Western Digital: Fiscal 2Q26 Financial Results

Revenue of $3.0 billion, up 25% YoY and up 7% QoQ

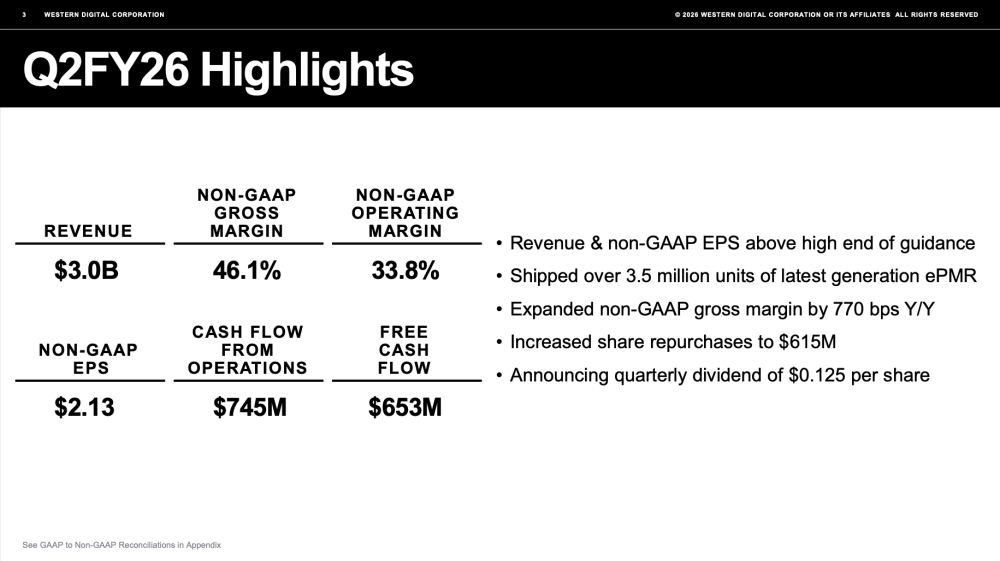

This is a Press Release edited by StorageNewsletter.com on February 5, 2026 at 2:32 pmFiscal Q2 FY26 Highlights:

- Revenue of $3.02 billion, up 25% YoY

- GAAP gross margin of 45.7%; non-GAAP gross margin of 46.1%

- GAAP diluted EPS of $4.73; non-GAAP diluted EPS of $2.13

- Cash flow from operations of $745 million; free cash flow of $653 million

- Q3FY26 revenue expected to be up approximately 40% YoY at mid-point

Western Digital Corp. reported fiscal second quarter 2026 financial results for the period ended January 2, 2026.

Click to enlarge

“Western Digital’s strong performance this quarter reflects our disciplined execution to meet demand in the AI-driven data economy, and the confidence our customers place in our ability to deliver reliable, high-capacity HDDs at scale,” said Irving Tan, CEO, Western Digital. “In our fiscal second quarter, we delivered strong revenue growth and gross margin expansion. During the quarter, free cash flow generation continued to be strong, and we returned over 100% of our free cash flow to shareholders in the form of share repurchases and dividend payments.”

Click to enlarge

Business Outlook for Fiscal Third Quarter of 2026

“Our business continues to strengthen. We expect strong revenue growth and improved profitability driven by continued data center demand and by the adoption of our high-capacity drives. For our fiscal third quarter of 2026, at the mid-point of the ranges provided in the table below, we expect revenues of $3.2 billion, non-GAAP gross margin of 47.5%, with non-GAAP EPS of $2.30,” said Kris Sennesael, CFO, Western Digital.

Dividend

Western Digital’s Board of Directors declared a cash dividend of $0.125 per share of the company’s common stock, which will be paid on March 18, 2026 to stockholders of record as of the close of business on March 5, 2026.

Comments

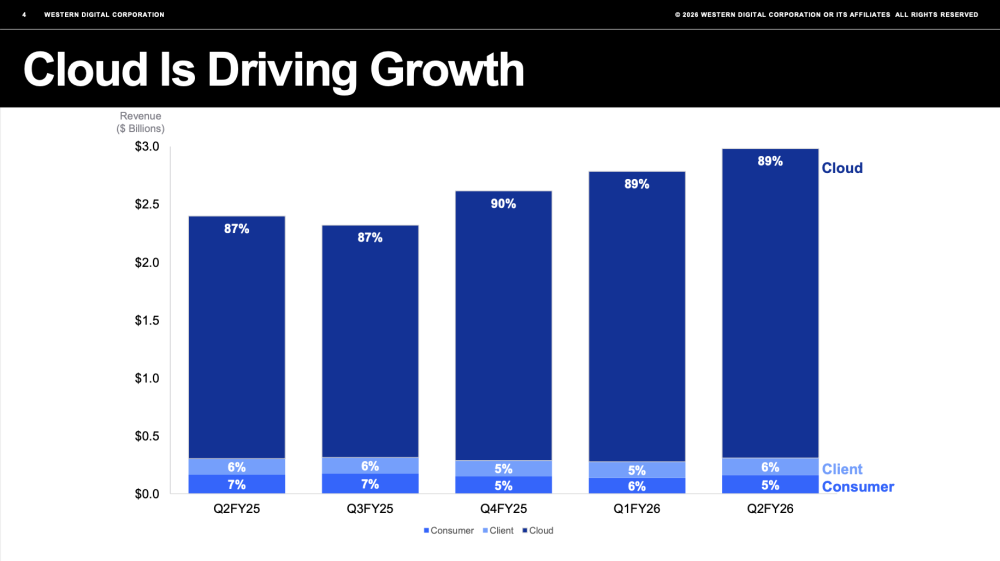

Western Digital posted strong financial quarter results above the $3 billion mark that confirms the dynamic of data storage and HDD in particular. Growth ratio for sequential - 7% QoQ - and annual trajectory - 25% YoY - are pretty similar to Seagate ones indicating once again that the segment is hot especially with the cloud demand and some other flash/SSD manufacturing difficulties as well. Clearly the cloud demands dominates figures pulled by hyperscalers and various cloud players.

Last 6 months have generated almost $6 billion - $5.84 billion exactly - and the ARR appears to be around $10.8 billion. The FY26 should be above $12 billion.

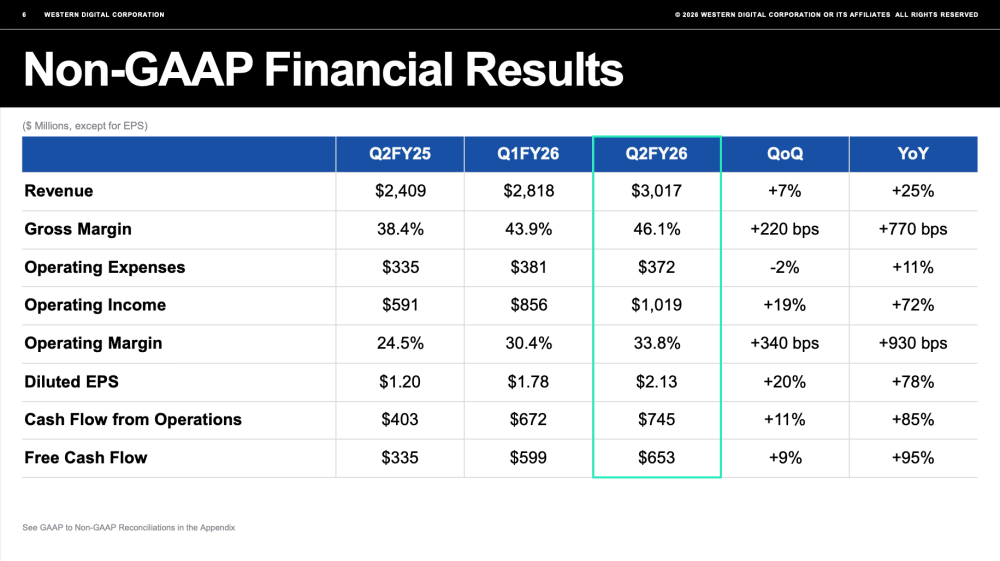

In details WDC demonstrated solid financial metrics when you check income and margin.

The $/TB still is in favor of HDD and represents one of the major advantage plus reliability and some performance angles as well in some verticals or IT needs.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter