Dell Technologies: Fiscal 2Q26 Financial Results

Solid results with small drop QoQ and YoY

This is a Press Release edited by StorageNewsletter.com on September 4, 2025 at 2:32 pmSummary:

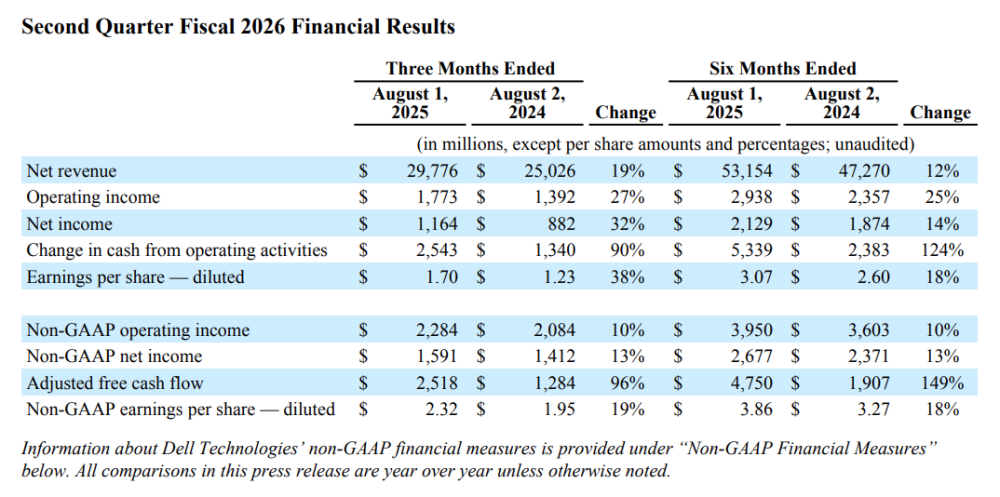

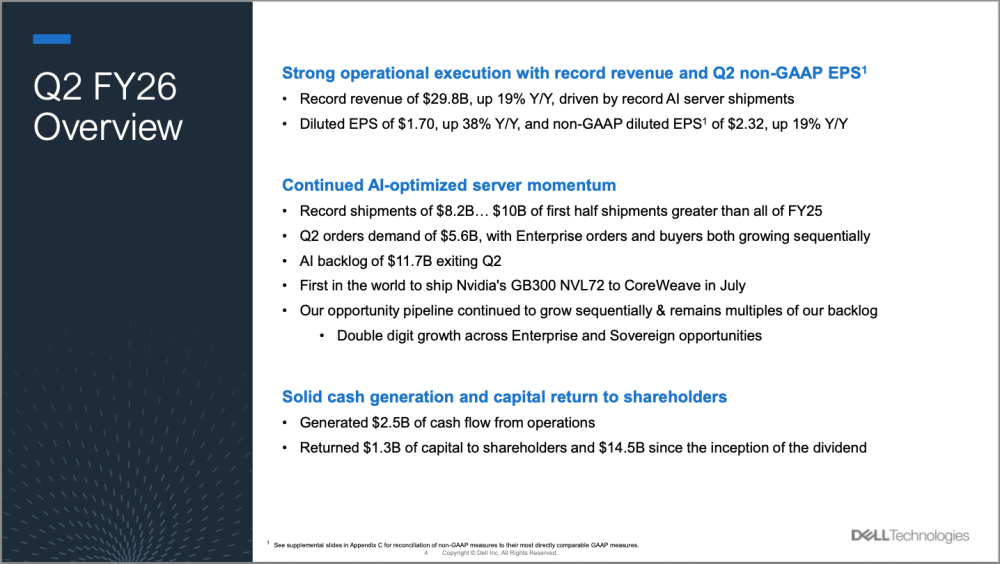

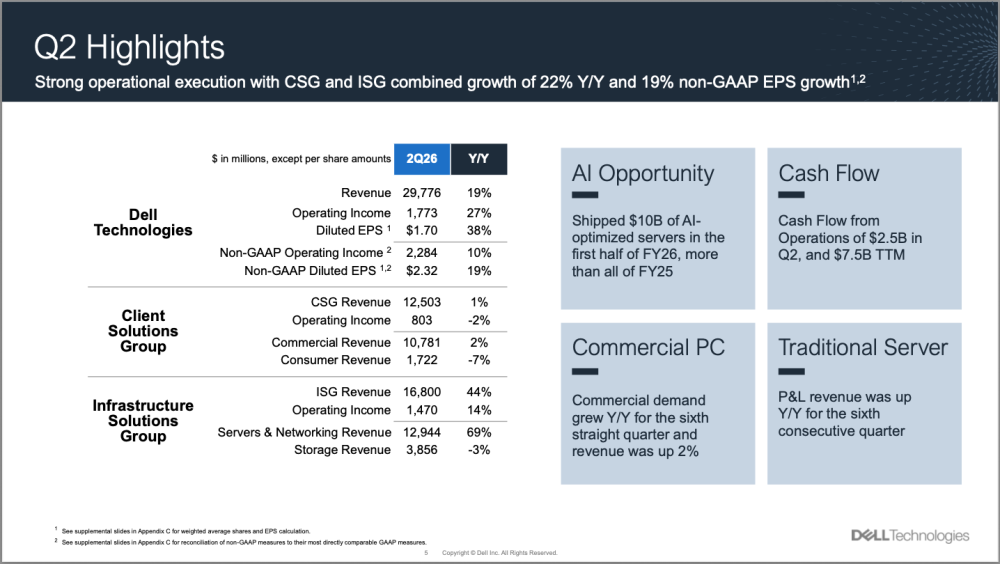

- Record revenue of $29.8 billion, up 19% YoY

- Operating income of $1.8 billion, up 27% YoY, and non-GAAP operating income of $2.3 billion, up 10%

- Diluted earnings per share (EPS) of $1.70, up 38% YoY, and record second-quarter non-GAAP diluted EPS of $2.32, up 19%

- Cash flow from operations of $2.5 billion

Dell Technologies announced financial results for its fiscal 2026 second quarter. The company also provides guidance for its fiscal 2026 third quarter and full year. “In Q2, we achieved strong top-line results and profitability, reaching record revenue of $29.8 billion,” said Yvonne McGill, CFO, Dell Technologies. “We delivered another quarter of robust cash generation, with $2.5 billion in cash flow from operations and $1.3 billion in shareholder returns.”

“In Q2, we achieved strong top-line results and profitability, reaching record revenue of $29.8 billion,” said Yvonne McGill, CFO, Dell Technologies. “We delivered another quarter of robust cash generation, with $2.5 billion in cash flow from operations and $1.3 billion in shareholder returns.”

“We’ve now shipped $10 billion of AI solutions in the first half of FY26, surpassing all shipments in FY25. This helped deliver another record revenue quarter in our Servers and Networking business, which grew 69%,” said Jeff Clarke, vice chairman and COO, Dell Technologies. “Demand for our AI solutions continues to be exceptional, and we’re raising our AI server shipment guidance for FY26 to $20 billion dollars.”

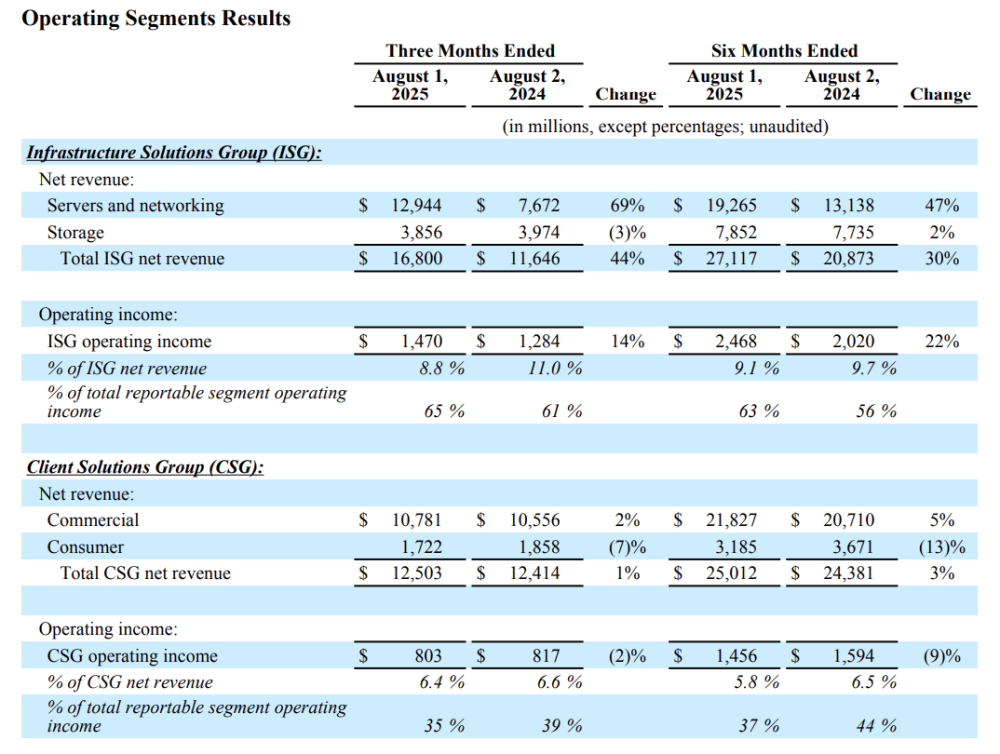

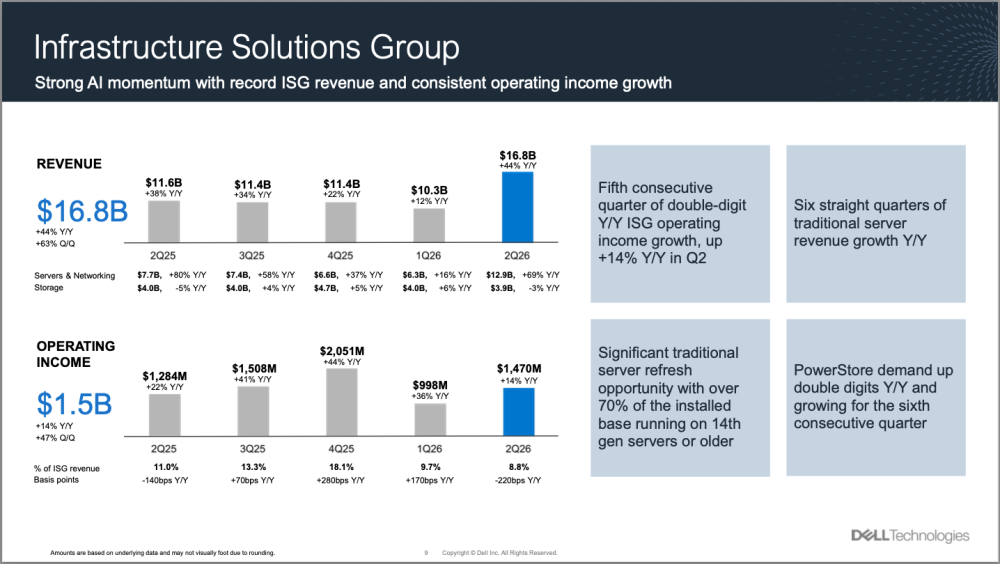

Infrastructure Solutions Group (ISG)

- Record revenue: $16.8 billion, up 44% YoY

- Record Servers and Networking revenue: $12.9 billion, up 69%

- Storage revenue: $3.9 billion, down 3%

- Second-quarter record operating income: $1.5 billion, up 14% YoY

Client Solutions Group (CSG)

- Revenue: $12.5 billion, up 1% YoY

- Commercial Client revenue: $10.8 billion, up 2%

- Consumer revenue: $1.7 billion, down 7%

- Operating income: $803 million, down 2% YoY

Capital Return

Dell Technologies returned $1.3 billion to shareholders in the second quarter through share repurchases and dividends.

Guidance Summary

- Full-year FY26 revenue expected between $105.0 billion and $109.0 billion, up 12% year over year at the midpoint of $107.0 billion

- Full-year FY26 GAAP diluted EPS expected to be $7.98 at the midpoint, up 25% year over year, and non-GAAP diluted EPS to be $9.55 at the midpoint, up 17%

- Third-quarter FY26 revenue expected between $26.5 billion and $27.5 billion, up 11% year over year at the midpoint of $27.0 billion

- Third-quarter FY26 GAAP diluted EPS expected to be $2.07 at the midpoint, up 26% year over year, and non-GAAP diluted EPS to be $2.45 at the midpoint, up 11%

Click to enlarge

Click to enlarge

Comments

Dell as a global company delivered strong results for 2Q26 with $29.8 billion, up 19% YoY, coming from $23.4 billion. FY25 also was a positive one with all quarters having 1 or 2 digits percentage growth with even Q2 with 10%.

Click to enlarge

Click to enlarge

Speaking about storage, this is covered by the ISG - Infrastructure Solutions Group - with the servers and networking business. Storage itself generated for 2Q26 $3.856 billion, down 3.5% QoQ at $3.996 billion and down 3% YoY at $3.974 billion. The first 6 months of the year reaches $7.852 billion, up 1.5% from similar period last year.

Click to enlarge

Storage for recent years, 25, 24 and 23, touched respectively $16.457 billion, up 1% from $16.261 billion but down 9% from $17.958 billion for FY23. That year was interesting as it is the only one that passed the $4 billion mark each quarter. FY24 and FY25 show a mix below and above that barrier for different quarters.

Finally the current storage business ARR reaches $17.045 billion.

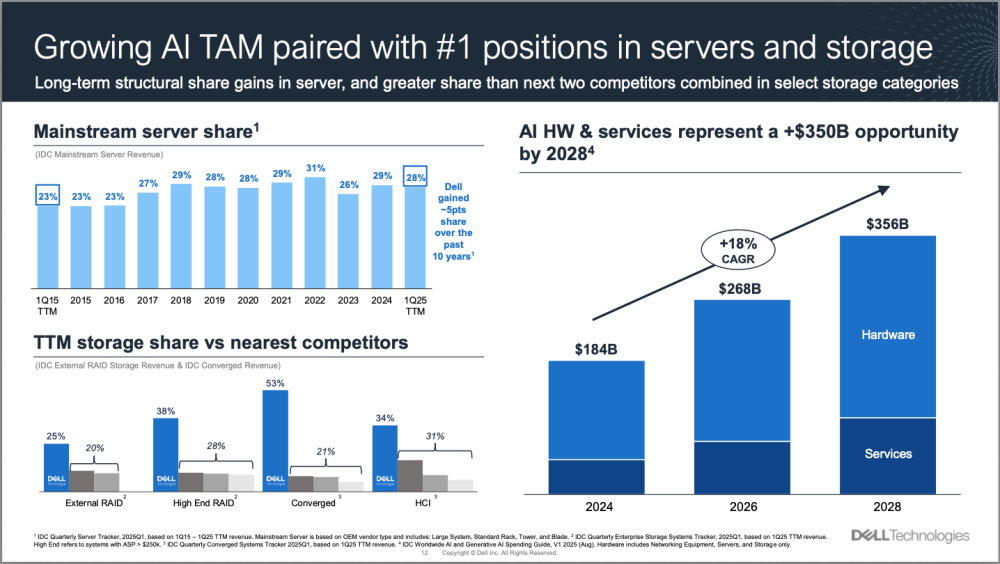

As a horizontal player with also a server business, Dell is considered as a giant generic IT players, this is a normal profile for a company of this size. It also means that specific end-users needs is still a direction to address. Obviously, vertical segments are not ignored by Dell having strong and proven solutions in various domains but AI really reshuffles cards. Dell is very strong in AI with its server line, no doubt on this. As AI is essentially covered by file and object storage models, PowerScale is obviously a new generation of scale-out NAS coming from Isilon acquired almost 15 years ago by EMC. Several extensions have been added and end-users and partners are looking for the physcial instance of the Project Lightning with the promise a a real parallel file system approach. AI is not so easy for companies who didn't natively addressed HPC on the storage side, EMC and Dell did this by partnering with several parallel file system software players like ThinkParQ for instance. And guess what, AI is the HPC, really pushing limits and stess processing and storage in a zone we never saw in the past.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter