Sandisk: Fiscal 2Q26 Financial Results

Revenue of $3.03 billion, up 61% YoY and up 31% QoQ

This is a Press Release edited by StorageNewsletter.com on February 11, 2026 at 2:01 pmSummary:

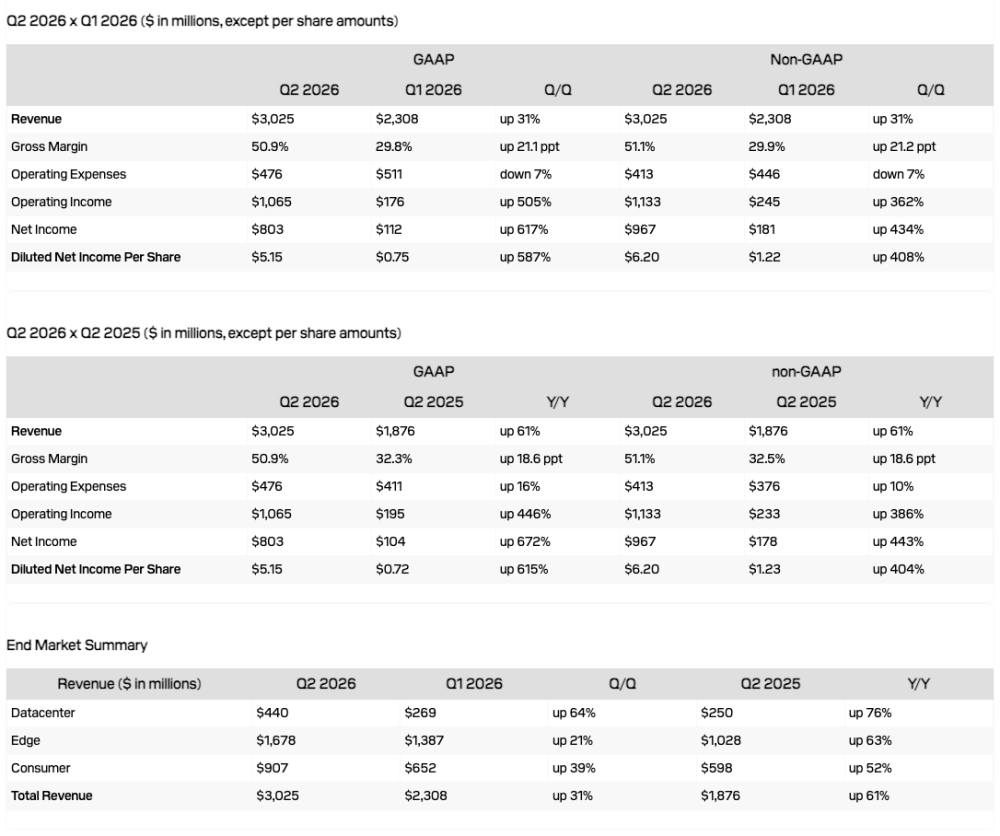

- Second quarter revenue was $3.03 billion, up 31% sequentially and above the guidance range, with GAAP net income reported at $803 million ($5.15 diluted net income per share). Second quarter Non-GAAP diluted net income per share was $6.20

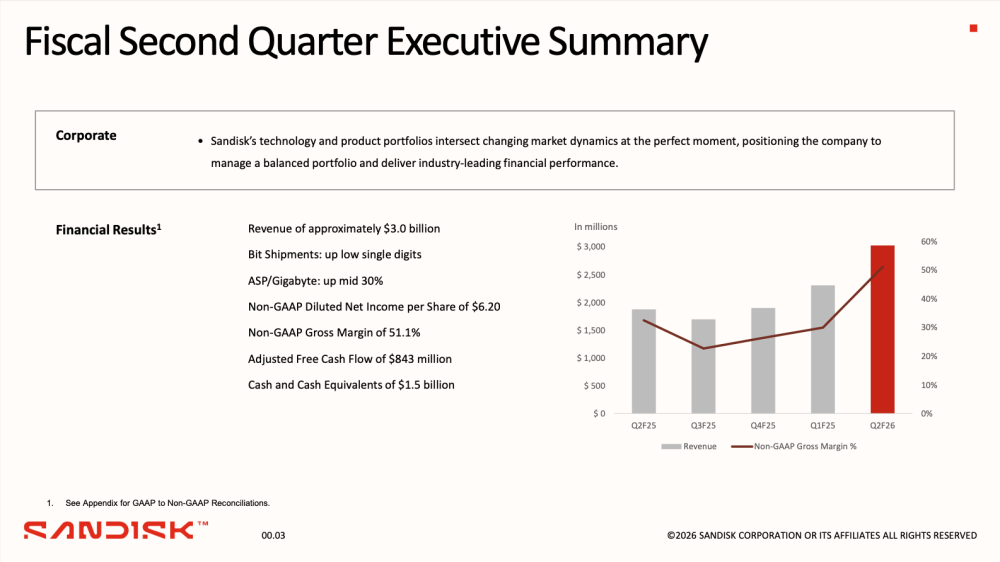

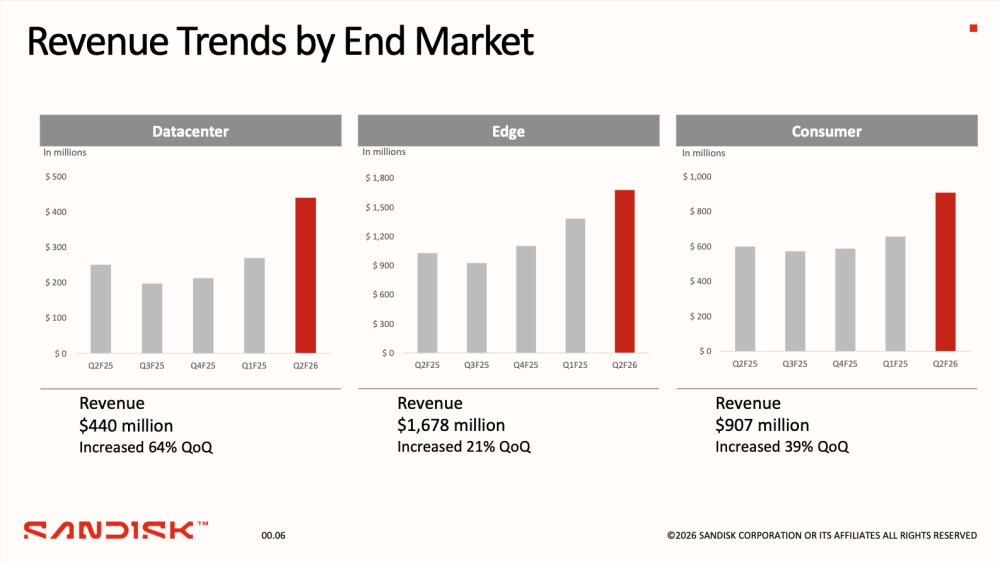

- Datacenter revenue was up 64% sequentially, driven by strong adoption among AI infrastructure builders, semi-custom customers, and technology companies deploying AI at scale

- Expect third quarter revenue to be in the range of $4.40 billion to $4.80 billion, with expected Non-GAAP diluted net income per share to be in the range of $12.00 to $14.00

Sandisk Corp. reported fiscal second quarter financial results.![]() “This quarter’s performance underscores our agility in capitalizing on better product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics, all at a time when the critical role that our products play in powering AI and the world’s technology is being recognized,” said David Goeckeler, CEO, Sandisk. “Our structural reset to align supply with attractive, sustained demand positions us to drive disciplined growth and deliver industry-leading financial performance.”

“This quarter’s performance underscores our agility in capitalizing on better product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics, all at a time when the critical role that our products play in powering AI and the world’s technology is being recognized,” said David Goeckeler, CEO, Sandisk. “Our structural reset to align supply with attractive, sustained demand positions us to drive disciplined growth and deliver industry-leading financial performance.”

Q2 2026 Financial Highlights

Click to enlarge

Basis of presentation

On February 21, 2025, Sandisk completed its separation from Western Digital Corporation (“WDC”) and became a standalone publicly traded company.

The company’s financial and operating results after the separation are presented on a consolidated basis. For periods prior to the separation, the company’s historical combined financial statements were prepared on a carve-out basis and were derived from WDC’s consolidated financial statements and accounting records and prepared as if the company existed on a standalone basis. The financial statements for all periods presented, including the historical results of the company prior to February 21, 2025, are now referred to as “Consolidated Financial Statements” and have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”).

Comments

SanDisk has continued to post very strong results following its separation from WDC. In 2Q26, revenue surpassed the $3 billion mark, rising 31% sequentially and 61% YoY.

Gross margin exceeded 50%, while net income reached $803 million, up sharply from $104 million in 2Q25 - an increase of nearly eightfold, or 672% YoY. Net income in 1Q26 stood at $112 million.

Click to enlarge

For the first six months of the fiscal year, revenue totaled $5.333 billion, representing a 42% increase compared with $3.759 billion in the same period last fiscal year. Annualized run-rate revenue (ARR) climbed to $8.929 billion, up 63% YoY and already exceeding full-year FY2025 revenue of $7.335 billion. With full-year guidance of $4.4-$4.8 billion for the second half and positive momentum expected in Q4, we estimate full-year revenue could reach $14.5–$15 billion - roughly double the prior year.

These strong results are being driven by solid demand, favorable pricing, and supply constraints. We also believe SanDisk’s independent performance highlights that the flash business within WDC had been a limiting factor. SanDisk’s revenue progression - $6.086 billion in 2023, $6.663 billion in 2024, and $7.335 billion in 2025 - reflects a previously modest growth trajectory that has clearly accelerated post-separation.

Click to enlarge

Click to enlarge

The datacenter segment remains robust, generating $440 million in revenue, up 64% from $269 million. The edge segment is performing particularly well, rising to $1.678 billion from $1.387 billion.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter