Twist Bioscience: Fiscal 2Q24 Financial Results

Twist Bioscience: Fiscal 2Q24 Financial Results

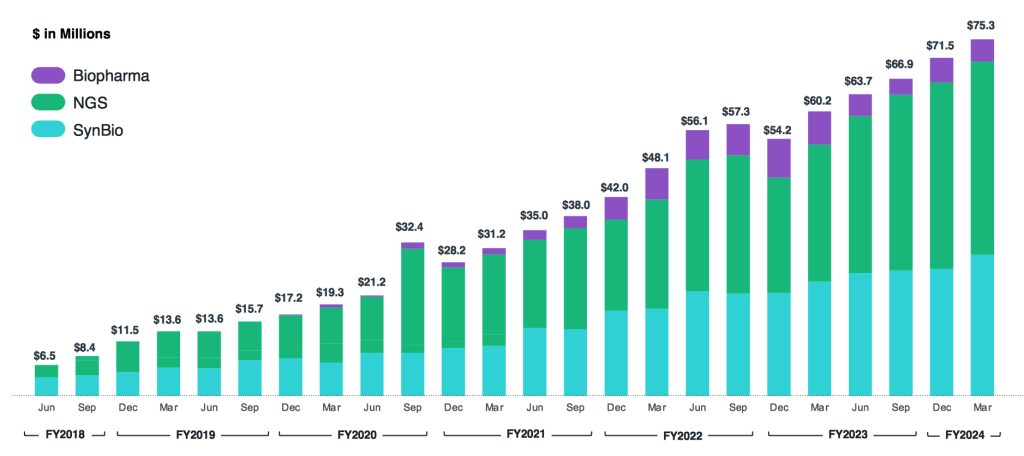

Revenue and orders increasing, but high net loss even if decreasing

This is a Press Release edited by StorageNewsletter.com on May 6, 2024 at 2:01 pm

| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 60.2 | 75.3 | 114.4 | 146.8 |

| Growth | 25% | 28% | ||

| Net income (loss) | (59.2) | (45.5) | (101.0) | (88.5) |

Twist Bioscience Corporation reported financial results and business highlights for the second quarter of fiscal 2024 ended March 31, 2024.

“This was another very strong quarter for Twist with both revenue and orders increasing to $75.3 million and $93.2 million, respectively,” said Emily M. Leproust, Ph.D., CEO and co-founder. “We’re encouraged by the reception of Express Genes, with more than 700 accounts, including 100 net new accounts ordering this differentiated product since launch. We see consistent strength In NGS, where our tools are used across fields and during the quarter we announced several differentiated products spanning research areas and geographies.”

He continued: “We remain steadfast and focused on our path to profitability. For the full business, gross margin improved from 31% to 41% for 2QFY23 and 2QFY24, respectively. More importantly, cash flow from operating activities continues to improve, and we are driving to breakeven. For the 6 months ended March 31, 2024, net cash used in operating activities was $42.4 million, compared to $98.4 million for the equivalent 6-month period in 2023. And, as we grow revenue, we continue to take steps to improve gross margin, driving toward gross margin over 50% by the end of fFY25.”

2FQ24 financial results

- Total orders received increased to $93.2 million compared to $64.2 million for 2FQ23.

- Total revenue increased to $75.3 million compared to $60.2 million for 2FQ23.

- SynBio revenue increased to $29.8 million compared to $24.2 million for 2FQ23.

- NGS revenue increased to $40.8 million for compared to $29.0 million for 2FQ23.

- Biopharma revenue was $4.7 million compared to $7.0 million in 2FQ23.

- Cost of revenue was $44.4 million compared to $41.7 million for 2FQ23.

- Gross margin increased to 41% compared to 31% for 2FQ23.

- R&D expenses were $24.1 million compared to $27.4 million for 2FQ23.

- Selling, general and administrative expenses were $55.6 million compared to $54.0 million for 2FQ23.

- Net loss attributable to common stockholders was $45.5 million, or $0.79 per share, compared to $59.2 million, or $1.04 per share, for 2FQ23.

- Adjusted EBITDA was -$26.8 million compared to -$45.5 million for 2FQ23.

- As of March 31, 2024, the company had $293.3 million in cash, cash equivalents and short-term investments.

Recent highlights:

- Shipped products to 2,253 customers in 2FQ24, compared to approximately 2,100 customers in 2FQ23.

- Shipped approximately 193,000 genes during 2FQ24, compared with approximately 152,000 genes during 2FQ23.

- Launched the cfDNA Library Preparation Kit to maximize the number of unique cfDNA molecules captured during library preparation for higher confidence in the accuracy and sensitivity of liquid biopsy tests.

- Launched IVDR-compliant Twist Precision Dx Products1, the first Twist products specifically developed to be included within regulated customer products.

- Announced technology early access of the Twist Flex Prep Ultra High-Throughput (UHT) Kit, designed to accelerate NGS’s microarray conversion and adoption in agricultural genomics by enabling unparalleled throughput at a fraction of the cost of existing on market solutions.

- Collaborated with Element Biosciences to develop the Twist for Element, Exome 2.0 plus Comprehensive Exome Spike-in Workflow for Element’s AVITI System.

- Launched a new Human Pangenome Spike-in for the Twist Exome 2.0 panel, developed to enable researchers to detect a more complete view of genetic variation during whole exome sequencing.

Updated FY24 guidance

Total revenue is expected to be in the range of $300 million to $304 million compared to previous guidance of $288 million to $293 million, indicating Y/Y growth of 22 to 24%, and includes the following:

- SynBio revenue is expected to be in the range of $118 million to $120 million compared to the previous estimate of $114 million to $117 million, indicating Y/Y of 20 to 22%

- NGS revenue is expected to be in the range of $162 million to $164 million compared to the previous estimate of $150 million to $152 million, indicating Y/Y growth of 31 to 33%

- Biopharma revenue is expected to be approximately $20 million compared to the previous estimate of approximately $24 million, indicating Y/Y decrease of approximately 13%

- Gross margin is expected to be approximately 41.5 to 42.0% for fiscal 2024, an increase from previous guidance of 40 to 41%

- Loss from operations before taxes of approximately $183 million to $188 million, a decrease from $189 million to $194 million provided previously

- Capital expenditure of $15 million, unchanged from prior guidance

- Ending cash, cash equivalents and short-term investments at September 30, 2024 of more than $245 million.

For 3F24, thecompany provided the following financial guidance:

- Total revenue of approximately $77 million

- SynBio revenue of approximately $31 million

- NGS revenue of approximately $41 million

- Biopharma revenue of approximately $5 million

- Gross margin of 41-42%

For 4FQ24, the firm provided the following financial guidance:

- Total revenue in the range of $77 million to $80 million

- Gross margin of 43-44%

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter