Western Digital: Fiscal 3Q25 Financial Results

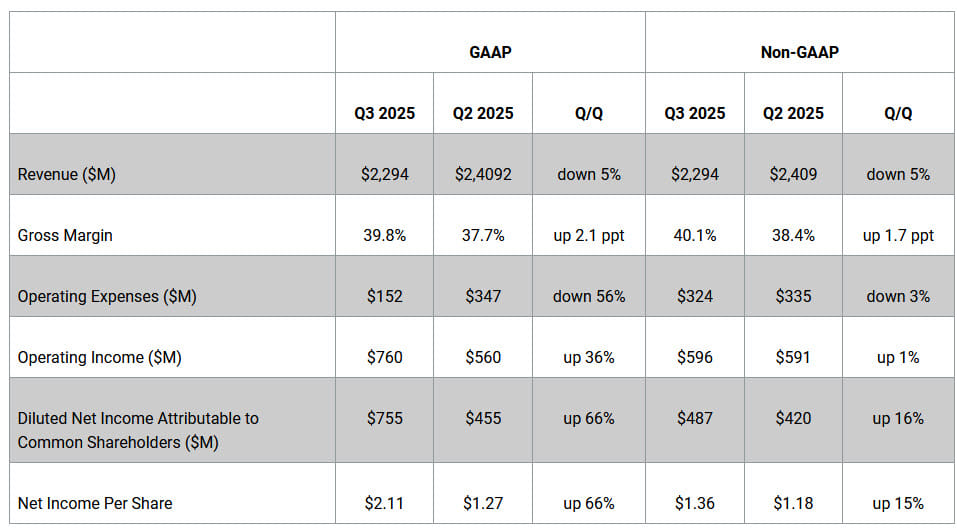

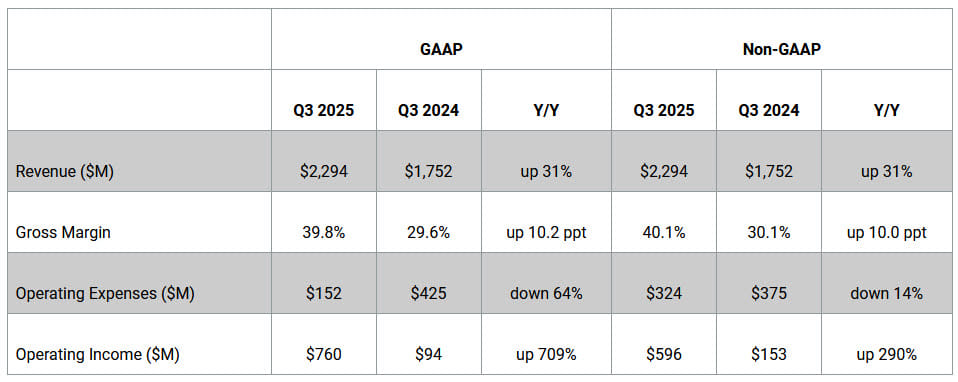

Revenue at $2.29 billion, down 5% Q/Q, expecting 4Q in the range of $2.45 billion +/- $150 million

This is a Press Release edited by StorageNewsletter.com on May 1, 2025 at 2:02 pmSummary:

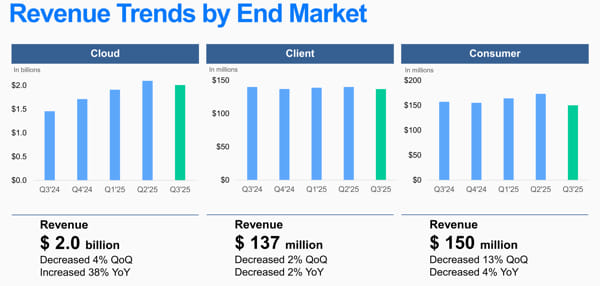

- Third quarter revenue was $2.29 billion, down 5% sequentially (Q/Q). Cloud revenue decreased 4% (Q/Q), Client revenue decreased 2% (Q/Q) and Consumer revenue decreased 13% (Q/Q).

- Third quarter GAAP earnings per share (EPS) was $2.11 and Non-GAAP EPS was $1.36.

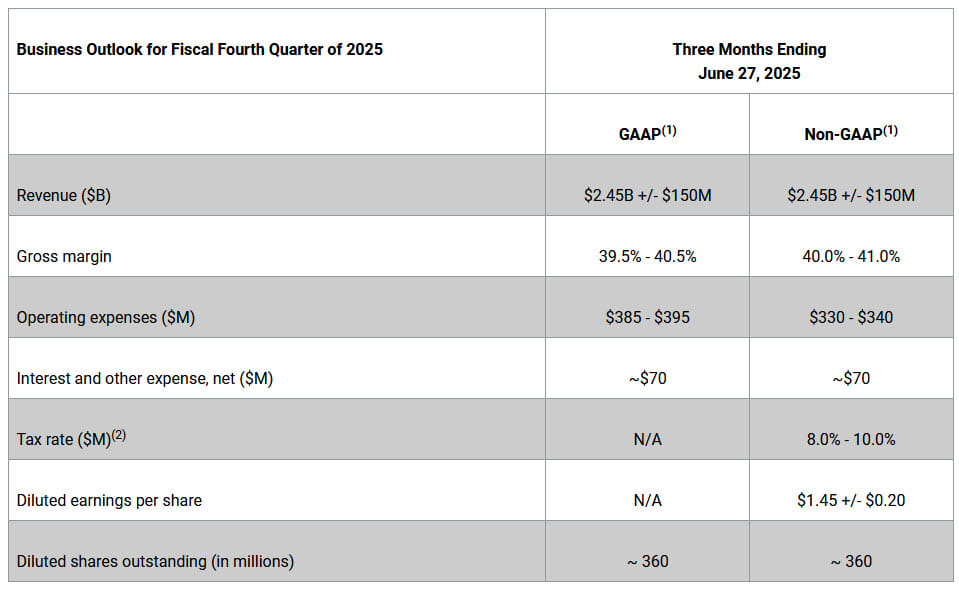

- Expect fiscal fourth quarter 2025 revenue to be in the range of $2.45 billion +/- $150 million.

- Non-GAAP EPS in the range of $1.45 +/- $0.20.

- The company’s Board of Directors authorized the adoption of a quarterly cash dividend program and declared a cash dividend of $0.10 per share.

Western Digital Corp. reported fiscal third quarter 2025 financial results.

![]() “Western Digital executed well in its fiscal third quarter achieving revenue at the high end of our guidance range and gross margin over 40%,” said Irving Tan, CEO, Western Digital. “Even in a world marked by geopolitical uncertainty and shifting tariff dynamics, one thing remains constant: the exponential growth of data. When it comes to storing that data, at scale, no technology rivals the cost-efficiency and reliability of HDDs. With our rich portfolio of storage products, WD is uniquely positioned to meet our customers’ mass storage needs.“

“Western Digital executed well in its fiscal third quarter achieving revenue at the high end of our guidance range and gross margin over 40%,” said Irving Tan, CEO, Western Digital. “Even in a world marked by geopolitical uncertainty and shifting tariff dynamics, one thing remains constant: the exponential growth of data. When it comes to storing that data, at scale, no technology rivals the cost-efficiency and reliability of HDDs. With our rich portfolio of storage products, WD is uniquely positioned to meet our customers’ mass storage needs.“

On April 29, 2025, the company’s Board of Directors authorized the adoption of a quarterly cash dividend program beginning with the quarter ending June 27, 2025 and declared a cash dividend of $0.10 per share of the company’s common stock, payable on June 18, 2025 to shareholders of record as of June 4, 2025.

Q3 2025 Financial Highlights

The company had an operating cash inflow of $508 million and ended the quarter with $3.48 billion of total cash and cash equivalents.

Additional details can be found within the company’s earnings presentation, which is accessible online at investor.wdc.com.

In fiscal third quarter:

- Cloud represented 87% of total revenue at $2.0 billion, down 4% sequentially and up 38% Y/Y. On a sequential basis, the decline was due to a 6% reduction in nearline bit shipments while pricing per unit in Cloud was up 5%. On a Y/Y basis, both revenue and bit shipments grew at 38% and 32%, respectively, driven by the strength of our product portfolio.

- Client represented 6% of total revenue at $137 million, down 2% on both a sequential and Y/Y Compared to last quarter and last year, revenue was down due to lower unit shipments.

- Consumer represented 7% of total revenue at $150 million, down 13% sequentially and 4% Y/Y. The sequential decline in Consumer was primarily due to lower unit shipments; year over year, the decrease was largely due to pricing.

(1) Non-GAAP gross margin guidance excludes stock-based compensation expense, totaling approximately $10 million to $15 million. The company’s Non-GAAP operating expenses guidance excludes stock-based compensation expense and other expenses, totaling approximately $50 million to $60 million. In the aggregate, Non-GAAP diluted earnings per share guidance excludes these items totaling $60 million to $75 million. The timing and amount of these charges excluded from Non-GAAP gross margin, Non-GAAP operating expenses, and Non-GAAP diluted earnings per share cannot be further allocated or quantified with certainty. Additionally, the timing and amount of additional charges the company excludes from its Non-GAAP tax rate and Non-GAAP diluted earnings per share are dependent on the timing and determination of certain actions and cannot be reasonably predicted. Accordingly, full reconciliations of Non-GAAP gross margin, Non-GAAP operating expenses, Non-GAAP tax rate and Non-GAAP diluted earnings per share to the most directly comparable GAAP financial measures (gross margin, operating expenses, tax rate and diluted earnings per share, respectively) are not available without unreasonable effort.

(2) Non-GAAP tax rate is determined based on a percentage of Non-GAAP pre-tax income or loss. Our estimated Non-GAAP tax rate may differ from our GAAP tax rate (i) due to differences in the tax treatment of items excluded from our Non-GAAP net income or loss; (ii) due to the fact that our GAAP income tax expense or benefit recorded in any interim period is based on an estimated forecasted GAAP tax rate for the full year, excluding loss jurisdictions; and (iii) because our GAAP income taxes recorded in any interim period are dependent on the timing and determination of certain GAAP operating expenses.

Basis of Presentation

On February 21, 2025 (the ‘Separation Date’), Western Digital Corporation (WDC) completed the previously announced separation of its Flash business unit into a separate company, Sandisk Corporation (Sandisk). Sandisk is now an independent public company.

The financial and operating results of Sandisk subsequent to the Separation Date are no longer consolidated into WDC’s financial and operating results, and the historical results and financial position of Sandisk for all periods prior to the Separation Date have been reflected as discontinued operations in WDC’s preliminary condensed consolidated balance sheets and preliminary condensed consolidated statements of operations included in this release.

Dividend Program

The amount and timing of future dividends under the company’s dividend program will depend on market conditions and other corporate considerations. The company may suspend or discontinue the dividend program at any time.

Investor Communications

A investment community conference call has been broadcasted on April 30th An archived version can be accessed at investor webpage.

Resources:

Third Quarter Fiscal 2025 Press Release with Financial Tables and Guidance Summary

Third Quarter Fiscal 2025 Earnings Presentation

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter