Carbonite Definitively Acquired by OpenText for $1.42 Billion

Nice acquisition in data protection and end-point security

This is a Press Release edited by StorageNewsletter.com on November 12, 2019 at 3:14 pmPress release from OpenText:

OpenText Corp. entered into a definitive agreement to acquire Carbonite, Inc., provider of cloud-based subscription data protection, backup, DR and end-point security to small and medium-sized businesses and consumers.

“Cloud platforms and secured, smart end-points are essential Information Management technologies as businesses transform into Industry 4.0,” said Mark J. Barrenechea, OpenText CEO and CTO. “This acquisition will further strengthen OpenText as a leader in cloud platforms, complete end-point security and protection, and will open a new route to connect with customers, through Carbonite’s marquee SMB/prosumer channel and products. We are very excited about the opportunities that Carbonite will bring, and I look forward to welcoming our new customers, partners and employees to OpenText.“

“We entered FY20 with a solid balance sheet and we are off to a strong start with the announced acquisition of Carbonite as part of our total growth strategy,” added OpenText EVP and CFO, Madhu Ranganathan. “We are excited by the opportunity to bring forth exceptional leadership in operational execution and integration capabilities to Carbonite. Once integrated, we expect to increase our annual recurring revenues, deliver strong cloud growth, and expand cloud margins and adjusted EBITDA. The resulting growth in cash flows will enable us to maintain a healthy balance sheet, deliver strong earnings, and continue to deliver consistent growth in dividends to shareholders.”

The acquisition of is expected to extend OpenText’s leadership in the Enterprise Information Management (EIM) market by complementing its security offerings in data loss prevention, digital forensics, end-point detection and response with the addition of Carbonite’s data protection and end-point security solutions. The acquisition also adds to OpenText’s cloud business and further complements its routes to market, enterprise customer base in the Global10K, enhanced SMB and prosumer markets.

About Transaction and Terms of the Agreement:

• Tender offer to be commenced for all outstanding Carbonite shares for $23.00 per share in cash

• Total purchase price of approximately $1.42 billion, inclusive of cash and debt

• Total purchase price is approximately 2.8x T(Trailing Twelve Months) Carbonite GAAP revenues (as of September 30, 2019), inclusive of annualized full year reported Webroot GAAP revenues, an acquisition which closed in March 2019

• Expect significant expansion of cloud revenues, cloud margins, adjusted EBITDA and cash flows in FY21

• Current Carbonite Annual Recurring Revenues (ARR) of 90%

• Accretive, and targeting to be on the OpenText operating model by end of FY21

• Funded with OpenText’s existing cash on hand and revolver

• Estimated OpenText net leverage ratio at closing of approximately 2.5x, with a target to return to less than 2x net leverage during the 4-6 quarters post close of transaction

• Financial projections and target models will be provided upon closing of transaction

• Expect the transaction to close within 90 days of this announcement

OpenText, through a wholly-owned subsidiary, intends to commence the tender offer for all of the shares of common stock of Carbonite within 10 business days. Pursuant to the agreement, the tender offer will be followed by a merger to acquire any untendered shares. The tender offer is subject to the tender of a majority of Carbonite’s shares and certain other regulatory approvals and customary closing conditions. The transaction is expected to close within 90 days.

Lazard Frères & Co. LLC has acted as sole investment banker to OpenText in connection with the transaction.

Press release from Carbonite:

Carbonite, Inc. entered into a definitive agreement to be acquired by OpenText Corp. for $23.00 per Carbonite share in cash.

The transaction values Carbonite at an enterprise value of approximately $1.42 billion and represents a 78% premium to Carbonite’s unaffected closing stock price on September 5, 2019, the last trading day before a media report was published speculating about a potential sale process.

“Following expressions of interest from multiple parties, the Carbonite Board conducted a thorough and comprehensive process, which included contact with a number of strategic and financial parties, to identify the best way to maximize shareholder value,” said Steve Munford, interim CEO and president/executive COB, Carbonite. “The board strongly believes that a transaction with OpenText delivers compelling, immediate and substantial cash value to shareholders.”

He continued: “Carbonite has expanded its solutions to become a leader in cyber resiliency. We have grown through both organic and inorganic opportunities over the years, enhancing our routes to market, diversifying our customer base, and assembling a talented workforce, while adding meaningful scale. Joining with OpenText is an exciting next step for Carbonite.”

OpenText is in Enterprise Information Management (EIM), both on-premises and for cloud services, offering the only complete solution for EIM with a comprehensive view of all the information within an organization. OpenText operates in 40 countries, providing a tested platform for growth and new sales opportunities.

The transaction is subject to customary closing conditions, including the tender of a majority of the outstanding shares of Carbonite common stock and regulatory approvals.

J.P. Morgan Securities LLC acted as financial advisor to Carbonite, and Skadden, Arps, Slate, Meagher & Flom LLP acted as legal advisor.

3Q19 Results:

Carbonite also announced financial results for the third quarter ended September 30, 2019:

• Revenue of $125.6 million increased 62% Y/Y.

• Non-GAAP revenue of $135.0 million increased 71% Y/Y.1

• Net loss was ($14.0) million, compared to net income of $0.6 million in 2018.

• Net loss per share was ($0.40) (basic and diluted), as compared to net income per share of $0.02 (basic and diluted) in 2018.

• Non-GAAP net income per share was $0.61 (basic) and $0.60 (diluted), as compared to $0.53 (basic) and $0.48 (diluted) in 2018.2

• Adjusted EBITDA of $40.2 million, or 30% of non-GAAP revenue, compared to $23.0 million, or 29% of non-GAAP revenue in 2018.3

Comments

| (in $ million) | 3Q18 | 3Q19 | 9 mo. 18 | 9 mo. 19 |

| Revenue | 77.7 | 125.6 | 219.4 | 328.3 |

| Growth | 62% | 50% | ||

| Net income (loss) | 0.6 | (14.0) | 6.8 | (23.2) |

Above are financial results for Carbonite for the 3 and 9 months ended September 30, 2019.

This acquisition, for $1.42 million inclusive of cash and debt, is a nice move for OpenText, getting a fast-growing public firm, probably the first one in a combination of data protection and end-point security products even if last quarter was not profitable and if the storage software is involved in at least 9 recent class actions by several law firms.

Acquired firm moved away from a traditional data backup business to a more proactive, defensive security company.

The deal marks a 78% premium on Carbonite’s share price on September 5, when it was first rumored the company was preparing to buy the backup and data recovery company. Private equity firms, Evergreen Coast Capital, KKR, and Vector Capital, were among the companies rumored to be circling Carbonite.

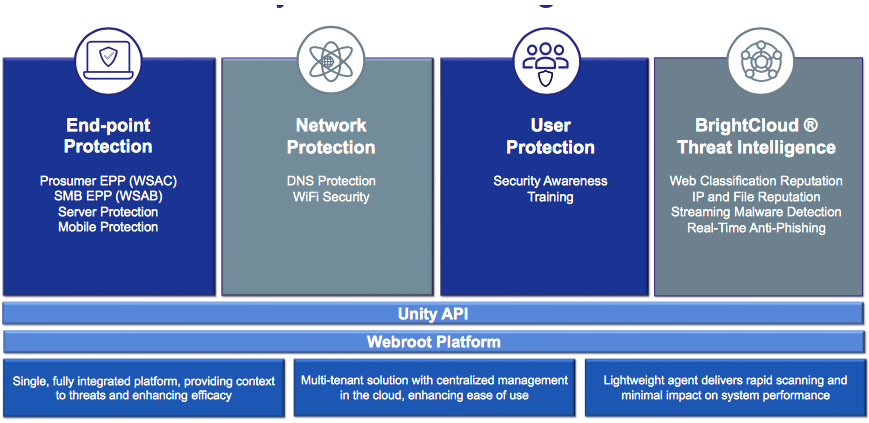

Carbonite Security Product Offering

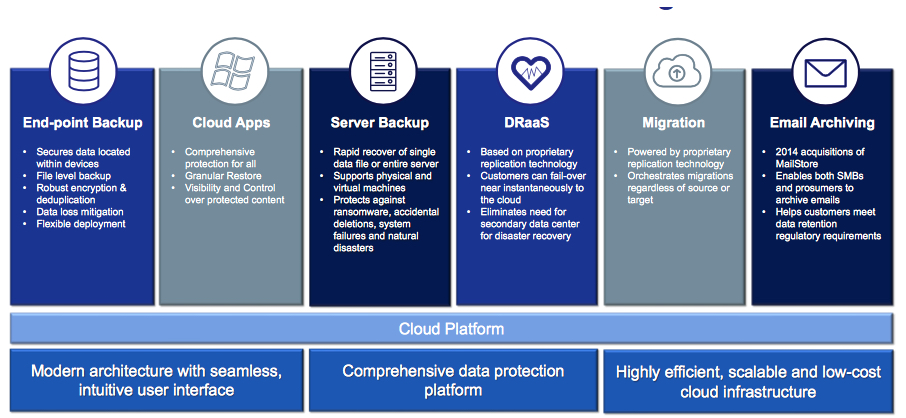

Carbonite Data Protection Product Offerings

Backup Review ranked Boston, MA-based Carbonite as ≠1 cloud backup companies for consumer and ≠2 for SMBs in November 2019

OpenText got $697 million in sales for 1FQ20 ended September 30, 2019 including $237 million in cloud revenue and $74 million net income. It was $2.9 billion for the entire FY19, being also profitable. It ended most recent quarter with about $1 billion in cash.

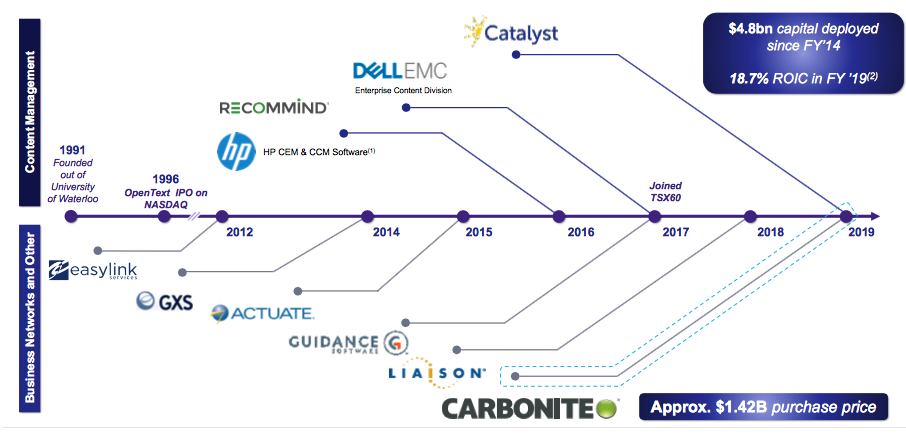

With around 13,100 individuals and founded in 1991, Opentext bought 8 companies in the past and the most recent one is its second biggest deal in storage after Dell EMC Enterprise Content Division for $1.62 billion in 2016. Other ones are EasyLink, GXS, ANX, Covisint, Recommind, Hightail, Catalyst, and Liaison.

OpenText' History

On its side, in FY18, Carbonite recorded $296.4 million in sales and already much more than that, $328.3 million, for 9 months ended September 30, 2019.

Founded in 2005, Carbonite, with 1,500 employees, will strengthen and broaden OpenText's information security offerings in digital forensics, end-point detection and response.

It brings big SMB and prosumer channel with 14,000 MSPs, 300,000 SMB customers, 50 million end-point points and 7 million prosumers, having 250PB under management and more than 200 issued patents

Carbonite closed IPO at lower price than expected ($10.00 per share) in 2011.

The acquired company proposed a public offering of common stock for 4 million shares in July 2018.

Formerly it raised $191.2 million in 8 rounds (source: Crunchbase):

- $6 million in 2006 in two rounds

- $15 million in 2007

- $25.2 million in 2008 in two rounds

- $20 million in 2010

- $1 million venture round in 2011

- $125 million in post-IPO equity in 2017

Founder, president and CEO David Friend left Carbonite in 2014, then replaced by Mohamad Ali quitting to become CEO of IDG and then Steve Munford current interim CEO and executive chairman since last July.

Below are the 9 acquisitions of Carbonite, including biggest one Webroot this year for $618.5 million. The company resold two of them to Betsol: Zmanda and Rebit (IP).

| Month | Year | Acquired company | Price in $ million |

Business af acquired company |

| 6 | 2011 | Phanfare |

NA | Photo-sharing service |

| 10 | 2012 | Zmanda | 15 | In enhanced version of open source backup project Amanda; acquired by Betsol in 2018 |

| 12 | 2014 | Mailstore | 20 | German company in email archiving solutions for SMBs |

| 9 | 2015 | Rebit (IP) | NA | Backup and recovery software; acquired by Betsol in 2017 |

| 12 | 2015 | Evault (Seagate) | 14 | BC and DR solutions designed for SMBs |

| 2 | 2017 | Double-Take Software (Vision Solutions) | 65 | HA software for SMBs |

| 8 | 2017 | Datacastle | NA | Enterprise mobility endpoint backup, recovery and analytics solutions |

| 2 | 2018 | Mozy | 145.8 | Online backup formerly owned by Dell EMC |

| 2 | 2019 | Webroot | 618.5 | Cybersecurity |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter