FalconStor: Fiscal 3Q20 Financial Results

Profitable, 12% Y/Y and 14% Q/Q revenue growth, but at only $4.4 million

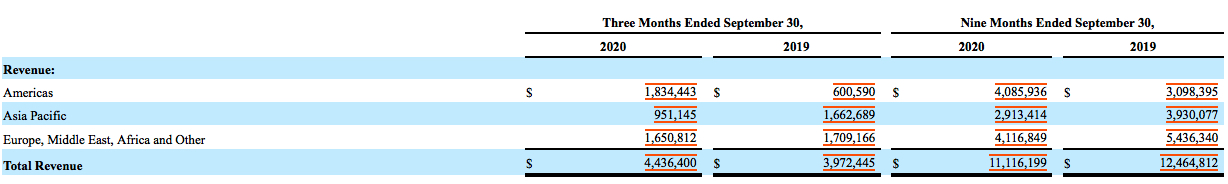

This is a Press Release edited by StorageNewsletter.com on November 11, 2020 at 2:21 pm| (in $ million) | 3Q19 | 3Q20 | 9 mo. 19 | 9 mo. 20 |

| Revenue | 4.0 | 4.4 | 12.5 | 11.1 |

| Growth | 12% | -11% | ||

| Net income (loss) | (0.6) | 1.5 | (1.9) | 1.2 |

FalconStor Software, Inc. announced financial results for its third quarter ended September 30, 2020.

Key Highlights:

• 11.7% Y/Y increase in recognized revenue

• 36.7% Y/Y increase in sales bookings, as a result of new customer sales and existing customer expansion results in core markets of the Americas, EMEA, SE Asia, Korea, and Japan

• 9.9% Y/Y increase in annual recurring sales bookings

• 214.8% Y/Y increase in net income, resulting in $1.1 million in total net income

• Retired $1 million short-term note secured in Q4 2019

• Expanded early sales of StorSafe, new patent-pending long-term archive retention and reinstatement product, which leverages the power and simplicity of industry-standard container technology to enable persistent long-term archive storage. It improves archive data portability, accessibility, security, and integrity validation, especially as it relates to multi-cloud storage leverage. The frim believes this will create capability that solves age old challenges in data usability and portability, resulting in a spectrum of archive storage options available to enterprise customers to utilize essentially any storage environment, while ensuring data security and efficient archive access.

“I am proud of the FalconStor team and our engaged set of global partners, as we continued to make consistent progress vs. our strategic plans,” said Todd Brooks, CEO. “Our momentum continued during the quarter, as the company delivered Y/Y revenue growth of 11.7%, while carefully managing our expenses. As a result, we generated $1.1 million of net income. In addition, our intentional shift to subscription-based offerings continued to improve as we delivered a 9.9% increase in annualized recurring sales. While uncertainties continue to exist as a result of Covid-19, we have seen our customers and prospects invest in the business-critical area of data production in which we sell our solutions. We continue to be encouraged by the strong level of new customers secured during the quarter in our core markets, which allowed us to generate a 19% Y/Y increase in total new customer sales bookings. As we move forward, we will continue to maniacally focus in our core markets, and with our innovative, patent-pending long-term archive retention and reinstatement solution, StorSafe, to help our enterprise customers reduce storage costs, while improving data portability, accessibility, and security – including ransomware protection.”

Click to enlarge

Additional Financial Highlights for 3FQ20:

19% Y/Y increase in sales bookings, allowed to close the 3FQ20 with $4.4 million in recognized revenue, compared to $4.0 million for the same period of the previous year. Revenue recognition on sales is driven by several factors. First, the volume of new product licenses and maintenance sales, both for expansion of our existing installed base and the acquisition of new customers. Second, customer retention, which sustains maintenance renewal revenue over long term sales arrangements. Firm’s software solutions play a role in managing and protecting critical data for businesses around the world, and the company is confident that, as the global economy recovers, its sales momentum will continue to capture the momentum achieved through its recent sales success. As FalconStor move forward through the balance of the year, its energy will be concentrated on generating positive cash flow, capital preservation, strategic growth in iys core markets and continued product innovation.

During 3FQ20, the company improves non-GAAP operating income to $2.0 million, compared with a Non-GAAP operating loss of $0.1 million for 3FQ19.

During 3FQ20, it improved its non-GAAP net income to $1.9 million, compared with a non-GAAP net loss of $0.2 million for 3FQ19. Deferred revenue as of September 30, 2020 totaled $6.1 million, compared with $7.4 million as of December 31, 2019.

It ended the quarter with $0.9 million of cash and cash equivalents, compared to $1.5 million at December 31, 2019.

In addition, the firm applied for the Payroll Protection Plan Loan (PPP) from the Small Business Administration and received $754 thousand in May of 2020.

There is no assurance that the company will be successful in generating sufficient bookings, billings, revenue or continue to reduce operating costs. Failure to generate sufficient revenue, billings, control or further reduce expenditures could result in an inability of the company to continue as a going concern. Subject to the foregoing, management believes that, based on projected cash flows, the company will have sufficient capital and liquidity to fund its operations for at least one year from the date of issuance of the accompanying interim condensed financial statements.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter