OpenText to Acquire Micro Focus International

For $6 billion

This is a Press Release edited by StorageNewsletter.com on August 30, 2022 at 2:02 pmOpenText Corp. reached agreement on the terms of a recommended all-cash offer to be made by OpenText Corporation, through its wholly-owned subsidiary, OpenText UK Holding Limited (Bidco), to acquire the entire issued and to be issued share capital of Micro Focus International plc and at a price of 532 pence per share, implying an enterprise value of approximately $6.0 billion on a fully diluted basis.

![]()

Micro Focus is a large software company serving thousands of organizations, including many of the largest companies in the Fortune Global 500 and had approximately $2.7 billion pro forma trailing 12 months revenue for the period ended April 30, 2022.

“We are pleased to announce our firm intention to acquire Micro Focus, and I look forward to welcoming Micro Focus customers, partners and employees to OpenText,” said OpenText CEO and CTO Mark J. Barrenechea. “Upon completion of the acquisition, OpenText will be one of the world’s largest software and cloud businesses with a tremendous marquee customer base, global scale and comprehensive go-to-market. Customers of OpenText and Micro Focus will benefit from a partner that can even more effectively help them accelerate their digital transformation efforts by unlocking the full value of their information assets and core systems.”

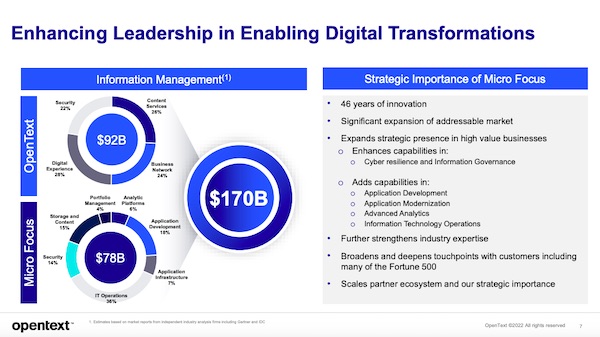

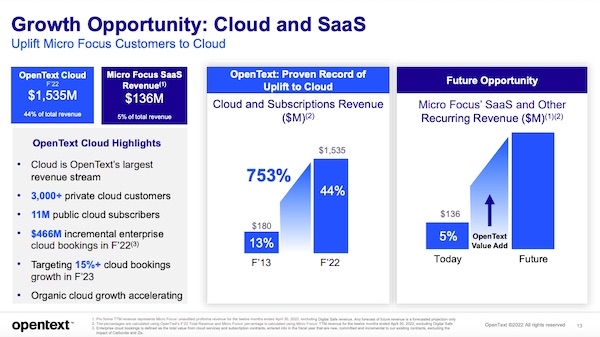

He added: “Micro Focus brings meaningful revenue and operating scale to OpenText, with a combined TAM of $170 billion. With this scale, we believe we have significant growth opportunities and ability to create upper quartile adjusted EBITDA and free cash flows. We expect Micro Focus to be immediately accretive to our adjusted EBITDA. Micro Focus will benefit from the OpenText Business System to create stronger operations and significant cash flows, and Micro Focus customers will benefit from the OpenText Private and Public Clouds.”

OpenText values Micro Focus’ brands and culture and attaches importance to the skill and experience of Micro Focus’ management team and employees.

“We intend to fund the all-cash acquisition with existing cash, new debt and our existing revolving credit facility. OpenText does not contemplate raising any equity to fund the acquisition. We are committed to providing investors with enhanced visibility into our high-value business areas, delivering a net leverage ratio of below 3x over 8 quarters and continuing our dividend program, and we expect to have Micro Focus on our operating model within 6 quarters of closing the transaction,” Barrenechea concluded.

About the Terms of the Acquisition (all figures approximate)

- Total purchase price of $6.0 billion, inclusive of Micro Focus’ cash and debt

- Total purchase price is 2.2x Micro Focus’ pro forma revenues

- Total purchase price is 6.3x Micro Focus’ pro forma adjusted EBITDA

- Expected cost synergies of $400 million, including Micro Focus’ previously announced cost savings program of $300 million (net of inflation), as well as $100 million in additional cost synergies

- Targeting to be on the OpenText operating model within 6 quarters of closing

- Expect meaningful expansion of cloud revenues, adjusted EBITDA and cash flows in FY24

- All-cash consideration for the acquisition to be funded by $4.6 billion in new debt, $1.3 billion in cash, and a $600 million draw on our existing revolving credit facility

- The acquisition is expected to close in 1CQ23, subject to the satisfaction (or, where applicable, waiver) of the conditions set out in Appendix 1 to the announcement.

Barclays Bank PLC, BMO Capital Markets Corp., Royal Bank of Canada and Citigroup Global Markets Inc. are acting as lead arrangers on the financing to OpenText.

Barclays Bank PLC is serving as sole financial advisor to OpenText. Allen & Overy LLP and Cleary Gottlieb Steen & Hamilton LLP are acting as legal advisors to OpenText.

Comments

This acquisition marks a significant event in the enterprise software segment boosting OpenText in the top WW ISVs with Microsoft, Oracle, SAP, Salesforce, Adobe, VMware, Intuit, ServiceNow, Autodesk, Citrix, Splunk, NortonLifeLock, Workday, and we can add IBM, even Red Hat or some verticals ones like Amdocs, Fiserv or ADP.

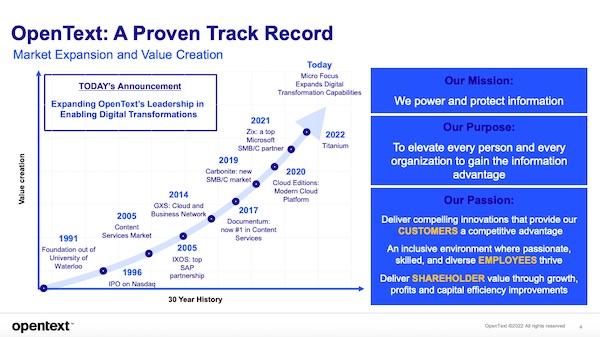

It confirms the ambition of Mark Barrenechea, CEO and CTO of OpenText, wishing to build for many years a large ISV. Always looking for external growth, his company clearly illustrates its desire to accelerate the race to reach a significant revenue and company size. And there is no reason that this quest will stop. We also remember past M&A operations driven by Barrenechea with SGI and Rackable Systems, and before his role at CA.

From a data management and storage perspective, OpenText acquired some strategic products to deliver what they call information management. Barrenechea's vision towards cloud and SaaS is perfectly fed here. They even justify this move with the aggregated total addressable market of $170 billion with 3.5% market share for the new OpenText. Considering products revenue it also is very relevant to mention customer support and maintenance revenue for the future union. The potential is real with even more aggressive battles among ISVs and cloud service providers coming from all the planet. What is sure is the natural cross and up-sell capabilities strengthening OpenText's presence within end-users, partners and channels environments. This is definitely a huge operation that will trigger some special reactions from the competition, OpenText becoming time after time a serious player in town.

On the financial side, it's worth to notice that the deal is a full cash deal without any equity in the balance. OpenText funds this $6 billion acquisition with its cash line, new debt and credit facility meaning also that Barrenechea has some other ideas in mind.

Such moves always invite observers to ask questions about the culture and potential divergence of strategy even if we see strong brands and product lines. Acquisitions after acquisitions, the company grows and the original spirit tends to be naturally diluted.

We wish to dig a bit in the product portfolio as several of these products came from HP like ArcSight, Data Protector (named for a long time OmniBack), Fortify and of course Mercury Interactive and Autonomy among others.

Autonomy was an epic story. On the Micro Focus web site we list 296 products that reminds us past vendors like CA or Platinum. Micro Focus itself has made several operations to acquire products and technologies but the main event was the HP software deal in 2017 for $8.8 billion that immediately transformed the company as a significant player.

On the pure OpenText side, the team has already integrated the cloud and SaaS needs with the acquisition of Carbonite in 2019 for $1.42 billion (included cash and debt) that included Webroot and Mozy, Zix in 2021 that brings indirectly CloudAlly, a cloud backup company, acquired in 2020 for $30 million, Hightail in 2018, Recommind in 2016 and a major one with EMC Enterprise Content Division with Documentum in 2016 for $1.6 billion approximately.

This move invites us to say a few words on HP then HPE strategy finally ignoring this software market angle or unable to manage and develop it strongly. It's true that it requires special DNA. With the importance of data, the explosion of volume for 2 decades, the multiplication of sources and individuals capabilities to generate content, this is a surprise or it is not, depending how you watch the market and companies trajectories. These needs are big trends that justify the launch of new actors and we all have plenty in mind. What did HP with Polyserve and Ibrix, ArcSight or Omniback and other acquisitions? They disappeared or all gone in the Micro Focus deal. It's true also to mention that HP then HPE managed carefully hardware oriented storage such Nimble Storage and other key assets like Cray and SGI in some ways. We're still surprised how HPE managed file storage, following our comments on Ibrix and Polyserve above, it received in the Cray basket some Lustre expertise, SGI with XFS/CXFS and they also signed with Weka and even IBM for Spectrum Scale. It confirms what we saw in the past for object storage with several offerings available on the Apollo platform, promoting the hardware whatever is the software as soon as users pick HPE. On the object storage part, HPE is still naked, distributing partners' solutions.

Back to OpenText with a clear ambition on the information management front with cloud and SaaS models, we wonder is SDS could be a software asset to add. It could be, and could clearly represent a serious exit for some file and object storage vendors having difficulties to find "their second wave". This OpenText move clearly shakes the market and gives all of us new reasons to observe the market in the coming quarters.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter