History 2003: EMC + Legato = Hardware + Software

Former acquired latter for $1.2 billion.

By Jean Jacques Maleval | December 28, 2023 at 2:00 pm“I guess there’s two types of people in this world. There’s hunters and zookeepers and Joe [Tucci] and I are both hunters“, said Legato chairman and CEO Dave Wright during the conference call following the announcement of the acquisition of his firm by EMC.

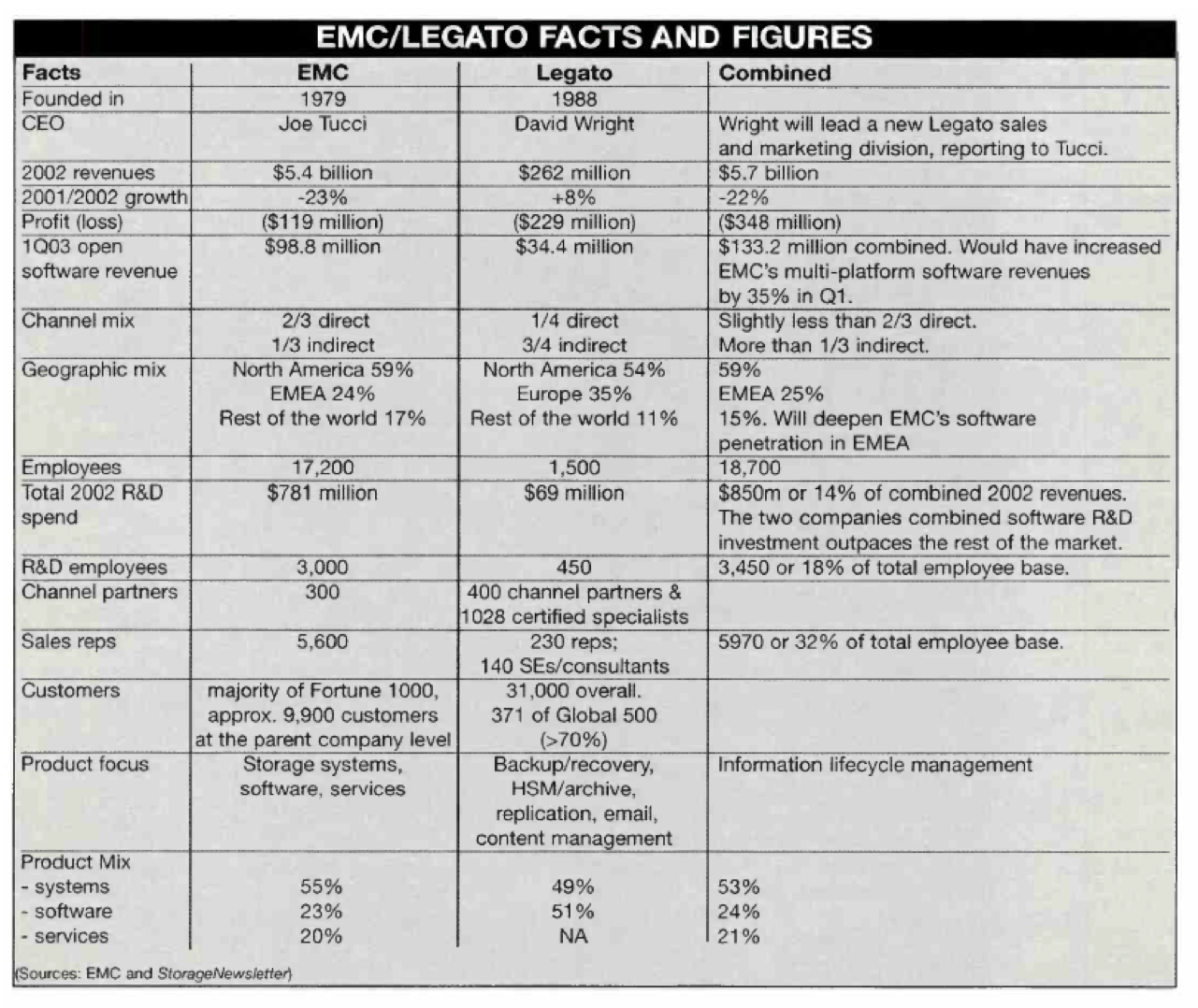

What company would want to acquire, at the princely sum of $1.2 billion, a 15-year old company whose last fiscal year, ended in December 2002, resulted in sales of $262 million, with losses of $229 million?

Within the storage industry, only EMC would or could dare. $1.2 billion for Legato Systems would be EMC’s most extravagant acquisition ever, even greater than the acquisition of Data General ($1.1 billion) in 1999.

It’s the storage transaction of the year, thus far, and confirms once again the general trend towards consolidation, by no means ending, within the storage industry.

In fact, the deal isn’t as exorbitant as it seems for EMC, which won’t even feel a ripple in its ready cash, still at $6 billion. Specifically, the financial transaction, an all-stock deal, will work as follows: EMC will issue 105 million new shares of common stock that will be offered to Legato shareholders, who will receive 0.9 of these new shares in exchange for each of their shares. 105 million is scarcely 5% of the more than 2 billion EMC shares currently in circulation. 5% is also the exact fraction of EMC’s sales that Legato’s sales represent. If we take the share value of each of the companies’ shares on the day of the announcement, i.e. $11.7 for the buyer, $9.1 for the seller, this means that Legato’s shareholders will receive $10.5 for each share traded, a 16% premium. This bonus is hypothetical, however, since it will depend on the value of the shares at the time the transaction is finalized, expected in early 4Q03, with December 31 the final deadline. On the day of the announcement, 105 million shares of EMC at $11.7 amounted to $1.2 billion. Shortly after, EMC share prices dipped, while Legato’s rose (thereby reducing the theoretical bonus, or perhaps more accurately, paying it early).

Could the deal go south? Highly unlikely, since according to the terms of the agreement, a break-up fee will costs its instigator $45 million.

For some time, a number of companies have been eyeing the software company – names such as HP and Sun had been mentioned – particularly after the drastic decline in its stock value due to serious accounting irregularities that came to light in 2000, leading to the departure of a number of executives and sales people.

Last year, the company was forced to part with $67 million in order to settle lawsuits vs. shareholders. It also encountered two further problems: a lack of resources for sufficient investment in R&D, and excessive costs, $134 million, or 53% of its 2002 revenues, at the sales and marketing level, which represents 500 direct-to-customer sales people, a third of the firm’s total workforce. Of course, 75% of Legato’s sales are generated through the channel.

The acquisition will allow EMC’s Tucci to get a little closer to his goal, as he’s told anyone who will listen, of attaining 30% of revenues from software, or 50% in software and service combined, by the end of 2004. For the moment, he is at 22% for software alone – but if we only take into account open software, and not that which runs only on EMC hardware platforms, that number drops to 7%. The addition of Legato will nudge EMC’s software sales from 22% to 24%.

The only conclusion, as Tucci has confirmed, is that other acquisitions on the software and services side are also in the works.

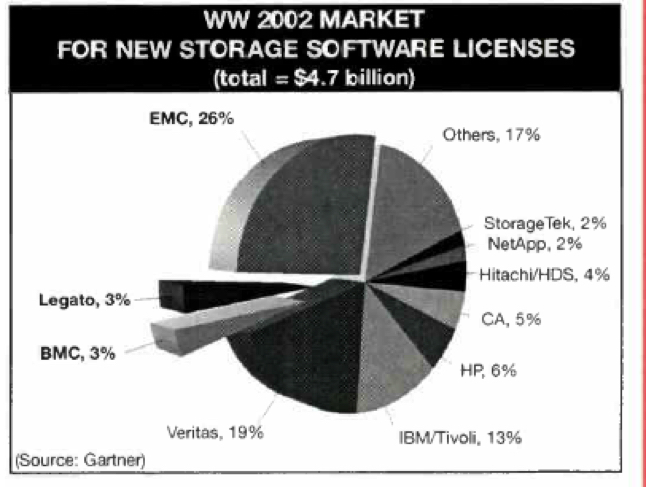

According to Gartner, EMC holds the ≠1 position in terms of revenue from new storage software licenses sold in 2002 WW, with $1.2 billion, or 26% of the total. Legato is 7th, with $135 million, or a 3% market share, although its sales were down 26% compared to 2001.

With the transaction, EMC will now also find itself directly involved in the backup and recovery market, in which Legato was ≠4 WW, with a 7% market share, behind Veritas, IBM and CA. Slightly ironic, given that EMC was always supremely disdainful of the tape technology that is a major component of the sector.

There is every indication that EMC will gradually replace its Enterprise Data Manager (EDM) with Networker, Legato’s star product, which will become EMC’s primary backup and recovery offering.

More importantly, and to a certain extent, the icing on the cake, is that EMC will also pick up OTG Software’s activities, acquired last year by Legato for $403 million, which means it acquires HSM, email and fixed document management software, a highly promising market. EMC was already a Legato partner for the implementation of this software on its Centera line, an ATA disk array solution for fixed documents.

“We spend about 19% of our R&O focused on EMC,” said Wright.

More generally, the storage leader is positioning itself even more dominantly in what it calls “information lifecycle management.”

Another consequence is that EMC is now also positioning itself as vendor for customers of all sizes, not only the big ones.

EMC intends to operate Legato as a separate software division, rather than as a subsidiary, retaining the brand name and the facility in Mountain View, CA that drives sales and marketing, still led by Wright, reporting to Tucci (the 2 have known each other for over 10 years).

Mark Lewis, VP of open software solutions, who has been remarkably silent about the acquisition, and who said nothing of the deal when we interviewed him last month, will lead the software development of the entire company under one team including the 450 Legato software engineers.

Legato’s customers had some reason for concern about the future of their supplier. On the one hand, they can take some comfort in the longevity of its products, while on the other hand, especially for those who were already EMC customers, and who had specifically turned to Legato as an independent software company, there may be some misgivings, which could benefit Veritas and CA.

We’re also waiting to learn the reaction of other Legato OEMs such as HP, IBM, StorageTek or Sun, who clearly will not be so keen to do business with their main rival.

Willy Wits, marketing director of StorageTek France, offered the following analysis: “We integrate Legato’s email and ASM product, an HSM for NT We see no reason not to continue to do so, unless EMC decides otherwise. We a/so work with their Networker product, but also with other software products from Atempo, IBM and Veritas.“

He added: “I’m a veteran of EMC, and I recall when it acquired what was known at the time as Epoch [in 1993. – Ed.] and that it didn’t work out so well. Of course, EMC is a different company now.“

To conclude, EMC is acquiring a formidable presence for large applications software. Until now, the hardware manufacture has hardly shined in the channel, hesitating between direct and indirect sales, with sales people who pushed primarily hardware. We’ll have to wait to see what the 2 sales forces can achieve together, despite their oddly separate organization, with EMC in one corner, the Legato division in the other, not unlike the structure of IBM and its separate Tivoli unit.

The only sour note in the deal: not all Legato shareholders are pleased. Several days after the announcement of the acquisition, Legato was served with 2 lawsuits filed in Santa Clara County Superior Court, each asserting identical claims of “breach of fiduciary duty and self-dealing vs. the defendants.” Both suits seek to enjoin the closing of the transaction and to force the company “to obtain a transaction in the interests of shareholders.” In any case, a much more interesting battle is set to take place between the 5 giants of the storage software industry: CA, EMC/Legato/BMC, IBM/Tivoli, Microsoft and Veritas.

This article is an abstract of news published on issue 187 on August 2003 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter