Western Digital: Fiscal 1Q23 Financial Results

Western Digital: Fiscal 1Q23 Financial Results

Revenue down 17% Q/Q and 26% Y/Y as HDD and especially flash sales sharply declining

This is a Press Release edited by StorageNewsletter.com on October 28, 2022 at 2:02 pm| (in $ million) | 1Q22 | 1Q23 | Growth |

| Revenue |

5,051 | 3,736 | -26% |

| Net income (loss) | 610 | 27 |

Western Digital Corp. reported fiscal 1FQ23 financial results.

“I am pleased to see the Western Digital team work together to deliver revenue at the upper half of the guidance range and operating income at the upper half as implied by the midpoints of our guidance, in the midst of an incredibly dynamic and challenging macroeconomic environment,” said David Goeckeler, CEO. “Overall, the organizational and portfolio improvements we have made over the past few years have equipped us to effectively manage through this consumer-led downturn, which is showing signs of stabilization. As we remain focused on innovation and execution, I am optimistic that Western Digital will emerge stronger as we continue to ramp multiple new products into data centers worldwide and market conditions improve.“

In 1FQ23:

- •Cloud represented 49% of total revenue. Sequentially, continued momentum in capacity enterprise drives sold to US cloud customers and an increase in smart video HDDs demand partly offset the decline in all other HDD product channels and flash. The Y/Y decrease was due to broad-based decline across both HDD and flash products.

- Client represented 33% of total revenue. Sequentially, the decline was attributed to flash, driven by inventory reduction at PC OEMs and lower pricing. The Y/Y decrease resulted primarily from reduced flash pricing.

- •Consumer represented 18% of revenue. On both a sequential and Y/Y basis, the revenue decline was due to flash pricing and lower retail HDD shipments.

Outlook

Company expects 2FQ23 revenue to be in the range of $2.90 billion to $3.10 billion with Non-GAAP EPS in the range of $(0.25) to $0.05.

Comments

As competitor Seagate more recently, WD recorded an ugly 1FQ23.

First quarter revenue is $3.74 billion, at top of guidance ($3,600-$3,800 million) expected last quarter, with tiny net income ($27 million). For 4FQ22, it was $4,528 million, -8% Y/Y, with net income of $301 million.

1FQ23 sales are down 17% Q/Q and 26% Y/Y as HDD and especially flash sales sharply decline.

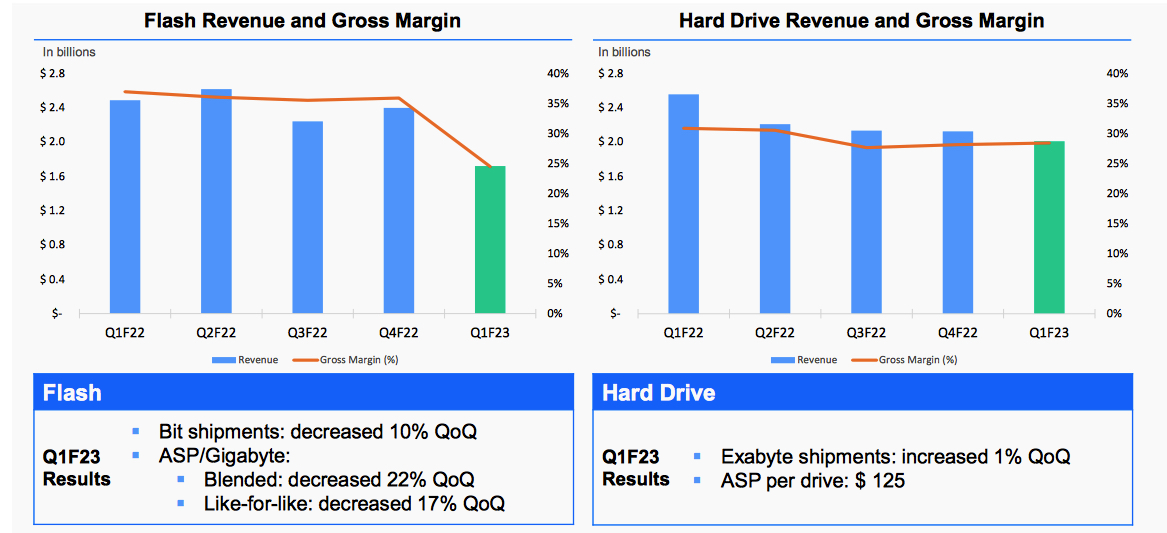

Flash and HDD metrics

Click to enlarge

HDD

During 1FQ23, HDD revenue declined modestly as forecasted in August. Sequentially, total HDD and nearline exabyte shipments were both flat. Continued momentum with US cloud customers and accelerated adoption of SMR HDDs were offset by softness in other capacity enterprise product channels and consumer HDD demand. Shipment of capacity enterprise drives based on SMR technologies exceeded 25% of this category, one quarter ahead of company's expectations. The vendor now expect SMR to represent over 40% of capacity enterprise exabyte shipment exiting FY23.

WD reported HDD revenue of $2 billion, down 5% sequentially and 21% Y/Y. Compared to the prior quarter, total HDD exabyte shipments increased by 1% and average price per HDD increased by 4% to $125. On a Y/Y basis, total HDD exabyte shipments decreased by 12% and average price per unit increased by 23%.

SMR adoption drove a 19% Q/Q and 21% Y/Y increase in average capacity to 17TB per capacity enterprise drive, and 20TB drive exabyte shipments increased more than 150% Q/Q. The firm is deep into the process of qualifying its latest generation of HDDs, including 26TB UltraSMR units at multiple US cloud and OEM customers.

Sequentially, nearline bit shipments were flat at 112EB, driven by success in transition to SMR HDDs.

On the manufacturing front, it has sharply reduced client HDD production capacity by approximately 40%.

SSD

Average capacity per client SSD increased 24% Q/Q and 54% Y/Y, driven by doubling of standard storage capacity for PCs sold by multiple OEMs.

Flash

On the technology front, BiCS5 accelerated to over two thirds of firm's flash revenue in the September quarter, up from about half in the previous quarter.

Flash revenue was $1.7 billion, down 28% Q/Q and 31% Y/Y. Sequentially, flash ASPs were down 22% on a blended basis and 17% on a like-for-like basis. Flash bit shipments decreased 10% Q/Q and 7% Y/Y.

Cloud

Looking at end markets, cloud represented 49% of revenue at $1.8 billion, down 13% Q/Q and 18% Y/Y. Compared to the prior quarter, continued momentum in capacity enterprise drives sold to US cloud customers and an increase in smart video HDD demand.

Clients

Clients represented 33% of total revenue at $1.2 billion, down 25% Q/Q and 34% Y/Y. Sequentially, the decline was attributed to flash driven by inventory reduction at PC OEMs and lower pricing. The Y/Y decline resulted primarily from the reduced flash pricing.

Consumer

It represented 18% of revenue at $0.7 billion, down 15% Q/Q and 30% Y/Y. On both Q/Q and Y/Y basis, the revenue decline was due to flash pricing and lower retail HDD shipments.

Outlook

The manufacturer expects 2FQ23 revenue to be in the range of $2.90 billion to $3.10 billion, once more a big decline, -17% to -22%.

In flash, the vendor expects shipments to increase sequentially in 2FQ23 and the balance of the FY23 as the market stabilizes. In HDD, it expects revenue to recover as its US cloud customers reduced their inventories over the next 2 quarters.

HDD and flash revenue

| in $ million | 1FQ21 | 2FQ21 | 3FQ21 |

4FQ21 |

1FQ22 |

2FQ22 |

3FQ22 |

4FQ22 |

1FQ23 |

4FQ22/1FQ23 growth |

| HDDs |

1,844 | 1,909 | 1,962 | 2,501 | 2,561 | 2,213 |

2,138 |

2,128 |

2,014 |

-5% |

| Flash |

2,078 | 2,034 | 2,175 | 2,419 | 2,490 | 2,620 |

2,243 |

2,400 |

1,722 |

-28% |

By business, and HDD

| Client revenue (1) |

Cloud revenue (1) |

Consumer revenue (1) |

Total HDDs (2) |

HDD ASP |

|

| 1FQ21 |

1,750 | 1,291 | 881 | 23.0 |

$79 |

| 2FQ21 |

1,869 | 1,014 | 1,060 | 25.7 |

$73 |

| 3FQ21 |

1,767 | 1,423 | 947 | 23.2 |

$82 |

| 4FQ21 |

1,895 | 1,995 | 1,030 | 25.4 |

$97 |

| 1FQ22 |

1,853 | 2,225 | 973 | 24.1 |

$102 |

| 2FQ22 |

1,854 | 1,920 | 1,059 | 21.6 |

$97 |

| 3FQ22 |

1,732 | 1,774 | 875 | 19.8 |

$101 |

| 4FQ22 |

1,637 | 2,098 | 793 | 16.5 |

$120 |

| 1FQ23 |

1,229 | 1,829 | 678 | 14.7 | $125 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter