Micron: Fiscal 2Q24 Financial Results

Micron: Fiscal 2Q24 Financial Results

Revenue jumps to $5.8 billion, up 23% Y/Y and 58% Q/Q, back to profitability thanks to AI boom.

This is a Press Release edited by StorageNewsletter.com on March 25, 2024 at 2:02 pm| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 4,726 | 5,824 | 7,778 | 10,550 |

| Growth | 23% | 36% | ||

| Net income (loss) | (1,234) | 793 | (2,507) | (441) |

Micron Technology, Inc. announced results for its second quarter of fiscal 2024, which ended February 29, 2024.

2FQ24 highlights

• Revenue of $5.82 billion vs. $4.73 billion for 1FQ24 and $3.69 billion for 2FQ23

• GAAP net income of $793 million, or $0.71 per diluted share

• Non-GAAP net income of $476 million, or $0.42 per diluted share

• Operating cash flow of $1.22 billion vs. $1.40 billion for 1FQ24 and $343 million for 2FQ23

“Micron delivered 2FQ24 results with revenue, gross margin and EPS well above the high-end of our guidance range – a testament to our team’s excellent execution on pricing, products and operations,” said Sanjay Mehrotra, president and CEO. “Our preeminent product portfolio positions us well to deliver a strong 2HH24. We believe Micron is one of the biggest beneficiaries in the semiconductor industry of the multi-year opportunity enabled by AI.”

Investments in capital expenditures, net were $1.25 billion for 2FQ24, which resulted in adjusted free cash flows of negative $29 million. The company ended 2FQ24 with cash, marketable investments, and restricted cash of $9.72 billion.

On March 20, 2024, the board of directors declared a quarterly dividend of $0.115 per share, payable in cash on April 16, 2024, to shareholders of record as of the close of business on April 1, 2024.

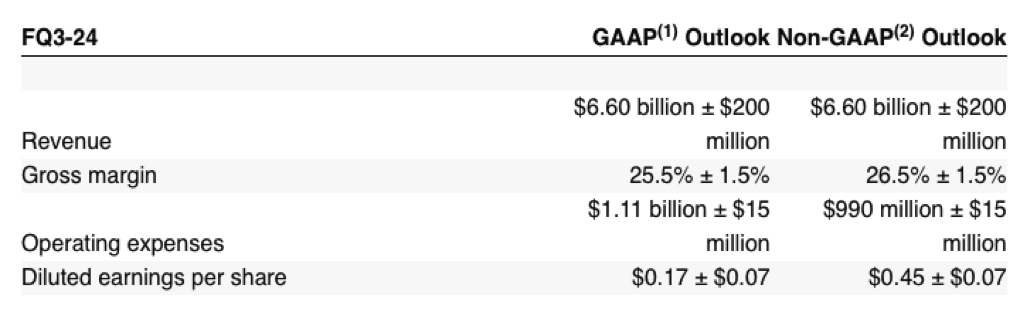

Business Outlook

The following table presents Micron’s guidance for 3FQ24:

Comments

Micron delivered 2FQ24 revenue ($5.8 billion), gross margin and earnings per share well above the high end of guidance - $4.2 billion to $4.6 billion for sales. It has returned to profitability and delivered positive operating margin a quarter ahead of expectation.

It drove robust price increases as the supply-demand balance tightened. This improvement in market conditions was due to a confluence of factors, including strong AI server demand, a healthier demand environment in most end markets, and supply reductions across the industry.

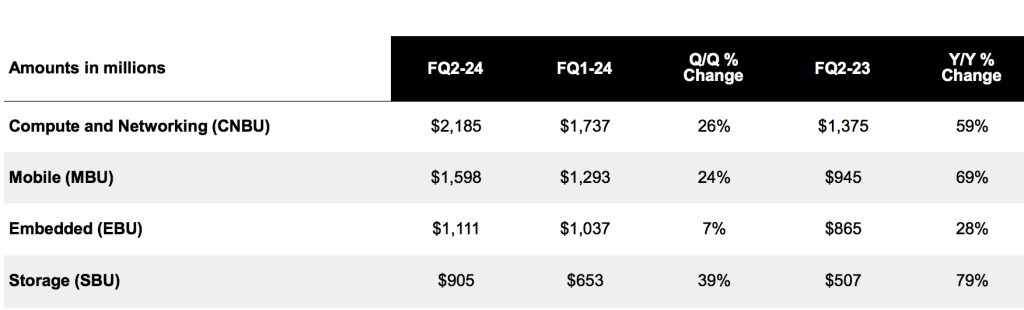

Revenue by business unit

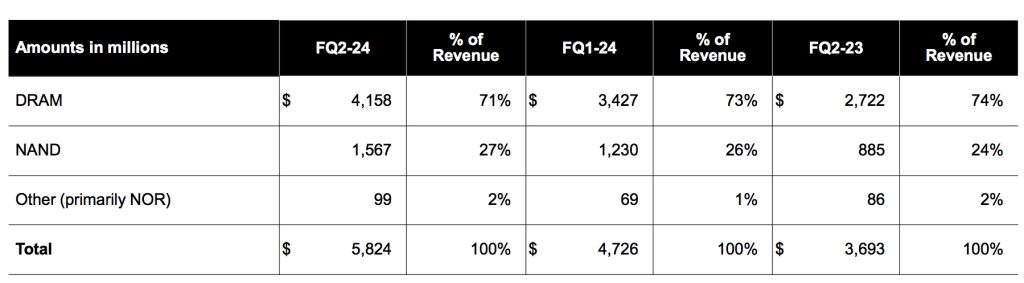

Revenue by technology

DRAM in 2FQ24

• $4.2 billion, representing 71% of total revenue

• Revenue increased 21% Q/Q

• Bit shipments increased by a low-single digit

percentage Q/Q

• ASPs increased by high teens Q/Q

NAND in 2FQ24

• $1.6 billion, representing 27% of total revenue

• Revenue increased 27% Q/Q

• Bit shipments decreased by a low-single digit percentage Q/Q

• ASPs increased by over 30% Q/Q

Technology update

Micron is at the forefront of ramping most advanced technology nodes in both DRAM and NAND. Reinforcing its leadership position, over 3 quarters of its DRAM bits are now on leadingedge 1-alpha and 1fl (1-beta) nodes, and over 90% of it NAND bits are on 176-layer and 232-layer nodes. The firm expects FY24 front-end cost reductions, excluding the impact of HBM, to track in line with its long-term expectations of mid to high single digits in DRAM and low teens in NAND, supported by the continued volume ramp of 1fl DRAM and 232-layer NAND.

It continues to mature its production capability with extreme ultraviolet lithography (EUV), and have achieved equivalent yield and quality on its 1-alpha as well as 1fl nodes between EUV and non-EUV flows. It began 1y (1-gamma) DRAM pilot production using EUV and are on track for volume production in calendar 2025.

The development of firm's next-gen NAND node is on track, with volume production planned for calendar 2025. The company expects to maintain its technology leadership in NAND AI server demand is driving rapid growth in HBM (high-bandwidth memory), DDR5 (D5) and data center SSDs, which is tightening leading-edge supply availability for DRAM and NAND. This is resulting in a positive ripple effect on pricing across all memory and storage end markets. The company expects DRAM and NAND pricing levels to increase further throughout calendar year 2024 and expect record revenue and much improved profitability now in FY25.

It expects calendar 2024 industry supply to be below demand for both DRAM and NAND. Manufacturer's bit supply growth in F24 remains below its demand growth for both DRAM and NAND, and the company expects to decrease its days of inventory in FY24.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| FY20 | 6,131 | 14% | 29% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | 1,957 | 4% | 25% |

| 3FQ22 | 2,300 | 18% | 26% |

| 4FQ22 | 1,688 | -26% | 25% |

| FY22 | 7,811 | 11% | 25% |

| 1FQ23 |

1,103 |

-35% | 27% |

| 2FQ23 | 885 | -20% |

24% |

| 3FQ23 | 1,013 | 14% |

27% |

| 4FQ23 | 1,205 | 19% |

30% |

| FY23 | 4,206 | -46% |

27% |

| 1FQ24 | 1,230 | 2% | 26% |

| 2FQ24 | 1,567 | 27% | 27% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter