DataCore Acquires StarWind Software

To strengthen hyperconverged infrastructure leadership across edge, remote offices, and small business markets

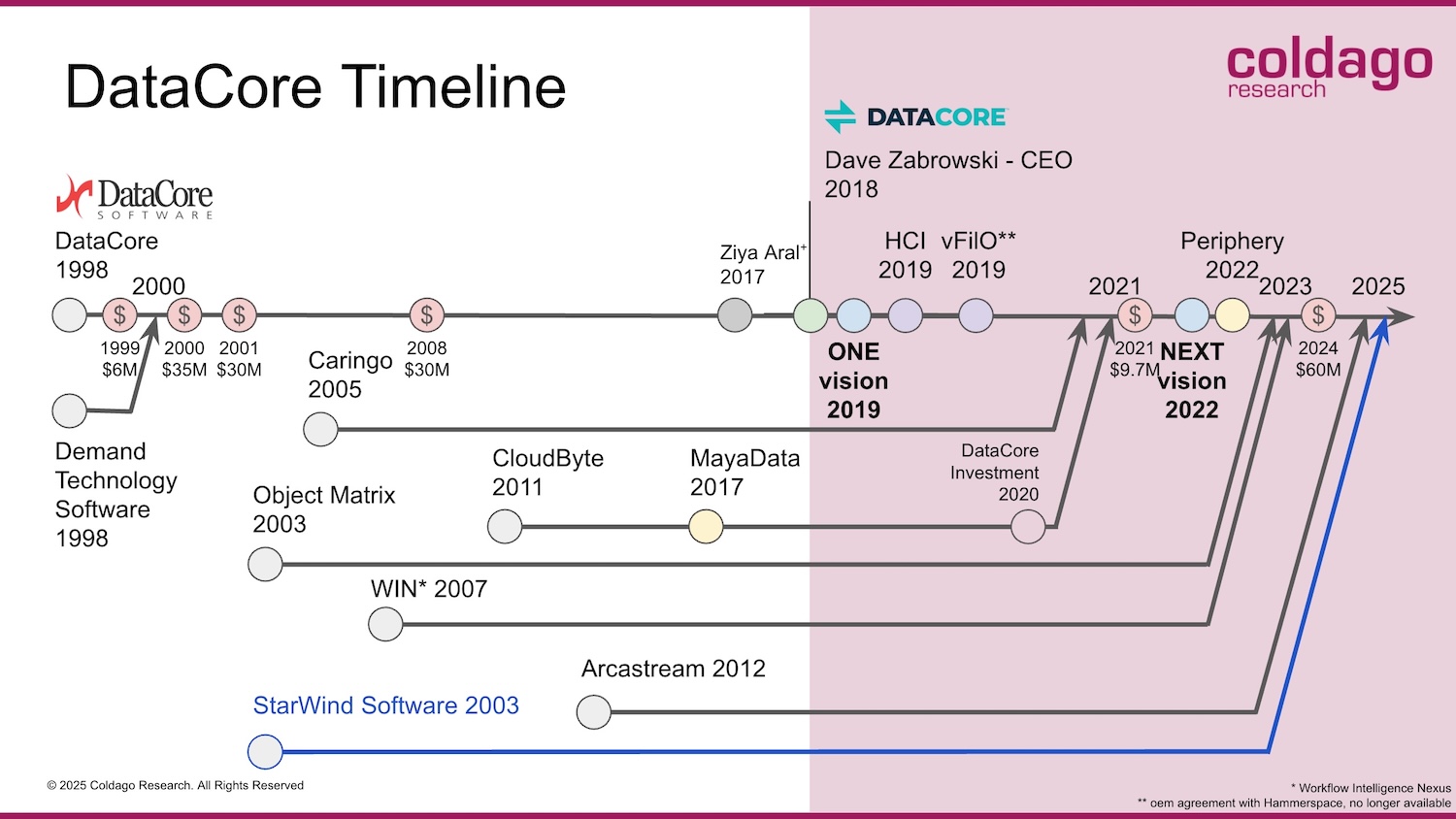

This is a Press Release edited by StorageNewsletter.com on May 22, 2025 at 2:24 pmDataCore Software, leader in data infrastructure and management solutions, announced its acquisition of StarWind Software, a trusted brand in hyper-converged infrastructure (HCI) for edge and remote office/branch office (ROBO) environments, serving the unique requirements of small and mid-sized businesses.

The acquisition extends DataCore’s reach beyond the core data center, enabling the delivery of streamlined, software-defined HCI solutions across highly distributed operations.

As businesses generate increasing volumes of mission-critical data at the edge, the need for simplified, scalable infrastructure has become a top priority. Gartner estimates that around 75% of enterprise data globally will be created and processed outside of traditional data centers. This shift is evident across numerous scenarios including retail chains processing in-store analytics, manufacturers preventing equipment failures with real-time monitoring, healthcare providers managing distributed patient data, and financial institutions requiring branch-level transaction processing. With StarWind’s technology, DataCore addresses these demands by offering a unified approach to HCI that reduces complexity and enhances operational efficiency across heterogeneous architectures.

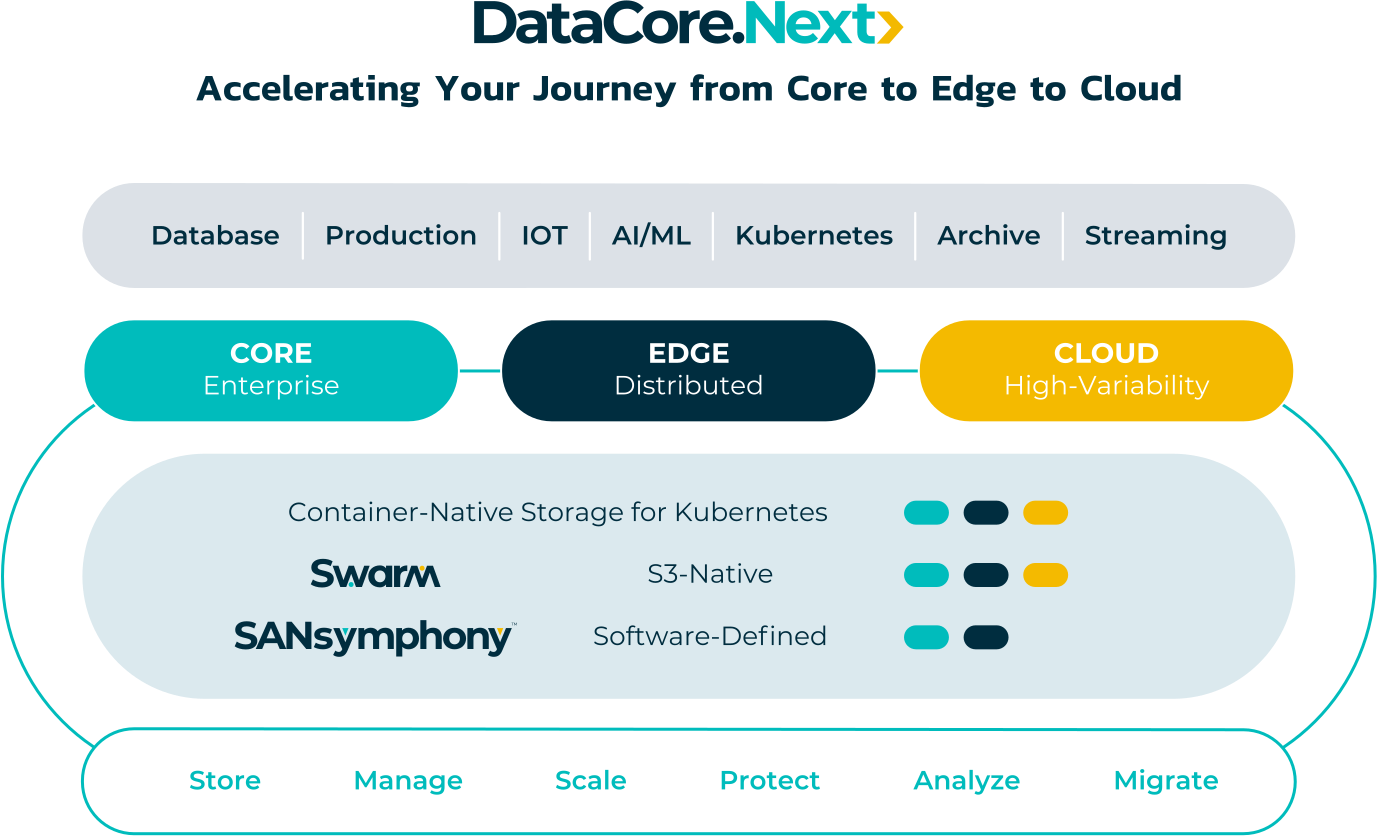

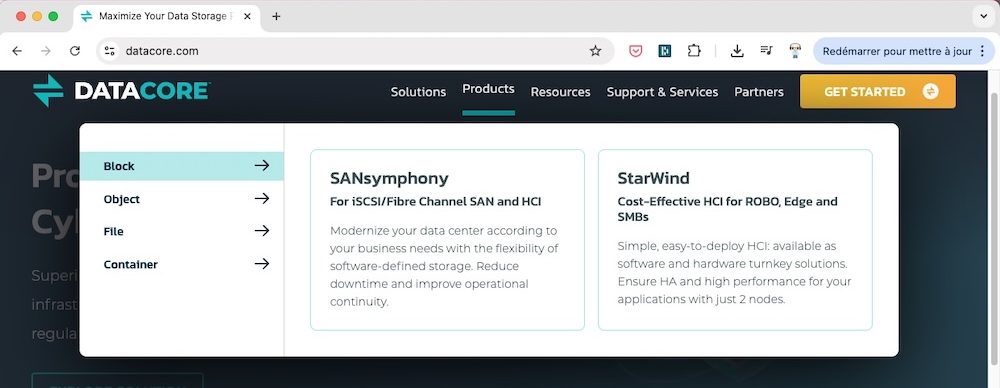

The combined company now offers one of the industry’s most comprehensive storage portfolios-spanning block, file, S3 object, and container-native storage. This broader scope aligns with DataCore.NEXT, the company’s strategic vision to support diverse workloads and deployment models across core, edge, and cloud environments through flexible, best-of-breed software-defined solutions.

“This acquisition represents a significant leap toward realizing our DataCore.NEXT vision,” said Dave Zabrowski, CEO, DataCore. “Merging our strengths with StarWind’s trusted edge and ROBO expertise allows us to deliver reliable HCI that works seamlessly from central data centers to the most remote locations. We are focused on giving organizations greater choice, control, and a more straightforward path for managing data wherever it resides.”

Managing IT across branch, remote, and edge locations brings growing pressure to do more with fewer resources. With tighter budgets and limited onsite staff, organizations demand resilient, low-footprint platforms that are easy to deploy and manage. The joint capabilities of DataCore and StarWind directly address this need, providing an attractive alternative to legacy HCI approaches.

Virtual Effect, a long-standing DataCore partner, welcomed the news of the acquisition. “We love the DataCore.NEXT vision, which optimizes how customers manage data across core, cloud, and edge environments,” said John Greenwood, CSO, Virtual Effect. “DataCore already leads the industry with one of the broadest SDS portfolios. The addition of StarWind brings another best-in-class solution into the fold, further strengthening their edge offerings and reinforcing their commitment to customer agility and infrastructure independence.”

“Joining the DataCore family allows us to bring our high-performance virtual SAN technology to a wider audience,” said Anton Kolomyeytsev, CEO, StarWind. “With growing uncertainty around Broadcom-VMware’s vSAN licensing and pricing-particularly in distributed and cost-sensitive environments-organizations are rethinking their infrastructure strategies. Together with DataCore, we are delivering greater flexibility, performance, and freedom from hardware and hypervisor lock-in without compromising simplicity or control.”

Comments

DataCore is definitely super active and Zabrowski's leadership has illustrated a clear wish to be part of the leader pack, at least on the brand, licence volume and number of installation part. This acquisition if the 6th under Zabrowski's CEO tenure.

This new acquisition confirms the company's desire to increase the valuation and prepare an exit, and by exit here, we mean a sale and not an IPO.

This is sustained by the .NEXT vision, illustrated above, with a few surprises and confirmations for a few quarters:

- The file storage activity is fuzzy as the company claims to have a file system which is not the case as Pixit relies on IBM Storage Scale parallel file system instances. Beyond the bargain and the opportunity to acquire Pixit for a 'penny', if DataCore would have been interested to acquire and own a real parallel file system, players like ThinkParQ, Quobyte... would have been an interesting pick. Others are not affordable. Tuxera, in the SMB Windows and Linux space, would have been a perfect fit and a very good pick as well but at the end, pricing remains a hot topic...

- Pixit acquisition have invited DataCore to rename the Perifery business into Pixitmedia by DataCore and we'll monitor where it goes...

- The vision has been to provide some file access virtualization solutions aka Network File Virtualization (NFV) and Network File Management (NFM) and they picked Hammerspace for vFilO but they gave up on this, remember this article written in November 2019.

- They had a HCI product which disappeared but as VMware destiny has changed radically with Broadcom, opportunities are real and players like Nutanix has a second life receiving a gift from the sky after tough times.

- Caringo and MayaData are strong moves when ObjectMatrix, WINS and ArcStream are more questionnable.

The choice of StarWind Software is definitely an interesting one being a recognized player in the domain addressing small/medium size needs. StarWind represents around $30 million of business and just putting their products in the DataCore strong channel should produce positive revenue impacts. Clearly the synergy exists at the strategy, product and sales levels with common partners. We can even wonder why it didn't happen before.

Click to enlarge

We all think DataCore as a storage software vendor not a HCI one as HCI is not a storage play, but shared storage instantiated by storage service layer like vSAN or StarWind Virtual SAN is. And this remark is key. Please consider this: if HCI is storage and HCI is the unification of compute and storage and network with a hypervisor layer, in that case data warehouse and other similar models should be considered as storage vendors as well but we all agree they're not. This comment is also illustrated by the recent Nutanix announced partnerships with Dell or Pure Storage connecting external storage. It confirms this long time claim. We never saw a HCI product competing for file and block storage in a RFP against pure players in the domain but we see several solutions implemented as virtual or physical appliance embedding VMs to deliver storage services but it is very different. HCI is about consolidation of infrastructure resources to consolidate applications workloads to reduce cost, footprint and optimize the IT environment at the end. And obviously this is an opportunity to plug storage.

For DataCore, the trajectory is in place and the next obvious phase should be the famous, long waiting, exit. We'll see. It will make sense at HPE and even Dell. At what price...

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter