StorCentric Continues Shopping, Acquiring Struggling Start-Up Vexata in AFAs

After Drobo, Nexsan and Retrospect

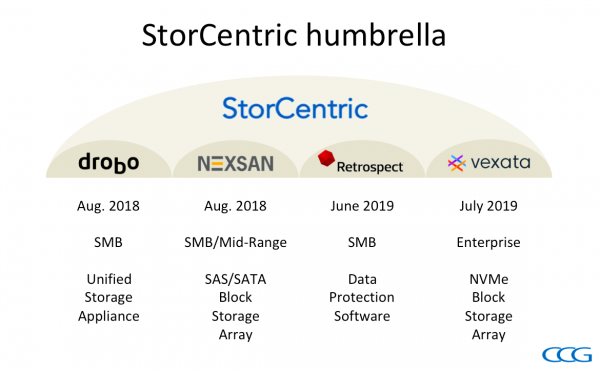

This is a Press Release edited by StorageNewsletter.com on July 3, 2019 at 2:09 pmStorCentric, Inc., parent company of Drobo, Nexsan and Retrospect, announced the acquisition of Vexata, Inc, its fourth acquisition in less than a year.

Vexata’s scalable NVMe high performance flash storage systems power cognitive era applications, such as those driving predictive analytics and autonomous decisions, and pairs it with StorCentric customer support now available to Vexata customers.

Performance Requirements for Next Gen of Applications

Vexata’s products deliver 10x performance and efficiency improvements at a fraction of the cost of existing all-flash storage solutions. Its NVMe flash-based arrays also deploy simply and seamlessly into enterprise and cloud data center environments.

“Purchasing Vexata at this time has enabled us to add a powerful and proven enterprise-grade NVMe flash solution that was not previously available under the StorCentric umbrella,” commented Mihir Shah, StorCentric CEO. “Our Nexsan enterprise customers are evaluating NVMe solutions to address evolving requirements for their most demanding applications. The Vexata products will provide a portfolio of highly scalable and performant data storage solutions with the operational simplicity of StorCentric’s portfolio of products.”

“The Vexata team is excited to be joining the StorCentric group of companies, and we see the move as an ideal fit for both organizations,” commented Surya Varanasi, co-founder and CTO, Vexata. “As part of the StorCentric family, Vexata will be able to leverage the strong Nexsan channel community of over 1,000 partners that provide customers transformative technology to address the most mission critical use cases. This announcement also gives Vexata customers access to an award-winning customer support experience.”

This announcement comes shortly after StorCentric’s acquisition of Retrospect, provider of backup and recovery tools, and underscores the company’s commitment to delivering the a comprehensive and powerful family of data storage solutions. The four brands under StorCentric offer a product portfolio with world-class hardware and software storage products, IP, and professional expertise focused on helping customers scale their businesses while accessing, protecting and archiving critical data. StorCentric now has a combined record of 1 million customers, 60 years of storage expertise and a focus on the media and entertainment, financial, government and healthcare verticals.

Comments

Surprise or not surprise? In fact, it confirms Vexata difficulties for a few months illustrated by the departure of a few executives (Ashish Gupta CMO and Rick Walsworth VP product marketing), sales strategy changes with direct sales, alliances with Fujitsu, limited market adoption and tough times to raise a new VC round that forces a rapid exit.

It also represents a new example of early AFA/NVMe players who suffer from lack of adoption and giants’ presence. Violin famous difficulties in the past, DSSD got acquired by EMC and was killed later, Mangstor morphed to Exten, Apeiron is invisible, E8, Excelero, Pavilion signed a few deals and partnerships but don’t really take off. Kaminario has anticipated some changes on the market and moved to pure software model, composable infrastructure and global partnership with TechData.

For StorCentric, it’s a bargain and a real invitation to high-performance storage with NVMe that complements well Nexsan product line. With a strong channel and installed base, Mihir Shah had a brilliant idea to decide fast about this move. Nobody anticipated this direction from Vexata or StorCentric and Shah’s wish to add software and key differentiators to the product is confirmed again.

It will help the company to pass the $100 million barrier probably this year. Important to notice that founder and CEO of Vexata, Zahid Hussain, doesn't join StorCentric.

It will also change a bit the 3 x 1/3 model with hardware, software and support/services promoted by Shah. We think this hardware business will represent close to 50% with Vexata.

As Vexata promoted lots of use cases with Spectrum Scale, StorCentric could think about adding a kind of NAS head on top and could acquire some file server technology to address file and block needs for enterprises… We'll see.

The Californian start-up was born in 2013 and got $103 million in total investment including Intel on three rounds in 2014, 2016 and 2017.

Read also:

StorCentric Acquires Retrospect

Third acquisition after Drobo and Nexsan to offer storage, archiving and backup solutions [with our comments]

27 Jun 2019 | Press Release

VP Rick Walsworth Left Vexata

As well as CMO Ashish Gupta

by Jean Jacques Maleval | June 27, 2019 | News

Exclusive Interview With Zahid Hussain, CEO and Co-Founder, Vexata

In all-flash array

by Philippe Nicolas | January 31, 2018 | News

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter