Dropbox: Fiscal 4Q22 Financial Results

Dropbox: Fiscal 4Q22 Financial Results

Sales up 6% Y/Y and 1% Q/Q, net increasing

This is a Press Release edited by StorageNewsletter.com on February 20, 2023 at 2:02 pm| (in $ million) | 4Q21 | 4Q22 | FY21 | FY22 |

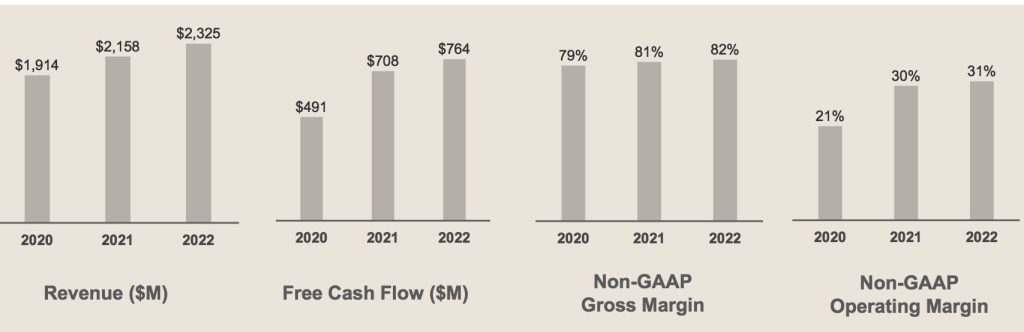

| Revenue | 565.5 | 598.8 | 2,158 | 2,325 |

| Growth | 6% | 8% | ||

| Net income (loss) | 124.6 | 328.3 | 335.8 | 533.2 |

Dropbox, Inc. announced financial results for its fourth quarter and fiscal year ended December 31, 2022.

“2022 was a solid year for Dropbox amidst a challenging macroeconomic environment,” said co-founder and CEO Drew Houston. “We increased our profitability and free cash flow and continued to use M&A as an engine for growth, welcoming FormSwift to Dropbox. Looking ahead to 2023, we remain focused on executing vs; our strategic objectives, improving our operational efficiency, and continuing to leverage advancements in AI and ML into our product roadmap as we work towards our mission of designing a more enlightened way of working.“

4FQ22 Results

• Total revenue was $598.8 million, an increase of 5.9% from 4FQ21. On a constant currency basis, yearly growth would have been 9.2%.

• Total ARR ended at $2.514 billion, an increase of $82.8 million Q/Q and an increase of 11.2% Y/Y. On a constant currency basis, Y/Y growth would have been 11.8%.

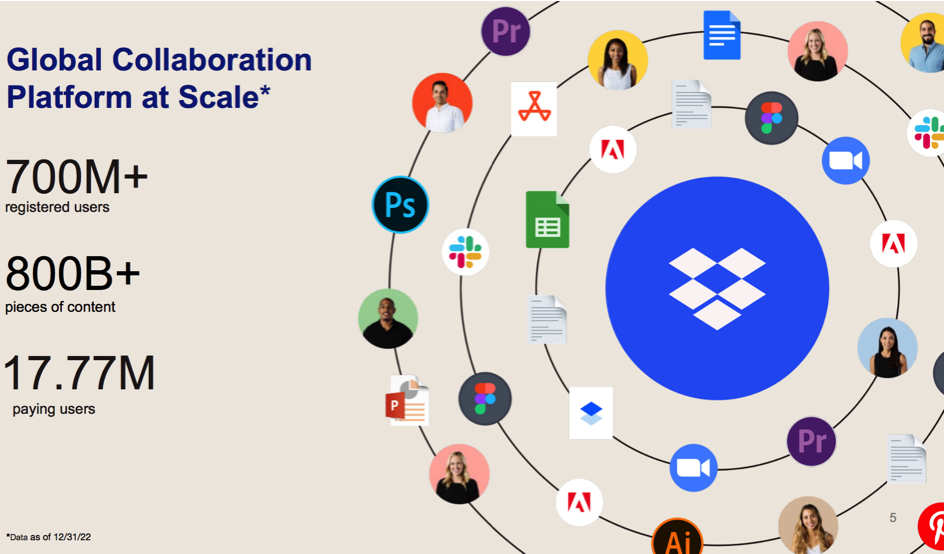

• Paying users ended at 17.77 million, as compared to 16.79 million for 4FQ21. Average revenue per paying user was $134.53, as compared to $134.78 for 4FQ21.

• GAAP gross margin was 80.7%, as compared to 79.5% in 4FQ21. Non-GAAP gross margin was 82.0%, as compared to 80.9% in 4FQ21.

• GAAP operating margin was (13.4%), as compared to 12.4% in 4FQ21. In 4FQ22, the company recorded impairment charges related to real estate assets of $162.5 million as a result of adverse changes in the corporate real estate market in the San Francisco Bay area, which has impacted its subleasing strategy in conjunction with its shift to Virtual First. In 4FQ21, it recorded impairment charges related to real estate assets of $14.0 million. Non-GAAP operating margin was 29.9%, as compared to 29.7% in 4FQ21.

• GAAP net income was $328.3 million, as compared to $124.6 million in 4FQ21 due to a one-time income tax benefit from the release of a valuation allowance of $420.2 million on the company’s U.S. federal and certain state deferred tax assets in 4FQ22, offset by the aforementioned impairment charge. In 4FQ21, the company released a valuation allowance of $38.1 million, resulting in a one-time income tax benefit on the firm’s Irish deferred tax assets. Non-GAAP net income was $141.2 million, as compared to $159.9 million in 4FQ21.

• Net cash provided by operating activities was $194.6 million, as compared to $162.7 million in 4FQ21. Free cash flow was $181.7 million, as compared to $161.4 million in 4FQ21. For 4FQ22, payments were made in the amount of $34.7 million related to deal consideration holdbacks pertaining to acquisitions, including $32.7 million of holdbacks paid to escrow related to 2 acquisitions completed within the quarter, including FormSwift.

• GAAP diluted net income per share attributable to common stockholders was $0.93, as compared to $0.32 in 4FQ21. Non-GAAP diluted net income per share attributable to common stockholders was $0.40, as compared to $0.41 in 4FQ21.

• Cash, cash equivalents and short-term investments ended at $1.343 billion.

FY22 Results

• Total revenue was $2.325 billion, an increase of 7.7% Y/Y. On a constant currency basis, Y/Y growth would have been 9.4%.

• Average revenue per paying user was $134.51, as compared to $133.73 in FY21.

• GAAP gross margin was 80.9%, as compared to 79.4% in FY21. Non-GAAP gross margin was 82.3%, as compared to 80.8% in FY21.

• GAAP operating margin was 7.8%, as compared to 12.7% in FY21. During FY22, the company recorded impairment charges related to real estate assets of $175.2 million as a result of adverse changes in the corporate real estate market in the San Francisco Bay area, which has impacted its subleasing strategy in conjunction with its shift to Virtual First, as well as an increase in common area fees for its San Francisco headquarters. During FY21, it recorded impairment charges related to real estate assets of $31.3 million. Non-GAAP operating margin was 30.9%, as compared to 30.0% in FY21.

• GAAP net income was $553.2 million, as compared to $335.8 million in FY21 due to a one-time income tax benefit from the release of a valuation allowance of $420.2 million on the company’s U.S. federal and certain state deferred tax assets in 4FQ22, offset by the aforementioned impairment charge. In 4FQ21, the company released a valuation allowance of $38.1 million, resulting in a one-time income tax benefit on the Company’s Irish deferred tax assets. Non-GAAP net income was $573.9 million, as compared to $609.3 million in FY21.

• Net cash provided by operating activities was $797.3 million as compared to $729.8 million in FY21. Free cash flow was $763.5 million as compared to $707.7 million in FY21. For FY22, payments were made in the amount of $49.0 million related to deal consideration holdbacks pertaining to acquisitions, including $32.7 million of holdbacks paid to escrow related to two acquisitions completed in 4FQ22, including FormSwift.

• GAAP diluted net income per share attributable to common stockholders was $1.52, as compared to $0.85 in FY21. Non-GAAP diluted net income per share attributable to common stockholders was $1.58, as compared to $1.54 in FY21.

FormSwift acquisition

This acquisition of a cloud-based service gives individuals and businesses a simple solution to create, complete, edit and save critical business forms and agreements, on December 15, 2022 for approximately $95 million, consisting primarily of cash payments, subject to customary purchase price adjustments. Of the approximately $95 million of consideration, $25.7 million is subject to ongoing employee service. The combination of Dropbox, Dropbox Sign, DocSend and FormSwift will help customers across industries manage end-to-end document workflows – from closing deals to onboarding teams – giving them more control over their business results.

Comments

The company expected last quarter revenue between $592 and $595 million, final figure being $598.8 million, up 6% Y/Y and 1% Q/Q, surpassing the Zacks Consensus Estimate by 0.84%. It has topped consensus revenue estimates 4 times over the last 4 quarters.

The company exited the quarter with 17.77 million paying users and added 230,000 net new paying users in 4FQ22, with over 200,000 of these paying users stemming from our acquisition of FormSwift.

Average revenue per paying user for 4FQ22 was $134.53, up slightly compared to 3FQ22.

For 1FQ23, the firm expects revenue to be in the range of $600 million to $603 million or up 7%.

For FY23, it expects revenue to be in the range of $2.475 billion to $2.490 billion, or up between 6% to 7%.

| Fiscal period |

Revenue in $ million |

Y/Y growth | Net loss in $ million |

| 2015 | 603.8 | NA | (352.9) |

| 2016 | 844.8 | 40% | (210.2) |

| 2017 | 1,107 | 13% | (111.7) |

| 2018 | 1,392 | 26% | (484.9) |

| 2019 |

1,661 | 19% | (52.7) |

| 2020 |

1,914 | 15% | (256.3) |

| 1Q21 |

511.6 | 12% | 47.6 |

| 2Q21 |

530.6 | 14% | 88.0 |

| 3Q21 |

550.2 | 13% | 75.6 |

| 4Q21 |

565.5 |

12% | 124.6 |

| FY21 |

2,158 | 13% | 335.8 |

| 1Q22 |

562.4 | 10% | 79.7 |

| 2Q22 |

572.7 | 8% | 62.0 |

| 3Q22 |

591.0 | 7% | 83.2 |

| 4Q22 |

598.8 | 6% | 328.3 |

| FY22 |

2,325 |

8% |

553.2 |

| 1Q23 (estim.) | 600-603 | 7% | NA |

| FY23 (estim.) |

2,475-2,490 |

6%-7% |

NA |

Earnings call transcript (subscription required)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter