Storage Start-Ups in 2018

36 financial rounds, lowest number historically

By Jean Jacques Maleval | January 7, 2019 at 2:17 pmSince 1998 we analyze the start-ups in the worldwide storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

2018 was not great year in term of financials deals: few M&As and financial rounds for start-ups.

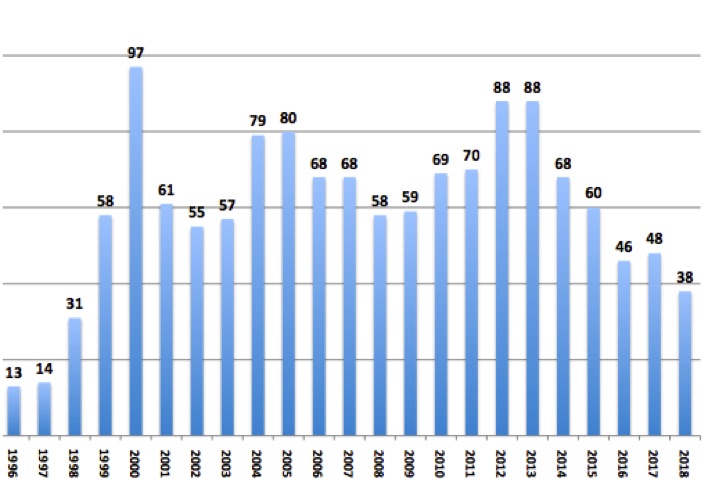

VCs were less reluctant to invest in storage. The number of financial rounds in 2018 is the lowest since 1999 with 38 – compared to 48 in 2018,- but with biggest rounds for a total amount of $1,442 million up 12% from $1,291 million in 2017.

The highest round last year was $250 million for Cohesity then $100 million for both Actifio and Cloud Constellation, being $180 million for Rubrik in 2017, $175 million for SimpliVity in 2015, and $900 million for Cloudera in 2014.

NUMBER OF FINANCIAL ROUNDS FROM 1996 TO 2018

(Source: StorageNewsletter.com)

LARGEST FINANCIAL ROUNDS IN 2018

(at $60 million and more)

| Company | in $ million |

| Cohesity | 250 |

| Actifio | 100 |

| Cloud Constellation |

100 |

| Cloudian |

94 |

| Qumulo |

93 |

| Egnyte |

75 |

| Wasabi Technologies |

68 |

| Datrium |

60 |

| Scality | 60 |

(Source: StorageNewsletter.com)

There was 9 rounds at $60 million and more last year. N° 1 Cohesity with $250 million this time got already $90 million in 2017 and $55 million in 2015, with now a total at $410 million. Actifio also surpasses $300 million in 2018 in total funding with $307.5 million.

Why not better in 2018?

The worldwide storage market is no more growing so fast and then not a real good opportunity for investors. Furthermore in the more popular technologies attracting users (SSDs, all-flash systems, software-defined storage, scale-out NAS, hyperconverged platform, cloud storage), there are already too many competitors including about all storage giants.

Furthermore, there is currently about no new killer technology that could convince VCs, just improvements.

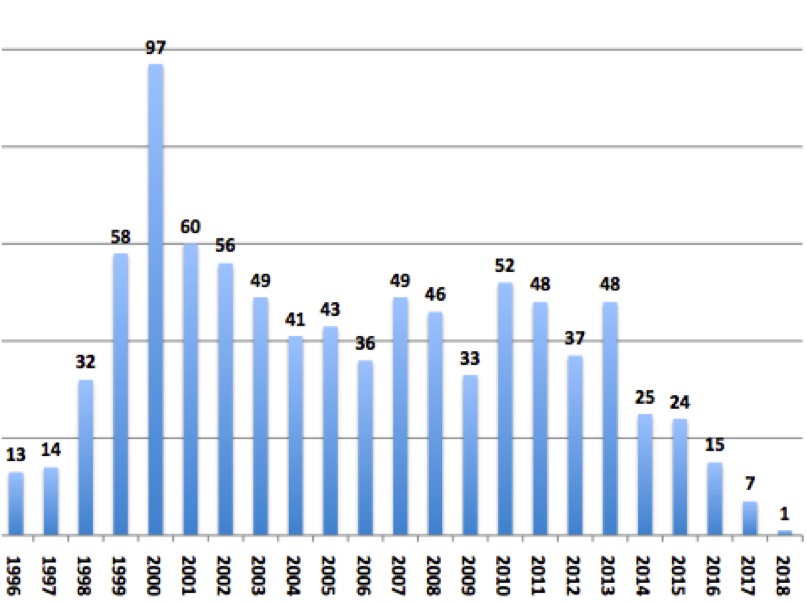

Less New Start-Ups

Also worrying is the reduced number of start-ups founded since the heydeys of 2000 when 97 new entities sprang up in a single year. We were only able to turn up only one new firm, Hammerspace, launched last year vs. 7 in 2017, 15 in 2016, 19 in 2015 and 25 in 2014, while these figures will go up as more of start-ups, operating in stealth mode, will come to light. For example, we found only 2 firms born in 2017 at the same time last year, this figure now being increased to 7 now discovered.

One of the reason is that the number of M&As is largely decreasing and often start-ups are created by people leaving acquired companies.

NUMBER OF STORAGE START-UPS LAUNCHED EACH YEAR SINCE 1996

(when the born year is known) (Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

2018 Good Year in Financial Funding

The average amount per round in 2018 is impressive, $38 million, a record since we investigate this market – excluding 2004 with $42 million -, increasing yearly 41%, from $27 million last year.

Investors put much more money in less start-ups.

These past 14 years, VCs have put $28 billion in storage start-ups. This amount is higher than the total figure in the table below ($17.8 billion adding all rounds) because, for several firms, we got the total invested but not the details per round.

On average, a company got historically $51 million in total funding, the average per round being $17 million.

ALL FINANCIAL ROUNDS FROM 2003 TO 2018

(only for start-ups releasing the amount of their financial rounds)

| Year | Number of rounds |

Total invested* |

Average per round* |

| 2003 | 57 | 759 | 13 |

| 2004 | 79 | 992 | 13 |

| 2005 | 80 | 1,004 | 13 |

| 2006 | 68 | 818 | 12 |

| 2007 | 68 | 789 | 12 |

| 2008 | 58 | 751 | 13 |

| 2009 | 59 | 591 | 10 |

| 2010 | 69 | 865 | 13 |

| 2011 | 70 | 1,235 | 18 |

| 2012 | 88 | 1,503 | 17 |

| 2013 | 88 | 1,645 | 19 |

| 2014 | 68 | 2,888 | 42 |

| 2015 | 60 | 1,679 | 28 |

| 2016 | 46 | 959 | 21 |

| 2017 | 48 | 1,291 | 27 |

| 2018 |

38 | 1,442 | 38 |

| TOTAL | 1,046 | 17,819 | 17 |

* in $ million

(Source: StorageNewsletter.com)

TOTAL INVESTED IN START-UPS FROM 2003 TO 2018 ALL ROUNDS INCLUDED

(only for companies releasing or calculated total amount invested)

| Total invested* | 27,664 |

| Number of start-ups | 546 |

| Average per start-up* | 51 |

* in $ million

(Source: StorageNewsletter.com)

PER ACTIVITY AMONG CURRENT 495 ALIVE START-UPS

| Activity | Number | % |

| Software | 250 | 47% |

| Hardware | 147 | 27% |

| SSP, cloud |

79 | 15% |

| Connection | 28 | 5% |

| Fundamental technology | 19 | 4% |

| Security | 7 | 1% |

| TOTAL | 530 | 100% |

Total is more than 495 as some companies are listed with more than one activity.

(Source: StorageNewsletter.com)

Where Are They Going?

What becomes of all these storage start-ups after we identify and count them. The conclusion is not really reassuring, a reminder that investment in these sorts of companies is in fact highly risky.

On all start-ups identified, only 4% eventually go public, and thus allow investors generally more than just to recoup their original stake. The same is generally true for the 29% that find buyers, although the asking price is not always greater than the total of all sunk investments. It is, in any case, the emergency exit that many companies are seeking. Meanwhile, another 18% just vanish off the map – doors closed.

Half of all alive start-ups remain in a holding pattern, still a start-up, still nursing the secret hope of an offer from a storage giant seeking to fill-in a missing technology.

WHAT HAPPENED TO THEM SINCE 1978

(out of a total 967 start-ups)

| Became public | 34 | 4% |

| Sold | 278 | 29% |

| Closed | 172 | 18% |

| Remaining start-ups | 483 | 50% |

(Source: StorageNewsletter.com)

13 start-ups found a buyer or merged in 2018 – 19 in 2017 – the biggest deal last year being X-IO Technologies sold to Violin for $87.5 million. HPE was an avid acquirer in 2017, buying Nimble Storage for $1.09 billion and SimpliVity for $650 million but only one (BlueData) in 2018.

There was just 4 IPOs in 2015 and 2 in 2016 as well as in 2017 but only one in 2018, by Dropbox, raising an historical record of $1.7 billion.

These facts demonstrate that, to get more money to finance the growth of young companies, IPO seems today a better way than an acquisition.

37 IPOs IN STORAGE INDUSTRY

| Company | IPO year | Amount raised* | Total funding* |

| Silicon Storage Technology |

1995 | 15 | NA |

| StorageNetworks | 2000 | 260 | 205 |

| BakBone | 2000 | NA | NA |

| McData | 2000 | 350 | NA |

| STEC | 2000 | 65 | NA |

| FalconStor** | 2001 | NA | 33 |

| Xyratex | 2004 | 48 | NA |

| Rackable Systems | 2005 | 75 | 21 |

| CommVault | 2006 | 161 | 75 |

| Double-Take | 2006 | 55 | 70 |

| Isilon | 2006 | 108 | 69 |

| Riverbed | 2006 | 86 | 38 |

| 3PAR | 2007 | 95 | 183 |

| Compellent | 2007 | 85 | 53 |

| Data Domain | 2007 | 111 | 41 |

| Mellanox | 2007 | 102 | 89 |

| Netezza | 2007 | 124 | 68 |

| Voltaire | 2007 | 47 | 75 |

| Rackspace Hostings | 2008 | 145 | NA |

| OCZ Technology | 2010 | 101 | NA |

| Carbonite | 2011 | 62 | 67 |

| Fusion-io | 2011 | 223 | 112 |

| JCY International | 2011 | 238 | NA |

| Parade Technologies | 2011 | 34 | 21.5 |

| Violin Memory | 2013 | 162 | 186 |

| Nimble Storage | 2013 | 168 | 99 |

| Barracuda Networks | 2013 | 75 | 40 |

| Hortonworks | 2014 | 110 | 173 |

| Adesto Technologies | 2015 | 22 | 54 |

| Box | 2015 | 554 | 175 |

| Mimecast | 2015 | 83 | 77.5 |

| Pure Storage | 2015 | 470 | 425 |

| EverSpin Technologies | 2016 | 40 | 45 |

| Nutanix | 2016 | 238 | 370 |

| Tintri | 2017 | 60 | 260 |

| Cloudera | 2017 | 225 | 1,041 |

| Dropbox |

2018 | 592 | 1,700 |

| Average of known figures | 154 | 108 |

* in $ million

** became public via a merger with Network Peripherals

(Source: StorageNewsletter.com)

WHERE DO 495 CURRENT ALIVE START-UPS COME FROM

Storage is mainly an US sport.

| Countries | Number of start-ups |

% |

| USA | 342 | 69% |

| UK | 23 | 5% |

| France | 20 | 4% |

| Canada | 14 | 3% |

| Israel* | 14 | 3% |

| India | 6 | 1% |

| Switzerland | 7 | 1% |

| Australia | 6 | 1% |

| China | 6 | 1% |

| Germany | 6 | 1% |

| Others | 51 | 10% |

| Total | 495 | 100% |

* Several start-ups were funded in Israel but transferred HQs in USA

(Source: StorageNewsletter.com)

HISTORICAL RECORDS IN TOTAL FINANCIAL FUNDING

(more than $200 million)

| Start-ups | Total financial funding* |

| Cloudera | 1,041 |

| Dropbox |

592 |

| Box | 554 |

| Pillar Data Systems | 544 |

| Pure Storage | 470 |

| Cohesity |

410 |

| Nutanix | 370 |

| Infinidat | 325 |

| Actifio |

308 |

| Rubrik | 292 |

| SimpliVity | 276 |

| Tintri | 260 |

| MapR | 250 |

| Pivot3 | 247 |

| BlueArc | 224 |

| Qumulo |

223 |

| Kaminario | 218 |

| StorageNetworks | 205 |

| Sanrise | 203 |

* in $ million

(Source: StorageNewsletter.com)

SEVEN START-UPS (known thus far) BORN IN 2017

| COMPANIES (HQ) | BUSINESS |

| Esoptra (Herentals, Belgium) |

customizable, ultralight information access and integration |

| L2 Drive (Irvine, CA) |

HDD technology |

| Market.space (Estonia) |

secure and transparent platform for storage, transmission and direct content distribution |

| plIO/s (Ramat Gan, Israel) |

NAND storage processor; investment from State Of Mind Ventures |

| ProGrade Digital (San Jose, CA) |

memory card; co-founders and executives from Micron and Lexar |

| Salvobit (Sofia, Bulgaria) |

secure peer-to-peer software for file sharing; crowdfunding in progress |

| Upbound (Seattle, WA) |

cloud-native computing enabling organizations to run, scale and optimize their services across multiple public and private cloud environments |

(Source: StorageNewsletter.com)

ONE START-UP (known thus far) BORN IN 2018

| COMPANY (HQ) | BUSINESS | ||||

| Hammerspace (Los Altos, CA) | software-as-a-service to simplify availability and control of unstructured data across hybrid cloud | ||||

ALL 39 FINANCIAL ROUNDS IN 2018

| COMPANY (HQ) | BORN IN | INVESTMENT IN 2017* | TOTAL INVESTMENT* | BUSINESS |

| Actifio (Weston, MA) | 2009 | 100 | 307.5 | solution for data protection, DR and BC; |

| Burlywood (Longmont, CO) | 2015 | 10.6 | 12 | modular controller architecture that accelerates time-to-market of new NAND adoption |

| ClearSky Data (Boston, MA) | 2013 | 20 | 59 | storage network simplifying data lifecycle and delivers enterprise storage as a fully managed sevice |

| Cloud Constellation (Los Angeles, CA) |

2015 | 100 | 105 | cloud data storage in space |

| CloudEndure (New York, NY) |

2012 | 7 | 25.2 | live-migration and DR solutions; also in Ramat Gan, Israel |

| Cloudian (San Mateo, CA) |

2011 | 94 | 173 | hybrid cloud storage platform; formerly Gemini Mobile Technlologies; series B funding from Intel Capital in 2013; last round in joint venture with Digital Alpha; acquired Infinity Storage in 2018 |

| CNEX Labs (San Jose, CA) |

2013 | 23 | 83 | NVMe PCIe SSD controller; two rounds in 2014, $17 million and then $20 million |

| Cohesity (San Jose, CA) |

2013 | 250 | 410 | web-scale, converged storage to unify backup, DevOps, and analytics |

| CTERA Networks (Petach Tikva, Israel) | 2008 | 30 | 100 | Cloud Attached Storage grouping small NAS into single appliance; also in NYC |

| Datrium (Sunnyvale ,CA) |

2013 | 60 | 170 | server-flash storage system |

| Egnyte (Mountain View, CA) |

2007 | 75 | 132.5 | cloud storage (online file server) |

| Excelero (Tel Aviv, Israel) |

2014 | 5 | 35 | software product that leverages, NVMe SSD and SR-IOV and RDMA; also in Santa Clara, CA |

| HyperGrid (San Jose, CA) |

2009 | 40 | 93 | hyper-converged all flash infrastructure; originated in Dublin, Ireland; formerly Gridstore; named change in 2016 following merger with DCHQ; $15 million and $25 million in 2018 |

| Igneous Systems (Seattle, WA) | 2013 | 15 | 41.6 | cloud infrastructure for data you can’t or won’t move off-premises |

| Imanis Data (San Jose, CA) |

2013 | 13.5 | 16.2 | formerly Talena; machine learning-based data management platform that includes cloud migration and backup/recovery tools |

| infinite.io (Austin, TX) |

2011 | 10.3 | 13.7 | peer-to-peer software which enables users to access all their data from any of their computing devices |

| LucidLink (San Francisco, CA) |

2016 | 5.5 | 7.1 | cloud backed distributed file service |

| Nantero (Woburn, MA) |

2001 | 29.7 | 120 | non volatile RAM memory |

| NGD Systems (Irvine, CA) | 2013 | 12.4 | 26 | SSDs based on own controller, formerly NxGn Data |

| Nyriad (Cambridge, New Zealand) |

2014 | 8.5 | 11 | storage solutions for big data and HPC |

| OpenDrives (Culver City, CA) |

2011 | 12 | 23 | all-flash and hybrid NAS for media workflows, series B in 2018 |

| OwnBackup (Fort Lee, NJ) |

2012 | 15.5 | 26.5 | backup and restore ISV on the Salesforce.com AppExchange; also in Israel |

| Pavilion Data Systems (San Jose, CA) |

2014 | 15 |

33 | processor agnostic storage in PCIe-based shared storage environment |

| Preservica (Abingdon Oxfordshire, UK) | 2012 | 10 | 13.7 | active digital preservation software; also in Boston, MA |

| Qumulo (Seattle, WA) |

2012 | 93 | 223 | scale-out file storage |

| Robin Systems (San Jose, CA) |

2013 | 17 | 39 | data-centric compute and storage containerization software |

| RStor.io (Saratoga, CA) |

2016 | 45 | 45 | hyper-distributed multicloud platform |

| Scale Computing (Indianapolis, IN) | 2008 | 34.8 | 95.8 | hyperconverged solutions |

| ScaleFlux (San Jose, CA) |

2014 | 25 | 40 | computational storage subsystem; also in Beijing, China |

| Scality (San Francisco, CA) |

2010 | 60 | 152 | massively scalable storage platform; spin-off from Bizanga; R&D in Paris; formerly BizangaStore; investment of HPE in 2016, probably around $10 million |

| SkyKick (Seattle, WA) |

2011 | 40 | 65 | SaaS cloud automation and management products for Microsoft information technology service providers |

| Spin Memory (Fremont, CA) | 2007 | 52 | 158 | orthogonal spin transfer magneto-resistive random access memory technology |

| Storage Made Easy (Sutton, UK) |

2008 | 4 | 6.5 | secure private enterprise file sharing and synchronization; wholly-owned by Vehera Ltd.; formerly SMEStorage |

| StorageOS (London, UK) |

2015 | 8 | NA | low entry point, full enterprise functionality storage array integrated with VMWare, Docker, AWS, and Google Cloud |

| Tresorit (Budapest, Hungary) |

2011 | 11.5 | 18 | cloud-based, secure file synchronising software; 80 million HUF investment from Euroventures IV |

| Upbound (Seattle, WA) |

2017 | 9 | NA | cloud-native computing enabling organizations to run, scale and optimize their services across multiple public and private cloud environments |

| Wasabi Technologies (Boston, MA) | 2015 | 68 | NA | cloud-based object storage as a service; formerly BlueArchive, successor of Storiant in software for cold storage |

| Weebit Nano (Hod Hasharon, Israel) |

2015 | 3 | NA | in semiconductor memory elements to become faster, more reliable energy efficient and cost effective NVM |

| Zadara Storage (Irvine, CA) | 2011 | 25 | 60 | software-defined storage as a service for public and private clouds (NAS and SAN); also in Nesher, Israel |

* in $ million

(Source: StorageNewsletter.com)

Note: when there are more than one round of financial funding the same year, we add them considering the total as only one round.

Read also:

Storage Start-Ups in 2017

VCs investing 34% more than in 2016

Storage Start-Ups in 2016

Worst year since 2003

by Jean Jacques Maleval | 2017.01.10 | News

Storage Start-Ups in 2015

Worst year since 2003 in number of financial rounds

by Jean Jacques Maleval | 2016.01.06 | News

Storage Start-Ups in 2014

Historical record for just one financial round: $900 million for …

by Jean Jacques Maleval | 2015.03.03 | News

Storage Start-Ups in 2013

$1.3 billion invested in 57 companies following 58 financial rounds

by Jean Jacques Maleval | 2014.01.08 | News

Storage Start-Ups in 2012

Innovation never stopping in industry, 67 new rounds last year

by Jean Jacques Maleval | 2013.02.13 | News

ANALYSIS: Storage Start-Ups in 2011

Record year in total financial funding: more than $1 billion

by Jean Jacques Maleval | 2012.01.04 | News

ANALYSIS: STORAGE START-UPs IN 2010

52 investment rounds vs. 49 in 2008 and 2009

by Jean Jacques Maleval | 2011.01.03 | News

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter