176.5 EB of LTO Capacity Shipped in 2024

Up 15.4% Y/Y and fourth consecutive year of growth due to unstructured data growth and hybrid cloud adoption

This is a Press Release edited by StorageNewsletter.com on July 28, 2025 at 2:02 pmThe LTO Program Technology Provider Companies (TPCs), Hewlett Packard Enterprise , IBM Corporation and Quantum Corporation, released their annual tape media shipment report, detailing Y/Y shipments through the fourth quarter of 2024.

The report reveals a record 176.5EB (1) of total tape capacity (compressed) shipped in 2024, representing a growth of 15.4% over 2023. This is a result of evolving infrastructure requirements fueled by continued enterprise implementation of modern technologies like AI and ML, which has contributed to significant unstructured data growth and shifts to lower cost hybrid cloud environments.

“Setting a new growth record for the fourth year in a row, LTO tape technology continues to prove its longevity as a leading enterprise storage solution,” said Bruno Hald, GM, secondary storage, Quantum. “Organizations navigating their way through the AI/ML era need to reconfigure their storage architectures to keep up, and LTO tape technology is an essential piece of the puzzle for those seeking a cost-friendly, sustainable, and secure solution to support modern technology implementation and the resulting data growth. We look forward to introducing the next iteration of LTO tape technology this year to bring enhanced storage capabilities to the enterprise.“

The key benefits of LTO tape technology include low TCO – which organizations can determine for themselves using the LTO Ultrium TCO Calculator – as well as robust sustainability and security features. In addition, LTO-10, the latest format spec for LTO Ultrium tape drives and media, will provide the same blazing speed as LTO-9 with higher capacity and density (30TB/cartridge, up to 75TB compressed), quantum-safe encryption, and zero required optimization time to help prepare organizations for the fast-evolving future of data.

“Continued growth in LTO tape shipments shows the important role that tape plays in modern data architectures, especially as companies deal with rapidly growing amounts of data,” said Phil Goodwin, research VP, infrastructure software platforms, IDC. “In fact, tape’s unique combination of scalability, cost-efficiency, and cyber resilience makes it a valuable component for enterprises seeking secure, sustainable long-term storage.“

With shipped capacity reaching an all-time high in 2024, LTO tape technology demonstrates its continued relevance in the storage space as organizations require vast amounts of structured and unstructured data to make the most of modern technologies for maximum business impact. Increased storage needs can lead to surging costs, significant power consumption, and expanded security risks. However, LTO tape complements disk, flash, and cloud solutions in tiered storage architectures to provide a low-cost, last line of defense vs. ransomware and other security threats. Further, offline copies of LTO tapes separate data archives from the connected environment, providing greater assurances for data recovery. Whether an organization is archiving big data for analytics, managing hundreds of hours of media content, or simply transporting large files across storage environments, LTO tape provides businesses of all types with a cost-effective, sustainable, and protected solution for saving the data they need to power evolving workloads and drive business forward.

Access the LTO Program’s annual shipment reports for tape media via the LTO Program website.

About Linear Tape-Open (LTO) Format

The LTO Ultrium format is a powerful, scalable, adaptable open tape format developed and continuously enhanced by technology providers Hewlett Packard Enterprise, IBM and Quantum (and their predecessors) to address the growing demands of data protection in the mid-range to enterprise server environments.

This ultra-high capacity generation of tape storage products is designed to deliver outstanding performance, capacity and reliability combining the advantages of linear multi-channel, bi- directional formats with enhancements in servo technology, data compression, track layout, and error correction.

Since the first LTO products were brought to market, over 5.7 million drives, 383 million cartridges, and 649 billion GB of media capacity have been shipped, making LTO Ultrium the most successful tape format in history. The LTO Ultrium format is licensed to, and format- compliant products are made by, multiple manufacturers; their production is not limited to one sole proprietor.

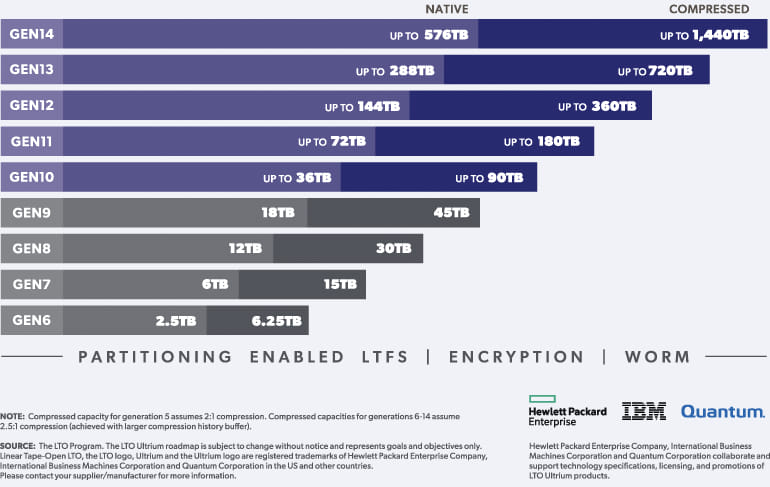

The LTO Ultrium format has a well-defined roadmap for growth and scalability. The roadmap represents intentions and goals only and is subject to change or withdrawal. There is no guarantee that these goals will be achieved. The roadmap is intended to outline a general direction of technology and should not be relied upon in making a purchasing decision. Format compliance verification is vital to meet the free-interchange objectives that are at the core of the LTO Program. Ultrium tape mechanism and tape cartridge interchange specs are available on a licensed basis.

(1) Assumes a 2.5:1 compression achieved with larger compression history buffer available beginning with LTO Gen 6 drives.

Comments

This is an enormous number only on new LTO capacity shipped in 2024 meaning that the LTO perimeter is much bigger than that if you consider the installed base and multiple generation of models. Last year it was 152.9EB and the year before 148.3EB showing a real acceleration. The list of key players that explain the success of the technology and products goes beyond HPE, IBM and Quantum and it includes Fujifilm, Sony and Western Digital.

It also is interesting to put the LTO trajectory in perspective with the roadmap in mind. And the LTO roadmap is bizarre, it doesn’t have any timing in it, just generation with capacity. We could accept this model if the consortium would respect the document but when LTO-8 was released with a capacity of 12TB, LTO-9 was supposed to offer 24TB and LTO-10 the double or 48TB. Guess what when the LTO-9 was unveiled it delivered 18TB instead of 24TB and then the LTO-10 was expected to deliver double capacity at 36TB. But the recent announcement of the LTO-10 shows 30TB, again a loss and a non respect of the roadmap. 30TB represents a drop of 37.5% compared with 48TB, this is huge, 30TB is just 25% more capacity of the original LTO-9.

Is it because LTO Tape Drive is a IBM monopoly? Only 2 vendors make tape cartridges, Fujifilm and Sony. For Tape Libraries, only a few vendors exist: BDT, IBM, Quantum and Spectra Logic. Remember also that Western Digital provides tape heads.

And if we extend the regression, LTO-11 would be supposed to deliver 96TB, then move down to 72TB to reach potentially 60TB.

In terms of speed, still 400 MBps but with 32Gb FC.

In 25 years, the capacity has been multiplied by 300, LTO-1 in 2000 offered 100GB.

Tape usage has changed over the years pushed by HDD and cloud and it still has a few advantages such at the cost. Tape is used for archive and deep archive and 2 key metrics and thresholds are important here: the Watt per TB and the capacity per Rack Unit especially for Tape Libraries. As a passive media, energy for tape is zero, only tape drives and robotics are powered. Also, remember that users track and buy $/TB as their first criteria for secondary storage. During many years tapes world have been integrated with the active data world with the active archive extension leveraging LTFS for some products but more globally exposing NAS protocols outside and more recently the S3-to-Tape playing a significant role.

The LTO-10 is on parity with HDD but largely diverge with SDD on the capacity side. Several companies promote 122TB SSDs and Kioxia already announced a 245TB SDD representing a significant ratio between them. Of course the pricing dimension is key.

This secondary storage domain dedicated to long term data preservation represents a huge business opportunity and we see other projects and initiatives for a few years such as Cerabyte, HoloMem, Folio Photonics, Digistore, Optera Data, classic optical approaches at different stages and some died, or others based on HDD such Leil, Disk Archive or FAST LTA.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter