Western Digital: Fiscal 4Q25 and FY25 Financial Results

Quarter Revenue Up 30% Y/Y at $2.61 billion, Up 51% at 9.52 billion for FY25, CFO expect $2.7 billion for next quarter

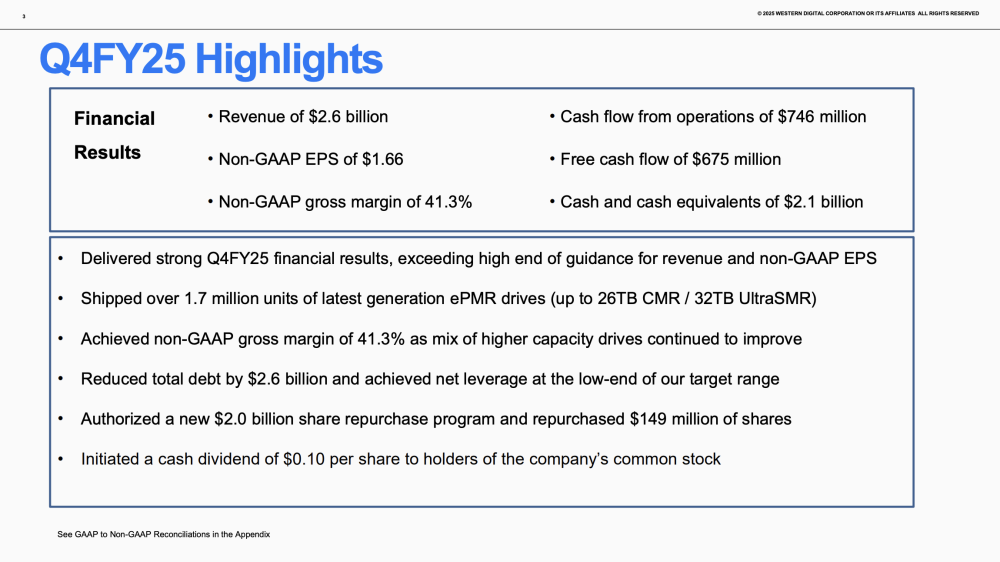

This is a Press Release edited by StorageNewsletter.com on August 1, 2025 at 2:02 pmQ4FY25 Highlights:

- Revenue of $2.61 billion, up 30% year over year

- GAAP diluted EPS of $0.67 and non-GAAP diluted EPS of $1.66

- Cash flow from operations of $746 million; free cash flow of $675 million

- Fiscal year 2025 revenue of $9.52 billion, up 51% year over year.

- Q1FY26 revenue expected to be up 22% year over year at mid-point

Western Digital Corp. reported fiscal fourth quarter and fiscal year 2025 financial results for the period ended June 27, 2025.

“Western Digital executed well in its fiscal fourth quarter, achieving revenue and gross margin above the high end of our guidance range while delivering strong free cash flow. In addition, during the quarter, we reduced debt by $2.6 billion, initiated a cash dividend, and announced the authorization of a $2.0 billion share repurchase program, reflecting our confidence in the long-term cash generating capability of our business,” said Irving Tan, CEO, Western Digital. “We are confident that HDDs will continue to remain the foundation of the world’s data infrastructure, delivering unmatched value for mass storage in an AI-driven future.“

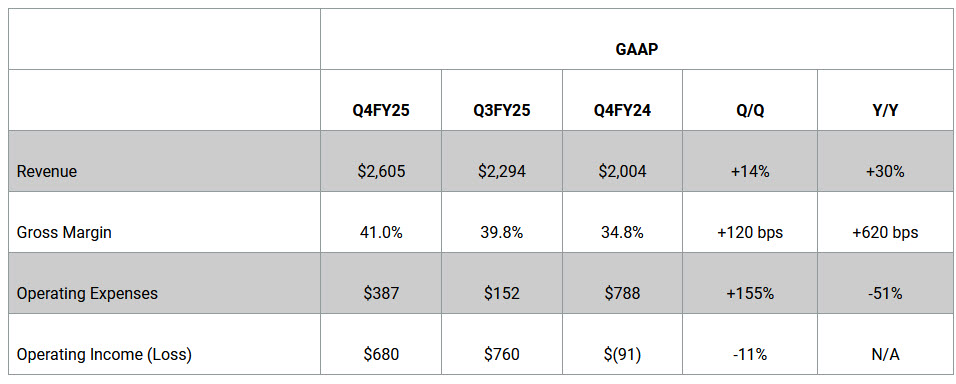

Q4FY25 Financial Highlights

($ in millions)

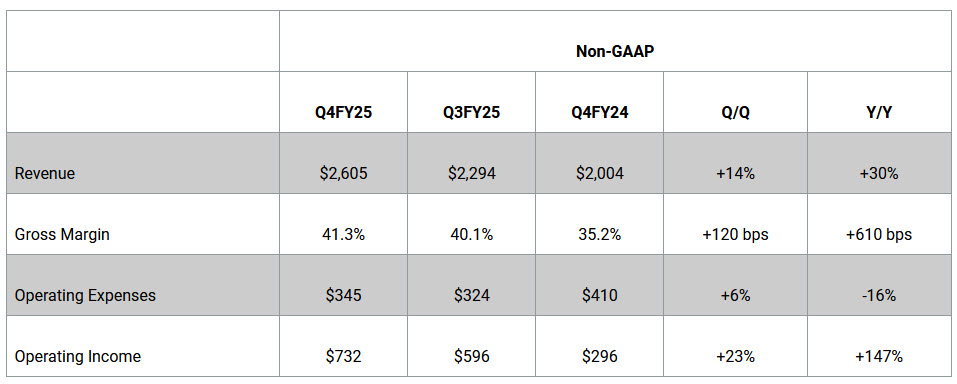

Fiscal Year 2025 Financial Highlights

($ in millions)

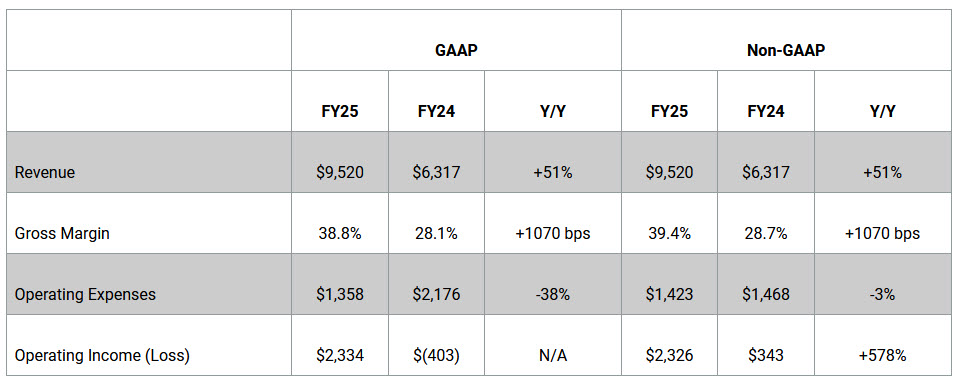

Business Outlook for Fiscal First Quarter of 2026

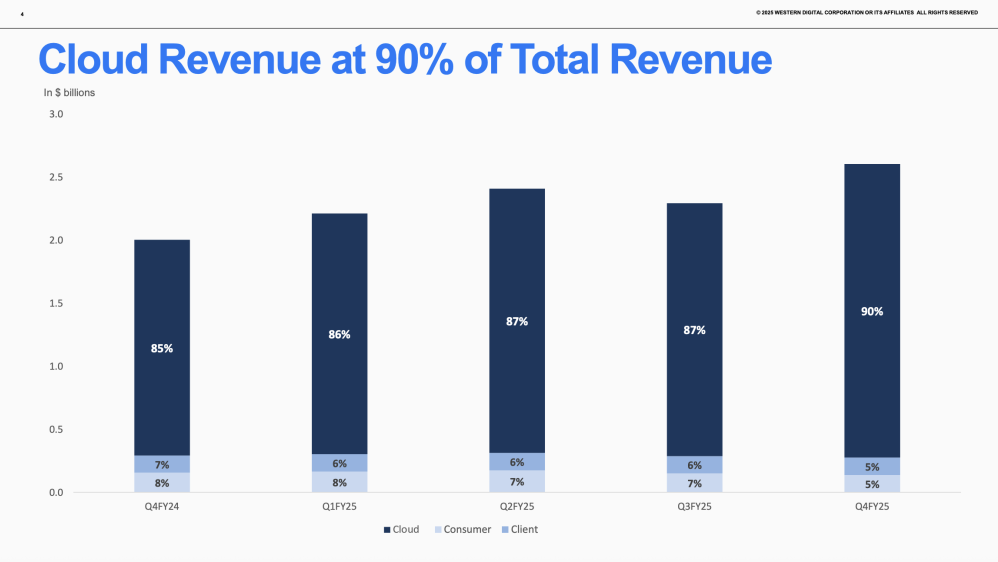

“We continue to see strong momentum in our business driven by Cloud, our largest addressable market. For our fiscal first quarter of 2026, at the mid-point of the ranges provided in the table below, we expect revenues of $2.7 billion, non-GAAP gross margin of 41.5%, with non-GAAP EPS of $1.54,” said Kris Sennesael, CFO, Western Digital.

(1) We provide earnings guidance only on a non-GAAP basis because certain information necessary to reconcile such guidance to GAAP is difficult to estimate or cannot be allocated or quantified with certainty and is dependent on future events outside of our control. Please refer to the section titled “Non-GAAP Guidance” under “Discussion Regarding the Use of Non-GAAP Financial Measures” in this press release for additional information regarding the non-GAAP measures, including quantification of known expected adjustment items.

Dividend

Western Digital’s Board of Directors declared a cash dividend of $0.10 per share of the company’s common stock, which will be paid on September 18, 2025 to stockholders of record as of the close of business on September 4, 2025.

Western Digital hosted a conference call to discuss its fiscal fourth quarter 2025 results and business outlook for the fiscal first quarter of 2026 on July 30th, 2025. The archived conference can be accessed online at investor.wdc.com.

Basis of Presentation

On February 21, 2025 (the “Separation Date”), Western Digital Corporation (“WDC”) completed the previously announced separation of its Flash business unit into a separate company, Sandisk Corporation (“Sandisk”).

The financial and operating results of Sandisk subsequent to the Separation Date are no longer consolidated into WDC’s financial and operating results, and the historical results and financial position of Sandisk for all periods prior to the Separation Date have been reflected as discontinued operations in WDC’s financial highlights, preliminary condensed consolidated balance sheets and preliminary condensed consolidated statements of operations included in this release.

Resources:

Fourth Quarter Fiscal 2025 Press Release with Financial Tables and Guidance Summary

Fourth Quarter Fiscal 2025 Earnings Presentation

Comments

Just after Seagate announced a strong fiscal year 2025, Western Digital unveils a similar trajectory with $9.52 billion for a 51% growth YoY.

Click to enlarge

It confirms that the demand for storage globally and for HDD in particular reaches new levels pushed by new workloads and the necessity to store more data for processing but also for preservation. The other parts of the markets with Flash/SSD and tape on the others side also see a positive curve.

It confirms that the demand for storage globally and for HDD in particular reaches new levels pushed by new workloads and the necessity to store more data for processing but also for preservation. The other parts of the markets with Flash/SSD and tape on the others side also see a positive curve.

It appears the the HDD market continues to be driven by the Western Digital and Seagate by far, having approximately 40% of the market each, followed by Toshiba for the rest.

Western Digital business today comes from hyperscalers with data center and cloud activities for the vast majority covered by CMR and SMR drives and relies almost exclusively on nearline drives representing almost 90% of what they shipped last year - 170EB for nearline on 190EB in total. The company prepares HAMR soon.

It seems that the split with Sandisk, effective since early this year, has generated some positive effects and contributes to a clear positioning and messaging for the company.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter