Kioxia: Fiscal 4Q20 Financial Results

Kioxia: Fiscal 4Q20 Financial Results

No word on IPO or acquisition for more than $10 billion company

By Jean Jacques Maleval | May 19, 2021 at 2:32 pm| (in ¥ billion) | 3Q20 | 4Q20 | FY19 | FY20 |

| Revenue | 287.2 | 294.7 | 987.2 | 1,178 |

| Growth | 3% | 19% | ||

| Net income (loss) | (13.2) | (21.0) | (166.7) | (24.5) |

Last March, the two long-time partners Micron and Western Digital were looking at possible deals for chip maker Kioxia Holdings Corp., formerly Toshiba Memory Holdings, that could value at around $30 billion. At the same time the Japanese company stated that it was also considering an IPO (its market valuation reaching $32 billion). But no one world on the subjects was included in the official comments of the most recent financial results of Kioxia.

Remember also, that, in August 2020, Kioxia filed for an IPO, raising up to ¥378 billion ($3.6 billion) in Tokyo’s biggest stock market listing at this time for that year.

The Asahi Shimbum reveals last May 14, that Bain Capital Private Equity, a US investment fund that holds a majority of Kioxia’s shares, has no plans to sell its stake in the Japanese semiconductor company as USA and China lock horns over dominance in the sector.

Revenue of Kioxia grew 19% for FY20 from FY19 at ¥1,178 billion ($10.8 billion), as the strong demand for NAND flash memory continued through the Covid-19 pandemic with work-from-home, online education, video streaming service trends, and 5G content expansion.

Profitability improved, returning to positive operating income for the year as a result of cost reduction, including the migration to firm’s fourth-gen BiCS flash and operating expense management.

4FQ20 trends

- Revenue increased sligthly 3% from 3FQ20 driven by SSD sales growth. Operating loss expanded primarily due to the timing of annual property tax of YEN9.4 billion yen.

- Strong demand for datacenter SSDs and client SSDs resulted in positive bit growth despite the seasonal decrease in smartphone-related shipments.

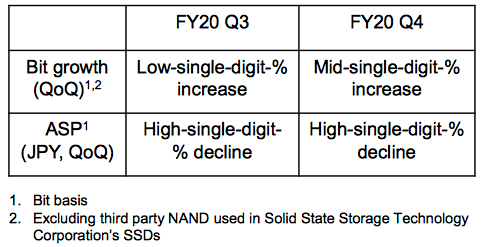

ASP decline slowed with an improving supply/demand balance in the NAND flash memory market.

New products and technology

Developed the sixth-gen, 162-layer 3D flash memory technology which applies an architecture of memory hole array and Circuit Under Array CMOS placement technology.

Yokkaichi Plant Fab7

It commenced to support sixth-gen 3D flash memory production. The first phase of construction scheduled to be completed by the spring of 2022.

Industry/market trends and outlook by Kioxia:

- Demand for datacenter SSDs and client SSDs stays strong driven by work-from-home and remote online education trends. Demand in smartphones continues to increase in the mid-term on expanding 5G lineups. Further, demand for enterprise SSD shows signs of recovery. Market consensus expects NAND supply/demand balance to continue to improve through the second half of 2021.

- In the longer term horizon, industry experts remain confident in the NAND market growth potential and the underlying demand drivers.

- Executing on manufacturing cost reductions consistent with firm’s historical trends through the transition to the next gen products, Kioxia is managing operating expenses given short-term business challenges.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter