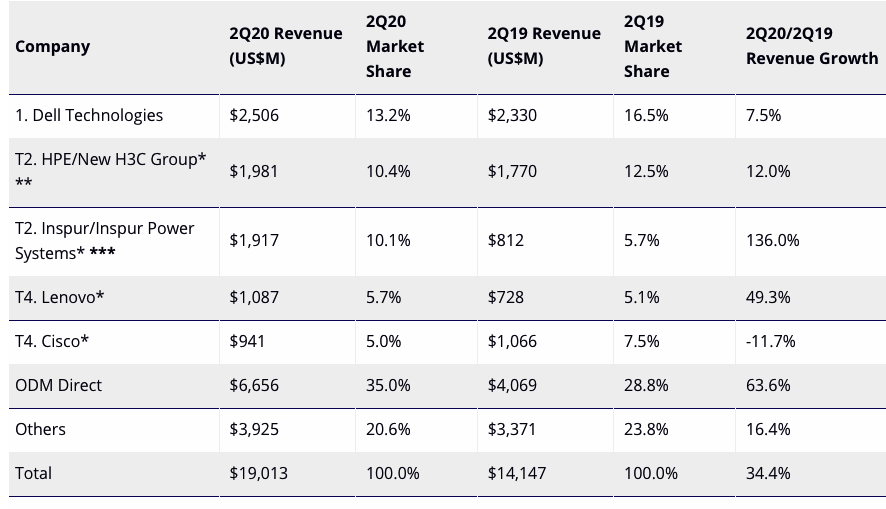

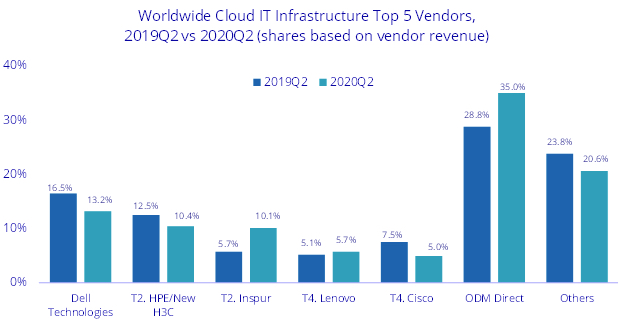

At the vendor level, the results were mixed. Inspur more than doubled its revenue from sales to cloud environments, climbing into a tie* for the second position in the vendor rankings while the group of original design manufacturers (ODM direct) grew 63.6% Y/Y. Lenovo’s revenue exceeded $1 billion, growing yearly at 49.3%.

Top Companies, WW Cloud IT Infrastructure Vendor Revenue, Market Share, and Y/Y Growth, 2Q20

(revenue in $million)

Notes:

* IDC declares a statistical tie in the WW cloud IT infrastructure market when there is a difference of 1% or less in the vendor revenue shares among 2 or more vendors.

** Due to the existing joint venture between HPE and the New H3C Group, IDC reports external market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

*** Due to the existing joint venture between IBM and Inspur, IDC reports external market share on a global level for Inspur and Inspur Power Systems as Inspur/Inspur Power Systems starting from 3Q18.

Long term, IDC expects spending on cloud IT infrastructure to grow at 5-year CAGR of 10.4%, reaching $109.3 billion in 2024 and accounting for 63.6% of total IT infrastructure spend. Public cloud datacenters will account for 69.4% of this amount, growing at 10.9% CAGR. Spending on private cloud infrastructure will grow at CAGR of 9.3%. Spending on non-cloud IT infrastructure will rebound after 2020 but will continue to decline overall with CAGR of -1.6%.

Taxonomy Notes

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

IDC defines Compute Platforms as compute intensive servers. Storage Platforms includes storage intensive servers as well as external storage and storage expansion (JBOD) systems. Storage intensive servers are defined based on high storage media density. Servers with low storage density are defined as compute intensive systems. Storage Platforms does not include internal storage media from compute intensive servers. There is no overlap in revenue between Compute Platforms and Storage Platforms, in contrast with IDC’s Server Tracker and Enterprise Storage Systems Tracker, which include overlaps in portions of revenue associated with server-based storage.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter