History (1997): Exclusive Interview With Al Shugart, CEO and CO, Seagate

"$19.5 billion in 2001 still holds."

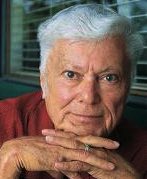

By Jean Jacques Maleval | December 3, 2021 at 2:00 pm We interviewed Al Shugart, whom we no longer need to introduce, at this year’s Comdex, in mid-November.

We interviewed Al Shugart, whom we no longer need to introduce, at this year’s Comdex, in mid-November.

CDSN: Seagate, the storage giant, is not growing. What’s wrong?

Shugart: We go as the computer industry goes. The computer industry is not doing very well. It’s very cyclical, and it’s down right now. So it’s because of the computer industry… Well, that and the fact that we have more competition. Both of those things.

What’s Seagate’s problem with high-end HDDs? Is it demand, or the new competition?

There’s a couple of things. First of all, my observation about the high-end is that the market in total has gone down, and is still going down. That’s number one. Number two is that there’s a lot more competition now in the high-end than we used to have. This additional competition means 2 things. One thing it means is that prices come down. The second thing it means is that our OEMs that used to rely on us as a single source now have opportunity to buy from more than one, which they want to do, they want to be multiple-sourced. So we’ve lost market share in a market that’s smaller, with reduced prices.

What else can go wrong? Is vertical integration a good strategy when you see that Western Digital and Quantum have better growth than IBM and Seagate?

Quantum’s gross margin is worse than Seagate’s. And you’ll ask me,’How can you say that, it was 19.2%?’ But if you take out DLT tape, it was 13.1%.

At the beginning of the year, you set a goal for the company to reach $19.5 billion in 2001. As for Seagate Software, you said in 1996 that it would hit the billion $ mark by 1999. Do you still stand by these statements?

Yeah, absolutely. I don’t know if the billion dollars for Seagate Software will hit by 1999, but they’ll make a billion and a half by 2001. And the $19.5 billion objective still holds.

This summer, we interviewed Ron Verdoorn, Seagate’s VP and COO of the storage products group, who introduced us to SLAM, Seagate’s new internal strategy for business re-engineering. What’s happening with Verdoorn and SLAM at the moment?

Two separate issues. SLAM is an initiative that we’ve been pursuing at Seagate to make us more productive by improving our processes, and that’s still in progress, and doing well, totally separate from Ron Verdoorn, although he was the stimulus behind getting it started. Ron Verdoorn has since resigned, because we didn’t have a job for him. His job disappeared – we reorganized and his job was split in 3. He decided he had more opportunities at other places, and I agreed with him.

Is he with another company? What’s he doing today?

I think he’s playing golf and having fun. Hopefully, I told him to… He’s still a very good friend, and I’ve had lots of call from people who want to hire him. He’s not very anxious to go back to work just yet, he was working pretty hard. In the last quarterly statement,

Seagate said it was currently reviewing its WW operations for eventual restructuration. What do you mean by that? What are you planning?

Well, I can’t tell you specifically what we’re going to do because we haven’t done any of it yet. What we have to do is make all of our operations in the company more productive. We’ve already done a few things which wouldn’t mean very much to you, we’ve moved headstock assembly from one group to another, we’ve taken disk drive production out of Thailand, lots of things like that. And with everyone of those moves, it’s cost us some money. Restructuring kinds of costs. In our October release, we said it would be up to $100 million of restructuring that we might have to take this quarter. Today we told people that our restructuring would exceed that 100. But all it is making us more productive.

What must change in your company to become a real force in 2.5-inch HDDs?

We have to catch up with IBM in the technology. That’s the main thing. IBM’s way ahead, we only have about 5% of the market for 2.5-inch drives, and we need to have about 15% to really make any money. The only way we’ll ever get that additional 10% from Toshiba and IBM is to catch IBM in the technology area, and have more competitive products. We ‘re still working in that area. If we can’t get our market share up to 15%, then we should drop out.

Seagate has launched a high performance 3-inch platter drive inside a 3.5-inch form factor. Is this just an experiment, or a long-term involvement?

This has nothing to do with form factor. This is a design decision to take the 3.5-inch drive that we had, and reduce power and reduce heat. By putting the 3-inch platter that we make ourselves into the 3.5-inch drive we’ve reduced power requirement and heat, and increased efficiency. So it’s not a question of a 3-inch drive, we just happen to use a 3-inch platter.

You have recently announced a 47GB, 5.25-inch drive. What’s the next capacity point?

I don’t know, but I think the next capacity point will be decided by the magneto-optical group, who will provide the next gen of very high capacity on a single spindle.

So this 5.25-inch drive will be the last of its kind?

I think that the Elite 47 will most likely be our last 5.25-inch drive, or at least our last 5.25-inch magnetic recording unit.

IBM has just announced GMR HDDs. When do you think Seagate will be ready?

I’m not sure. We’re making GMR heads now, we’re experimenting, but we’re not ready to announce a product yet, we will be early next year. IBM is ahead of everybody with GMR, they always have been. But IBM is usually about 4 years ahead of the requirement, they’re very, very good. We can only hope to catch them. But we have GMR in the lab, we’re working on it, and we expect early next year to announce a product.

You once wrote in an article that when you founded Seagate, you put a few million dollars in the company. But to acquire Quinta, you paid more than $300 million. How do you justify this kind of high price?

The $320 million we paid for Quinta is justified on the basis of what it would cost us to start from scratch ourselves, and what it would cost to come out with a product later, because that’s also a real factor. And you evaluate those costs vs. the cost of buying a firm that already has the people and the technology, and it weighed in very much in favor of acquiring Quinta, if they’d sell, and they agreed to sell. So it was an economic decision.

Seagate is partially involved in Terastor as a supplier, and totally involved in Quinta. How do you compare the two companies’ technologies?

We don’t talk about our competitors. Also, were a supplier of Terastor, and we don’t talk about people we supply to.

You were not initially a big supporter of optical technology. Have you changed your mind?

Yes. Nobody supported optical technology. The drives have been around for years and years, but the market hasn’t been very big because they’re too costly and too slow, and it didn’t look like there was a very good growth pattern. In the last few years, well, there’s been a lot that’s happened. A lot of development happening in the industry that makes magneto-optical very practical, the most important of which is that we’re able to make things very, very small. We can make very small lenses now, we can make very small recording heads, which you couldn’t do 5 years ago. With the advent of these very small components, magneto-optical drives look like a much more definite probability. Miniaturization is the answer.

There was a recent agreement between IBM, Hewlett-Packard and Seagate for a new tape technology. Is it just a DLT-killer agreement?

Well, DLT has that market and what’s wrong with that is that there’s not a standard that permits customable. The industry needs very high capacity drives from multiple vendors that are interchangeable. So we’ve been working with Hewlett-Packard and IBM to agree on a spec that would guarantee interchangeability between drives. The 3 companies would themselves develop, themselves build and themselves sell. And also, there’s a third party that will then in turn license other companies to manufacture drives to the same spec, with the assurance of interchangeability, which you don’t get with DLT. So I think we’re doing something for the industry.

Do you have something in the works? Will it be longitudinal, or what have you decided?

We’ve deliberately said nothing about the technology. We’ve done a lot of work on the technology as has IBM and HP, none of us has said anything about the technology, none of us has announced a product. Each of us will announce a product in due time. All we’ve done is agree on the spec to guarantee interchangeability.

When do you think there will be a product on the market?

Next year, closer to the end of next year. But IBM and HP may be on a different schedule. We already have a product that attacks the low-range of the high-capacity tape drive market, the Sony AIT. We’re a licensee of Sony, and we’ve only been selling this product for a short time, and it’s doing very well. That’s the low-end of the high-capacity market. This new spec we’ve agreed upon is at the top end.

You were upset when Singapore Technologies bought Micropolis. Or you were suspicious. Are you happy that Micropolis is now out of business?

I was upset that the Singapore government was buying a disk drive company and going into competition with other disk drive companies. I don’t think that’s the place of a country’s government, and I objected to that it’s very difficult for me to be happy about a company going bankrupt, because I know a lot of the people who are now out of work, but yes, I’m glad to see them out of business.

Have you noticed that now, when you buy a PC, it’s always marked ‘Intel inside.’ But it’s never marked ‘Seagate inside,’ or ‘Quantum inside,’ or ‘Western Digital’ inside. Why don’t you have a branding strategy?

In fact we do have a branding strategy, which we’ve just started, we’ve been working on it over a year. We started out with television advertising segments, this is corporate branding, nothing to do with products. We’ve got a brand new council of all the different operating groups, and we’ve all agreed during the last year, after a number of studies all over the world, we’ve observed people. Now we have a branding plan that we instituted 2 weeks ago in 8 different markets in the US. It consists of TV advertising, 60s commercials that are very clever, and I think it’s a good start This week, these commercials are being shown here in Las Vegas. We’ll run them again in January, and then in the next month, we’ll begin our print-advertising campaign. Then we’ll start simil,campaigns outside the US. But a key part of our strategy is corporate branding.

I’ve been covering this industry for 10 years now, but I still don’t know where the name Seagate comes from. Can you fill me in?

It’s an old story, and I’m surprised you haven’t heard it. I found it in the dictionary. The name of the company was Shugart Technology, but that was just to sign leases, because people were familiar with the name Shugart. But we knew we’d change it. When we got to the point where we were going to deliver diskdrives, we knew we had to come up witha name. So I was looking in the dictionary for a 7-letter word that started with ‘S’, ended in ‘T’ with a ‘G’ in the middle, and the only thing I found was Sea-gate, with a hyphen, and I took out the hyphen. And I asked around, nobody liked it except for me and Finis [Conner], so we said ‘good, we’re the ones that matter.’

Do you still enjoy being head of Seagate?

Yes. If I didn’t, I’d quit. I don’t need the money.

In your mind is Steve Luczo the best candidate to succeed you?

I don’t believe in naming successors, but he is clearly the second in command at our company.

Do you see a comeback for Finis Conner in this industry in the near future?

I have no idea, you’d have to ask Finis. I never see him.

Paul Gilovich told me you played basketball together. You’re a good player?

That was when we were both at IBM, and we were on one of the IBM teams, we had an IBM league. But he was about 6’10”, and I was only 6′, so…

This article is an abstract of news published on issue 119 on December 1997 from the former paper version of Computer Data Storage Newsletter.

Note: The company records $10.7 billion in revenue for FY2001.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter