Storage Start-Ups in 2015

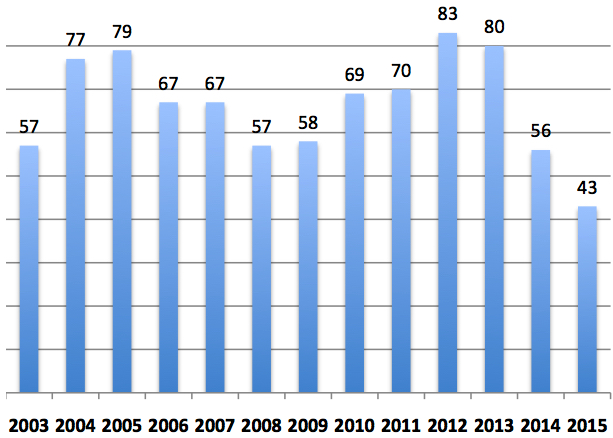

Worst year since 2003 in number of financial rounds

By Jean Jacques Maleval | January 6, 2016 at 2:58 pmVCs were much more reluctant to invest in storage in 2015. There were only 43 financial rounds during the year, the lowest figure since 2003 (!) for a total amount of no more than $1,4 billion, twice less than the former year. The highest round was $175 million for SimpliVity in 2015, $900 million for Cloudera in 2014.

NUMBER OF FINANCIAL ROUNDS SINCE 2003 (Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

LARGEST FINANCIAL ROUNDS IN 2015

(at $70 million and more)

| Company | in $ million |

| SimpliVity | 175 |

| Infinidat | 150 |

| Tintri | 125 |

| Code 42 Software |

85 |

| Datto | 75 |

| Tegile Systems |

70 |

(Source: StorageNewsletter.com)

Why?

The worldwide storage market is no more growing and then not a good opportunity for investors.

Fore the more popular technologies attracting users (SSDs, all-flash systems, software-defined storage, scale-out NAS, hyperconverged platform, Hadoop), there are already too many competitors and about all storage giants.

There is currently about no no killer technology that could convince VCs.

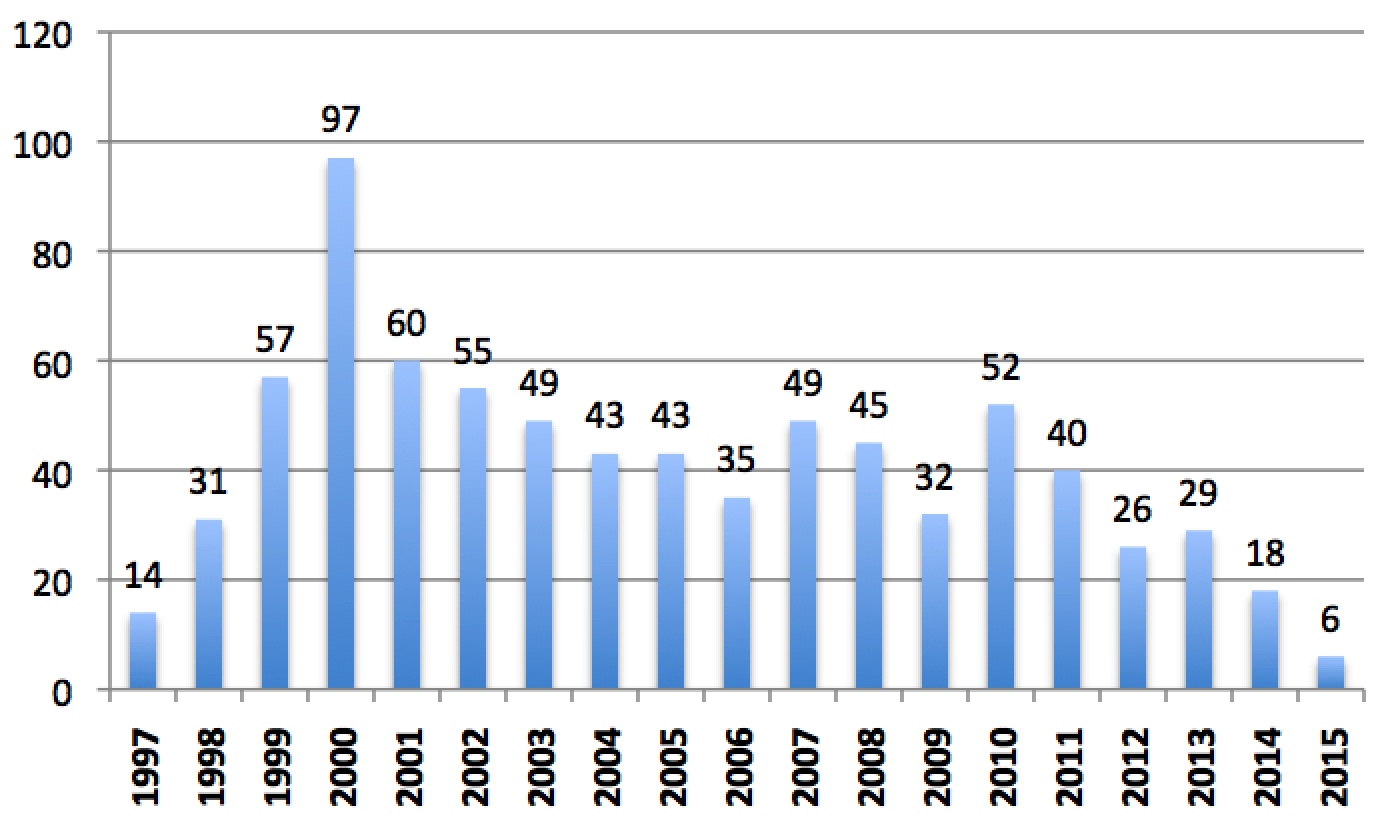

Fewer New Start-Ups

Also worrying is the reduced number of start-ups founded since the heydeys of 2000 when 97 new entities sprang up in a single year. We were only able to turn up 6 new firms launched last year vs. 18 in 2014 and 29 in 2012, while these figures will go up as more of them, operating in stealth mode, will come to light. For example, we found only 2 born firms in 2014 at the same time last year, this figure being increased by 16 more entities discovered later.

NUMBER OF STORAGE START-UPS LAUNCHED EACH YEAR SINCE 1997

(when the born year is known)

(Source: StorageNewsletter.com)

2015 Far to Be a Record in Financial Funding

The average amount per round decreases yearly 33%, from $49 million to $33 million.

Investors put less money in fewer start-ups.

These past 13 years, VCs have put $22 billion in storage start-ups. This amount is much higher than the total figure in the table below ($15 billion adding all rounds) because, for several firms, we got the total invested but not the details per round.

On average, a company got historically $44 million in total funding, the average per round being $17 million.

ALL FINANCIAL ROUNDS FROM 2003 TO 2015

(only for start-ups releasing the amount of their financial rounds)

| Year | Number of rounds |

Total invested* |

Average per round* |

| 2003 | 57 | 759 | 13 |

| 2004 | 77 | 980 | 13 |

| 2005 | 79 | 995 | 13 |

| 2006 | 67 | 817 | 12 |

| 2007 | 67 | 758 | 11 |

| 2008 | 57 | 755 | 13 |

| 2009 | 58 | 593 | 10 |

| 2010 | 69 | 861 | 12 |

| 2011 | 70 | 1,235 | 18 |

| 2012 | 83 | 1,449 | 17 |

| 2013 | 80 | 1,545 | 19 |

| 2014 | 56 | 2,761 | 49 |

| 2015 | 43 | 1,435 | 33 |

| TOTAL | 863 | 14,942 | 17 |

* in $ million

(Source: StorageNewsletter.com)

TOTAL INVESTED IN START-UPS FROM 2003 TO 2015 ALL ROUNDS INCLUDED

(only for companies releasing total amount invested)

| Total invested* | 21,855 |

| Number of start-ups | 492 |

| Average per start-up* | 44 |

* in $ million

(Source: StorageNewsletter.com)

PER ACTIVITY AMONG CURRENT 447 ALIVE START-UPS

| Activity | % |

| Software | 46% |

| Hardware | 28% |

| SSP | 15% |

| Connection | 5% |

| Fundamental technology | 4% |

| Security | 1% |

| TOTAL | 100% |

(Source: StorageNewsletter.com)

Where Are They Going?

What becomes of all these storage start-ups after we identify and count them. The conclusion is not really reassuring, a reminder that investment in these sorts of companies is in fact highly risky.

On all start-ups identified, only 3% eventually go public, and thus allow investors more than just to recoup their original stake. The same is generally true for the 28% that find buyers, although the asking price is not always greater than the total of all sunk investments. It is, in any case, the emergency exit that many companies are seeking. Meanwhile, another 18% just vanish off the map – doors closed.

50% of all start-ups of them remain in a holding pattern, still a start-up, still nursing the secret hope of an offer from a storage giant seeking to fill-in a missing technology.

WHAT HAPPENED TO THEM SINCE 1978

(out of a total 873 start-ups)

| Became public | 30 | 3% |

| Sold | 247 | 28% |

| Closed | 159 | 18% |

| Remaining start-ups | 447 | 51% |

(Source: StorageNewsletter.com)

Eleven start-ups did find buyers in 2015 and 16 in 2014, the biggest deal last year being SolidFire acquired by NetApp for $870 million, Fusion-io by SanDisk for $1.1 billion two years ago.

There was just one IPO in 2014 (Hortonworks) and 3 in 2015 (Box, Mimecast, Pure Storage). Pure Storage raised $450 million, the highest sum never received by a storage company becoming public. Nutanix is also on the way to enter in the stock exchange. Some other ones could try like like Actifio, Cloudera, DataCore, MapR, Scality, SimpliVity, Tegile and Tintri.

These facts demonstrate that, to get more money to finance the growth of young companies, IPO is today a better way as VCs are disinclined to invest in storage.

31 IPOs IN STORAGE INDUSTRY

| Company | IPO year | Amount raised* | Total funding* |

| Silicon Storage Technology |

1995 | 15 | NA |

| StorageNetworks | 2000 | 260 | 205 |

| BakBone | 2000 | NA | NA |

| McData | 2000 | 350 | NA |

| STEC | 2000 | 65 | NA |

| FalconStor** | 2001 | NA | 33 |

| Xyratex | 2004 | 48 | NA |

| Rackable Systems | 2005 | 75 | 21 |

| CommVault | 2006 | 161 | 75 |

| Double-Take | 2006 | 55 | 70 |

| Isilon | 2006 | 108 | 69 |

| Riverbed | 2006 | 86 | 38 |

| 3PAR | 2007 | 95 | 183 |

| Compellent | 2007 | 85 | 53 |

| Data Domain | 2007 | 111 | 41 |

| Mellanox | 2007 | 102 | 89 |

| Netezza | 2007 | 124 | 68 |

| Voltaire | 2007 | 47 | 75 |

| Rackspace Hostings | 2008 | 145 | NA |

| OCZ Technology | 2010 | 101 | NA |

| Carbonite | 2011 | 62.5 | 67 |

| Fusion-io | 2011 | 223 | 112 |

| JCY International | 2011 | 238 | NA |

| Parade Technologies | 2011 | 34 | 21.5 |

| Violin Memory | 2013 | 162 | 186 |

| Nimble Storage | 2013 | 168 | 99 |

| Barracuda Networks | 2013 | 75 | 40 |

| Hortonworks | 2014 | 110 | 173 |

| Box | 2015 | 554.5 | 175 |

| Mimecast | 2015 | 83 | 77.5 |

| Pure Storage | 2015 | 470 | 425 |

| Average of known figures | 124 | 100 |

* in $ million

** became public via a merger with Network Peripherals

(Source: StorageNewsletter.com)

WHERE DO 447 CURRENT ALIVE START-UPS COME FROM

| Countries | Number of start-ups |

% |

| USA | 319 | 71% |

| France | 19 | 4% |

| UK | 18 | 4% |

| Canada | 14 | 3% |

| Israel | 8 | 2% |

| India | 7 | 2% |

| China | 6 | 1% |

| Switzerland | 6 | 1% |

| Others | 50 | 11% |

| Total | 447 | 100% |

HISTORICAL RECORDS IN TOTAL FINANCIAL FUNDING

(more than $200 million)

| Start-ups | Total financial funding* |

| Cloudera | 1,041 |

| Box | 554,5 |

| Pillar Data Systems | 544 |

| Pure Storage | 470 |

| Nutanix | 312 |

| SimpliVity | 276 |

| Tintri | 260 |

| Dropbox | 257,2 |

| Infinidat | 230 |

| BlueArc | 224 |

| Actifio | 207,5 |

| StorageNetworks | 205 |

| Sanrise | 203 |

* in $ million

(Source: StorageNewsletter.com)

18 NEW START-UPS (known thus far) BORN IN 2014

| Company | Activity and comments |

| AccelStor (New Taipei City, Taiwan) | all-flash array; spin-off from Innodisk; joint venture between Innodisk (50%), Toshiba and SuperMicro |

| Datawise.io (San Jose, CA) | network and storage solutions for Linux containers |

| Datos IO (San Jose, CA) | distributed versioning platform built for recovery of scale-out databases |

| E8 Storage (Tel Aviv-Yafo, Israel) | in stealth mode; storage architecture for enterprise and software-defined cloud; funding round in December 1, 2014 from Magna VC; |

| Fractalio Data (Bangalore, India) | formerly Datalifecycle company; grid-based storage and information management platform, IntegralStor, that grows from terabytes to petabytes |

| Iguaz.io (Herzliya, Israel) | in stealth mode; data management and storage solutions for big data, IoT and cloud applications soft |

| infinite io (Austin, TX) | network-based storage controller |

| Kazan Networks (Auburn, CA) | NVMe over Fabrics solution for flash connectivity |

| LifeSite (San Francisco, CA) | secure web-based solution for storing all of life’s vital information and documents; $4.5 million in early stage funding and then $5 million series A in 2015 |

| Nano-Meta Technologies (West Lafayette, IN) |

plasmonics to advance optical technology; parent company of Photonic Nano-Meta Technologies LLC, Russian Skolkovo-affiliated subsidiary |

| Revert (Auckland, New Zealand) | online backup |

| Rubrik (Palo Alto, CA) | scale-out storage architecture for backup; two rounds in 2015, $10 million anf $41million |

| StorNetware Systems (Bangalore, India) |

in stealth mode; solution called, Cloud In A Box, Cinabox |

| TransferSoft (Culver City, CA) | HyperTransfer software capable of up to 40Gb/s network bandwidth |

| Velostrata (San Jose, CA) | real-time hybrid cloud solution that streams production workloads to and from the cloud in minutes; R&D in Israel |

| Xitore (Orange County, CA) | new way of solid state storage increasing bandwidth, reducing latency; formerly eXtreme Data Storage; in stealth mode |

| ZeroStack (Mountain View, CA) | scale-out private cloud that converges compute, storage, networking and management services; two rounds in 2015: $5.6 million and then $16 million |

| ZettaBox (London, UK) | cloud storage service in Europe, offices in London and Prague |

(Source: StorageNewsletter.com)

6 NEW START-UPS (known thus far) BORN IN 2015

| Company | Activity and comments |

| Datacube.io (France) | backup cloud in SaaS mode |

| FlashGrid (Sunnyvale, CA) | open storage software available to Oracle database customers |

| InterModal Data (Santa Clara, CA) | disaggregated storage software solution for enterprise |

| IzumoBASE (Tokyo, Japan) | software-defined storage, investment from Global Brain in 2014 |

| OpenIO (Hern, France) | open source object storage solution for massive storage infrastructures; also office in San Francisco |

| outpace.IO (Winder, GA) | like defunct Coraid in storage based on ATA over Ethernet; technical and operational business in Montreuil, France (Alyseo) |

(Source: StorageNewsletter.com)

ALL 43 FINANCIAL ROUNDS IN 2015

| NAME(HQ) | FOUNDED IN | 2015 FUNDING* | TOTAL FUNDING* | ACTIVITY AND COMMENTS |

| Axcient (Mountain View, CA) | 2007 | 25 | 76.1 | local backup on an appliance and online backup with DR; raises $7 million and $10.6 million in 2013; acquired DirectRestore in 2014 |

| BlueData Software (Mountain View, CA) |

2012 | 20 | 39 | big data platform |

| ClearSky Data (Boston, MA) | 2013 | 27 | 39 | storage network simplifying data lifecycle and delivers enterprise storage as a fully managed sevice |

| CloudEndure (Mill Valley, CA) | 2012 | 7 | 12.2 | real-time replication and recovery of cloud-based applications; also in Ramat Gan, Israel |

| Cloudistics (Reston, VA) | 2013 | 0.7 | 0.7 | storage acceleration |

| Code 42 Software (Minneapolis, MN) | 2001 | 85 | 137.5 | offsite and online backup solutions, also in UK |

| Cohesity (Santa Clara, CA) | 2013 | 55 | 70 | web-scale, converged storage to unify backup, DevOps, and analytics |

| Coho Data (Palo Allto, CA) | 2011 | 30 | 67 | formerly Convergent.io; founded by XenSource veterans; in hybrid and all-flash system with software-defined storage networking |

| Crossbar (Santa Clara, CA) | 2008 | 35 | 85 | RRAM non-volatile memory competing with flash and DRAM |

| Datos IO (San Jose, CA) | 2014 | 15 | 15 | distributed versioning platform built for recovery of scale-out databases |

| Datto (Norwalk, CT) | 2007 | 75 | 100 | hardware- and cloud-based on- and off-site backup, DR and BC solutions |

| EverSpin Technologies (Chandler, AZ) | 2008 | 25 | 45 | MRAM; with roots in Freescale Semiconductor; $20 million in series A financing and intellectual property from Freescale |

| Exablox (Sunnyvale, CA) | 2010 | 23 | 45.5 | cloud managed, scale-out, object-based storage appliance; formerly Oneblox |

| Hedvig (Santa Clara, CA) | 2012 | 18 | 30.5 | software-defined storage system for cloud |

| Iguaz.io (Herzliya, Israel) | 2014 | 15 | 15 | in stealth mode; data management and storage solutions for big data, IoT and cloud applications soft |

| Infinidat (Herzliya, Israel) | 2010 | 150 | 230 | high-end enterprise storage systems; also in Needham, MA |

| infinite io (Austin, TX) | 2014 | 3.4 | NA | network-based storage controller |

| InterModal Data (Santa Clara, CA) |

2015 | 4 | 4 | disaggregated storage software solution for enterprise |

| Kaminario (Newton, MA) | 2008 | 15 | 143 | all-flash arrays; R&D in Israel |

| LifeSite (San Francisco, CA) | 2014 | 9.5 | 9.5 | secure web-based solution for storing all of life’s vital information and documents; $4.5 million in early stage funding and then $5 million series A in 2015 |

| Liqid (Lafayette, CO) | 2013 | 5.7 | 5.7 | in stealth mode; Kingston and Phison investors |

| Nantero (Woburn, MA) | 2001 | 31.5 | 73 | nonvolatile RAM memory; $10.5 million in 2003 in a second round |

| pCloud (Bulgaria) | 2013 | 3 | 3 | cloud storage provider |

| Peaxy (San Jose, CA) | 2012 | 15 | 32 | storage and management software |

| Pivot3 (Austin, TX) | 2002 | 45 | 171.5 | RAID Across Independent Gigabit Ethernet (RAIGE) for video surveillance |

| Pluribus Networks (Palo Alto, CA) |

2010 | 50 | 95 | distributed network hypervisor OS, converging compute, network, storage and virtualization |

| Qumulo (Seattle, WA) | 2012 | 40 | 66.8 | data-aware scale-out NAS; seed funding of $2.3 million and series A $24.5 million in 2012 |

| Revert (Auckland, New Zealand) |

2014 | 1.2 | 1.6 | online backup |

| Robin Systems (Milpitas, CA) | 2013 | 15 | 22 | data-centric compute and storage containerization software |

| Rubrik (Palo Alto, CA) | 2014 | 51 | 51 | scale-out storage architecture for backup; two rounds in 2015, $10 million and $41million |

| Scale Computing (Indianapolis, IN) | 2008 | 18 | 61 | hyper-converged solutions; $9 million and $17 million rounds in 2010 |

| Scality (San Francisco, CA) | 2010 | 45 | 80 | massively scalable storage platform; spin-off from Bizanga; R&D in Paris; formerly BizangaStore |

| SimpliVity (Westborough, MA) |

2009 | 175 | 276 | 2U box platform to manage virtualized infrastructure; formerly Ecological Solution |

| SoftNAS (Houston, TX) | 2013 | 5 | 6.4 | cloud storage OS |

| SpiderOak (Kansas City, MO) | 2007 | 3.5 | 3.5 | online backup and sharing service |

| Springpath (Sunnyvale, CA) | 2012 | 25 | 34 | software-defined storage; formerly Storvisor |

| Tegile Systems (Newark, CA) | 2009 | 70 | 117.5 | multi-protocol SSD/HDD array with de-dupe for primary storage |

| Tintri (Mountain View, CA) | 2008 | 125 | 260 | purpose-built SSD storage system for virtual machines; two rounds in 2011: $17 million (A,B) and then $18 million (C) |

| TransferSoft (Culver City, CA) | 2014 | 3 | 3 | HyperTransfer software capable of up to 40Gb/s network bandwidth |

| Velostrata (San Jose, CA) | 2014 | 14 | 14 | real-time hybrid cloud solution that streams production workloads to and from the cloud in minutes; R&D in Israel |

| WeTransfer (Amsterdam, The Netherlands) |

2009 | 25 | 25 | file-transfer service |

| ZeroStack (Mountain View, CA) |

2014 | 21.6 | 21.6 | scale-out private cloud that converges compute, storage, networking and management services; two rounds in 2015: $5.6 million and then $16 million |

| ZettaBox (London, UK) | 2014 | 10 | 10 | cloud storage service in Europe, offices in London and Prague |

* in $ million

(Source: StorageNewsletter.com)

Note: when there are more than one round of financial funding the same year, we add them considering the total as only one round.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter