SK hynix: Fiscal 2Q22 Financial Results

SK hynix: Fiscal 2Q22 Financial Results

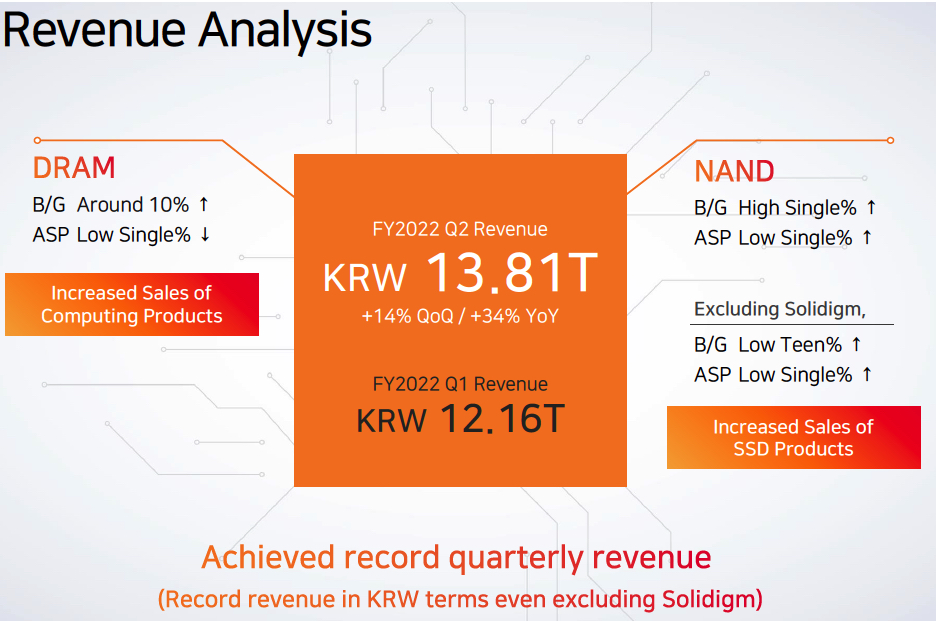

Record revenue of $10.6 billion up 34% and 14% Q/Q, outlook weakens

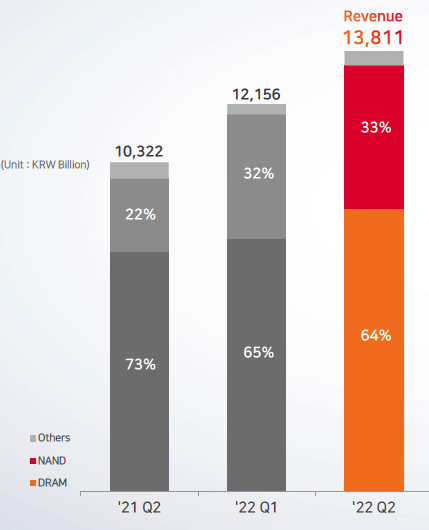

This is a Press Release edited by StorageNewsletter.com on July 29, 2022 at 2:02 pm| (in KRW or won billion) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 10,322 | 13,811 | 18,816 | 25,967 |

| Growth | 34% | 38% | ||

| Net income (loss) | 1,988 | 2,877 | 2,981 | 4,830 |

SK hynix Inc. reported revenue of 13.81 trillion won, operating profit of 4.19 trillion won (with operating margin of 30%), and net income of 2.88 trillion (with net income margin 21%) in 2FQ22.

The company achieved record high quarterly sales along with operating profits over 4 trillion won.

This is the first time that the company has posted revenue over 13 trillion won in a single quarter. Previously, the company’s highest quarterly revenues were 12.38 trillion won, recorded in 4FQ21.

“Although DRAM product prices fell during the second quarter, revenue increased as NAND prices rose and overall sales volume increased,” the company said. “Continued rise of the US dollar and the addition of Solidigm’s sales also worked as positive factors for the quarterly revenue.”

In addition, the company recovered an operating profit over 4 trillion won and an operating profit margin of 30% after 2 quarters following the 4FQ21. This is attributable to the improvement in profitability as the yield rate of the 1anm DRAM and 176-layer 4D NAND, has improved.

“It is meaningful to have achieved excellent business performance despite the difficult business environment such as global inflation, prolonged conflicts between Russia and Ukraine, and Covid-19 lockdown in certain regions of China,” the company added.

However, the firm predicted that memory demand would slow in 2H22. This is because shipments of PCs and smartphones that contain memory are expected to become lower than initially predicted. In addition, the demand for server memory supplied to data center customers is also likely to slow as customers will consume their inventories preferentially. However, the company expects that the memory demand for data centers will grow steadily in mid- to long-term.

Regarding the future business plan, SK hynix stated that it would carefully review next year’s investment plan while monitoring product inventory levels in 2H22.

“Although the uncertainty of the business environment has increased recently, we are confident in the long-term growth potential of the memory industry,” said Kevin (Jongwon) Noh, president and CMO. “We will focus on increasing fundamental business competitiveness while flexibly adapting to changes in the business environment.”

Comments

The huge DRAM and NAND Korean company continues to expand rapidly. Y/Y revenue is up 34% and 14% Q/Q for the most recent quarter at KRW 13.8 billion or $10.58 billion with excellent net income increasing 45% Y/Y. The former 3-month period was also remarkable with sales up yearly 43% and good profitability.

The firm was ranked ≠4 by Trendfocus in the WW SSD market in exabytes shipped in 1CQ22 with a 10.1% market share, behind Samsung (39.2%), WDC (11.6%) and Kioxia (10.2%).

Revenue by product

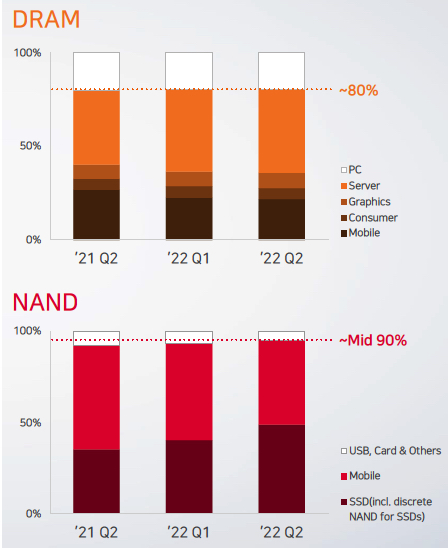

Revenue by application

Company plant

DRAM

- 1anm yield improvement and mix expansion

- DDR5/LPDDR5 sales portion increase and focus on increasing density

- Started volume production and sale of industry’s first developed HBM3

NAND

- 176L yield improvement and mix expansion

- 2Q22 eSSD revenue share 40%, further expansion through 2H22

Outlook for FY22

- DRAM demand B/G: Low teen percentage Y/Y

- NAND demand B/G: around +20% Y/Y

Server

- 1H22: Set build affected by component shortages, but healthy demand overall.

- 2H22: Customers are likely to digest inventory due to economic slowdown.

On-premise IT spending cuts by corporations may lead to higher use of cloud service, thus increasing Opex instead of Capex, potentially accelerating growth of cloud business and DC demand in the mid-long term.

PC and mobile

- Consumer applications are most directly affected by inflation/reduced purchasing power.

- Significant downward revision in unit demand is expected.

PC: Y/Y decline in PC shipment, but memory contents growth from higher share of high-end PCs (for example gaming) will offset the decline.

Mobile: Y/Y decline in smartphone shipment, especially due to weak demand for low/mid-end segment, but flagship demand expected to be solid with new product launched in 2H22.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter