Storage Start-Ups in 2019

No one ! It never happens historically.

By Jean Jacques Maleval | January 3, 2020 at 2:13 pmSince 1986 we analyze the start-ups in the WW storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

2019 was not great year at all: we didn’t find any new one born that year up to now and such a disaster never happens historically.

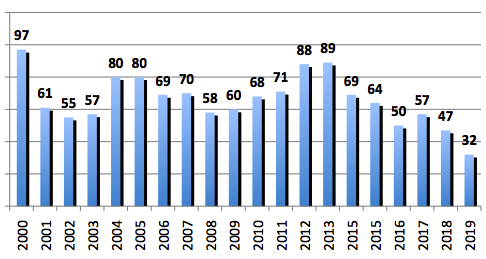

Furthermore VCs were less reluctant to invest in storage. The number of known financial rounds in 2019 was only 32, and 2018 was the lowest since 1999 with 47 to be compared to 57 in 2018,- but with biggest rounds for a total amount of $2,200 million up 33% from $1,650 million in 2018, this later figure up 13% from $1,460 million in 2017.

The highest round last year was $250 million for Cohesity then $100 million for both Actifio and Cloud Constellation, being $180 million for Rubrik in 2017, $175 million for SimpliVity in 2015, and $900 million for Cloudera in 2014.

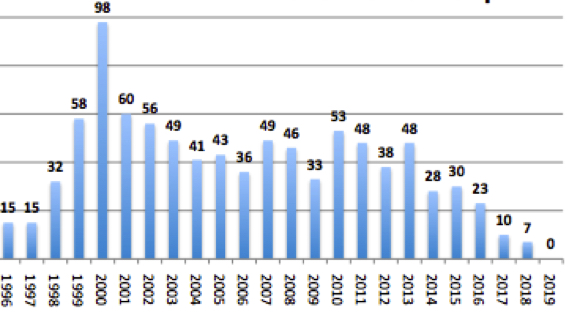

NUMBER OF NEW START-UPS LAUNCHES EACH YEAR FROM 1996 TO 2019

(when born year is known)

(Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

LARGEST FINANCIAL ROUNDS IN 2019

(at more than $100 million)

| Company | in $ million |

| Kaseya | 500 |

| Veeam Software |

500 |

| Rubrik |

261 |

| Clumio |

186 |

| Acronis |

147 |

| Druva Software |

130 |

(Source: StorageNewsletter.com)

There was 6 rounds at $100 million and more last year, 9 rounds at $60 million and more in 2018. Number ones Kaseya and Veeam got half million dollar in 2019, not bad, their total being $567 million and $500 million respectively.. Cohesity received $250 million in 2018 and got already $90 million in 2017 and $55 million in 2015, with now a total at $410 million. Actifio also surpasses $300 million in 2018 in total funding with $307.5 million.

Why poor results in 2019?

The WW storage market is no more growing so fast and then not a real good opportunity for investors. Furthermore in the more popular technologies attracting users (SSDs, all-flash systems, software-defined storage, scale-out NAS, hyperconverged platform, cloud storage), there are already too many competitors including about all storage giants.

Furthermore, there is currently about no new killer technology that could convince VCs, just improvements.

Less New Start-Ups

Also worrying is the reduced number of start-ups founded since the heydeys of 2000 when 98 new entities sprang up in a single year. We were not able to find one last year vs. 7 in 2018, 10 in 2017, 23 in 2016, 30 in 2015 and 28 in 2014, while these figures will go up as more of start-ups, operating in stealth mode, will come to light. For example, we found only one firm born in 2018 at the same time last year, this figure now being increased to 7 now discovered.

One of the reasons is that the number of M&As is largely decreasing as often start-ups are created by people leaving acquired companies.

NUMBER OF FINANCIAL ROUNDS EACH YEAR SINCE 2000

(when amount is known)

(Source: StorageNewsletter.com)

But 2019 Good Year in Financial Funding

On the positive side, the average amount per round when known in 2019 is impressive, $69 million – a record since we investigate this market -, increasing yearly 97%. It was $35 million in 2018 and $26 million in 2017.

Finally, investors put much more money in less start-ups.

VCs have put $30.5 billion in storage start-ups since we collect these data. This amount is higher than the total figure in the table below from 2000 to 2019 only.

On average, a company got historically $53 million in total funding.

TOTAL INVESTED IN START-UPS FROM 2003 TO 2019 ALL ROUNDS INCLUDED

(only for companies releasing or calculated total amount invested)

| Total invested | $30.5 billion |

| Number of start-ups | 577 |

| Average per start-up | $52.9 million |

(Source: StorageNewsletter.com)

PER ACTIVITY AMONG CURRENT 515 ALIVE START-UPS

| Activity | Number | % |

| Software | 253 | 46% |

| Hardware | 157 | 29% |

| SSP, cloud |

82 | 15% |

| Connectivity | 28 | 5% |

| Fundamental technology | 19 | 3% |

| Security | 7 | 1% |

| TOTAL | 546 | 100% |

Total is more than 515 as some companies are listed with more than one activity.

(Source: StorageNewsletter.com)

Where Are They Going?

What becomes of all these storage start-ups after we identify and count them? The conclusion is not really reassuring, a reminder that investment in these sorts of companies is in fact highly risky.

On all start-ups identified, only 3% eventually go public, and thus allow investors generally more than just to recoup their original stake. The same is generally true for the 30% that find buyers, although the asking price is not always greater than the total of all sunk investments. It is, in any case, the emergency exit that many companies are seeking. Meanwhile, another 17% just vanish off the map – doors closed.

Half of all alive start-ups remain in a holding pattern, still a start-up, still nursing the secret hope of an offer from a storage giant seeking to fill-in a missing technology.

WHAT HAPPENED TO THEM

(out of a total 1,002 start-ups)

| Became public | 34 | 3% |

| Sold | 298 | 30% |

| Closed | 173 | 17% |

| Remaining start-ups | 497 | 50% |

| TOTAL |

1,002 | 100% |

(Source: StorageNewsletter.com)

11 start-ups found a buyer in 2019, 13 in 2018, 19 in 2017 – the biggest deal last year being Hedvig sold to Commvault for $225 million. In 2018, it was X-IO Technologies sold to Violin for $87.5 million. HPE was an avid acquirer in 2017, buying Nimble Storage for $1.09 billion and SimpliVity for $650 million but only one (BlueData) in 2018.

No IPO was recorded in 2019. It never happens since 2012. There was just 4 in 2015 and 2 in 2016 as well as in 2017 but only one in 2018, by Dropbox, raising an historical record of $1.7 billion.

To get more money to finance the growth of young companies, IPO seems a better way than an acquisition.

37 IPOs IN STORAGE INDUSTRY

| Company | IPO year | Amount raised* | Total funding* |

| Silicon Storage Technology |

1995 | 15 | NA |

| StorageNetworks | 2000 | 260 | 205 |

| BakBone | 2000 | NA | NA |

| McData | 2000 | 350 | NA |

| STEC | 2000 | 65 | NA |

| FalconStor** | 2001 | NA | 33 |

| Xyratex | 2004 | 48 | NA |

| Rackable Systems | 2005 | 75 | 21 |

| CommVault | 2006 | 161 | 75 |

| Double-Take | 2006 | 55 | 70 |

| Isilon | 2006 | 108 | 69 |

| Riverbed | 2006 | 86 | 38 |

| 3PAR | 2007 | 95 | 183 |

| Compellent | 2007 | 85 | 53 |

| Data Domain | 2007 | 111 | 41 |

| Mellanox | 2007 | 102 | 89 |

| Netezza | 2007 | 124 | 68 |

| Voltaire | 2007 | 47 | 75 |

| Rackspace Hostings | 2008 | 145 | NA |

| OCZ Technology | 2010 | 101 | NA |

| Carbonite | 2011 | 62 | 67 |

| Fusion-io | 2011 | 223 | 112 |

| JCY International | 2011 | 238 | NA |

| Parade Technologies | 2011 | 34 | 21.5 |

| Violin Memory | 2013 | 162 | 186 |

| Nimble Storage | 2013 | 168 | 99 |

| Barracuda Networks | 2013 | 75 | 40 |

| Hortonworks | 2014 | 110 | 173 |

| Adesto Technologies | 2015 | 22 | 54 |

| Box | 2015 | 554 | 175 |

| Mimecast | 2015 | 83 | 77.5 |

| Pure Storage | 2015 | 470 | 425 |

| EverSpin Technologies | 2016 | 40 | 45 |

| Nutanix | 2016 | 238 | 370 |

| Tintri | 2017 | 60 | 260 |

| Cloudera | 2017 | 225 | 1,041 |

| Dropbox |

2018 | 756 | 1,700 |

| Average of known figures | 159 | 202 |

* in $ million

** became public via a merger with Network Peripherals

(Source: StorageNewsletter.com)

WHERE DO 513 CURRENT ALIVE START-UPS COME FROM?

Storage is mainly an US sport.

| Countries | Number of start-ups |

% |

| USA | 357 | 70% |

| UK | 25 | 5% |

| France | 20 | 4% |

| Canada | 17 | 3% |

| Israel* | 14 | 3% |

| China | 7 | 1% |

| Switzerland | 7 | 1% |

| Australia | 6 | 1% |

| Belgium | 6 | 1% |

| Germany | 6 | 1% |

| India | 6 | 1% |

| Others | 42 | 10% |

| Total | 513 | 100% |

* Several start-ups were funded in Israel but transferred HQs in USA

(Source: StorageNewsletter.com)

HISTORICAL RECORDS IN TOTAL FINANCIAL FUNDING

(more than $200 million)

| Start-ups | Total financial funding* |

| Dropbox |

1,700 |

| Cloudera | 1,041 |

| Kaseya |

567 |

| Box | 554 |

| Rubrik |

553 |

| Pillar Data |

544 |

| Veeam |

500 |

| Pure Storage | 470 |

| Cohesity |

410 |

| Nutanix | 370 |

| Druva |

328 |

| Infinidat | 325 |

| Actifio |

308 |

| SimpliVity | 276 |

| Tintri | 260 |

| MapR | 250 |

| Pivot3 | 247 |

| BlueArc | 224 |

| Qumulo |

223 |

| Kaminario | 218 |

| StorageNetworks | 205 |

| Sanrise | 203 |

* in $ million

(Source: StorageNewsletter.com)

SEVEN START-UPS (known thus far) BORN IN 2018

| Company (HQ) |

Total investment in $ million |

Business |

| 3Box (New York City, NY) |

2.5 | decentralized identity and storage infrastructure; also in Berlin, Germany |

| Agilestorage (San Jose, CA) |

NA | hybrid and flash appliances |

| Asura Technology (Chino, CA) |

NA | SSDs |

| Grax (Boston, MA) |

12.8 | captures irrefutable and recoverable record of every single change that happens to data over time |

| Hammerspace (Los Altos, CA) |

NA | software-as-a-service to simplify availability and control of unstructured data across hybrid cloud |

| ShardSecure (New York City, NY) |

NA | Microshard technology offers protection for storing and sharing data in cloud; seed funding in 2019 |

| Xoralgo (Wilington, DE) |

NA | PentaRAID, new RAID technology |

(Source: StorageNewsletter.com)

ALL 32 FINANCIAL ROUNDS IN 2019

| Company (HQ) |

Born in | Investment in 2019* | Total investment* | Business |

| Box (New York City, NY) |

2018 | 2.5 | 2.5 | decentralized identity and storage infrastructure; also in Berlin, Germany |

| Acronis (Burlington, CA) |

2000 | 147 | 158 | backup software |

| Alluxio (San Mateo, CA) |

2015 | 8.5 | 16 | memory-centric distributed storage system; formerly Tachyon Nexus |

| Atempo (Les Ulis, France) |

1992 | 8 | 43.9 | backup and archiving software; formerly Quadratec; acquired Storactive in 2006, Lighthouse Global Technologies in 2008, ASG Software Solutions in 2011; becoming independent company with Woxoo in 2017; acquired Synerway in 2017 |

| Avalanche Technology (Fremont, CA) |

2006 | 33 | 140.5 | low power non-volatile magnetic memory |

| Bamboo Systems (Cambridge, UK) |

2015 | 4.5 | 5 | global hyperconvergence platform; US HQs in Charlotte, NC; formerly Kaleao |

| Clumio (Santa Clara, CA) |

2017 | 186 | 186 | SaaS for enterprise backup; $51 million in 2 rounds in 2019, and $135 million same year in series C |

| Diamanti (San Jose, CA) |

2014 | 35 | 78 | network and storage solutions for Linux containers; formerly Datawise.io |

| Druva Software (Sunnyvale, CA) |

2007 | 130 | 328 | continuous data availability and de-dupe backup software for laptops; investment of NTT in 2016; originally in Pune, India |

| EndureDR (Israel) |

2015 | 2.5 | 2.5 | recovery readiness solution; also in San Jose, CA |

| Folio Photonics (Cleveland, OH) |

2012 | 8 | 12.2 | optical disc holding 1TB or 2TB, spun-off from the Center for Layered Polymeric Systems |

| Grax (Boston, MA) |

2018 | 12.8 | 12.8 | captures irrefutable and recoverable record of every single change that happens to data over time |

| Igneous Systems (Seattle, WA) |

2013 | 5 | 66.6 | cloud infrastructure for data you can’t or won’t move off-premises |

| JetStream Software (San Jose, CA) |

2016 | 7.7 | 11.5 | data management software for enterprise hybrid cloud computing |

| Kaseya (New York City, NY) |

2000 | 500 | 567.4 | complete IT infrastructure management software; acquired Unitrends, Spanning Clup Apps, IT Glue and RapîdFire Tools in 2018, ID Agent in 2019 |

| Kasten (Los Altos, CA) |

2017 | 14 | 17 | cloud-native data management for Kubernetes |

| Komprise (Campbell, CA) |

2014 | 24 | 42 | software using analytics-driven adaptive automation to manage massive data growth transparently across all storage silos |

| Liqid (Lafayette, CO) |

2013 | 28 | 50 | on-demand composable infrastructure |

| MemVerge (San Jose, CA) |

2017 | 24.5 | 24.5 | software and hardware to empower seamless convergence of main computer memory and storage using single pool of Intel Optane DC; one seed round in 2017 |

| Nasuni (Boston, MA) |

2009 | 25 | 145 | secure cloud storage; founded by former executives of Archivas |

| Odaseva (San Francisco, CA) |

2012 | 11.7 | 14 | in Salesforce data protection; also in Paris, France, and NYC |

| OwnBackup (Englewood Cliffs, NJ) |

2012 | 23.3 | 49.8 | backup and restore ISV on the Salesforce.com AppExchange; also in Israel |

| Pavilion Data Systems (San Jose, CA) |

2014 | 25 | 58 | processor agnostic storage in PCIe-based shared storage environment |

| PlIO/s (Ramat Gan, Israel) |

2017 | 20 | 45 | NAND storage processor; investment from State Of Mind Ventures |

| Portworx (San Francisco, CA) |

2014 | 27 | 55.5 | software-defined infrastructure for containerized applications |

| RackTop Systems (Fulton, MD) |

2010 | 15 | 15.8 | secure, high-performance NAS platform |

| Rubrik (Palo Alto, CA) |

2014 | 261 | 553 | scale-out storage architecture for backup; two rounds in 2015, $10 million and $41million; acquired Datos IO in 2018 |

| Sage Microelectronique (Hangzhou City, China) |

2011 | 35 | SSD controller IC; acquired Initio in 2016 | |

| VAST Data (New York City, NY) |

2016 | 40 | 80 | Universal Storage Architecture with flash memory to bring end to enterprise HDD and storage tiering area; also in Tel Aviv, Israel |

| Veeam Software (Baar, Switzerland) |

2006 | 500 | 500 | storage backup software for virtualization environments |

| Weebit Nano (Hod Hasharon, Israel) |

2015 | 3.1 | NA | in semiconductor memory elements to become faster, more reliable energy efficient and cost effective NVM |

| WekaIO (San Jose, CA) |

2014 | 32.7 | 66.7 | software-defined storage scales storage to hundreds of petabytes, tens of millions of IO/s, sub milliseconds latency; also engineering in Tel Aviv, Israel; $2 million investment from Western Digital Capital in 2019 included |

* in $ million

(Source: StorageNewsletter.com)

Note: when there are more than one round of financial funding the same year, we add them considering the total as only one.

Read also:

Storage Start-Ups in 2018

36 financial rounds, lowest number historically

| January 7, 2019 | News

Storage Start-Ups in 2017

VCs investing 34% more than in 2016

| February 1, 2018 | News

Storage Start-Ups in 2016

Worst year since 2003

by Jean Jacques Maleval | January 1, 2017 | News

Storage Start-Ups in 2015

Worst year since 2003 in number of financial rounds

by Jean Jacques Maleval | January 6, 2016 | News

Storage Start-Ups in 2014

Historical record for just one financial round: $900 million for …

by Jean Jacques Maleval | March 3, 2015 | News

Storage Start-Ups in 2013

$1.3 billion invested in 57 companies following 58 financial rounds

by Jean Jacques Maleval | January 8, 2014 | News

Storage Start-Ups in 2012

Innovation never stopping in industry, 67 new rounds last year

by Jean Jacques Maleval | February 13, 2013 | News

ANALYSIS: Storage Start-Ups in 2011

Record year in total financial funding: more than $1 billion

by Jean Jacques Maleval | January 4, 2012 | News

ANALYSIS: STORAGE START-UPs IN 2010

52 investment rounds vs. 49 in 2008 and 2009

by Jean Jacques Maleval | January 3, 2011 | News

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter