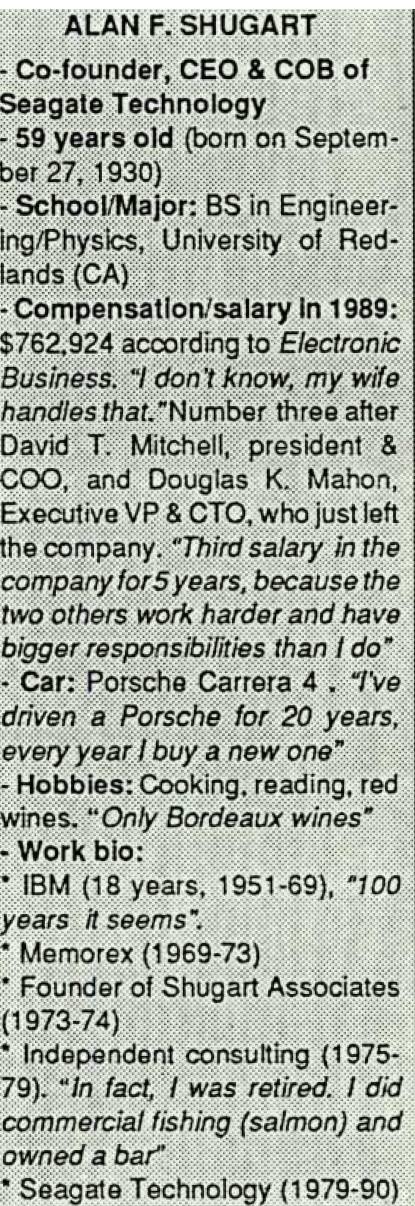

History (1990): Exclusive Interview With Al Shugart, Co-Founder, CEO and Chairman, Seagate

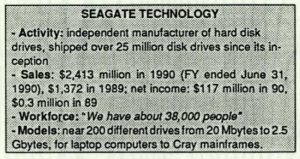

"On unit volume basis, Seagate is ahead, before IBM", but not in value.

By Jean Jacques Maleval | December 30, 2019 at 2:38 pm

StorageNewsletter: Last year, your company, a $1.27 billion firm, bought Imprimis, a $1.15 billion firm, for $450 million in cash and securities. Today, do you think it was a good deal?

Shugart: Yes, no question about that, I would do it again.

How did you manage the restructuration between the 2 companies, with such different cultures?

Well, it wasn’t easy. I think the reason of the success is that the employees of both companies wanted it. They thought it was a good idea and that helped quite a bit. It’s not been easy and were not done. By the end of December. I think we’ll have it done.

How many people were laid off with this acquisition (at that time, 26,000 people were working with Seagate 8,500 with Imprimis, total being 34,500. Ed.)?

I don’t know. We didn’t do anything that was not already planned. We closed the plant in Heppenheim (Germany) because it was no longer economical to make disk drives there, but that was in the plan of Imprimis before we purchased it. We reduced the manpower in Omaha, NE, where they make oxide disks but that was in the plan also because the need for oxide disks has been going down. We’ve reduced the manpower for disk drive manufacturing in Minneapolis, MN, and that was in the plan because we’ve been transferring the Minneapolis disk drive products to Oklahoma City, OK, for production. I don’t think that we’ve laid off a lot of people. Here and there, there were excess people when we combined functions, but not necessarily Imprimis people were dismissed, sometimes they were Seagate people.

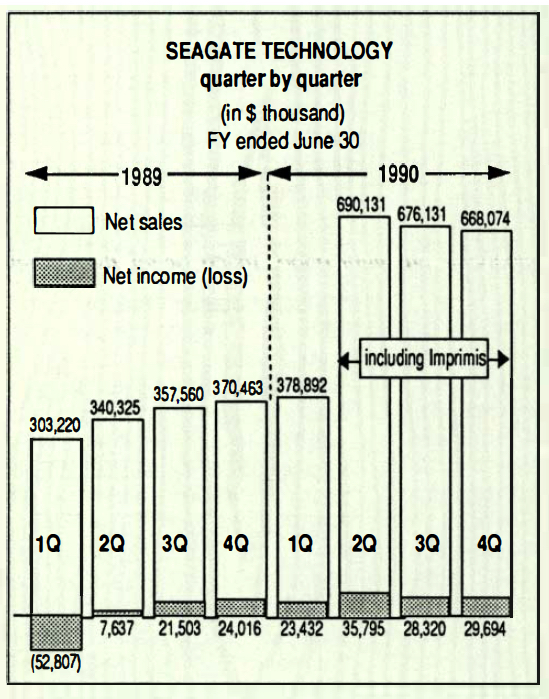

If you add figures, when the 2 companies merged, your sales were $1.27 billion and the sales of Imprimis were $1.15, it’s not higher than your 1990 sales.

The sales together are with 3/4’s of Imprimis. We bought Imprimis after the first quarter of 1990.

Do you think the group grows faster than the growth of the Industry?

Our growth in the last year has not been exceptional, we’ve been kind of flat, if you look at our quarter to quarter revenues. The consumer product end of our business has slipped. The higher end part has held pretty well. Our market share stayed about 30%, and we recognize that in the consumer product area we need to put emphasis into new products. And we’re going to do that now.

Your company sold 5.1 million drives In 1988, 5.7 million In 1989. How many were sold (with Imprimis) in 1990?

We don’t give out that information anymore. Seagate is now the first independent Winchester drives manufacturer.

But what’s you rank, all manufacturers included (IBM, Fujitsu, Hitachi, NEC, Hewlett-Packard, etc.)?

I think we’re the largest disk drive manufacturer on a unit volume basis. I think we make more disk drives than any other manufacturer.

Including IBM?

Including IBM. Probably on a revenue basis, IBM sells more, gets more money because it makes more big drives.

What is the percentage of your sales to OEMs and to distribution channels?

It’s about 50/50. But that varies by quarter, and also it’s a little misleading because our distribution channel also sells to OEMs. And there’s a whole set of customers called value-added system integrators, they could be OEMs, but they also buy from the distribution channel.

Who are your main OEMs?

I think it’s easier to describe who are not. I don’t know who we don’t sell to.

Who is the first one?

IBM is a large customer and we are required to report customers that are 10% of our revenues for the whole year. IBM, we reported for several years in a row, at one time it was maybe 50%. We haven’t reported IBM for quite some time.

So, the biggest one is less than 10% of your sales?

Yes, actually it’s less than 5%, at least last quarter, even less than 3%. We have about 500 customers now.

What’s the percentage of your sales in Europe?

That varies. Last quarter I think it was 23% on a revenue basis. About 12% Far East. 65% USA. Those are all general numbers.

It means that you are not very strong In Europe?

Not as strong as we should be. And we are putting emphasis in that area. Our largest geographic sales area is Germany, then France and UK are about the same.

What do Eastern European countries represent to your firm?

Very small now. But I think that Eastern Europe represents an as larger market as Western Europe. Maybe it will be 5 to 10 years from now. We have approval from governmental agencies to sell certain kinds of disk drives into Eastern block countries. A lot more than before.

What kind of regulations is there?

First of all, there is the U.S. Commercial Department and then second there is COPAN (European COCOM, the European approval agency). We have to have both of those approvals. We now have the approval to sell disk drives up to a certain capacity, 180MB or something. But you also have to meet other parameters: transfer rate, access time.

The Winchester industry seems to be the last one. In the peripherals sector, the Japanese are not strong. How do you explain this situation?

The Japanese are strong. However, from a technology standpoint, USA still has technology leadership, in that particular area, but not very far ahead. The Japanese are very good, much better than other people in the world, once the technology levels up of being able to implement that technology in high volume and good quality. In Winchester disk drives, they haven’t had the opportunity of doing that because every 28 months the recording density doubles. In the foreseeable future, I see that recording densities will continue to double every 28 months which makes it difficult for the Japanese to implement their high volume strategies.

Even in the long term, aren’t you afraid of Japanese?

We have two big competitors: one is the IBM company and the other is all the Japanese companies. We sell disk drives in Japan and we do very poorly there, we don’t make any money. We have to be there. We have a sales office with a very fancy sign like everybody else does. We purchase a lot of components there.

In a publication from Seagate, you talk about 1990’s, a decade of cost. What do you mean by that?

What I mean is that there are so many competitors, building up so much volume capability that there will be more disk drives than there is market. So therefore some will go out of business. The company that will survive will be the company that has the best cost structure in building their disk drives. Requirement for that is a high degree of vertical integration, making all your own parts so you don’t have to pay the profit to somebody else.

How many people do you employ in the Far East?

About 25,000. And maybe it’s 28,000, I’m not sure. The largest population is in Thailand, then Singapore and Malaysia.

Did you read the International Herald Tribune, issue June 21, about Seagate’s Asian manufacturing?

I don’t remember.

Is it true that some of your employees only earn 50 cents an hour?

I don’t know what the wage rate is in the Far East. I know that we are one of the better employers.

Why can’t Winchester drive manufacturing be more automated?

We have a lot of automation.

Yes, but 28,000 people!

Because we do a lot of microscope work, that’s mainly what we do in the Far East. Companies that have higher revenues per employee buy their components from other companies that have the microscope work done. We do that ourselves. It’s impossible to automate microscope work, winding head coils or that kind of thing. We are very automated in Fremont, CA a disk plant that makes thin film disks, and in Minneapolis for thin film heads.

Your success Is based on Far East factories. The success of Quantum is based on the manufacturing by a Japanese subcontractor, MKE.

Yes, I don’t know how they do that. I don’t know how Quantum’s growth margins are able to stay as high as they have with buying their products from Matsushita. Somebody is not taking a profit.

All your best competitors (Conner, Quantum) intend to open manufacturing plants in Europe. You don’t. Why?

We will announce, before the end of this year, specific plans for producing disk drives in Europe.

In Ireland?

We haven’t made that decision yet. We will be producing disk drives in Europe before the end of 1991.

Some analysts think that your industry is once more going into overcapacity production next year.

Yes, I’ve mentioned that a little earlier. There is a lot of truth to that. There was a big problem in 84. That’s a definite possibility of a real problem. Now what will happen. Perhaps everybody won’t install the total manufacturing capability or capacity they said they were going to and that would help. Our European decision is a strategic one as opposed to getting more product into the market place.

Seagate never was a leader in technology, preferring to emphasize on volume production at a low price, rather than high technology at a high price. Did that change since you acquired Imprimis?

First of all, I don’t think it’s true. I think that cost and technology are really kind of acquainted. It’s much more tougher technical jobs in many times to build a lot of something at a cheap price than it is to build a few that perform higher densities. Seagate has always directed its activity prior to Imprimis towards high-volume low-end kinds of products. We are changing some of our tactics, so that we can get also newer products with higher technology in the low-end. You’ll see some examples of it at Comdex where we’re going to announce a broad line of products, including 2.5-inch products which is on your list of questions probably.

Of course. But once again, in the new 2.5-inch drives, you are late, one year after the first ones like Conner or PrairieTek, JVC and now Quantum.

Ouantum is not going to have 2.5-inch, according to their announcement, until next Summer and I guess our schedule will be compatible with that, which means Ouantum won’t be ahead of Seagate. I don’t know that either Conner or PrairieTek is making any money on 2.5-inch drives.

Will magneto-optical drives compete with Winchesters in the future?

I don’t think so. If I’m wrong, and I’m wrong half the time, and if we need to do something in optical technology, we’d have to go and buy an optical company which should not be a big problem because I think that most of them are for sale.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠33, published on October 1990.

Note: Al Shugart, 76, died on December 12, 2006 in Monterey, CA, following complications from heart surgery.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter