Twist Bioscience: 2FQ23 Financial Results

Twist Bioscience: 2FQ23 Financial Results

Growth of revenue but serious impact on DNA storage team

This is a Press Release edited by StorageNewsletter.com on May 12, 2023 at 2:02 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 48.1 | 60.2 | 90.1 | 114.4 |

| Growth | 25% | 27% | ||

| Net income (loss) | (60.6) | (61.6) | (116.7) | (106.3) |

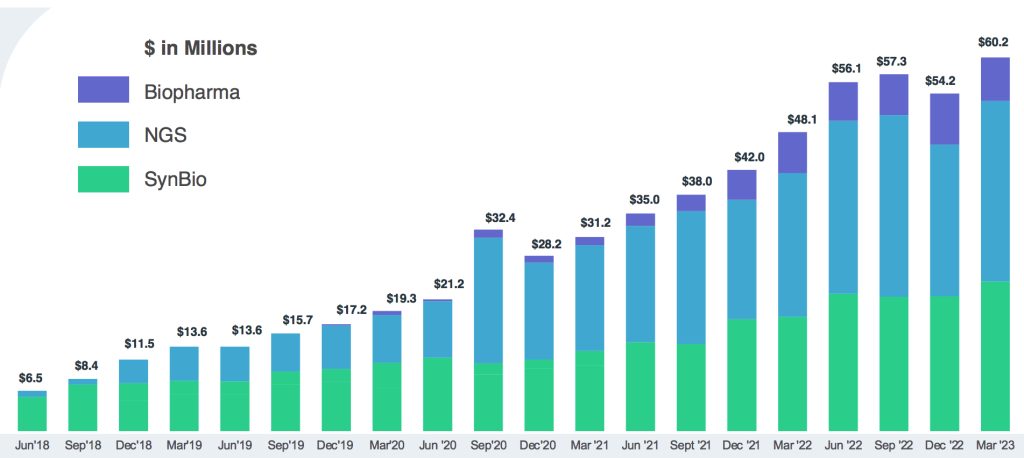

- Record revenue of $60.2 million in 2QFY23; up 25% over $48.1 million in 2QFY22

- Orders increased to $64.2 million in 2QFY23; up 17% over 2QFY22

- Decisive actions to accelerate path to profitability

Twist Bioscience Corporation reported financial results and business highlights for the second quarter of fiscal 2023 ended March 31, 2023.

“We reported a strong quarter overall, breaking the $60 million revenue threshold for the first time and exceeding our guidance,” said Emily M. Leproust, Ph.D., CEO and co-founder. “NGS, in particular, had an excellent quarter and we announced our Biopharma Solutions integrated offering, which brings together in vivo, in vitro and in silicon approaches to antibody discovery. In January, we shipped the first products from the Factory of the Future and are now manufacturing the vast majority of our genes, gene fragments and oligo pools in our Wilsonville facility.”

The company also announced decisive and proactive actions aimed at accelerating its path to profitability while simultaneously extending the company’s runway. These actions will focus resources on the support of key commercial and development opportunities that have the potential to deliver significant ROI. As part of these initiatives, the firm conducted a comprehensive review of the business and is resizing many teams throughout the organization and reducing its workforce by approximately 270 employees, or about 25%.

For example, manufacturing for the majority of synthetic biology products has transitioned to the Factory of the Future, thereby reducing overall fixed costs and removing duplication between the South San Francisco and Wilsonville sites. NGS panels will continue to be made in South San Francisco. Additionally, the vendor plans to maintain its global commercial presence to drive topline growth while streamlining teams including R&D across the business to focus on programs where the company believes it has a clear competitive advantage and sees the greatest potential for long-term profitable growth and value creation. The biopharma team has been resized to focus on revenue-generating partnerships and the firm will moderate its investment in DNA storage while maintaining its competitive lead.

Leproust continued: “As we grow the company and pursue the many commercial opportunities we see ahead, we remain laser focused on achieving adjusted EBITDA breakeven for the core and biopharma businesses while maintaining optionality for the potential we see in storage. Following a strategic and holistic analysis of the business, we prioritized and reengineered our cost base, and with these substantive changes, we believe we are operating from a position of strength, operating as a leaner organization focused on disruptive market opportunities for profitable and scalable growth.”

Revenue growth

2FQ23 financial results

- Orders: Total orders received for 2FQ23 were $64.2 million compared to $55 million for 2FQ22.

- Revenue: $60.2 million compared to $48.1 million for 2FQ22.

- Cost of revenues: $41.7 million compared to $29.7 million for 2FQ22.

- R&D expenses: $27.4 million compared to $31.2 million for 2FQ22.

- Selling, general and administrative expenses: $54.0 million for both 2FQ23 and 2FQ22.

- Net loss: Net loss attributable to common stockholders was $59.2 million, or $1.04 per share, compared to $60.7 million, or $1.13 per share, for 2FQ22.

- Cash position: As of March 31, 2023, the company had $387.7 million in cash, cash equivalents and investments.

Recent highlights:

- Shipped products to 2,100 customers in 2FQ23, vs. approximately 2,000 customers in 2FQ22.

- Shipped approximately 152,000 genes during 2FQ23, compared with approximately 124,000 genes during 2FQ22.

Guidance for FY23

- Revenue guidance is expected to be approximately $235 million to $238 million, compared to previous guidance of $261 million to $269 million

- SynBio revenue is expected to be $96 million to $98 million, compared to previous guidance of $104 million to $106 million

- NGS revenue is expected to be $113 million to $114 million, compared to previous guidance of $120 million to $123 million

- Biopharma revenue is expected to be $26 million, compared to previous guidance of $37 million to $40 million

- Gross margin is expected to be 35-36%, compared to previous guidance of approximately 39-40% for FY23

- Operating expenses including R&D and SG&A are expected to be approximately $313 million to $319 million, a decrease compared to previous guidance of $330 million primarily driven by a decrease in expected stock-based compensation expense

- R&D expense is expected to be approximately $112 million to $114 million, compared to previous guidance of $130 million

- SG&A expense is expected to be $197 million to $200 million, compared to previous guidance of $204 million

- Mark to market of contingent consideration and indemnity holdbacks is projected to be a credit of $5 million, compared to previous guidance of $4 million

- Separation costs are expected to be approximately $9 million to $11 million

- Operating loss is expected to be approximately $230 million to $234 million, a decrease compared to the $260 million projection given in November 2022, and includes the following:

- Stock-based compensation is expected to be approximately $43 million, compared to previous guidance of $50 million

- Depreciation and amortization are expected to be approximately $29 million, with no change from previous guidance

- Operating expenses for DNA storage is expected to be approximately $40 million, a decrease from previous guidance of $46 million

- Capital expenditure is expected to be approximately $40 million, compared to previous guidance of $50 million

- FY23 end cash is projected to be $320 million, compared to previous guidance of $300 million

3FQ23 guidance:

- Revenue is expected to be approximately $60 million to $61 million

- Gross margin is expected to be approximately 30%

4FQ23 guidance:

- Revenue is expected to be approximately $62 million to $63 million

- Gross margin is expected to be approximately 36%

FY24 guidance

- Twist expects to exit FY24 with adjusted EBITDA breakeven for its core (SynBio, NGS) and Biopharma businesses in the fourth quarter

- Operating expenses for DNA storage are expected to be $40 million, a decrease compared to previous guidance of $57 million

- Fiscal year end cash is projected to be $220 million, compared to previous guidance of $170 million

Comments

Twist Bioscience announced its 2FQ23 results with a revenue passing the $60 million barrier for one quarter for the first time.

Emily M. Leproust, Ph.D., CEO and co-founder, confirms: "As part of these initiatives, Twist conducted a comprehensive review of the business and is resizing many teams throughout the organization and reducing its workforce by approximately 270 employees, or about 25%. The biopharma team has been resized to focus on revenue-generating partnerships and Twist will moderate its investment in DNA data storage while maintaining its competitive lead."

One of the efforts and objectives exposed by the company is related to DNA Data Storage claiming in the recent highlights section of the press release: "Continued to work toward demonstration of end-to-end Gb Century Archive DNA data storage solution by the end of calendar 2023 and launch of the Tb Century Archive solution in early calendar 2025."

As mentioned above, the DNA Data Storage activity is impacted as several members have been laid off. We got confirmation from Steffen Hellmold, SVP business development, that he's now on the market looking for new opportunities like many of his colleagues. He has made clear personal choices, even risks, to this DNA storage aspect for a few years, being a true believer and ambassador of this approach.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter