Dell Technologies: Fiscal 3Q26 Financial Results

Producing $27.0 billion, down 9 % QoQ and up 11% YoY

This is a Press Release edited by StorageNewsletter.com on November 27, 2025 at 2:02 pmSummary:

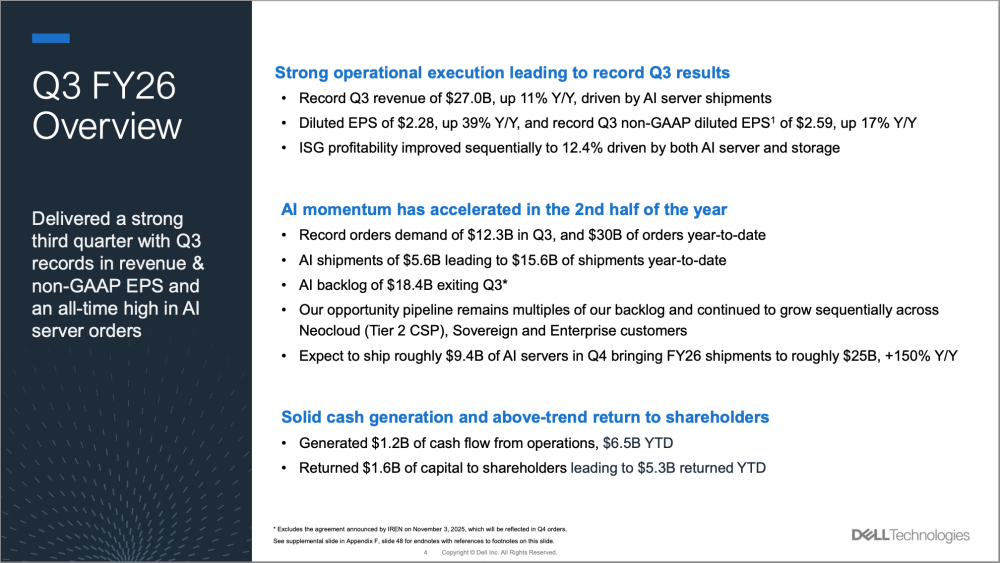

- Record third-quarter revenue of $27.0 billion, up 11% YoY

- Diluted earnings per share (EPS) of $2.28, up 39% YoY, and record third-quarter non-GAAP diluted EPS of $2.59, up 17%

- Cash flow from operations of $1.2 billion

Dell Technologies announced financial results for its fiscal 2026 third quarter and provides guidance for its fiscal 2026 fourth quarter and full year. The company also names David Kennedy its CFO on a permanent basis.![]() “In the third quarter we delivered record Q3 revenue of $27 billion, record Q3 profitability, strong cash generation and above-trend capital return of $1.6 billion,” said David Kennedy, CFO, Dell Technologies. “FY26 will be another record year, and we’re raising our AI shipment guidance to roughly $25 billion, up over 150% year over year, and revenue guidance to $111.7 billion, up 17%.”

“In the third quarter we delivered record Q3 revenue of $27 billion, record Q3 profitability, strong cash generation and above-trend capital return of $1.6 billion,” said David Kennedy, CFO, Dell Technologies. “FY26 will be another record year, and we’re raising our AI shipment guidance to roughly $25 billion, up over 150% year over year, and revenue guidance to $111.7 billion, up 17%.”

“AI momentum is accelerating in the second half of the year, leading to record AI server orders of $12.3 billion and an unprecedented $30 billion in orders year to date,” said Jeff Clarke, vice chairman and COO, Dell Technologies. “Our five-quarter pipeline is multiples of our $18.4 billion backlog with a mix of neocloud, sovereign and enterprise customers. Dell is winning in AI because of our unique ability to engineer bespoke high-performance solutions, rapidly deploy large, complex clusters, and provide global support.”

Infrastructure Solutions Group (ISG)

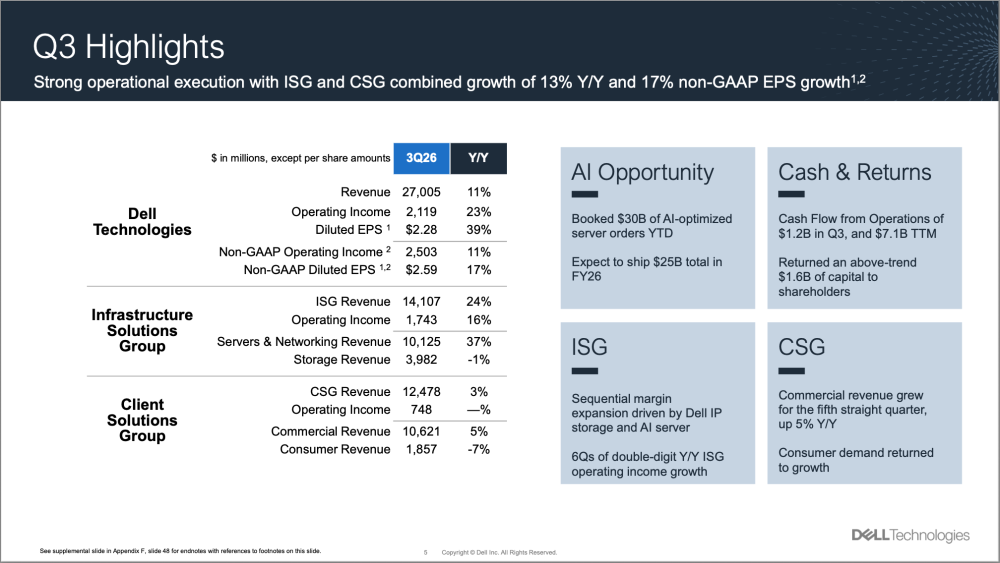

- Record third-quarter revenue: $14.1 billion, up 24% YoY

- Record third-quarter Servers and Networking revenue: $10.1 billion, up 37%

- Storage revenue: $4.0 billion, down 1%

- Record third-quarter operating income: $1.7 billion, up 16% YoY

Client Solutions Group (CSG)

- Revenue: $12.5 billion, up 3% YoY

- Commercial Client revenue: $10.6 billion, up 5%

- Consumer revenue: $1.9 billion, down 7%

- Operating income: $748 million, flat YoY

Capital Return

Dell Technologies returned $1.6 billion to shareholders in the third quarter through share repurchases and dividends. Year to date, the company has returned $5.3 billion to shareholders and repurchased over 39 million shares.

Guidance Summary

- Full-year FY26 revenue expected between $111.2 billion and $112.2 billion, up 17% YoY at the midpoint of $111.7 billion

- Full-year AI server shipments expected to be roughly $25 billion, up over 150%

- Full-year FY26 GAAP diluted EPS expected to be $8.38 at the midpoint, up 31% YoY, and non-GAAP diluted EPS to be $9.92 at the midpoint, up 22%

- Fourth-quarter FY26 revenue expected between $31.0 billion and $32.0 billion, up 32% YoY at the midpoint of $31.5 billion

- Fourth-quarter FY26 GAAP diluted EPS expected to be $3.05 at the midpoint, up 42% YoY, and non-GAAP diluted EPS to be $3.50 at the midpoint, up 31%

Third Quarter Fiscal 2026 Financial Results

Click to enlarge

Click to enlarge

Comments

Dell delivered a solid quarter with YoY growth of 11% but down 9% sequentially. 2Q26 was exceptional at almost $30 billion. The first 9 months pass the $80 billion mark and the company reaffirms its guidance to reach $111 billion for the fiscal year with a very precise manner, a granularity of $500 million. It will represent a significant growth, around 17%, coming from $95 billion in FY24. With this consideration, it means that the coming quarter would pass the famous $30 billion threshold, the 1st time in Dell's history.

Click to enlarge

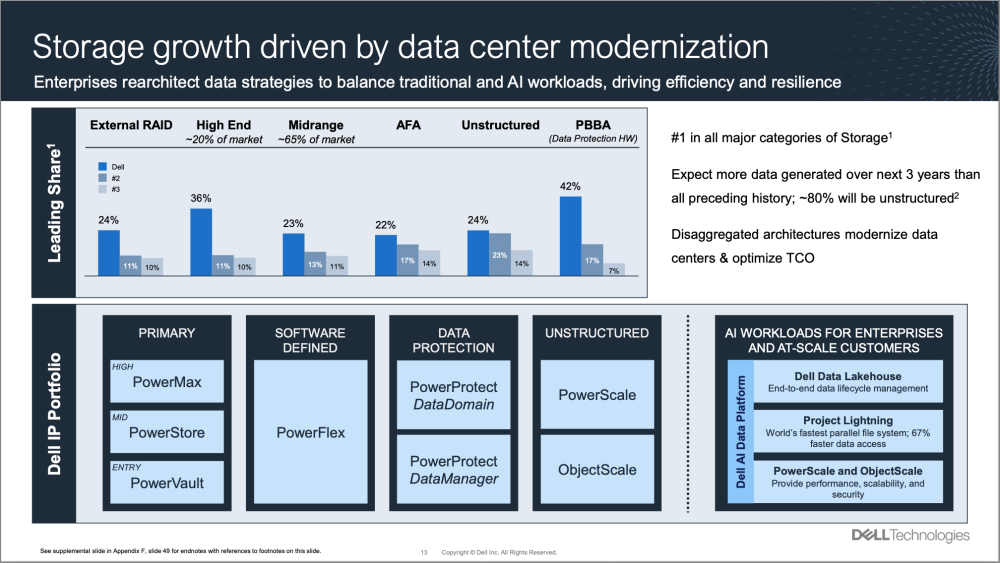

The AI demands boosted servers sales thus supported the ISG growth but at the same time storage is down 1% YoY at $3,982 billion coming from $4,004 billion one year ago. Checking last 6 quarters, including this one, storage revenue is very flat around $4 billion except in 4Q25 at $4.7 billion. We'll see if the same peak will appear again for the last financial quarter as the #30 billion barrier should pull that associated segment.

Click to enlarge

Prices had some effects on the sale trajectory even if, in volumes, storage products delivered pretty results. The Power portfolio has been pretty well received this quarter again. Ignoring HPC with a dedicated storage solution, confirmed by partnerships in this domain, the company continues to have difficulties in AI storage, being a superset of HPC storage. Like NetApp and Pure Storage, the company chose to unveil a tactical answer with a limited pNFS implementation as a new iteration of PowerScale. The market waits official public release of Project Lightning, as the new parallel file storage, Michael Dell expects as he stats at Dell Technologies World in 2024.

Click to enlarge

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter