Western Digital: Fiscal 4Q22 Financial Results

Western Digital: Fiscal 4Q22 Financial Results

Revenue down 8% Q/Q and horrible outlook for 1FQ23 with sales decreasing between 16% and 20% Q/Q

This is a Press Release edited by StorageNewsletter.com on August 8, 2022 at 2:04 pm| (in $ million) | 4Q21 | 4Q22 | FY21 | FY22 |

| Revenue | 4,920 | 4,528 | 16,922 | 18,783 |

| Growth | -8% | 11% | ||

| Net income (loss) | 622 | 301 | 821 | 1,500 |

Summary

- 4FQ22 revenue was $4.53 billion, down 8% Y/Y. Cloud revenue increased 5%, client revenue declined 14%, and consumer revenue declined 23% Y/Y. FY22 revenue was $18.79 billion, up 11% Y/Y.

- 4FQ22 GAAP earnings per share (EPS) was $0.95 and non-GAAP EPS was $1.78. FY22 GAAP EPS was $4.75 and non-GAAP EPS was $8.22.

- Generated operating cash flow of $295 million and free cash flow of $(97) million in 4FQ22. Generated operating cash flow of $1.88 billion and free cash flow of $0.68 billion in FY22.

- Expect 1FQ23 revenue to be in the range of $3.60 billion to $3.80 billion with non-GAAP EPS in the range of $0.35 to $0.65.

Western Digital Corp. reported fiscal fourth quarter and fiscal year 2022 financial results.

“I am proud of our team for driving strong FY22 performance, during which revenue grew 11% and non-GAAP EPS increased 81%, demonstrating progress in unlocking the earnings potential of our business,” said David Goeckeler, CEO. “In addition to strong financial performance, FY22 was a hallmark year for Western Digital from an innovation, product development and execution perspective. The combination of our innovation engine and the multiple channels to deliver our products to the market puts Western Digital in a great position to capitalize on the large and growing opportunities in storage ahead even in the midst of macro dynamics weighing on near-term demand.”

In 4FQ22:

- Cloud represented 46% of total revenue. Within cloud, the continued ramp of 18TB and 20TBe HDDs drove a 7% Y/Y increase in nearline HDD revenue. In flash, enterprise SSD revenue more than doubled sequentially and was up 38% Y/Y.

- Client represented 36% of total revenue. On both a sequential and Y/Y basis, client HDD led the revenue decline while flash was roughly flat.

- Consumer represented 18% of revenue. On a sequential basis, the revenue decline was primarily due to lower retail HDD shipments. The Y/Y decrease was due to broad-based decline in retail products across HDD and flash.

In FY22:

- Cloud represented 42% of total revenue. The revenue increase was led by a 38% increase in nearline HDD while flash products for enterprise SSD applications more than doubled.

- Client represented 38% of total revenue. Revenue declined modestly as growth in flash was offset by a mid-30% decrease in client HDD.

- Consumer represented 20% of total revenue. The revenue decline was all attributed to retail HDD.

Outlook for 1FQ23:

Revenue between $3.60-$3.80 billion

Comments

The most notable figure released for this quarter is the extremely bad outlook for next 3-month period: revenue between $3,600-$3,800 million or a quarterly decrease between 16% and 20% Q/Q. The firm expects flash to lead the sequential revenue decline as customer's rightsize their inventory. It also expect a relatively modest decline in overall HDD revenue, primarily driven by client and consumer, with gross margin relatively flat.

WDC reported 4FQ22 revenue of $4.528 million, up 3% Q/Q and down 8% Y/Y, non-GAAP gross margin of 32%, and non-GAAP earnings per share of $1.78, all within the guidance ranges provided last April.

Revenue trends by end market

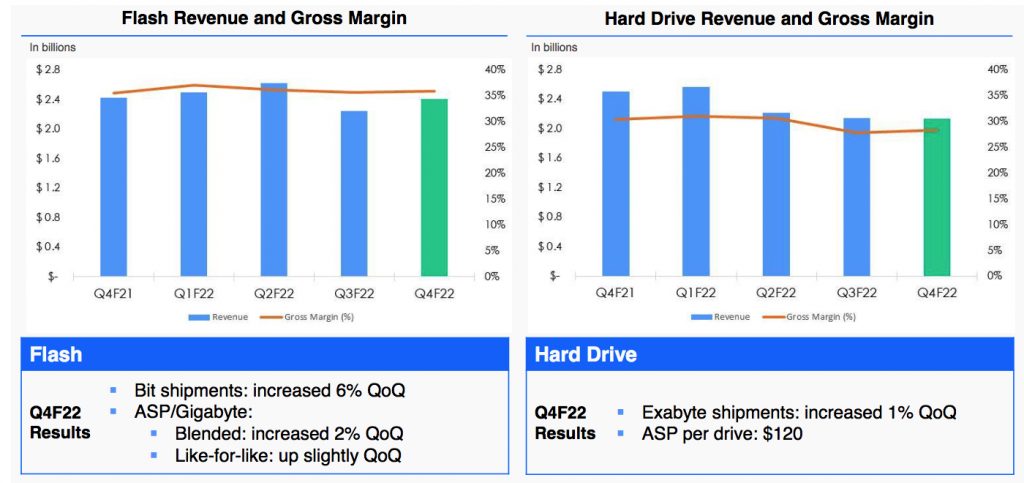

Flash and HDD metrics

Flash

• In 4FQ22 flash revenue of $2.4 billion was up 7% Q/Q and down 1% Y/Y.

• Enterprise SSD revenue more than doubled sequentially in 4FQ22 and for FY22.

• Gaming exabyte shipment grew nearly 70% Y/Y. WD_BLACK SSD certified for Sony PS5 game consoles.

• BiCS5 represented approximately half of flash revenue, and the company is preparing to ramp BiCS6 late this calendar year and into 2023.

• Bit shipments: increased 6% Q/Q and 11% Y/Y.

• ASP/GB:

-

- Blended: increased 2% Q/Q

- Like-for-like: up slightly Q/Q

HDDs

• On a Y/Y basis, total HDD exabyte shipments decreased by 10%.

• HDD revenue declined sequentially due primarily to consumer and client HDD demand.

• Strong demand from cloud customers for latest gen energy assisted drives drove a near record nearline shipment of 111EB.

• Shipping 22TB CMR drives, and qualification of 26TB SMR drive is underway.

• Confident in multi-year product roadmap of capacity enterprise drives, which combine ePMR, OptiNAND, UltraSMR and triple stage actuators to deliver a portfolio of drives, in commercial volumes, at a variety of capacity points.

• Exabyte shipments: increased 1% Q/Q

• ASP per drive: $120 increased by 24% Y/Y

The client end market represented 36% of total revenue at 1.6 billion, down 5% Q/Q and 14% Y/TY On both a quarterly and yearly basis, client HDD led the revenue decline, while flash revenue was roughly flat. Consumer represented 18% of revenue at $0.8 billion, down 9% Q/Q and 23% Y/Y. On a sequential basis, the revenue decline was primarily due to lower HDD retail shipments.

The Y/Y decrease was due to broad-based decline in retail products across HDD and flash. For FY22, cloud revenue increased 40% Y/Y, led by a 38% increase in nearline HDD. Flash product revenue for enterprise SSD applications more than doubled Y/Y. Client revenue decreased 3% Y/Y as growth in flash was offset by a 30% decrease in client HDD.

Client HDD for PCs and notebooks represents just mid-single-digit percentage of total HDD revenue exiting the fiscal year. Lastly, consumer revenue decreased 6% for the year, all attributed to a decline in retail HDD.

HDD and flash revenue

| in $ million | 1FQ21 | 2FQ21 | 3FQ21 |

4FQ21 |

1FQ22 |

2FQ22 |

3FQ22 |

4FQ22 |

3FQ21/4FQ22 growth |

| HDDs |

1,844 | 1,909 | 1,962 | 2,501 | 2,561 | 2,213 |

2,138 |

2,128 |

-1% |

| Flash |

2,078 | 2,034 | 2,175 | 2,419 | 2,490 | 2,620 |

2,243 |

2,400 |

7% |

By business, and HDD

| Client revenue (1) |

Cloud revenue (1) |

Consumer revenue (1) |

Total HDDs (2) |

HDD ASP |

|

| 1FQ21 |

1,750 | 1,291 | 881 | 23.0 |

$79 |

| 2FQ21 |

1,869 | 1,014 | 1,060 | 25.7 |

$73 |

| 3FQ21 |

1,767 | 1,423 | 947 | 23.2 |

$82 |

| 4FQ21 |

1,895 | 1,995 | 1,030 | 25.4 |

$97 |

| 1FQ22 |

1,853 | 2,225 | 973 | 24.1 |

$102 |

| 2FQ22 |

1,854 | 1,920 | 1,059 | 21.6 |

$97 |

| 3FQ22 |

1,732 | 1,774 | 875 | 19.8 |

$101 |

| 4FQ22 |

1,637 | 2,098 | 793 | 16.5 |

$120 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter