Phison: Fiscal 3Q22 Financial Results

Phison: Fiscal 3Q22 Financial Results

Revenue at NT$14.6 billion, down -13% from 3FQ21

This is a Press Release edited by StorageNewsletter.com on November 8, 2022 at 2:02 pmPhison Electronics Corp. announced its consolidated financial results for 3FQ22 and the operating results for October.

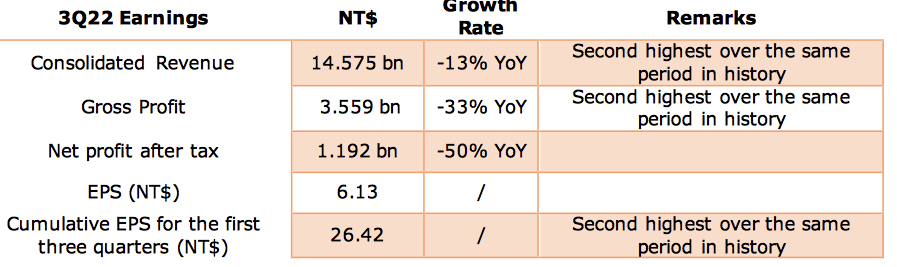

Consolidated revenue in 3FQ22 was NT$14.575 billion, down 13% compared to 3FQ21, and the cumulative revenue for the year reached NT$47.966 billion, an increase of 5% compared with the same period last year, a record high for the same period in history; the gross profit in 3FQ22 was NT$3.559 billion, and the cumulative gross profit for the year was NT$13.901 billion, with an annual growth rate down 3%, the second highest in history. In addition, the gross profit margin in 3FQ22 was 24.42% (the cumulative gross profit margin in the first three quarters reached 28.98%, the second highest in history), the net profit after tax was NT$1.192 billion, and the EPS was NT$6.13.

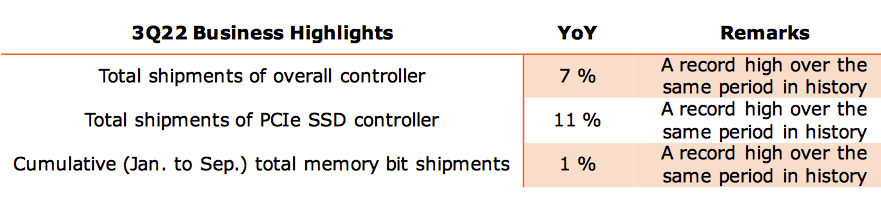

Compared with 3FQ21, the overall controller shipments in 3FQ22 increased by nearly 7%, of which the total PCIe SSD controller shipments increased by nearly 11%; in addition, the total shipments of memory bits (total bits) accumulated to the third quarter of the year increased by nearly 1%, all hitting a record high for the same period.

K.S.Pua, CEO, said that the loss of inventory prices caused by the slowdown in market demand has 3FQ22 gross profit margin by about 5%, which is a short-term effect. In other words, in the long run, Phison’s financial health and profitability are still relatively stable.

CEO went on to explain that, despite the current economic downturn, his company has continued to make gains in the field of design services, including applications such as servers, automotive systems, PCs, and mobile phones, and has received various customized projects.

Furthermore, the manufacturer continues to help customers around the world through its NAND controller and storage development resource sharing platform to build storage solutions for various storage applications, and at the same time continue to expand the market share of controller ICs and NAND storage modules, and eventually expand the scale of revenue.

CEO emphasized that it is a fact that market conditions are not good, but his firm is pursuing long-term stable development and profitability, and no matter how bad the market is, it will eventually pass; in other words, the R&D investment required for various customized design service demands of customers may have an impact on short-term benefits, but in the long run, it will help to enhance the added value and customer satisfaction to customers. This will further stabilize the foundation of long-term revenue and profitability, which will also be the main axis and growth momentum of future development.

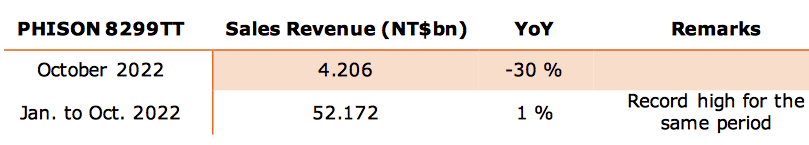

Phison also at the same time announced the operating results for October 2022, with consolidated revenue of NT$4.206 billion, an annual growth rate down 30% Y/Y. The annual cumulative revenue to October reached NT$52.172 billion, an annual growth of nearly 1% Y/Y, a new high for the same period.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter