Commvault: Fiscal 4Q23 Financial Results

Commvault: Fiscal 4Q23 Financial Results

Sales down 1% and loss drastically increasing

This is a Press Release edited by StorageNewsletter.com on May 4, 2023 at 2:02 pm| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 205.9 | 203.5 | 769.6 | 784.6 |

| Growth | -1% | 2% | ||

| Net income (loss) | 8.0 | (43.5) | 33.6 | (35.8) |

Commvault Systems, Inc. announced its financial results for the fourth quarter and fiscal year ended March 31, 2023.

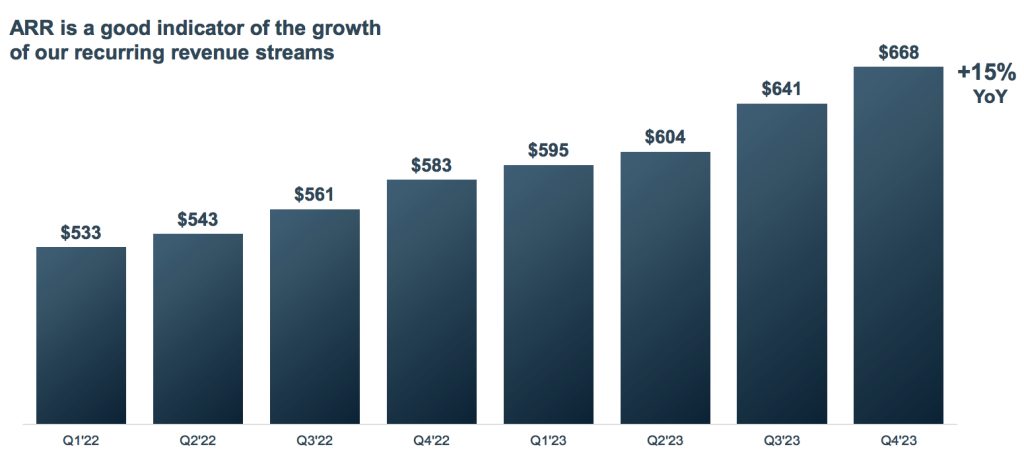

“Commvault closed out the year strong, highlighted by Metallic eclipsing the $100 million ARR mark, 15% Y/Y total ARR growth, and strong cash flow,” said Sanjay Mirchandani, president and CEO. “We enter the new fiscal year with momentum and confidence that Commvault customers are future proofed for the road ahead.”

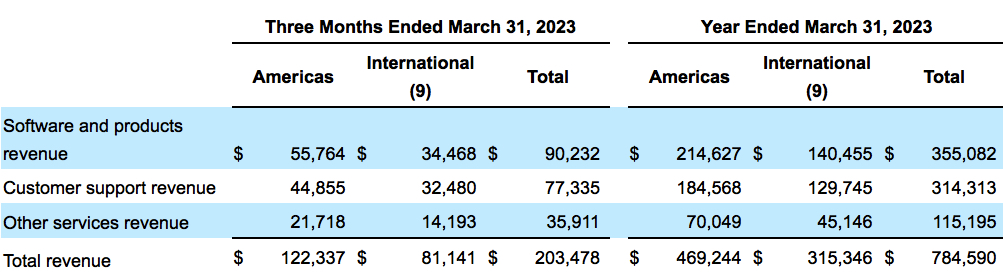

Total revenue for 4FQ23 was $203.5 million, a decrease of 1% Y/Y. On Y/Y constant currency basis, total revenue growth would have been 2%. Total recurring revenue was $173.9 million, flat Y/Y. On a Y/Y constant currency basis, total recurring revenue growth would have been 3%. Recurring revenue represented 85% of total revenue.

For FY23, total revenues were $784.6 million, an increase of 2% from FY22. On a Y/Y constant currency basis, total revenue growth would have been 6%.

Annualized recurring revenue (ARR), which is the annualized value of all active firm’s recurring revenue streams at the end of the reporting period, was $668.4 million as of March 31, 2023, up 15% Y/Y. On a Y/Y constant currency basis, ARR growth would have been 17%, driven by continued strength in Metallic as-a-service offerings.

Software and products revenue in 4FQ23 was $90.2 million, a decrease of 10% Y/Y, with a 12% decrease in larger deals (deals with greater than $0.1 million in software and products revenue). On a Y/Y constant currency basis, software and products revenue would have declined 8%.

Larger deal transaction revenue represented 72% of software and products revenue in 4FQ23. There were 187 larger deal transactions in 4FQ23, compared to 226 for 4FQ22. The average dollar amount of larger deal revenue transactions was approximately $347,000 in 4FQ23, representing a 6% increase from 3FQ23.

Software and products revenue for FY23 was $355.1 million, flat from FY22. On a Y/Y constant currency basis, software and products revenue growth would have been 4%.

Services revenue in 4FQ23 was $113.2 million, an increase of 7% Y/Y. For FY23, services revenue was $429.5 million, an increase of 4% FY22. The yearly increases were driven by revenue from Metallic as-a-service offerings. On a Y/Y constant currency basis, services revenue would have increased 11% for 4FQ23 and 9% for FY23.

On a GAAP basis, loss from operations (EBIT) was $37.7 million for 4FQ23 compared to income of $11.4 million in 3FQ23. The Y/Y decline in GAAP EBIT was primarily attributable to a $53.5 million noncash impairment charge related to the pending sale of company’s corporate HQs. Non-GAAP EBIT was $45.4 million in 4FQ23 compared to $46.6 million in 4FQ22.

On a GAAP basis, loss from operations (EBIT) for FY23 was $15.9 million compared to income of $41.6 million in FY22. Non-GAAP EBIT was $159.9 million in FY23 compared to $161.7 million in FY22.

Operating cash flow was $67.8 million for 4FQ23 compared to $87.1 million of operating cash flow in 3FQ23. For FY23, operating cash flow was $170.3 million, compared to $177.2 million for FY22. Deferred revenue growth related to Metallic as-a-service offerings continues to be a driver of cash flow.

During 4FQ23, Commvault repurchased approximately 1.0 million shares of its common stock totaling $60.8 million at an average price of approximately $60.76 per share. During FY23, it repurchased approximately 2.5 million shares of its common stock totaling $150.9 million at an average price of approximately $59.90 per share. Total cash was $287.8 million as of March 31, 2023 compared to $267.5 million as of March 31, 2022. There were no borrowings vs. the revolving credit facility.

On April 20, 2023, the board of directors approved an increase of the share repurchase program so that $250.0 million was available. The board’s authorization permits the storage company to make purchases of its common stock from time to time in the open market or through privately negotiated transactions, subject to market and other conditions. The board’s authorization has no expiration date.

Comments

4FQ23 revenue reaches $203.5 million, down 1% Y/Y and up 4% Q/Q with net loss of as high as $43.5 million. For FY23, the figure for global sales is $784.6 million, up 2% Y/Y.

Total ARR

Total ARR in 4FQ23 was $668 million, an increase of 15% Y/Y and 17% in constant currency. For this quarter, total subscription ARR, including term based licenses and SaaS contracts grew 38% Y/Y to $477 million. Subscription ARR represents 71% of total ARR, up from 59% in 4FQ22. The company is quickly nearing a milestone with subscription ARR approaching $500 million. This includes $101 million of SaaS ARR which doubled from FY22. These subscription metrics provide confidence in future growth opportunity.

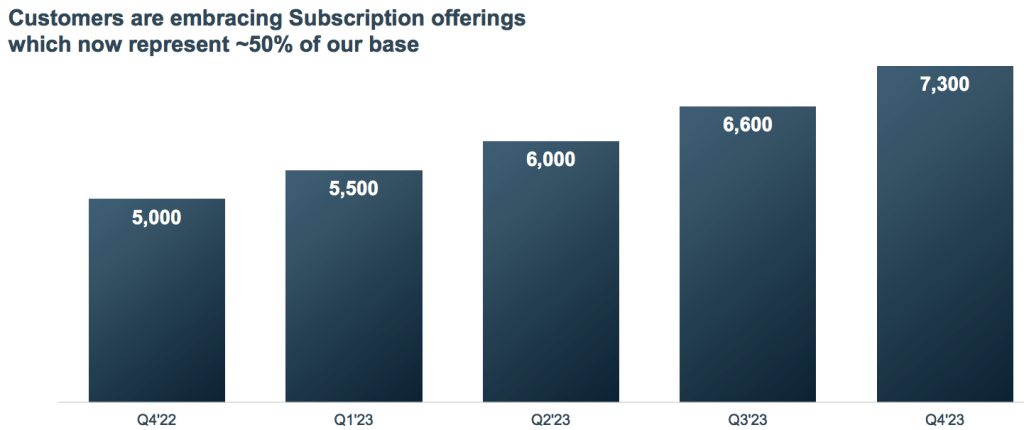

Subscription customer growth

Under new reporting structure, 4FQ23 subscription revenue, which includes the software portion of term licenses and SaaS, increased 9% Y/Y to $95 million and represented 46% of total revenue compared to 42% a year ago.

4FQ23 customer support was $77 million compared to $85 million a year ago. Customer support includes software updates, phone and web-based support for a term-based and perpetual software licenses. The yearly decline in customer support revenue was driven by foreign exchange headwinds and from the strategic conversion of certain perpetual customers to subscription offerings.

From a customer perspective, company's land and expand strategy is working as the firm added over 600 new subscription customers during 4FQ23.

Approximately 40% of Metallic customers used Commvault software solution and 30% of Metallic customers have multiple SaaS offerings.

The storage software company ended the quarter with no debt and $288 million in cash.

For 1FQ24, the firm expects subscription revenue, which includes both the software portion of term based licenses and SaaS, of $95 million to $98 million, representing 10% Y/Y growth at the midpoint. It expects total revenue of $195 million to $199 million or +2% to +1% Y/Y.

It expects subscription revenue to be in the range of $420 million to $430 million, growing 22% Y/Y at the midpoint. At these levels, subscription revenue should cross over 50% of total revenue, which is expected to be in the range of $805 million to $815 million or +3% to +4%.

Revenue and net income (loss) in $ million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| FY18 | 699.4 | 8% | (61.9) |

| FY19 | 711.1 | 2% |

3.6 |

| FY20 |

670.9 |

-6% |

(5.6) |

| FY21 | 723.5 | 8% | (31.0) |

| 1FQ22 |

183.4 | 6% | 13.9 |

| 2FQ22 |

177.8 | 4% | 1.7 |

| 3FQ22 | 202.4 | 8% | 10.0 |

| 4FQ22 | 205.9 | 8% | 8.0 |

| FY22 | 769.6 | 6% | 33.6 |

| 1FQ23 | 198.0 | 8% | 3.5 |

| 2FQ23 | 188.1 | 6% | 4.5 |

| 3FQ23 | 195.1 | -4% | (0.3) |

| 4FQ23 | 203.5 | -1% |

(43.5) |

| FY23 | 784.6 | 2% |

(35.8) |

| 1FQ24 (estim.) | 195-199 | 2% - 1% |

NA |

| FY24 |

805-815 |

3% - 4% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter