Sale of Kioxia to Rivals May Be in Works

Comment from Trendfocus

This is a Press Release edited by StorageNewsletter.com on April 5, 2021 at 2:33 pmThis comment was authored on April 1, 2021 into a Periodic Installment, Mergers and Acquisitions, by Trendfocus, Inc.

Sale of Kioxia to Rivals May Be in the Works

The Wall Street Journal article names potential suitors.

On March 31, 2021, The Wall Street Journal, citing unnamed sources familiar with the matter, claimed that NAND flash and SSD manufacturer Kioxia could potentially be purchased by either Western Digital Corporation or Micron Technology Incorporated, following the sale of Toshiba Memory Corporation in 2018 to a group led by private equity firm Bain Capital and a number of additional investors.

Toshiba Corporation maintains a 40% stake in the spin-outwhich was named Kioxia Holdings Corporation in 2019. Kioxia filed for an IPO in 2020; however, the plan was scrapped due to economic uncertainties arising from the pandemic.

While based on news reports, talks are likely underway between Kioxia and its 2 potential acquirers, further details on the structure or certainty of any sale are still undetermined.

With a post-pandemic economic bounce-back on the horizon, an IPO could still be executed as market conditions improve and NAND supply and demand dynamics look to be tightening in the coming quarters. Of more recent concern is the shortage of semiconductor components tied to high demand for electronics products and fully utilized IC foundries. A semiconductor shortage that limits product builds may reduce NAND absorption, inadvertently leaving flash in inventory.

Consolidation of the NAND flash market has gained momentum in the past year with SK Hynix’s announced purchase of Intel’s NAND business in 2020. The companies expect regulatory approval by late 2021, with final closing of the deal by 2025.

Kioxia maintains its flash Ventures JV with Western Digital, which was created between Toshiba and SanDisk prior to the formation of Kioxia and the 2016 purchase of SanDisk by Western Digital. Since the 2 partners share in the investment and development of their BiCS (bit-cost scalable) NAND products, the combination of the partners under Western Digital would appear to make the most sense.

However, news articles suggest that the valuation of Kioxia would be in the neighborhood of $30 billion, far higher than the $19 billion cost of SanDisk and well beyond the current $20 billion market capitalization of Western Digital. Long-term debt for the company, based on its 4CQ21 earnings was nearly $9 billion, and the company maintained a debt-to-equity ratio of 0.9 in that quarter.

Micron, on the other hand, is led by former SanDisk co-founder and chief executive Sanjay Mehrotra. With a market capitalization of nearly $100 billion and long-term debt of approximately $6.3 billion, Micron’s debt-to-equity ratio of 0.18 (based on November 2020 data) indicates far less leverage than Western Digital, making a deal potentially more likely. However, Micron and Kioxia maintain vastly different NAND designs which would complicate integration, especially as Micron would become a significant rival/partner to Western Digital in flash ventures. With 70% of Micron’s revenue generated through its DRAM business, an expanded footprint in the NAND market provides it additional customer leverage in selling both DRAM and NAND in combined memory deals. This contrasts with Western Digital’s business which, absent of DRAM, generates roughly equal revenue between flash and HDD.

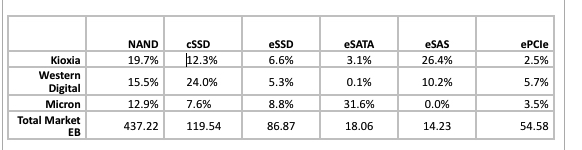

A combination of Kioxia and Western Digital would result in the industry’s largest NAND flash producer. Based on 2020 results, the 2 combined to ship 35.2% of total NAND bits, exceeding Samsung’s 32.8% share. If Micron acquired Kioxia, its NAND market share would total 32.6% of the 2020 market, roughly equivalent to Samsung, who has consistently been the market leader by a wide margin.

The following table lists, in share based on exabytes shipped, the 2020 results for Kioxia, Western Digital and Micron for NAND, client SSDs (designated cSSD), total enterprise SSDs (eSSD), and each of the three enterprise SSD interfaces (eSATA, eSAS and ePCle).

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter