Cloud IT Infrastructure Spending Up 2% Y/Y in 1Q20

But investments in traditional, non-cloud, infrastructure plunged yearly 16%.

This is a Press Release edited by StorageNewsletter.com on June 29, 2020 at 1:37 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of IT infrastructure products (server, enterprise storage, and Ethernet switch) for cloud environments, including public and private cloud, increased 2.2% in 1Q20 while investments in traditional, non-cloud, infrastructure plunged 16.3% year over year.

The broadening impact of the Covid-19 pandemic was the major factor driving infrastructure spending in the first quarter. Widespread lockdowns across the world and staged reopening of economies triggered increased demand for cloud-based consumer and business services driving additional demand for server, storage, and networking infrastructure utilized by cloud service provider datacenters. As a result, public cloud was the only deployment segment escaping Y/Y declines in 1Q20 reaching $10.1 billion in spend on IT infrastructure at 6.4% Y/Y growth. Spending on private cloud infrastructure declined 6.3% Y/Y in 1Q20 to $4.4 billion.

IDC expects that the pace set in 1Q20 will continue through rest of the year as cloud adoption continues to get an additional boost driven by demand for more efficient and resilient infrastructure deployment.

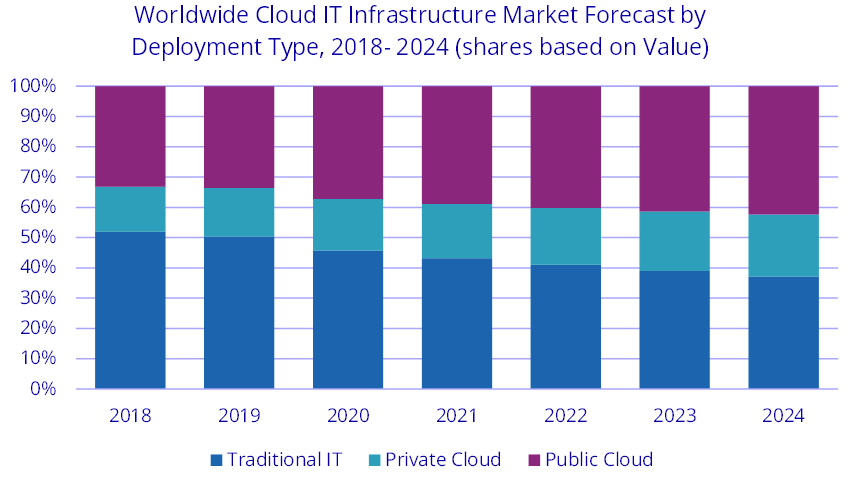

For 2020, investments in cloud IT infrastructure will surpass spending on non-cloud infrastructure and reach $69.5 billion or 54.2% of the overall IT infrastructure spend. Spending on private cloud infrastructure is expected to recover during the year and will compensate for the first quarter declines leading to 1.1% growth for the full year. Spending on public cloud infrastructure will grow 5.7% and will reach $47.7 billion representing 68.6% of the total cloud infrastructure spend.

Disparity in 2020 infrastructure spending dynamics for cloud and non-cloud environments will ripple through all three IT infrastructure domains – Ethernet switches, compute, and storage platforms. Within cloud deployment environments, compute platforms will remain the largest category of spending on cloud IT infrastructure at $36.2 billion while storage platforms will be fastest growing segment with spending increasing 8.1% to $24.9 billion. The Ethernet switch segment will grow at 3.7% year over year.

At the regional level, Y/Y changes in vendor revenues in the cloud IT Infrastructure segment varied during 1Q20, ranging from 21% growth in China to a decline of 12.1% in Western Europe.

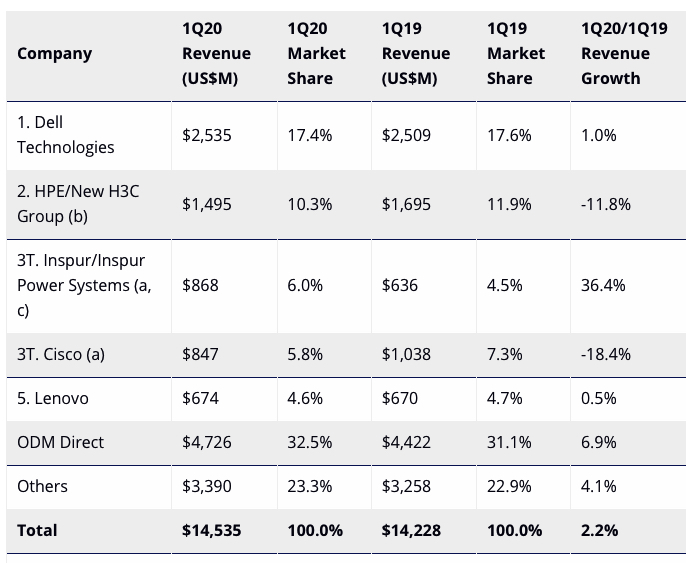

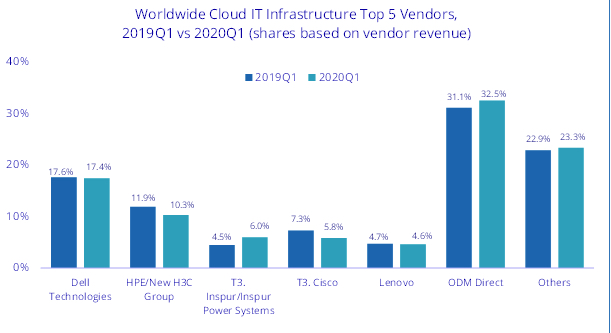

Top Companies, WW Cloud IT Infrastructure Vendor Revenue, Market Share, and Y/Y Growth, 1Q20

(revenue in $million)

Notes:

a. Statistical tie in the WW cloud IT infrastructure market when there is a difference of 1% or less in the vendor revenue shares among two or more vendors.

b. Due to the existing joint venture between HPE and the New H3C Group, external market share on a global level for HPE as HPE/New H3C Group starting from 2Q16 and going forward.

c. Due to the existing joint venture between IBM and Inspur, external market share on a global level for Inspur and Inspur Power Systems as Inspur/Inspur Power System starting from 3Q18.

Long term, IDC expects spending on cloud IT infrastructure to grow at a 5-year CAGR of 9.6%, reaching $105.6 billion in 2024 and accounting for 62.8% of total IT infrastructure spend.

Public cloud datacenters will account for 67.4% of this amount, growing at a 9.5% CAGR. Spending on private cloud infrastructure will grow at a CAGR of 9.8%. Spending on non-cloud IT infrastructure will rebound somewhat in 2020 but will continue declining with a five-year CAGR of -1.6%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter