Covid-19 Impacts India’s External Storage Market Adversely in 2Q20 Resulting in Y/Y Degrowth of 37%

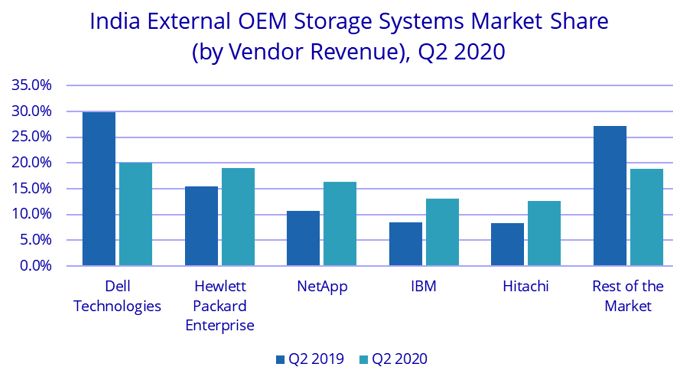

Dell leader with 20% market share followed by HPE with 19%

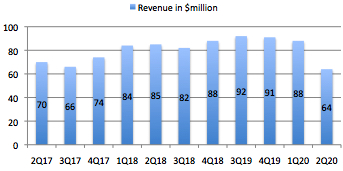

This is a Press Release edited by StorageNewsletter.com on October 7, 2020 at 2:25 pmAs per IDC‘s Worldwide Quarterly Enterprise Storage Systems Tracker release, India’s external storage market witnessed degrowth of 36.8% Y/Y by vendor revenue and stood at $63.8 million in 2Q20.

The majority of the Y/Y decline is due to the impact of Covid-19 resulting in delayed demand for storage across organizations during the quarter.

“Organizations have been impacted differently due to Covid-19. Majority of the are still in the crisis stage, responding to day-to-day challenges by focusing on BC, cost optimization, and business resiliency. Very few organizations are in the recovery stage, investing aggressively on digital capabilities to sustain the growth and also to avoid any future disruptions, like the current pandemic,” says Dileep Nadimpalli, research manager, enterprise infrastructure, IDC India.

AFAs contributed 34.9% to the overall external storage systems market in 2Q20. Most of the organizations are considering and deploying AFA for their primary workloads to enable better performance and also to address the future data requirements. New age flash solutions such as NVMe and storage class memory would further drive the flash adoption in near future.

The entry storage category was the worst impacted as compared to high-end and mid-range storage systems in 2Q20. The decreased demand for entry storage was predominantly due to decreased spending from professional services organizations.

Multi-cloud journey is one of the key imperatives across the majority of the organizations to get the best of capabilities from various cloud service providers. Businesses are considering and adopting data management tools to enable them to cloudifiy their storage to seamlessly move across public clouds, private clouds, and traditional datacenters.

Major Vendors Analysis

Dell Technologies continued to be the market leader in India’s external OEM storage systems market with a 20.1% market share by vendor revenue, followed by HPE with a 19.0% market share in 2Q20.

IDC India Forecast

The external enterprise storage systems market is expected to grow at a single-digit CAGR for the 2019-2024 time period. it is expected that storage spending in CY20 to decline due to the Covid-19 impact, however expecting the market to recover in CY21.

Comments

Here are the figures for the last known quarters for the external storage market in India, according to former IDC reports, with regularly growth since 4Q17, but with huge decrease since 2020 essentially due to Covid-19:

| Period | Revenue in $million |

Y/Y growth |

| 2Q17 | 70 | +9% |

| 3Q17 | 66 | +0% |

| 4Q17 | 74 | +5% |

| 1Q18 | 84 | +13% |

| 2Q18 | 85 | +21% |

| 3Q18 | 82 | +24% |

| 4Q18 | 88 | +9% |

| 3Q19 | 92 | +8% |

| 4Q19 | 91 | +6% |

| 1Q20 | 88 | -21% |

| 2Q20 |

64 |

-37% |

Read also:

Revenue in India to Reach Only $4.5 Billion in 2024 Due to Covid-19

CAGR of 4% from 2019

September 14, 2020 | Press Release

India's External Storage Market Up 6% Y/Y in 4Q19 (Dell Leader in Front of HPE)

As investments from banking and state government entities increased [with our comments]

April 3, 2020 | Press Release

India External Storage Market Grows 8% Y/Y in 3Q19 at $92 Million

Dell leader with 32% market share followed by HPE with 12% [with our comments]

December 30, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter