Smart Global Holdings: Fiscal 1Q21 Financial Results

Smart Global Holdings: Fiscal 1Q21 Financial Results

Sales and profitability increasing

This is a Press Release edited by StorageNewsletter.com on January 7, 2021 at 2:17 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

272.0 | 291.7 | 7% |

| Net income (loss) | 0.2 | 2.0 |

SMART Global Holdings, Inc. reported financial results for the first quarter fiscal 2021 ended November 27, 2020.

1FQ21 Highlights:

• Net sales of $291.7 million, 7.2% higher than 1FQ20.

• GAAP net income of $2.0 million, or $0.08 per share, compared with $0.2 million or $0.01 per share in 1FQ20.

• Non-GAAP net income of $19.6 million or $0.78 per share, 46.4% and 41.8% higher than 1FQ20, respectively.

• Adjusted EBITDA of $29.5 million, 25.4% higher than 1FQ20.

“I am proud of the results our team delivered in 1FQ21 during these challenging times. Total revenue grew by 7% when compared 1FQ20, and non-GAAP earnings per share of $0.78 exceeded the high end of our guidance range,” commented Mark Adams, president and CEO. “With our continuing focus on delivering differentiated solutions to our valued customers and driving operational excellence across each of our businesses, we remain optimistic about the future and our ability to deliver strong returns for our shareholders.”

Business outlook for 2FQ21: net sales between $285 to $305 million.

Comments

1FQ21 revenue exceeded the midpoint of guidance range as combined memory sales, including specialty memory in Brazil were up 14% from 1FQ20.

The company ended the most recent quarter with $164.1 million of cash and cash equivalents compared with $150.8 million at the end 4Q20.

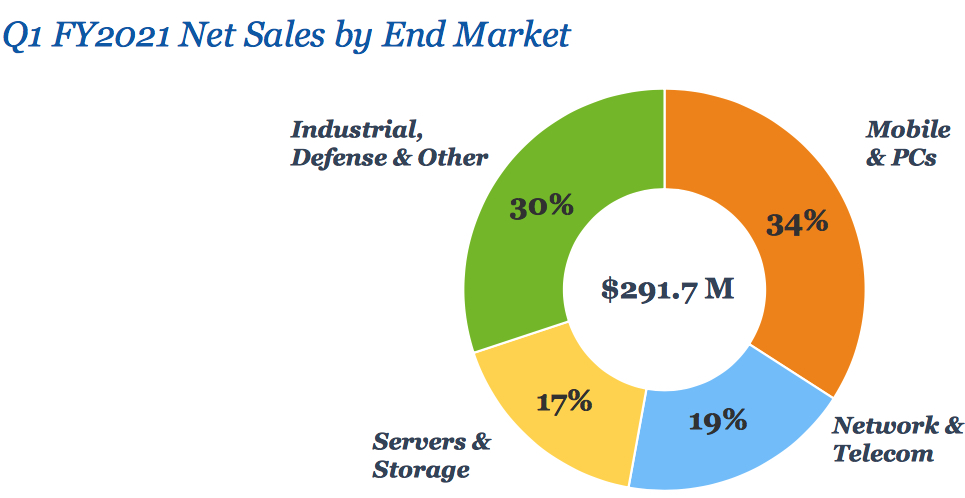

A breakdown of net sales per end market for the quarter was as follows: mobile and PCs 34%; network and telecom, 19%; servers and storage, 17%; industrial defense and other, 30%. Mobile and PCs along with servers and storage as a percentage of sales were both up from 4FQ20, accounting for 51% of revenue in 1FQ21 which is 43% in 4FQ20. Networking and telecom was down 6% from the prior quarter, reflecting weaker enterprise spending in just completed quarter.

Revenue of specialty compute and storage solutions:

- 1FQ20: $74,490 million

- 4FQ20: $66,877 million

- 1FQ21: $65,873 million

For these products, during 1FQ21, the company records strong demand for DDR3 products and NVDIMM (persistent memory) for storage applications:

- New customers sampling SSD products using firm's proprietary controller

- Expanding into new vertical markets with customer wins in surveillance and transportation

- Introduced new line of PCIe NVMe SSD flash products for industrial embedded applications

Specialty memory achieved revenue of $120.7 million in 1FQ21, a 16% increase when compared to 1FQ20. DDR-3 product portfolio performed well in 1FQ21 due to increase demand, as well as stabilization of DRAM pricing. The firm also saw increased demand for our persistent memory or NVDIMM products aimed at storage applications.

Note the recent decision of Smart to shut down its battery business in Brazil.

For 2FQ21 net sales are expected from 1FQ21 in the range of -2% and +5%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter