CoreWeave: Fiscal 3Q25 Financial Results

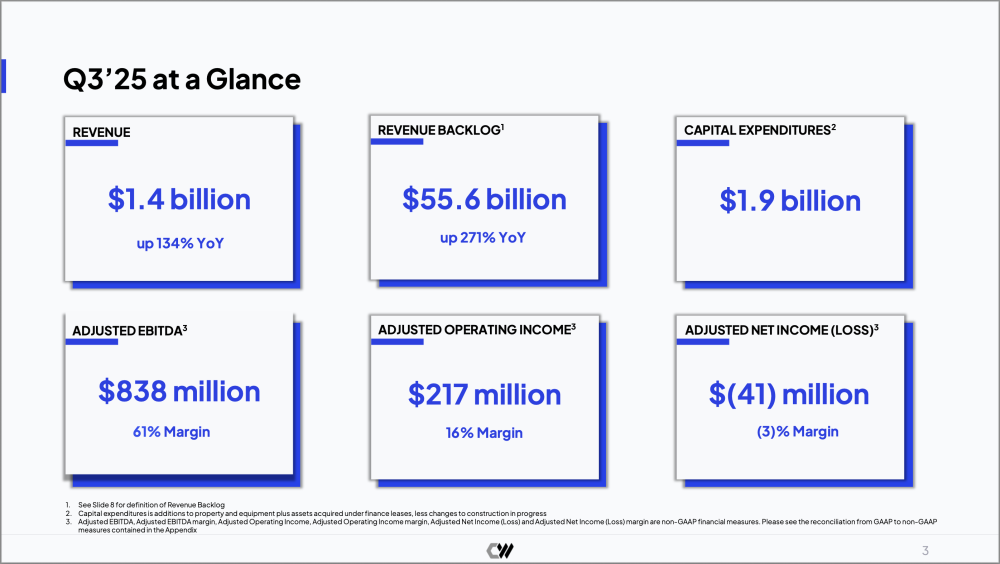

Revenue of $1.365 billion, up 12% QoQ and up 134% YoY

This is a Press Release edited by StorageNewsletter.com on November 14, 2025 at 2:03 pmCoreWeave, Inc., key cloud for AI provider, reported financial results for the third quarter ended September 30, 2025.![]() “We delivered an exceptional third quarter, setting new records for revenue and almost doubling our revenue backlog to more than $55 billion,” said Michael Intrator, co-founder, chairman and CEO, CoreWeave. “Our performance reflects disciplined execution across every part of our business, from scaling infrastructure and expanding capacity to deepening customer relationships and advancing our software and services. CoreWeave’s position as the essential cloud for AI has never been stronger as we drive growth through focus and innovation to power the next generation of AI.”

“We delivered an exceptional third quarter, setting new records for revenue and almost doubling our revenue backlog to more than $55 billion,” said Michael Intrator, co-founder, chairman and CEO, CoreWeave. “Our performance reflects disciplined execution across every part of our business, from scaling infrastructure and expanding capacity to deepening customer relationships and advancing our software and services. CoreWeave’s position as the essential cloud for AI has never been stronger as we drive growth through focus and innovation to power the next generation of AI.”

Third Quarter 2025 Financial Highlights

Click to enlarge

Additional Third Quarter 2025 Financial Highlights

Revenue backlog1 was $55.6 billion as of September 30, 2025.

1 Revenue backlog includes remaining performance obligations, plus other amounts we estimate will be recognized as revenue in future periods under committed customer contracts, in each case, subject to the satisfaction of delivery and availability of service requirements.

Click to enlarge

Third Quarter 2025 Highlights

- Customer wins across AI labs, Hyperscalers and Enterprises

- Entered into an up to approximately $14.2 billion multi-year deal with Meta to power next-generation workloads with option to meaningfully expand

- Expanded the OpenAI partnership with an up to approximately $6.5 billion deal, bringing total commitments to up to approximately $22.4 billion

- Expanded relationship with a leading hyperscaler, marking their sixth contract to date

- Partner of choice for leading AI pioneers and enterprises including: Inference.net, Mizuho Bank, NASA JPL, and Poolside

- Continued rapid scaling of Purpose-Built AI Infrastructure

- Added approximately 120 MW of active power in the quarter, bringing the total to approximately 590 MW

- Expanded total contracted power to approximately 2.9 GW while further diversifying our portfolio of providers

- Key Technology Leadership Milestones

- First to deploy Nvidia GB300 NVL72 systems, powering frontier AI companies at scale

- First to make Nvidia RTX PRO 6000 Blackwell Server Edition instances generally available

- Acquired OpenPipe, a leading platform for training AI agents with reinforcement learning

- Strengthening Financial Position

- Raised $1.75 billion in 9.0% Senior Unsecured Notes due 2031 to drive the next generation of cloud computing for the future of AI

- Closed the DDTL 3.0 Facility, a $2.6 billion delayed draw term loan facility at SOFR +4%, driving substantial progress in reducing our cost of capital

- Amended the DDTL 2.0 Facility (DDTL 2.1) by increasing the remaining drawable capacity by $0.4 billion to create a new $3.0 billion tranche of delayed draw term loans at SOFR +4.25%, significantly below the original cost of the facility

- Satisfied the share price performance obligations to automatically terminate the Series C Preferred Stock Put Right, increasing Stockholders’ Equity by $1.2 billion

- Other Noteworthy Updates

- Agreed to a $6.3 billion strategic collaboration with Nvidia to scale GPU infrastructure and accelerate AI innovation

- Introduced CoreWeave Ventures, a new initiative to back founders and companies building the platforms and technologies that will shape the AI ecosystem and the next frontier of computing

- Announced intent to commit up to $6 billion to equip a state-of-the-art data center in Lancaster, Pennsylvania, with an initial 100 MW of capacity and expansion potential to 300 MW

- Announced an incremental £1.5 billion commitment in the UK, bringing the total investment to £2.5 billion, to accelerate AI innovation and growth through sustainable computing

Comments

As CoreWeave belongs to the small group of AI cloud providers what some people name neoclouds, others GPU-as-a-Service, probably a too limited term, revenue obviously follows a stellar trajectory. Sequentially up 12%, the annual revenue skyrockets reaching $1.365 billion, up 134% YoY. The ARR approaches $4.3 billion.

This is fueled by an amazing AI demands and the beauty of virtuous circles, in fact close partnerships, between Nvidia, AI firms, META, neoclouds plus "classic" cloud providers and we can even add other processors and accelerators companies such as AMD plus players like SambaNova, Cerebras or Groq and obviously investors,

These group of players signed mega-deals and obviously these ones can't be delivered immediately as they're so big and also multi-years contracts by nature. As said, they feed and sustain a limited group of companies. It means that the backlog explodes representing almost 13x the ARR as contracts elements are not all available. We'll monitor carefully these backlogs aspects as it represents exceptional amounts that invite some people to reintroduce a bubble effect...

Click to enlarge

Regarding storage associated services, CoreWeave lists selected several key partners such as DDN, IBM with Storage Scale, Pure Storage, Vast Data and Weka, but the recent "big" deal with Vast Data confirms their choice.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter