Indian External Storage Market Witnessed Marginal 0.4% Growth Y/Y at $66.4 Million in 3Q17- IDC

Most underrated country in WW storage industry

This is a Press Release edited by StorageNewsletter.com on January 24, 2018 at 2:31 pmIndia’s external storage market witnessed marginal 0.4% growth Y/Y (by vendor revenue) and stood at $66.4 million in 3Q17 according to IDC‘s AsiaPac Quarterly Enterprise Storage Systems Tracker, Q3 2017.

The growth was majorly driven by banking, professional services, manufacturing and government verticals in 3Q17. Optimization drive for storage infrastructure across organizations stood out to be the leading reason for greater demand for hyper converged infrastructure, software defined storage and cloud technologies.

“Organizations are facing challenges not only on accommodating exponential data growth but also on real-time data processing. Enterprises are demanding for storage infrastructure which can respond fast and help them achieve the desired business outcomes,” says Dileep Nadimpalli, associate research manager, enterprise infrastructure, IDC.

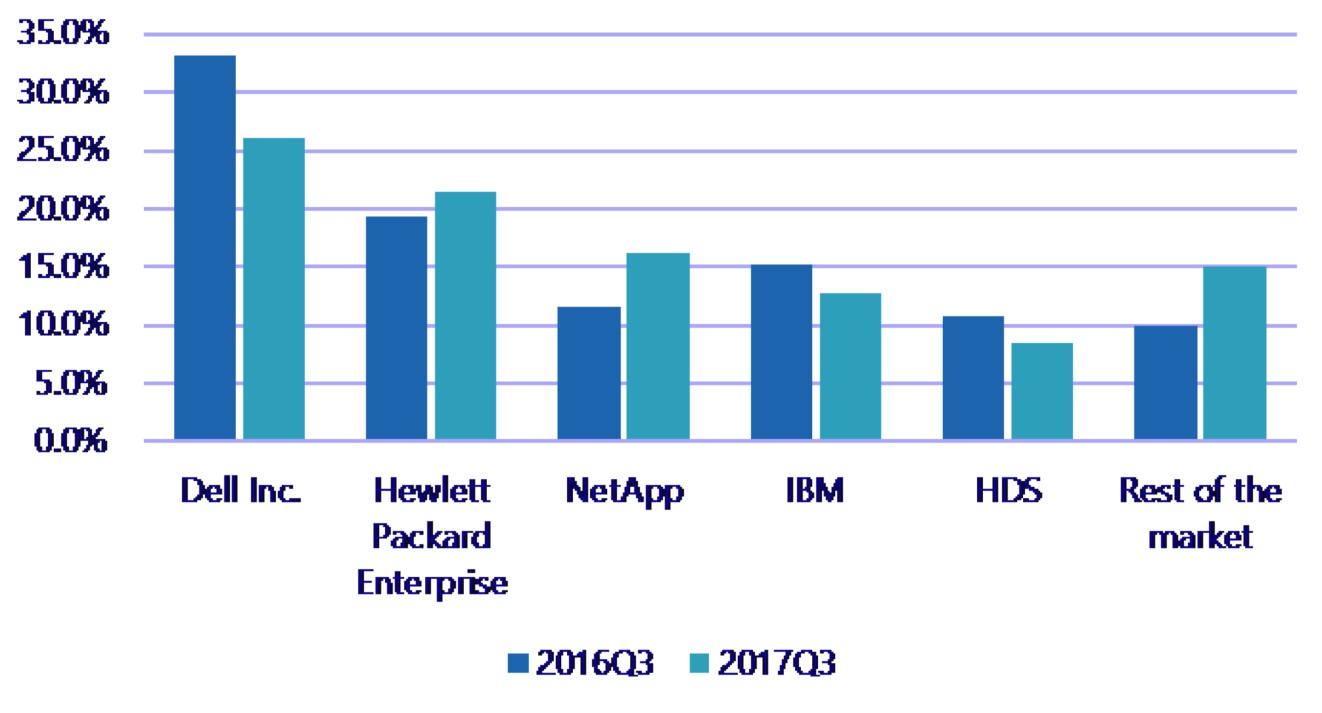

India External Storage Systems by Market Share, 3Q17

(vendor revenue)

While high end storage segment witnessed a high double-digit growth in 3Q17 due to large deployments from banking vertical, mid-range and entry-level segments saw a decline Y/Y in 3Q17.

New buyer segments such as third-party datacenters and cloud service providers for storage vendors will be created owing to demand for cloud transformation but would it would cannibalize some portion of traditional storage market coming from the enterprise customers.

“While the overall storage market has tepid growth, there are pockets of storage market which look promising. Midrange storage will continue to grow as they capture market from high end storage. AFA will continue with their increased adoption and is expected to overtake pure HDD deployments in few years,” says Sharyathi Nagesh, senior research manager, enterprise infrastructure, IDC.

Major Vendors Analysis

Dell Inc. emerged as the market leader with a 26.1% market share by vendor revenue, however witnessed a Y/Y decline in 3Q17. Hewlett Packard Enterprise gave tough competition to Dell, narrowing the gap in terms of vendor revenue and stood at second position. IBM and HDS witnessed double-digit Y/Y decline while Huawei and NetApp saw a significant Y/Y growth in 3Q17.

IDC India Forecast

The external enterprise storage systems market is expected to grow in single digit in terms of CAGR for 2016 – 2021 time-period. Increased external storage spending is expected from banking and government sectors in the coming quarters. Organizations have multiple storage infrastructure options (such as all-flash array, hyperconverged, software-defined storage, object-based, etc.) available in the market at competitive price points. With so many available choices, it will be interesting to see how organizations will choose their storage infrastructure.

Comments

India is growing slowly in storage but this country is largely underrated among the industry.

Storage giants (Dell, HPE, NetApp, IBM, HDS) have subsidiaries there as overall in the world but also there are in India a community of excellent software people being subcontractors of foreign IT firms, and furthermore some local vendors.

To give an example of the weight of India in storage, it's the fourth country in number of visitors of StorageNewsletter.com with 4.1% behind USA (52.7%) of course, but not so far from UK (4.6%) and France (4.4%) and in front of Japan (3.4%) and Germany (3.2%)

Druva Software, born in 2007 and launched by Jaspreet Singh is the most well-known Indian storage company originally in Pune, and now based in Sunnyvale, CA, having raised as much as $198 million, but no storage giant emerged with the small exception of Moser Baer historically the king of disappearing floppy discs and then optical disc media now becoming a fast decreasing market.

India also is the location of a lot of online backup companies.

When you think about India and storage, one name always comes back to your mind, a star,

Kumar Malavalli, 74, an Indian-American technology entrepreneur and philanthropist. He co-founded Brocade Communications with Paul Bonderson, Jr. in 1995, where he was CTO. Then he was CEO and chairman of InMage Systems, acquired by Microsoft in 2014. He is currently co-founder and chief strategy officer of Glassbeam in an interesting business, machine data analytics, and since 12 years.

He never stopped to invest into storage start-ups and in a lot of them, including InterSAN, SV Systems, Cloverleaf, Karthika, Alpine Techonlogies, Orchesys, CloudVolumes, Formation Data - half a dozen of them being finally closed or sold.

He is also the chairman and a founder of the India Community Center in Milpitas, CA.

When I was young, one people told me: "What's better than one Indian? Two Indians." And this country is the second most populous one in the world, with 1.34 billion people, nearly a fifth of the world's population, just beaten by China (1.38 billion). And it is expected to see India becoming number one and surpassing China in the next few years.

Storage Start-ups based in India

| Company | Born in | CEO |

Total invested in $ million |

Activity |

| Druva Software (Sunnyvale, CA) | 2007 | Jaspreet Singh | 198 | continuous data availability and de-dupe backup software for laptops; investment of NTT in 2016; originally based in Pune, India |

| Fractalio Data (Bangalore) | 2014 | Sanjay Jayaram, director | NA | formerly Datalifecycle company; grid-based storage and information management platform, IntegralStor, that grows from terabytes to petabytes |

| NanoArk Technologies India (Hyderabad) | 2007 | P.R. Mukund | NA | WaferFiche to preserve permanently texts as images on silicon wafers; subsidiary of NanoArk Corp., in Rochester, NY |

| QUADStor Systems (Bangalore) | NA | Shivaram Upadhyaula | NA | storage virtualization software; born around 2007 |

| StorNetware Systems (Bangalore) | 2014 | Rajiv Ganth, founder, CTO | NA | in stealth mode; solution called Cloud In A Box, Cinabox |

| Vaultize (Pune Maharashtra) | 2010 | Anand A. Kekre | NA | enterprise file sharing and sync and mobility, funding round in 2013; formerly Anoosmar Technologies |

| Vembu Technologies (Chennai) | 2002 | Sekar Vembu | NA | peer-to-peer backup; acquired CloudNucleus in 2011 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter