Market to Grow to $86 Billion for NAND and $151 Billion for DRAM With 2020-2026 CAGR of 15% and 8%, Respectively

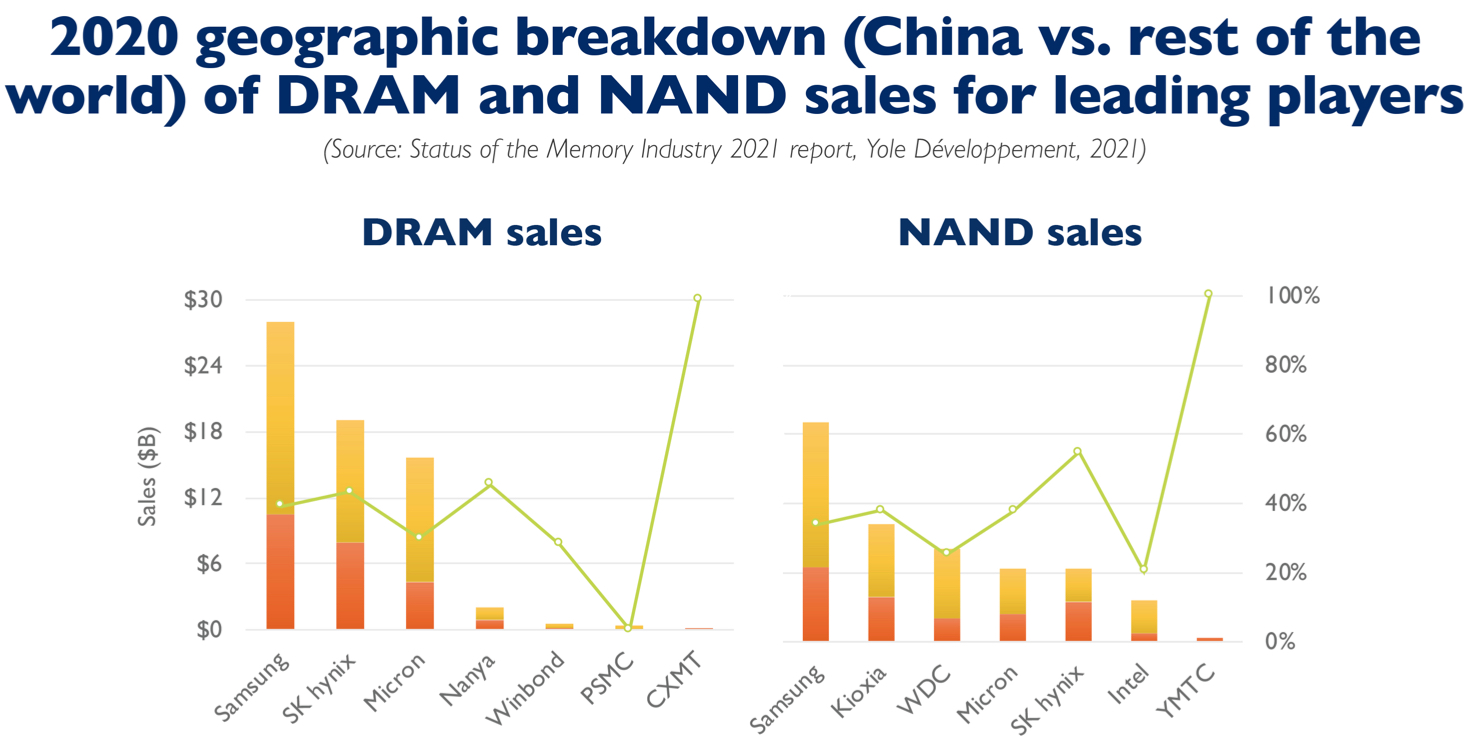

China bets on 2 key players: YMTC and CXMT.

This is a Press Release edited by StorageNewsletter.com on June 22, 2021 at 2:32 pmAmid the pandemic, trade-war tensions, and chip shortages, the memory market outlook remains bright, to reach more than $180 billion in 2022, according to Yole Développement.

Outline:

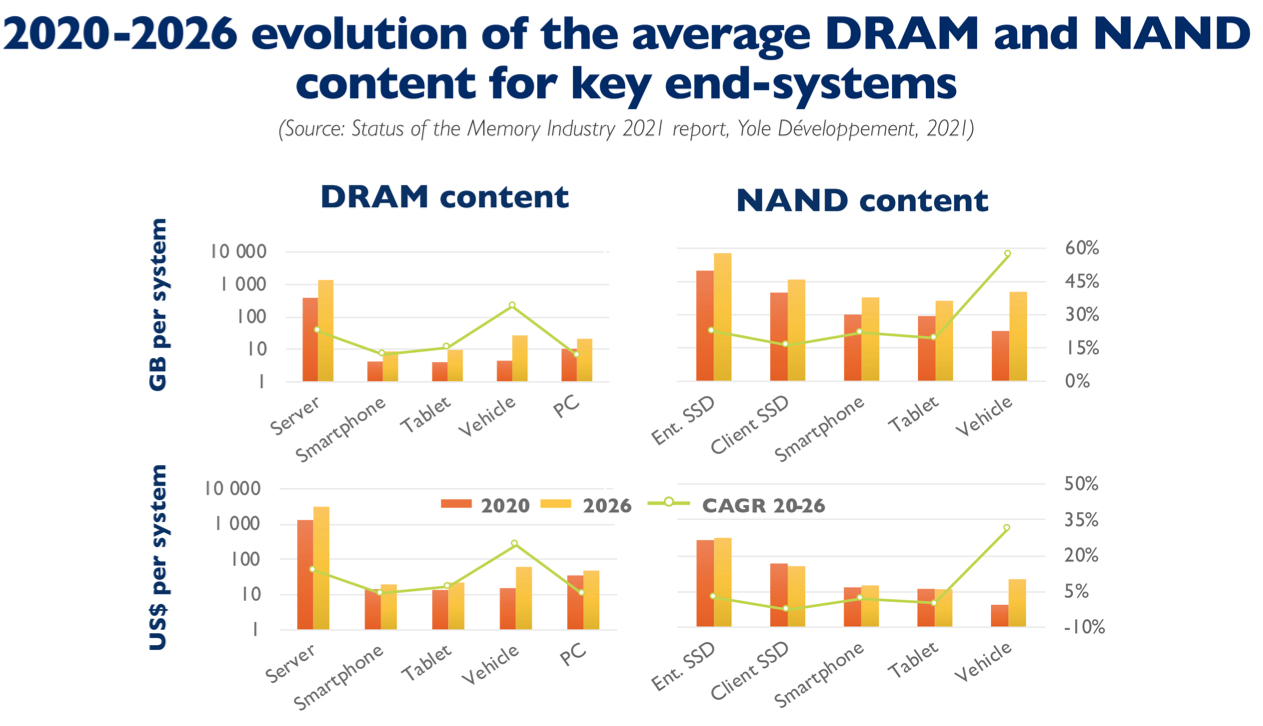

Market forecasts and trends: Combined DRAM and NAND revenue in 2020 was $122 billion, up 15% from 2019. NAND and DRAM are commodity products and are used, respectively, as storage and working memory for smartphones, SSDs, PCs, servers and vehicles. They represent 96% of the stand-alone memory markets. Their revenue is expected to grow with 15% and 8% CAGR 2020-2026 respectively. The pandemic had a mixed impact on the memory industry datacenter and laptop demand grew, automotive and smartphones faced a slowdown. Thanks to a combination of Capex cuts from suppliers in recent years and flourishing demand, the future is looking bright, particularly for DRAM.

Products’ evolution: In 2020 the leading 3D NAND manufacturers have been ramping up the new 1xxL gen. In parallel, following Micron, Samsung and SK hynix have been ramping up 1z DRAM technology. The processor memory interface is rapidly evolving to meet the demands of emerging data intensive applications: memory sizes must increase, while the bandwidth between memory and the CPU must grow.

Supply chain: The consolidation of the NAND market has started with the acquisition of Intel’s 3D NAND business by SK hynix. The DRAM oligopoly of Samsung, SK hynix, and Micron remained largely unchanged in 2020, with Samsung being the undisputed leader with up to 42% market share. The Chinese efforts to develop a local semiconductor memory industry narrowed down to 2 key players: YMTC and CXMT.

“NAND and DRAM are the workhorse memory technologies,” says Simone Bertolazzi, PhD. senior technology and market analyst, one of the authors of Status of the Memory Industry report, 2021 edition. “They are used, respectively, as storage and working memory for a broad spectrum of applications and systems, including smartphones, tablets, SSDs, PCs, servers, and vehicles.“

The consulting company announced a combined DRAM and NAND revenue rose 15% from 2019, reaching about $122 billion in 2020.

Mike Howard, VP of DRAM and memory research, explains: “Thanks to a combination of Capex cuts from suppliers in recent years and flourishing demand, the future is looking bright, particularly for DRAM. Revenues will peak again in 2022, reaching record-high values of $122 billion (DRAM) and $77 billion (NAND).”

In the long term, DRAM and NAND revenues are expected to grow to $86 billion (NAND) and $151 billion (DRAM) with 2020-2026 CAGR of about 15% and 8%, respectively.

In the same period, the ASP is expected to decrease by ~5% (DRAM) and ~16% (NAND), driven by cost-per-bit reductions enabled by technology scaling.

Walt Coon, VP of NAND and memory research, adds: “Both the DRAM and NAND markets are cyclical in nature, as they are characterized by periods of shortages and oversupply that give rise to strong price variations and revenue volatility.”

After substantial oversupply in 2019 – with ASPs down 49% Y/Y for both NAND and DRAM – overall market conditions improved in 2020 despite trade-war tensions and the outbreak of Covid-19. The pandemic had a mixed impact on the memory industry: data center and laptop demand grew, automotive and smartphones faced a slowdown. The net outcome has been a relatively balanced memory demand, while NAND/DRAM production started slowing down as memory suppliers underinvested in new wafer capacity.

“In the present semiconductor shortage era, the storage-drive industry is facing a scarcity of SSD controllers and other NAND sub-components, which causes supply chain uncertainty and puts pressure on ASPs,” comments Bertolazzi.”The recent shutdown of Samsung’s manufacturing facility in Austin, TX, which manufactures NAND controllers for its SSDs, further amplifies this situation and will likely accelerate the NAND pricing recovery, particularly in the PC SSD and mobile markets where impacts from controller shortages are most pronounced.“

Yole’s vision of memory industry

The memory-processor interface is key for overcoming the “memory wall”, announce its memory analysts. CXL and DDR5 will enable the new wave of data-intensive applications.

The processor-memory interface is rapidly evolving to meet growing performance needs from data intensive applications, which are being hampered by the so-called “memory wall”, a bandwidth limitation associated with data transfer between the memory and the processing unit.

DDR5 DRAM is the latest updated to the DDR standard and will boost performance compared to DDR4. The new spec brings lower voltage and moves PMICs onto the memory module. It doubles the maximum data rate and increases the die density by a factor of 4 (up to 64Gb).

The production of DDR5 memory is now gaining momentum, with all leading DRAM manufacturers having already finalized their mainstream DDR5 designs:

- SK hynix announced that they are ready to start shipping DDR5 memory to module manufacturers.

- Micron announced sampling of DDR5 memory based on the 1znm technology, targeting RDIMMs for servers.

- The DDR5 memory standard will be utilized by upcoming Intel’s server CPUs

- Regarding AMD, its platforms are expected to be launched later this year.

“At Yole we expect a veritable takeoff of DDR5 will occur from 2022,” points out Bertolazzi.

Besides DDR, a variety of new open interfaces and protocols are currently in the works: CXL, Gen-Z, OpenCAPI, CCIX. Among these, CXL is picking up momentum in data center applications, providing a sweet spot – in terms of capacity and density – for connecting high-capacity DRAM and SCM technologies such as 3D XPoint.

Companies cited in report include:

Adata: Alliance Memory, AP Memory, Apacer, Applied Materials, ASML, Avalanche, Canon, Centon, CXMT, Dialog Semiconductor, Dosilicon, Etron, ESMT, Everspin, Fujitsu, GigaDevice, GlobalFoundries, H-Grace, Hitachi, HLMC, IBM, IDT, Infineon-Cypress, Intel, ISSI, JHICC, Kingston, Kioxia, KLA Tencor, Lam Research, Lapis, Longsys, Liteon, Macronix, Marvell, and Maxio.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter