Kioxia: Fiscal 1Q21 Financial Results

Kioxia: Fiscal 1Q21 Financial Results

+12% for revenue Q/Q, coming back to profit, waiting for IPO or more probably M&A with WD

By Jean Jacques Maleval | September 7, 2021 at 1:32 pm| (in ¥ million) | 4Q20 | 1Q21 | Growth |

| Revenue |

294.7 | 329.5 | 12% |

| Net income (loss) | (21.0) | 12.3 |

Kioxia Holdings Corp. announced its financial results for the first quarter of fiscal year 2021 ended June 30, 2021.

Its revenue grew in line with NAND flash memory market estimated by the company also at 12% Q/Q.

Good quarter for the flash maker with sales up 12% quarterly at ¥330 billion and back to net income.

Shipments for datacenter SSDs remained strong, and enterprise SSD shipments have started to recover. Furthermore, shipments for smartphone increased, which resulted in positive bit growth in this quarter.

ASP increased for the first time in 4 quarters driven by the improvement of supply/demand balance in the NAND flash memory market.

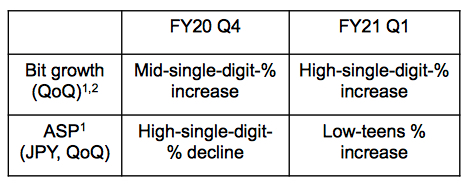

Recent sales trends

1. Bit basis

2. Excluding third party NND used in Solid State Storage Technology Corporation’s SSDs

The company started mass production of 5th-gen BiCS flash.

It announced expansion of Yokohama Technology Campus and new research center.

According to Kioxia, “overall NAND market demand is expected to remain at high level driven by work-from-home and remote online education trends. Demand for datacenter SSDs is strong, and demand for enterprise SSDs is expected to continue the recovery driven by increased capital investment from our customers. Furthermore, demand for smartphones continues its recovery on expanding 5G lineups after the decline caused by Covid-19. Although there are some concerns on reduced production due to components shortage, market consensus expects NAND supply/demand to maintain stability at current levels through the second half of 2021.”

Big stuff for the company was the recent M&A offering of as much as $20 billion by WD, followed by point of view of Kioxia that IPO was favored, probably to push WD to exceed this huge sum.

Roots of Kioxia

- On April 1, 2017, Toshiba Corporation spun off its memory business into the former Toshiba Memory Corporation (Former TMC).

- On June 1, 2018, it sold all of the shares of Former TMC to K.K. Pangea, a special purpose acquisition company formed by a consortium led by Bain Capital Private Equity, LP, and as a result, Former TMC became a wholly-owned subsidiary of K.K. Pangea.

- On August 1, 2018, K.K. Pangea merged with Former TMC, with K.K. Pangea as the legally surviving entity. On the same date, K.K. Pangea was renamed Toshiba Memory Corporation (TMC).

- On March 1, 2019, Toshiba Memory Holdings Corporation (TMCHD) was established as the holding company for TMC through a sole-share transfer, whereby TMC’s then-existing shareholders became the shareholders of TMCHD and TMC became a wholly-owned subsidiary of TMCHD.

- On October 1, 2019, TMCHD and TMC were renamed Kioxia Holdings Corporation and Kioxia Corporation, respectively.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter