Western Digital: Fiscal 2Q23 Financial Results

Hideous quarter like for Seagate, with revenue at $3.1 billion, down 17% Q/Q and 36% Y/Y, and net loss

This is a Press Release edited by StorageNewsletter.com on February 1, 2023 at 2:12 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 4,833 | 3,107 | 9,884 | 6,843 |

| Growth | -36% | -31% | ||

| Net income (loss) | 564 | (446) | 1,174 | (419) |

- Second quarter revenue was $3.11 billion, at the high end of the guidance range.

- 2FQ23 GAAP earnings per share (EPS) was $(1.40) and non-GAAP EPS was $(0.42), which includes $100 million of underutilization related charges in HDD.

- 2FQ23 GAAP operating loss was $321 million and non-GAAP operating loss was $119 million.

- Expect fiscal 2FQ23 revenue to be in the range of $2.60 billion to $2.80 billion.

- Expect non-GAAP EPS in the range of $(1.70) to $(1.40) which includes underutilization charges in flash and HDD totaling $250 million, with flash driven by a 30% reduction in wafer starts beginning in January.

Western Digital Corp. reported fiscal second quarter 2023 financial results.

“The Western Digital team delivered revenue at the high end of our guidance range, despite a challenging flash price environment and continued cloud inventory digestion,” said David Goeckeler, CEO. “We continue to take action to reset the business in response to the post-pandemic environment by optimizing our cost structure and strengthening our liquidity. These actions, including strategically reducing our capital expenditures across both flash and HDD and our operating expenses, as well as amending our financial covenants and securing recent financings, will give us the financial flexibility and optionality to weather this cycle, while also positioning us to continue executing our product roadmap and furthering our technical leadership over the long term.”

The company generated $35 million in cash flow from operations and ended the quarter with $1.87 billion of total cash and cash equivalents.

In 2FQ23:

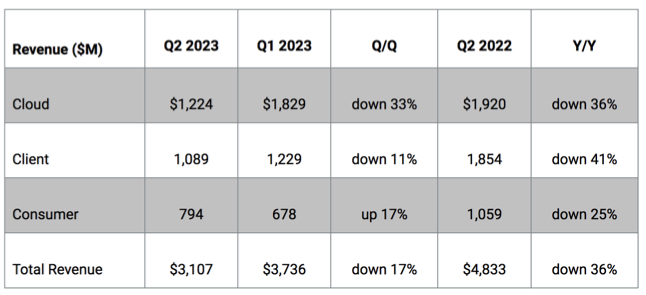

Cloud represented 39% of total revenue. Sequentially, declines in both capacity enterprise drives sold to cloud customers and smart video customers were partly offset by an increase in flash shipments. The Y/Y decline was primarily due to inventory digestion in HDDs.

Client represented 35% of total revenue. Sequentially, the decline was driven by pricing pressure across flash products, which was partly offset by an increase in HDD shipments. The Y/Y decline was also due to pricing pressure in flash as well as lower client SSD shipments for PC applications.

Consumer represented 26% of revenue. Sequentially, the increase was driven by a seasonal uptick in both retail HDDs and flash. The Y/Y decline was driven by lower retail HDD shipments and pricing pressure in flash.

Outlook for 3FQ23

Revenue between $2.60 and $2.80 billion

Comments

The company delivered revenue at the high end of the guidance range provided in October ($2.90 billion to $3.10 billion). Total revenue for the quarter was $3.1 billion, down 17% Q/Q and 36% Y/Y. Non-GAAP loss per hare was $0.42. Looking at end markets, cloud represented 39% of revenue at $1.2 billion, down 33% sequentially and 36% Y/Y.

Revenue trends by end market

Flash

- Flash revenue was $1.7 billion, down 4% Q/Q and 37% Y/Y. Sequentially, flash ASPs were down 20% on a blended basis and 13% on a like-for-like basis. Flash bit shipments increased 20% sequentially and remained approximately flat Y/Y.

- Bit shipments increased 20% Q/Q exceeding forecast

- ASP/Gigabyte: Blended: decreased 20% Q/Q; like-for-like: decreased 13% Q/Q

- Reduced wafer starts by 30% beginning in January.

- BiCS5 represented 70% of flash revenue in 2FQ23. BiCS6 to reach cost crossover in 3FQ23.

- BiCS8, the next gen 3D-NAND node, has entered productization phase.

- Premium brands, including SanDisk, SanDisk Professional, and WD_BLACK continued to deliver strong share and profitability to support the business. WD_BLACK client SSD, which is optimized for gaming continues to be well-received in the marketplace. It achieved a record exabyte shipments, unit shipments, and average capacity per drive resulting in exabyte shipment increase of 73% Q/Q and 41% Y/Y for this product.

- BiCS8 incorporates several 3D NAND architectural innovations to deliver a leap in performance and cost-effective solutions to a range of exciting , demonstrating the benefits of firm's partnership with Kioxia

HDD

- Revenue of $1.5 billion down 28% sequentially and 34% Y/Y. Total HDD exabyte shipments decreased 35% Q/Q and ASP per hard drive decreased 21% to $99.

- On a Y/Y basis, total HDD exabyte shipments decreased 33%, and ASP price per unit, at $99, increased 2%.

- Completed qualifications and commenced shipments of latest gen 22TB CMR HDDs at multiple cloud and major OEM customers.

- Aggressively ramping 22TB CMR product and expect this drive along with its SMR variants to be growth engine going forward.

- During 2FQ23, WD consolidated production lines across its manufacturing facilities and idled certain media production lines in Asia, reducing client HDD capacity by approximately 40%.

- In cloud, it experienced a decline in nearline shipments as customers were undergoing inventory digestion and ongoing subdued China demand.

- During 2FQ23, HDD revenue declined significantly as cloud inventory digestion intensified, while demand for retail and client HDD improved.

- Qualifications of our 26TB UltraSMR drives are also progressing. Major customers remain committed to adopting SMR drives as the 20% capacity gain that UltraSMR drives over CMR offer multi-gen TCO benefits to the most complex data centers.

For 3FQ23, revenue is expected between $2.60 and $2.80 billion between -16% to -10%.

In HDDs, overall demand in cloud has stabilized, and the manufacturer expects modest improvement in nearline to offset a seasonal decline in client and consumer HDDs. It expects stronger improvements in the second half of this calendar year, led by the ramp of our 22 and 26TB HDDs. In flash, it expects enterprise SSD product demand for 3FQ23 to be sharply reduced as certain large cloud customers have entered a digestion period. In addition, a reduction in commercial PC demand is expected to impact client SSD shipments in the near term.

In HDD, the vendor expects revenue to increase modestly in 3FQ23 as growth in nearline shipments outpaces decline in consumer. In flash, it expects both shipments and ASP to decrease sequentially.

Initial estimate is for flash demand bit growth to be in the low 20% range with production bit growth to be well below that of demand.

HDD and flash revenue

| in $ million | 1FQ21 | 2FQ21 | 3FQ21 |

4FQ21 |

1FQ22 |

2FQ22 |

3FQ22 |

4FQ22 |

1FQ23 |

2FQ23 |

1FQ23/2FQ23 growth |

| HDDs |

1,844 | 1,909 | 1,962 | 2,501 | 2,561 | 2,213 |

2,138 |

2,128 |

2,014 |

1,657 |

-18% |

| Flash |

2,078 | 2,034 | 2,175 | 2,419 | 2,490 | 2,620 |

2,243 |

2,400 |

1,722 |

1,450 |

-16% |

By business, and HDD

| Client revenue (1) |

Cloud revenue (1) |

Consumer revenue (1) |

Total HDDs (2) |

HDD ASP |

|

| 1FQ21 |

1,750 | 1,291 | 881 | 23.0 |

$79 |

| 2FQ21 |

1,869 | 1,014 | 1,060 | 25.7 |

$73 |

| 3FQ21 |

1,767 | 1,423 | 947 | 23.2 |

$82 |

| 4FQ21 |

1,895 | 1,995 | 1,030 | 25.4 |

$97 |

| 1FQ22 |

1,853 | 2,225 | 973 | 24.1 |

$102 |

| 2FQ22 |

1,854 | 1,920 | 1,059 | 21.6 |

$97 |

| 3FQ22 |

1,732 | 1,774 | 875 | 19.8 |

$101 |

| 4FQ22 |

1,637 | 2,098 | 793 | 16.5 |

$120 |

| 1FQ23 |

1,229 | 1,829 | 678 | 14.7 | $125 |

| 2FQ23 |

1,089 | 1,224 | 794 | 12.9 | $99 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter