Micron: Fiscal 3Q22 Financial Results

Micron: Fiscal 3Q22 Financial Results

Revenue of $8.6 billion, up 16% Y/Y, but weak outlook of $7.2 billion ±$400 million for next quarter

This is a Press Release edited by StorageNewsletter.com on July 4, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 7,422 | 8,642 | 19,431 | 24,115 |

| Growth | 16% | 24% | ||

| Net income (loss) | 1,735 | 2,626 | 3,141 | 7,195 |

Micron Technology, Inc. announced results for its third quarter of fiscal 2022, which ended June 2, 2022.

3FQ22 highlights

• Revenue of $8.64 billion vs. $7.79 billion for 2FQ22 and $7.42 billion for 3FQ21

• GAAP net income of $2.63 billion, or $2.34 per diluted share

• Non-GAAP net income of $2.94 billion, or $2.59 per diluted share

• Operating cash flow of $3.84 billion vs. $3.63 billion for 2FQ22 and $3.56 billion for 3FQ21

“Micron delivered record revenue in the fiscal third quarter driven by our team’s excellent execution across technology, products and manufacturing,” said president and CEO Sanjay Mehrotra. “Recently, the industry demand environment has weakened, and we are taking action to moderate our supply growth in FY23. We are confident about the long-term secular demand for memory and storage and are well positioned to deliver strong cross-cycle financial performance.”

Investments in capital expenditures, net were $2.53 billion for the third quarter of 2022, which resulted in adjusted free cash flow of $1.31 billion. Micron repurchased approximately 13.8 million shares of its common stock for $981 million during 3FQ22 and ended the quarter with cash, marketable investments, and restricted cash of $11.98 billion, for a net cash position of $5.01 billion.

On June 30, 2022, the board of directors declared a quarterly dividend of $0.115 per share, payable in cash on July 26, 2022, to shareholders of record as of the close of business on July 11, 2022.

Business outlook for 4FQ22

- Revenue: $7.2 billion ±$400 million

- Gross margin: 41.5% ±1.5% (GAAP), 42.5% ±1.5% (non-GAAP)

- Operating expenses: $1.13 billion ±$25 million (GAAP), $1.05 billion ±$25 million (non-GAAP)

- Diluted earnings per share: $1.52 ±$0.20 (GAAP), $1.63 ±$0.20 (non-GAAP)

Comments

Global 3FQ22 revenue was a record $8.6 billion, up 11% Q/Q and up 16% Y/Y with strong profitability and free cash flow. At the end of the former quarter, it was expected for the most recent 3-month period sales of $8.7 billion ± $200 million or up between 9% and 14% Q/Q.

The Micron team delivered these good results despite supply chain challenges and Covid-19 control measures in China, which impacted our business on both the demand side and the supply side.

Micron ended the quarter with $12 billion of cash and investments and $14.5 billion of total liquidity. 3FQ22 total debt was $7 billion. DRAM

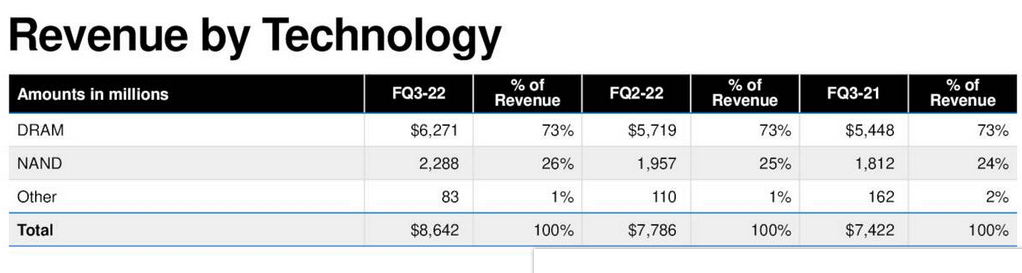

DRAM

3FQ22 DRAM revenue was $6.3 billion, representing 73% of total revenue. It increased 10% Q/Q and was up 15% Y/Y. Sequentially, bit shipments increased by slightly over 10% while ASPs declined slightly.

NAND

3FQ22 NAND revenue was $2.3 billion, representing 26% of total revenue. It increased 17% Q/Q and was up 26% Y/Y. Sequential bit shipments increased in the high-teens percent, and ASPs declined slightly.

Company's 1-alpha DRAM and 176-layer NAND ramps are several quarters ahead of the industry and progressing well the firm continues to qualify new products that use these nodes. It also making excellent progress on its 232-layer node and expect to ramp production by the end of calendar 2022.

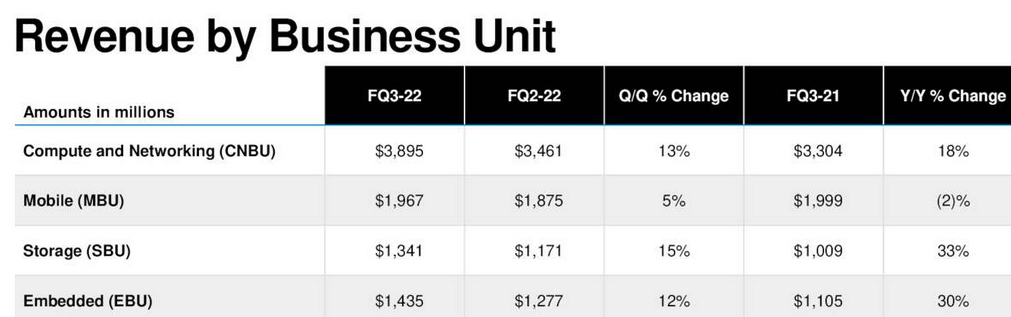

Compute and Networking Business Unit

Revenue here was $3.9 billion, up 13% Q/Q and up 18% Y/Y. Data center, graphics and networking contributed to both yearly and sequential growth.

Mobile Business Unit

Revenue was approximately $2 billion, up 5% Q/Q and down 2% Y/Y. Strong execution and product momentum to deliver sequential growth in a challenging smartphone market demand environment.

Storage Business Unit

Revenue was $1.3 billion, up 15% Q/Q and up 33% Y/Y. The firm achieved record SSD revenue, with both data center and client SSD revenue reaching all-time highs. Data center SSD revenue more than doubled Y/Y.

Embedded Business Unit

It achieved record revenue at $1.4 billion, up 12% Q./Q and up 30% Y/Y. Both automotive and industrial revenues set records in the quarter.

Data center 3FQ22 revenue grew by a double-digit percentage sequentially and over 50% Y/Y. Data center end demand is expected to remain strong in 2H22, driven by robust cloud Capax growth. Despite the strong end demand, the company is seeing some enterprise OEM customers wanting to pare back their memory and storage inventory due to non-memory component shortages and macroeconomic concerns.

Outlook

Forecast for calendar 2022 PC unit sales is expected to decline by nearly 10% Y/Y from the very strong unit sales in calendar 2021.

QLC SSD technology is expected to increase as a percentage of 176-layer bit output in 4FQ22 and beyond.

Due to weaker demand in 2H22, the company now expects Y/Y calendar 2022 industry bit demand growth to be below the long-term CAGRs of mid-to-high-teens percentage for DRAM and high-20s percentage for NAND. Despite the near-term weakness, secular demand trends remain strong, and long-term DRAM and NAND bit demand CAGR remains unchanged from prior expectations.

Industrial IoT achieved record revenue in 3FQ22, demonstrating broad-based growth with various end market applications. Micron continues to see tailwinds from secular growth drivers as industrial customers invest in increasing factory automation and digitization.

It is planning for a reduced level of bit supply growth in FY23 and will use inventory to supply part of the market demand next year. This approach will enable to reduce wafer fab equipment Capex for FY23 vs. prior plans, and the company now expect FY23 wafer fab equipment Capex to decline Y/Y.

Expectations for calendar 2022 industry bit demand growth have moderated since last earnings call. Near the end of 3FQ22, the firm saw a significant reduction in near-term industry bit demand, primarily attributable to end demand weakness in consumer markets, including PC and smartphone. These consumer markets have been impacted by the weakness in consumer spending in China, the Russia-Ukraine war, and rising inflation around the world.

There are consumer demand and inventory-related headwinds impacting the industry and consequently 4FQ22 outlook.

It is expected PC per unit memory and storage content growth trends to remain healthy in calendar 2022, driven by a mix shift toward enterprise PCs and the increasing content in new architectures such as Apple's M1 Ultra platform, which features up to 128GB of DRAM.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| 1FQ20 | 1,422 | 18% | 28% |

| 2FQ20 | 1,514 | 6% | 32% |

| 3FQ20 | 1,665 | 10% | 31% |

| 4FQ20 | 1,530 | -8% | 25% |

| FY20 | 6,131 | 14% | 29% |

| 1FQ21 | 1,574 | 3% | 27% |

| 2FQ21 | 1,650 | 5% | 26% |

| 3FQ21 | 1,812 | 10% | 24% |

| 4FQ21 | 1,971 | 9% | 21% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | ∼2,000 | 6% | 25% |

| 3FQ22 | 2,300 | 11% | 26% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter