Smart Global Holdings: Fiscal 1Q19 Financial Results

Sales and net income 48% higher than year ago quarter

This is a Press Release edited by StorageNewsletter.com on January 14, 2019 at 2:15 pm| (in $ million) | 1Q18 | 1Q19 | Growth |

| Revenue |

265.4 | 383.9 | 48% |

| Net income (loss) | 21.0 | 31.0 | 48% |

SMART Global Holdings, Inc., parent company of SMART Modular Technologies, Inc., reported financial results for the first quarter of fiscal 2019 ended November 30, 2018.

First Quarter Fiscal 2019 Highlights:

- Net sales of $393.9 million, 48% higher than year ago quarter

- GAAP operating income of $47.8 million

- Adjusted EBITDA of $56.5 million

- GAAP diluted earnings per share (EPS) of $1.33

- Non-GAAP diluted EPS of $1.75

“We had a strong start to fiscal 2019 with revenue in our first quarter exceeding the high end of our guidance and coming in at $393.9 million,” commented Ajay Shah, chairman and CEO. “Driving the quarter was continued success in our specialty memory business, as well as solid sequential growth from our new specialty compute and storage Solutions business. Our business in Brazil also met expectations.“

“Looking ahead we remain optimistic about our overall business. We are seeing increased seasonality during our second fiscal quarter in our Brazil business. However, our other lines of business are expected to perform at or above our previous expectations for fiscal Q2,” he concluded.

Business outlook for next quarter:

$310 to $325 million in net sales

Comments

Abstrats of the earnings call transcript:

Ajay Shah, chairman and CEO:

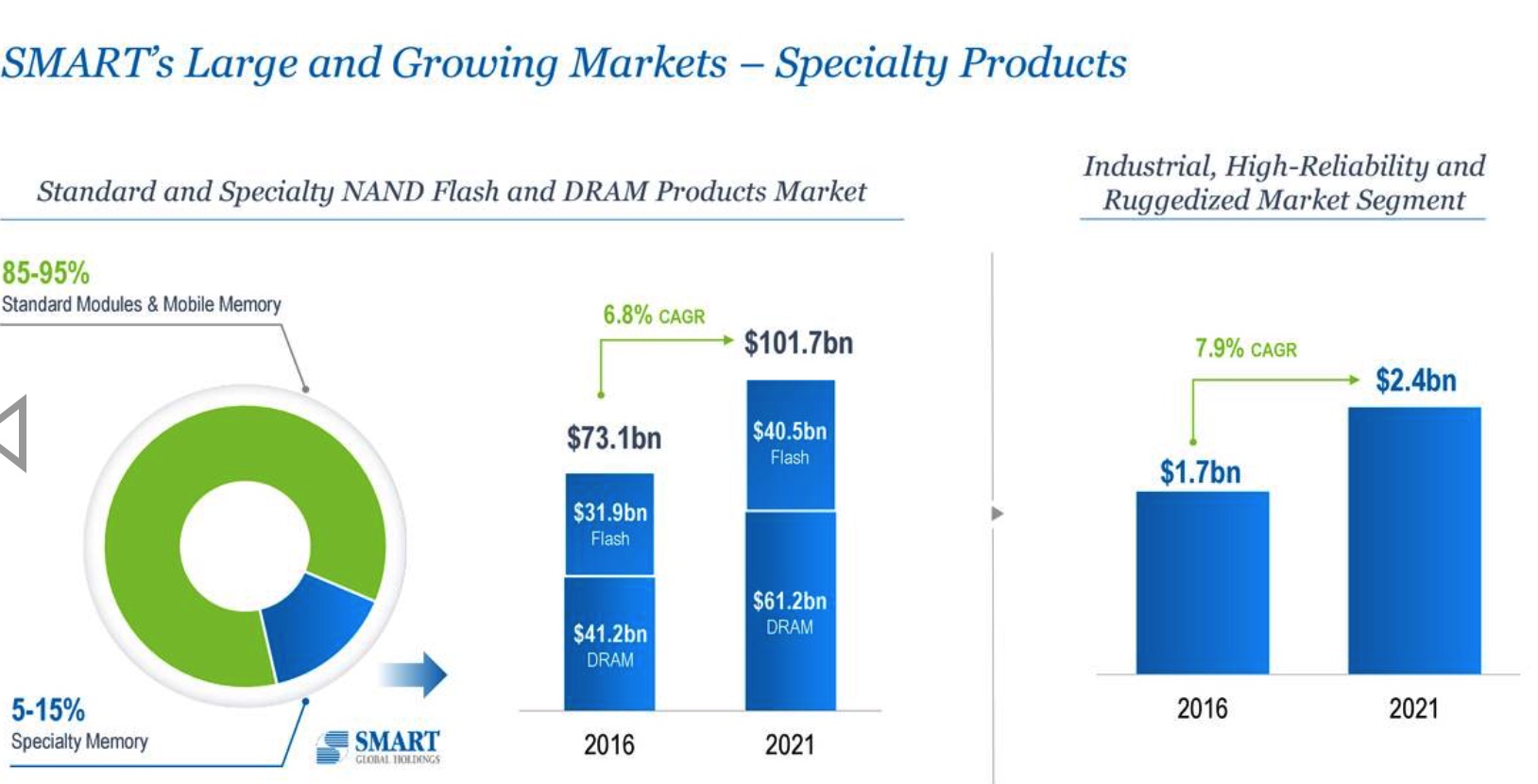

"Turning to our specialty memory business, net sales grew by almost 14% sequentially to reach $140 million for the quarter. The continued proliferation of all-flash arrays within server and storage applications was a strong driver for this business.

"So as you look at our performance in Q1, we were demonstrating that the reductions in memory prices that you are seeing in the market for DDR4 or 3D NAND flash products are not so relevant for our business. With the reducing cost per bit for 3D NAND flash products, we are actually seeing new opportunities for specialty SSD products in the various types of markets that I have talked about and with both existing and new customers. Our breakdown of net sales by end market for the first fiscal quarter was as follows: mobile and PCs 46%; network and telecom, 19%; servers and storage, 13%; industrial, aerospace, defense and other, 22%."

Jack Pacheco, chief operating and financial officer:

"Net sales increased by 5% over the previous quarter and by 48% over the year ago quarter.

"Cash and cash equivalents increased to $63 million at the end of the first quarter compared with $31 million at the end of the prior quarter as we reduced inventory and our prepayments for accounts payable in Brazil.

"Our business in Brazil typically experienced seasonality in the quarter due to holidays as well as customer shutdowns in December and January."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter