India’s External Storage Market Up 6% Y/Y in 4Q19 (Dell Leader in Front of HPE)

As investments from banking and state government entities increased

This is a Press Release edited by StorageNewsletter.com on April 3, 2020 at 2:36 pmAs per IDC Corp.‘s Worldwide Quarterly Enterprise Storage Systems Tracker 4Q19, India’s external storage market witnessed a growth of 6.0% Y/Y by vendor revenue and stood at $91.0 million in 4Q19.

Banking, professional services, government, manufacturing, and telecommunications industries contributed 81.2% to the overall external storage market in 4Q19.

“India witnessed back to back strong growth rates for the last couple of years, but COVID-19 outbreak would act as a major barrier for storage market growth in CY20. COVID-19 would have a negative impact on verticals such as manufacturing, transportation, construction, personal and consumer services, etc. However, we can expect positive growth from healthcare, insurance and telecommunications verticals,” says Dileep Nadimpalli, research manager, enterprise infrastructure, IDC India.

AFAs witnessed a growth of 6.1% Y/Y, which contributed 28.8% to the overall external storage systems market in 4Q19. The advent of real-time applications, which need high performance with minimal latency is expected to drive the growth for AFAs in the near future.

Mid-range storage systems grew by 13.5% Y/Y due to increased investments from banking and government organizations in 4Q19. The entry storage segment witnessed degrowth of 12.6% Y/Y growth, while the high-end storage segment saw marginal growth in 4Q19.

As a growing requirement in the digital economy, organizations are opting for automation technologies, which are self-healing even at the infrastructure layer and consumption-based pricing to lower their CAPEX and to avoid unwanted over-provisioning of infrastructure. To address these needs some of the major vendors are embedding ML/deep learning to infrastructure and have started offering consumption-based pricing.

Major Vendors Analysis

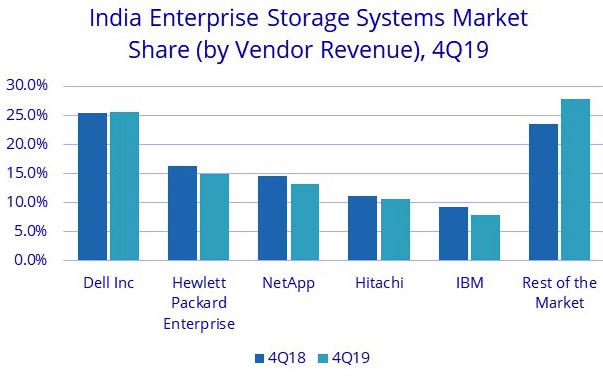

Dell Technologies continued to be the market leader with a 25.6% market share by vendor revenue, followed by Hewlett Packard Enterprise with a 14.9% market share in 4Q19. Dell Technologies witnessed a marginal Y/Y growth, while all other major vendors saw a decline in terms of Y/Y market share in 4Q19.

IDC India Forecast

The external enterprise storage systems market is expected to grow at a single-digit CAGR for the 2019-2024 time period. Large technology refresh projects along with multiple digital transformation initiatives and incorporation of emerging third platform technologies and innovation accelerators such as IoT, AI, big data, etc. across organizations would drive storage demand in the near future.

Comments

Compared to its huge population, Indian storage market is not big but growing rapidly, faster than the WW industry.

Here are the figures for the last known quarters for the country's external storage market, according to former IDC reports:

| Period | Revenue in $million |

Y/Y growth |

| 2Q17 | 70 | +9% |

| 3Q17 | 66 | +0% |

| 4Q17 | 74 | +5% |

| 1Q18 | 84 | +13% |

| 2Q18 | 85 | +21% |

| 3Q18 | 82 | +24% |

| 4Q18 | 88 | +9% |

| 3Q19 | 92 | +8% |

| 4Q19 |

91 |

+6% |

Read also:

India External Storage Market Grows 8% Y/Y in 3Q19 at $92 Million

Dell leader with 32% market share followed by HPE with 12% [with our comments]

December 30, 2019 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter